El 26 de julio, Bloomberg publicó una noticia que sacudió a los medios y alertó a las empresas de todo el mundo sobre la amenaza de un fraude deepfake impulsado por inteligencia artificial. La noticia describía cómo un ejecutivo de alto rango de Ferrari casi fue víctima de una sofisticada estafa deepfake en la que una persona que llamó pudo replicar la voz de Benedetto Vigna, el director ejecutivo de Ferrari. Con empresas globales que corren el riesgo de perder millones, esta noticia ha subrayado la importancia de implementar software y protocolos avanzados de verificación de identidad en todas las operaciones.

Fraude deepfake y caso de estudio de Ferrari: ¿Qué ocurrió?

Un martes por la mañana como cualquier otro, un alto ejecutivo de Ferrari empezó a recibir varios mensajes de texto que parecían ser del director ejecutivo, Benedetto Vigna. Los mensajes provenían de un número inusual. Uno de los mensajes decía: “Oye, ¿te enteraste de la gran adquisición que estamos planeando? Podría necesitar tu ayuda”.

El impostor luego declaró que necesitaría que el ejecutivo "esté listo para firmar el Acuerdo de Confidencialidad que nuestro abogado le enviará lo antes posible". Continuó: "El regulador del mercado de Italia y la bolsa de valores de Milán ya han sido informados. Estén preparados y Por favor máxima discreción."

Aunque estos mensajes pueden no parecer convincentes, la llamada de voz que siguió fue mucho más engañosa. Los estafadores lograron replicar la voz de Vigna, ya que la imitación reflejaba perfectamente su acento y tono de voz italianos.

El impostor intentó explicar por qué, de hecho, llamaba desde un número de teléfono diferente, ya que la naturaleza de la conversación era increíblemente confidencial, con posibles repercusiones para China y que requería realizar una transacción de cobertura de divisas no especificada.

“Lo siento, Benedicto, pero Necesito identificarte”, dijo el ejecutivo y le hizo una pregunta: “¿Cuál era el título del libro que me recomendaste hace unos días?”

Tras esta pregunta de verificación, el estafador se dio por vencido y finalizó la llamada. El incidente dio lugar a una investigación interna en Ferrari, pero los representantes decidieron no hacer comentarios al respecto.

Cómo el fraude deepfake se infiltra en las empresas

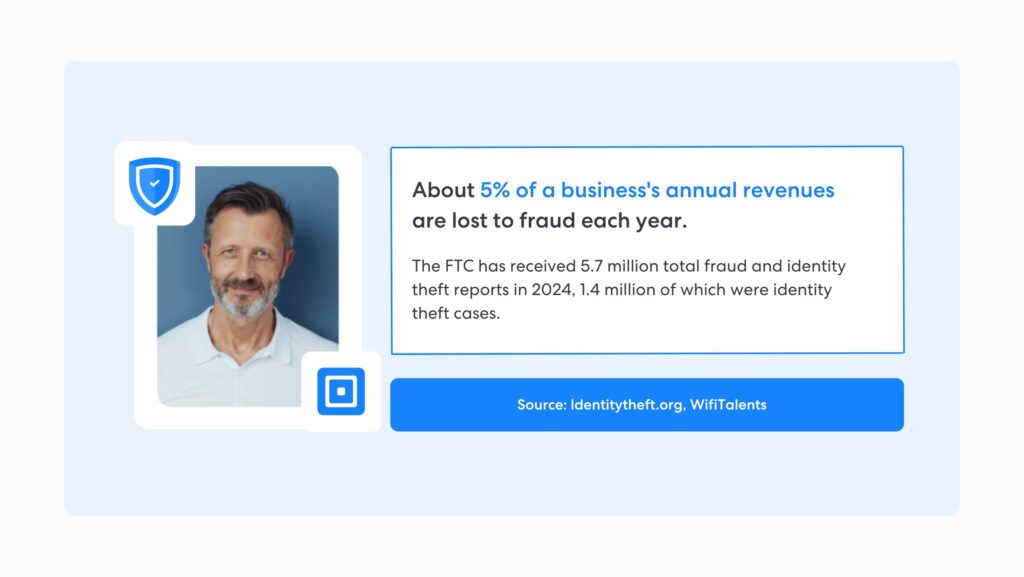

Si bien este caso es alarmante, ciertamente no es el primero de su tipo. Los deepfakes han ido aumentando su alcance desde hace varios años, y la cantidad de videos deepfakes en línea ha aumentado. por 550% desde 2019 hasta 2023.

Sorprendentemente Más de un tercio de las empresas En todo Estados Unidos se ha producido un incidente de seguridad deepfake en los últimos 12 meses.

En mayo, los medios de comunicación informaron que el director ejecutivo de la empresa de publicidad WPP Plc, Mark Read, fue víctima de una estafa muy similar. Se utilizó una elaborada falsificación para imitar al director ejecutivo en una llamada de Microsoft Teams. A medida que estas estafas impulsadas por IA se vuelven más precisas, es más fácil que los equipos se conviertan en víctimas y corran el riesgo de perder millones.

Stefano Zanero, profesor de ciberseguridad en el Politécnico de Milán de Italia, afirmó en una entrevista con la revista Fortune que:

“Es solo cuestión de tiempo y se espera que estas sofisticadas herramientas de deepfake basadas en inteligencia artificial se vuelvan increíblemente precisas”.

El escenario más probable hoy para Los actores de amenazas utilizan deepfakes en los intentos de comprometer el correo electrónico comercial (BEC). Los atacantes pueden luego usar tecnología de clonación de voz y video impulsada por IA para engañar a los destinatarios para que realicen transferencias de fondos corporativos.

