TL;DR: Watchlist screening solutions are vital for Anti-Money Laundering (AML) compliance. These tools help firms combat financial crime by flagging high-risk parties. However, watchlist screening best practices may differ across industries, particularly fintech firms. This guide explores what is watchlist screening and how fintech firms can best use it for AML compliance.

What is Watchlist Screening Software for FinTechs?

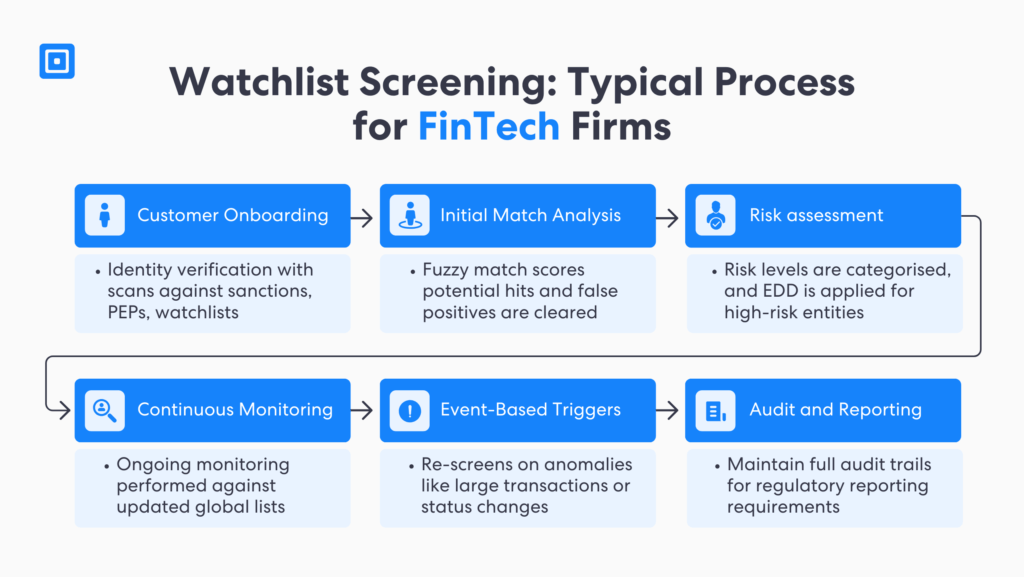

Watchlist screening is a key method used by compliance teams to check customers, business partners, and entities against official law enforcement databases. With specialized watchlist software, this process is simplified by checking users against multiple trusted data sources to identify potential risks. Furthermore, watchlist screening is part of the broader Anti-Money Laundering process, enabling organizations to counter terrorism financing and prevent financial crimes.

There are several list types that a watchlist screening platform checks against, including government sanctions lists (such as EU, UN, and Office of Foreign Assets Control, also known as OFAC), Politically Exposed Persons (PEPs) databases, criminal watchlists (such as Interpol), and adverse media databases. Watchlist screening solutions are crucial for global fintechs to meet Customer Due Diligence (CDD) requirements. You can learn more here: What is Customer Due Diligence (CDD)?

Firms must prioritize entities involved in higher-risk activities, particularly Politically Exposed Persons (PEPs) and customers from countries subject to high-risk designations or non-FATF jurisdictions.

Failure to implement robust AML screening can lead to serious legal trouble and significant penalties, resulting in massive reputational damage. The Financial Action Task Force (FATF), the intergovernmental body that tackles terrorism financing, financial crime, and money laundering, recommends that companies:

- Require financial institutions and organizations to use a Risk-Based Approach (RBA) for global watchlist checks, including Enhanced Due Diligence (EDD) for higher risks.

- Enhanced measures are required for high-risk individuals, including politically exposed persons, who require additional checks.

- A clear system must be implemented to prevent and block funds or other assets from sanctioned, suspicious individuals.

- Ongoing monitoring is crucial to assess risk and ensure that screening systems remain up to date with evolving adverse media coverage, PEP, and sanctions lists.

Why FinTechs Must Prioritize Robust Watchlist Screening Processes

FinTechs, in particular, are subject to heightened scrutiny by regulatory bodies. This is because the FinTech sector involves multiple vulnerabilities for bad actors to exploit. The rapid onboarding, global reach, large transactions, and high volume of new customers create a perfect environment for sanctions evasion. Therefore, firms operating in the FinTech sector must implement comprehensive screening to strengthen compliance and build regulatory trust.

