TL;DR: Identity document verification is vital to modern Know Your Customer (KYC) processes. Along with proof of address checks, it supports organizations in seamlessly verifying a user’s identity, forming a key part of Customer Due Diligence (CDD) requirements. This guide explores the importance of digital document verification and its role within the KYC process.

What does a Know Your Customer Process Involve?

The KYC process comprises multiple interconnected stages, designed to verify that individuals are who they claim to be before any business relationship is established. As such, businesses can verify the legitimacy of clients and assess potential risk, safeguarding the firm from financial crimes and regulatory breaches. However, many modern businesses face the dilemma of complying with stringent KYC compliance while ensuring their processes remain seamless for onboarding clients.

Implementing effective KYC controls requires a strategic understanding and balance between efficiency and compliance. It involves three main stages: the Customer Identification Program (CIP), CDD, and ongoing monitoring. By following these steps, financial institutions can strengthen Anti-Money Laundering (AML) and Counter-Terrorism Financing (CFT) compliance.

Customer Identification Program (CIP)

Implementing adequate document verification can be cumbersome and challenging for many businesses. As such, this forces a trade-off between meeting compliance and satisfying customers. In a typical KYC process, customers must have their ID, proof of address, bank statements, and, in the U.S., even their Social Security Number (SSN) verified. However, without a clear workflow, bottlenecks can appear in onboarding, with industry reports indicating a 40-60% drop-off rate in the document submission process.

The CIP forms the first phase, where businesses collect, verify, and assess basic customer information. The most commonly gathered information includes a customer’s full name, residential address, date of birth, and government-issued identification number. Subsequently, these identity documents will be verified against official government databases. Based on this verification, the assessor will assign a risk level and produce a comprehensive risk assessment. You can learn more here: Customer Identification Program: What Is CIP?

Customer Due Diligence Measures

KYC and CDD are mandatory for financial institutions and other entities for safeguarding trust. The Financial Action Task Force (FATF) recommends that financial institutions undertake ongoing CDD measures to prevent fraudulent activity and financial crime. Effective KYC systems support AML checks while protecting the financial system from bad actors.

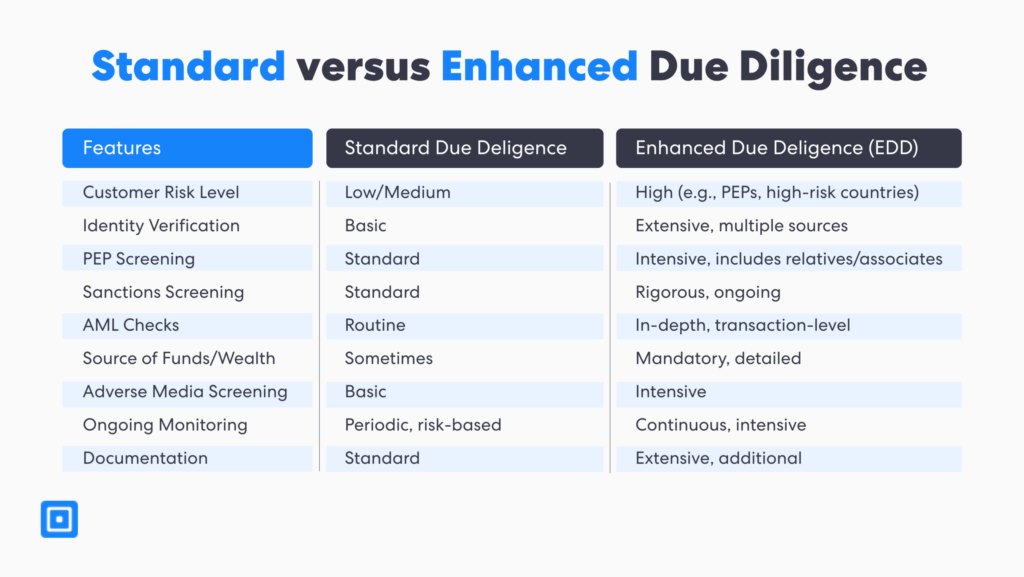

There are three levels of customer due diligence: standard, simplified, and enhanced. The level of customer due diligence applied is derived from a customer’s risk score, which is calculated during onboarding and throughout the ongoing due diligence process.

Standard Customer Due Diligence Requirements

CDD requirements can vary depending on the business type and parties involved. For regulated industries, such as financial institutions, customers who need to open a bank account will need to undergo a more rigorous KYC procedure. This includes submitting official identity documents, such as driver’s licenses, and proof of financial standing, such as tax or mortgage statements.