Lamentablemente, muchas empresas ya han sido víctimas de este tipo de estafas. El South China Morning Post informó de un ejemplo en febrero, cuando los estafadores engañaron a los empleados mediante deepfakes y una empresa anónima se enfrentó a un ataque. pérdida de HK$200 millones ($26 millones de dólares).

Reacciones a los deepfakes en todo el mundo

En el Reino Unido, la publicación de deepfakes se convirtió en ilegal en virtud de la Ley de Seguridad en Internet, aprobada el año pasado. Esta decisión se tomó debido a la creación generalizada de deepfakes sexualmente explícitos.

La UE publicó la Ley de IA de la UE, adoptada por el Parlamento Europeo el 13 de marzo de 2024, que aborda específicamente cómo se deben regular las falsificaciones profundas en la UE, y establece que "los usuarios de un sistema de IA que genere o manipule contenido de imagen, audio o video que se parezca apreciablemente a personas, objetos, lugares u otras entidades o eventos existentes y que parezca falsamente auténtico o veraz para una persona ('falsificación profunda'), deberá revelar que el contenido ha sido generado artificialmente o manipulado.”

Aunque los deepfakes no están prohibidos en la UE, la Oficina de Inteligencia Artificial está preparando códigos de práctica que proporcionarán más asesoramiento sobre la clasificación de los deepfakes. Todavía está por ver si el Reino Unido seguirá esta iniciativa o no, sin embargo, las respuestas al Libro Blanco de Inteligencia Artificial del gobierno exigieron una mayor transparencia.

China ha adoptado regulaciones específicas para atacar directamente a los deepfakes después de varios escándalos importantes, lo que llevó a que la aplicación deepfake ZAO fuera prohibida en las tiendas de aplicaciones. Esto contrasta marcadamente con la postura de Estados Unidos sobre la regulación de la IA, donde no existen leyes federales sobre la creación o el intercambio de deepfakes. Sin embargo, el cambio podría estar a la vuelta de la esquina, con proyectos de ley como el del Senado de Estados Unidos Ley NO FAKES siendo propuesto.

Por qué debemos actuar ahora

A pesar de que estafas como esta tienen una gran difusión en línea, muchas organizaciones siguen sin ser conscientes de la amenaza de los ataques fraudulentos impulsados por IA. Sin embargo, existen tecnologías que pueden identificar estas formas de deepfakes y todas las empresas deben aprovecharlas.

Verificación de identidad biométrica (IDV) El software de detección de vida examina los rasgos faciales y las expresiones sutiles en imágenes o vídeos, analizando si muestran señales de vida. Por lo tanto, se pueden detectar los deepfakes, pero no son suficientes las organizaciones que aprovechan estas tecnologías.

Beneficios del eKYC basado en IA para las empresas

Se necesitan soluciones eKYC que aprovechen la IA para proteger a las organizaciones. Se han dado muchos casos de deepfakes que eluden los métodos de verificación de identidad, lo que ha permitido a los estafadores infiltrarse en todo tipo de empresas.

En 2019, se utilizó un vídeo muy falso para estafar a un director ejecutivo transferir $243,000 a una cuenta bancaria. De manera similar, en 2021, una banda criminal utilizó deepfakes para eludir la autenticación eKYC y acceder a cuentas bancarias que contenían millones de dólares.

En 2019, un director ejecutivo engañó a un director ejecutivo para que enviara $243,000 a una cuenta bancaria. De manera similar, en 2021, una banda de delincuentes eludió la autenticación eKYC con videos e imágenes deepfake y accedió a cuentas bancarias que contenían millones de dólares. Como resultado, muchas empresas se han dado cuenta de la necesidad de invertir en tecnologías avanzadas de inteligencia artificial para detectar y evitar que se utilicen deepfakes en los procesos de autenticación. eKYC puede ofrecer:

- Soluciones a medida: Flujos de trabajo automáticos que pueden adaptarse en gran medida para adaptarse a diferentes requisitos de cumplimiento. Al utilizar tecnologías de aprendizaje automático, las soluciones eKYC pueden agilizar la extracción de datos y al mismo tiempo brindar una experiencia de incorporación de usuarios fluida.

- Incorporación simplificada: La implementación de un proceso eKYC sólido le permite verificar a los clientes de manera rápida y eficiente, lo que permite a las organizaciones escalar de manera segura.

- Seguridad mejorada: eKYC es mucho más eficaz para proteger a las organizaciones del fraude de identidad y los delitos financieros. El uso de verificación biométrica avanzada, así como la detección de fraude basada en inteligencia artificial, permite a las organizaciones minimizar el riesgo de fraude.

- Experiencia del cliente mejorada: El proceso de incorporación simplificado también da como resultado una experiencia de usuario más positiva, lo que reduce la fricción y aumenta la satisfacción del cliente.

- Alcance global: Las soluciones eKYC permiten a las empresas operar globalmente, verificando rápidamente a muchos clientes y admitiendo múltiples idiomas y diversas regulaciones internacionales.

eKYC con ComplyCube

ComplyCube es una plataforma todo en uno RegTech100 para automatizar el cumplimiento de la verificación de identidad (IDV), la lucha contra el lavado de dinero (AML) y el conocimiento de su cliente (KYC). Tiene clientes globales en los sectores legal, telecomunicaciones, servicios financieros, atención médica, comercio electrónico, criptomonedas, viajes y más.

Nuestro conjunto completo de soluciones KYC/AML impulsadas por IA mejoradas con flujos de trabajo automáticos están altamente adaptadas para satisfacer los requisitos de cumplimiento de nuestros clientes. Al utilizar tecnologías de aprendizaje automático desarrolladas y propiedad de nuestro equipo, nuestras soluciones agilizan la extracción de datos y al mismo tiempo brindan una experiencia de incorporación fluida para el usuario.

Contacto Nuestro equipo de expertos hoy.