Getting the Best Value for Identity Verification Platforms

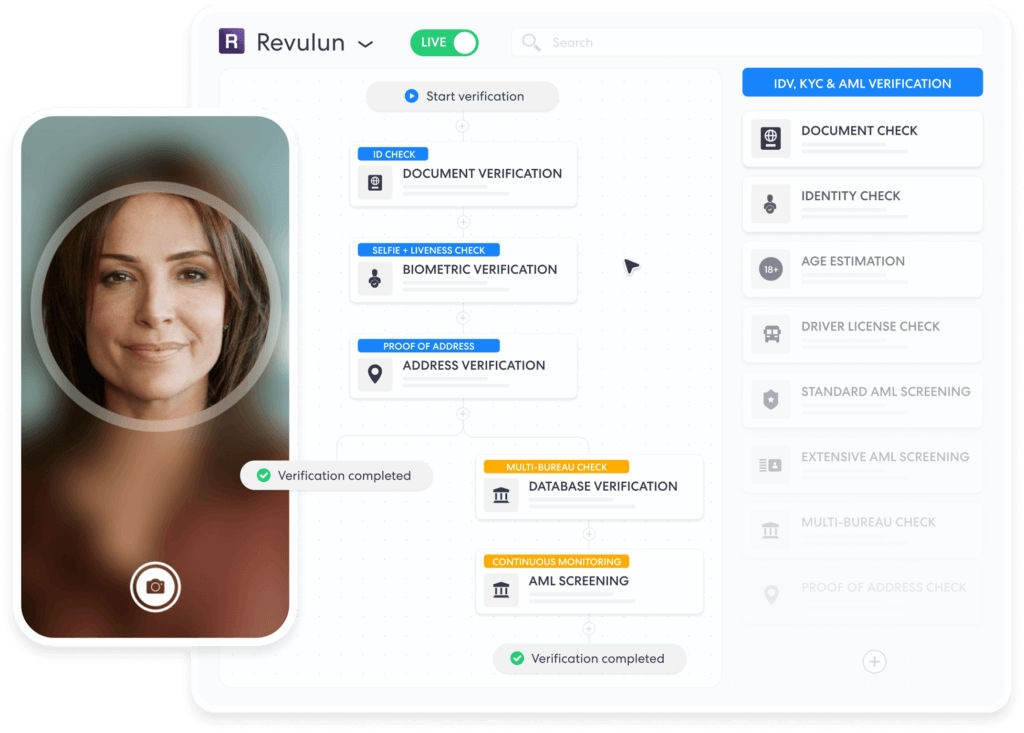

Balancing privacy rights with fraud mitigation is becoming increasingly complex. A robust Identity Verification framework can help firms uphold data protection and privacy standards while meeting stringent compliance regulations....