CDD supports firms in identifying and preventing suspicious activities within financial transactions at an early stage. Moreover, international KYC standards require financial institutions to use a Risk-Based Approach (RBA) to CDD. In some cases, high-risk factors in the customer’s risk profile show that CDD is insufficient, and a firm requires Enhanced Due Diligence (EDD). You can learn more here: What is a Risk-Based Approach (RBA)?

Enhanced Due Diligence Requirements

EDD requires more comprehensive identity document verification and background checks. For instance, an organization can determine if a customer requires EDD by examining their geographic location, business activities, and any suspicious transactions. This stage mitigates potential threats, including organized crime, money laundering, and terrorist financing. Ultimately, EDD offers multi-layered protection:

- Uncovers associated beneficial owners, business relationships, and sources of funds.

- Identify Politically Exposed Persons (PEPs) and adverse media coverage.

- Cross-verify the customer against the sanctions list and watchlist.

Ongoing Monitoring and Regulatory Compliance

Conducting ongoing monitoring is necessary to identify any suspicious patterns or emerging risk factors in customer behaviour. In cases involving high-risk individuals or suspicious activity, there is a greater need for conducting transaction screening and continuous risk monitoring. The integration of public and private data sources, often with third-party services, enables a comprehensive understanding of customer activities.

Screening against PEP and sanctions lists is especially crucial, as these lists are updated frequently. Therefore, for businesses to comply with anti-money laundering regulations, they must prioritise PEP and sanctions screening as an ongoing requirement. Businesses, particularly financial institutions, must thoroughly document these procedures to demonstrate compliance with regulatory requirements and support audit activities related to customer identities.

Acceptable Forms of Proof of Address in KYC

Proof of address verification establishes the customers’ connection to a specific geographic jurisdiction. Thus, it supports various regulatory requirements, including jurisdictional risk profile evaluations, sanctions screening, and tax reporting obligations. Proof of address, plus an ID and proof of income, will suffice for standard customer due diligence. Specifically, acceptable forms of proof of address include utility bills, bank statements, government correspondence, and lease agreements.

To qualify as proof of address, these documents must be recent, preferably dated within the previous three months. This ensures accuracy and relevance for ongoing compliance purposes. Address verification processes face unique challenges related to document formatting, language variations, and regional differences. Modern verification systems use machine learning algorithms that process official records in multiple languages and recognize various formats.

The Role of Identity Document Verification Technology

As seen above, Identity Verification (IDV) plays a foundational role in KYC. Official documents such as passports, driver’s licenses, and national identity cards are used because they contain standardized information formats. However, the layout, structure, and watermarks vary in different countries. Advanced identity document verification systems utilize innovative features to automatically validate various data from documents worldwide more efficiently.

