The Best Automated Age Verification Solutions in 2026

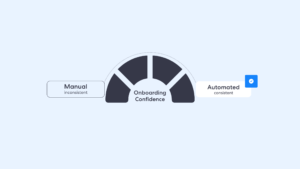

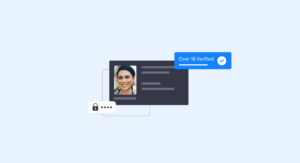

Automated age verification solutions are critical to meeting regulatory compliance. Modern age assurance solution supports firms in achieving quicker results, complying with data privacy laws, and adapting to changing regulations....