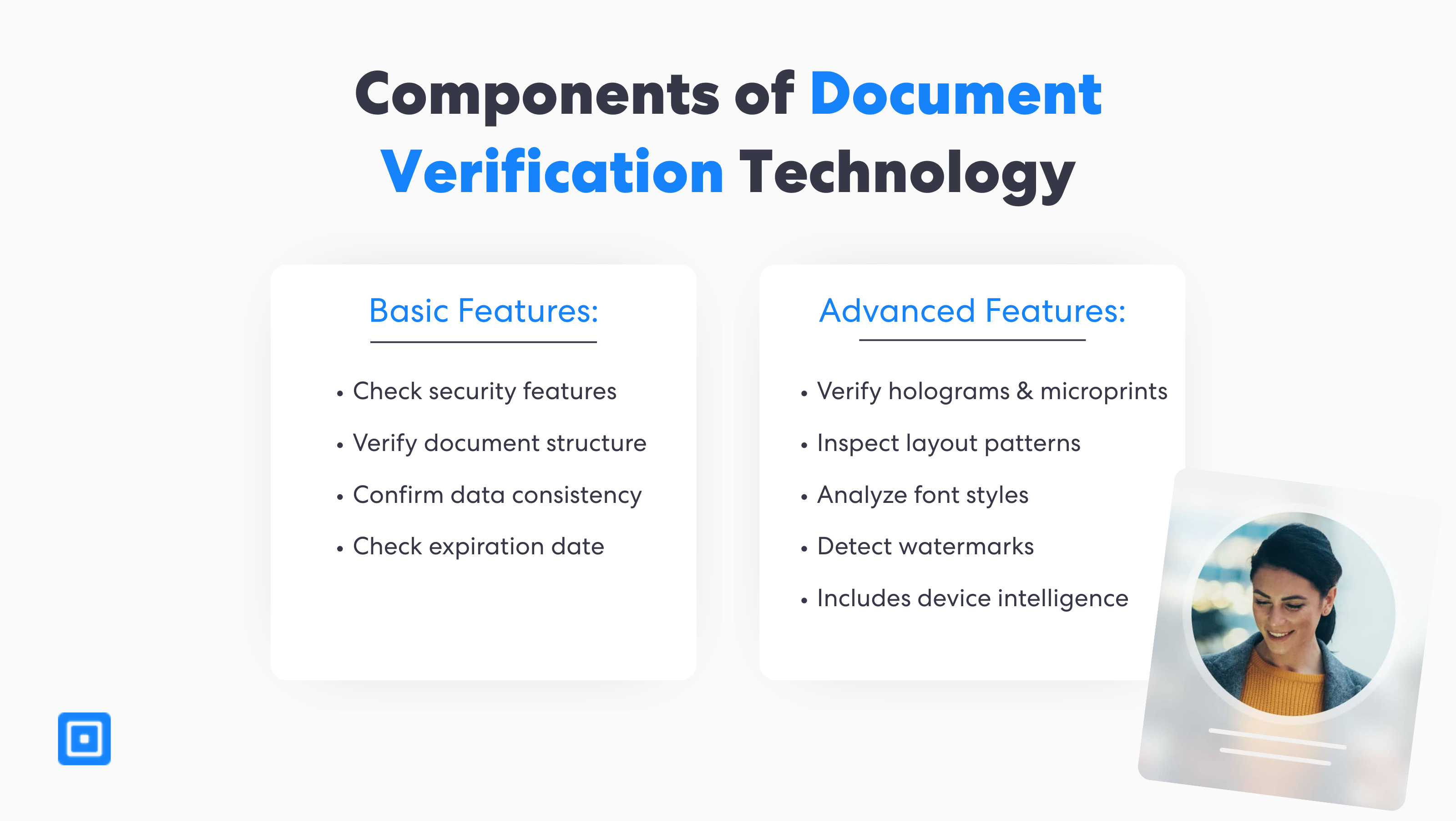

The basic features of digital document verification technology include analyzing security features in a document, confirming data consistency, and ensuring the document remains current up to its expiration date. Advanced features utilize sophisticated technology to verify a document’s authenticity more thoroughly. It includes analyzing font styles, inspecting layout patterns, and detecting watermarks and holograms. Basic and advanced features work together to create a stronger identity verification process.

Optical Character Recognition (OCR)

OCR technology provides businesses with a more resource-efficient way to manage identity documents. Handwritten or printed documents can be converted into machine-readable data in real-time. It minimizes human error and reduces manual labor, boosting operational efficiency for organizations that screen thousands of documents a day.

Device Intelligence

As document forgeries become more sophisticated, identity verification has had to adapt with new security features. Device intelligence technology collects metadata from a device used during the KYC process. Generally, a user’s IP address, device type, and even browser can be detected. This adds another layer of security against suspicious activity, helping to uncover a customer’s identity.

Document Authentication

Document authentication determines whether or not the information provided is genuine and valid. This involves analyzing security features, document structure, and data consistency to identify anomalies or alterations. Elements such as font characteristics, layout patterns, watermarks, and security elements can be assessed for authenticity.

Integration of Identity Document Verification with Anti-Money Laundering Checks and Screening

According to the United Nations Office on Drugs and Crime, money laundering refers to the processing of criminal proceeds to disguise their illicit origin. The estimated annual amount of money laundered globally is between 2 and 5% of the global GDP, or between $800 billion and $2 trillion USD. A comprehensive anti-money laundering program can help reduce money laundering activities.

In just one year, the amount of money laundered is estimated to be between $800 billion and $2 trillion US dollars.

Identity document verification plays a foundational role in this effort. It ensures the identity credentials of customers are accurate, providing genuine data to fuel comprehensive AML checks and prevent financial crime. Businesses can identify potential risks related to money laundering, sanctions violations, and further reduce false positives in AML systems.

Global Sanctions and PEP Screening

Global sanctions and PEP screening occur in real-time during onboarding and throughout the relationship lifecycle to identify newly designated high-risk individuals or entities that may impact existing customer relationships. According to the Financial Conduct Authority (FCA), low-quality CDD and KYC increases the risk of firms breaching sanctions, tying back in the importance of identity document verification in effectively managing sanctions risk.

Harry V, Chief Technology Officer (CTO) at ComplyCube, stresses, “Combining thorough initial due diligence with periodic re-screening or ongoing monitoring ensures firms maintain compliant, up-to-date customer risk profiles, preventing sanctions breaches and reputational harm.”

It is crucial to integrate KYC and CDD processes as ongoing, dynamic processes. – Harry V, CTO, ComplyCube.

PEP screening represents a critical component of any AML check. PEP databases contain information about individuals who hold political positions or maintain close associations with politically significant figures. Because of the potential for corruption, such individuals require enhanced due diligence. On the other hand, sanctions screening uses verified customer information to search global sanctions lists. Organizations such as the Office of Foreign Assets Control (OFAC), the United Nations, and the European Union maintain these lists. You can learn more here: What is Sanctions Screening?

Case Study: CB Payments Limited (CBPL) Fined £3 Million for Gaps in Verification

The FCA’s Discovery of CBPL’s KYC and AML Gaps

The FCA fined CBPL over £3 million after finding significant lapses in its KYC and AML frameworks, including failures in its digital document verification process. CBPL did not implement sufficient due diligence and lacked adequate controls over its risk management.

CBPL’s Penalty and Continued Failures

CBPL’s weakness in its KYC process severely compromised the effectiveness of its document verification, enabling over 13,000 high-risk users to make transactions. The FCA also found that 31% of these users deposited nearly $24.9 million. You can learn more about the CPBL case here: The CryptoCubed Newsletter: July Edition.

Outcome and Learning

- The case served as a key warning to other crypto firms, damaging the reputation of CBPL.

- Identity and document checks must enforce high-risk rules and risk classifications across all flows to eliminate gaps.

- High-risk indicators must feed directly into strong due diligence without exceptions or delays to prevent potential fraud immediately.

Adverse Media Screening

Adverse media screening identifies negative news coverage or regulatory actions that might indicate increased compliance risks. It analyzes customer names and associated information against vast databases of news articles, regulatory announcements, and court records to identify potential reputational concerns. Identity document verification confirms that an individual being screened gets identified correctly, which allows any institution to link negative coverage to the right user.

Key Takeaways

Identity document verification plays a crucial role in supporting KYC compliance by validating government-issued IDs, such as passports or driver’s licenses.

AML screening relies on accurate document verification technology to assess risk and support ongoing monitoring capabilities.

Digital document verification, when combined with proof of address and liveness checks, forms a multi-layered verification of a user’s identity.

Document authentication supports KYC by examining different fonts, metadata, and watermarks to confirm the authenticity of identity documents.

Optical character recognition enables firms to automatically and accurately extract data from documents, minimizing human error.

Boost Fraud Prevention and AML Efforts

To comply with KYC and AML regulations, organizations cannot overlook digital document verification. Forward-looking firms are moving away from legacy systems by adopting advanced, AI-powered document verification technology. With features such as OCR and document authentication, the costs from manual data entry and human error are minimized. Additionally, companies must integrate identity document verification with AML checks, such as PEP screening, to build a robust KYC framework.

When paired with continuous monitoring, it empowers faster decision-making, strengthening the KYC process for total regulatory compliance. ComplyCube is a UKDIATF-certified leader in KYC and AML. The platform offers comprehensive compliance solutions, including case management, risk scoring, and document verification capabilities. Speak to a member of the team to learn more about how you can prevent fraud and achieve 63% in cost reductions.

Frequently Asked Questions

What is sufficient for proof of address?

For proof of address checks, common acceptable forms of documents include utility bills (such as gas or broadband) and bank statements. These documents must be dated within the last three months and have an accurate name and residential address.

Does a Social Security card count as a form of ID?

A Social Security card is used by U.S residents and acts as an additional identification document for identity document verification. Organizations perform a Social Security Number (SSN) check to verify the legitimacy of a user. SSN checks are combined with other government IDs, such as a passport or driver’s license, during identity verification.

Can a fake identity card be detected easily?

A fake identity card can be detected when analyzed with advanced verification technology. Modern digital document verification incorporates AI and OCR technology to extract and detect tampered data rapidly.

Why is document verification important in the Know Your Customer process?

Identity document verification is an important step in the KYC process as it enables businesses to assess potential risk and comply with KYC and AML laws. Additionally, digital document verification supports the ongoing monitoring process, creating a robust system that safeguards against fraud and other financial crimes.

What documents does ComplyCube accept for identity document verification?

ComplyCube accepts over 13,000 documents from 220+ territories. Typically, official documents such as a valid passport, government-issued national card, or a driver’s license are required during identity verification. For regulated industries such as banks, customers may need to verify identity through selfie or video verification.