For many firms, implementing effective global watchlist screening processes can be tricky. If the customer onboarding process involves too many steps to ensure compliance, this creates a customer experience trade-off. To maintain operational efficiency and user trust, automated screening tools are essential. The right watchlist screening solutions enable FinTechs to identify suspicious activities in real time while minimizing false positives.

Case Study: Starling Bank’s Shocking AML Watchlist Screening Failures

Starling Bank’s Whopping £28.96 million fine by the UK

In 2024, the UK’s Financial Conduct Authority (FCA) fined Starling Bank over £28M. The penalty followed the FCA’s finding that Starling Bank had breached multiple AML laws. Specifically, this includes failure to screen against the OFAC and the full UK sanctions lists.

Key Gaps in Starling Bank’s AML Compliance Program

Investigations found that the company was using an outdated sanctions system that resulted in screening only a small portion of the full sanctions lists. Critical alerts were being missed despite heightened geopolitical sanctions activity during that period.

Solutions & Outcomes

Starling Bank’s deficiencies led to the opening of over 54,000 accounts for 49,000 high-risk customers, causing reputational damage and eroding customer trust.

The FCA cited the importance of strong governance, noting that senior management oversight and staff training are crucial for effective risk assessment.

ComplyCube was able to deliver layered verification tailored to sector- and country-specific risks, supporting both KYC and AML compliance.

Key Features of Watchlist Screening Solutions for FinTechs

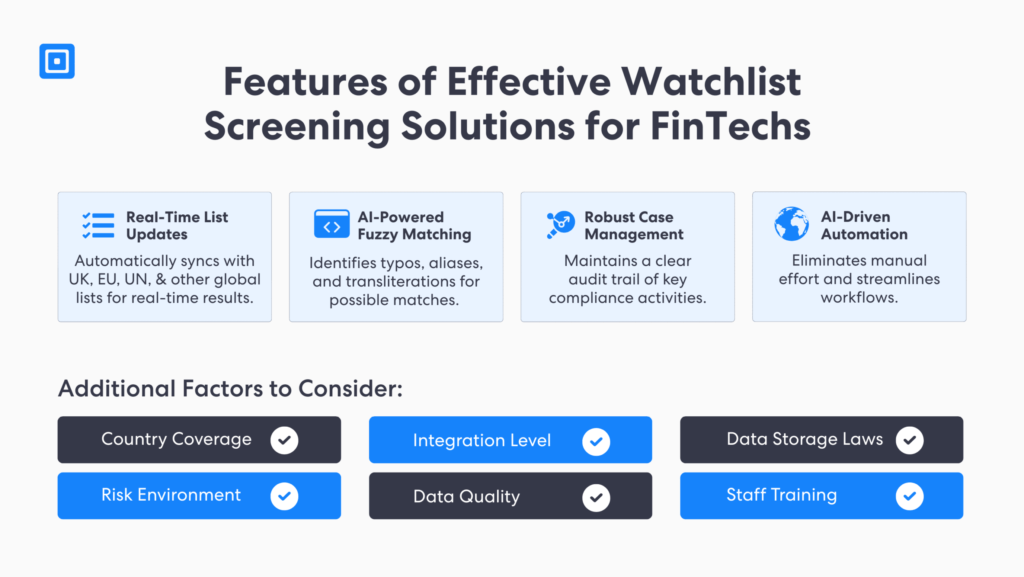

After learning about what is watchlist screening and its importance for FinTechs, it is critical to understand the key features to look out for. Under FATF recommendations, Targeted Financial Sanctions, whereby identification and freezing of funds from sanctioned or high-risk individuals must be implemented without delay.

To ensure regulatory compliance, FinTechs must prioritize global watchlist tools with real-time screening, fuzzy matching, and effective case management. Together, these features help businesses effectively identify high-risk, sanctioned individuals and block them from crucial services. Additionally, compliance with independent data security certifications, such as ISO 27001 and GDPR, is essential to protecting customer data.

Real-time data sync with official lists

To ensure screening accuracy, it is essential to integrate real-time, up-to-date watchlists. Since data points on official databases are updated daily, businesses must therefore ensure to use current watchlist data. To do this, FinTechs should look for watchlist checks vendors with powerful API and SDKs that can pull real-time changes in watchlist databases, adverse media sources, and PEP lists.

Advanced fuzzy matching algorithms for low false positives

Fuzzy matching leverages AI and machine learning to capture similar or partial matches in name variations, transliterations, and aliases. By doing so, fuzzy matching helps financial institutions identify minor name variations or misspellings used by sanctioned entities to evade detection. However, a common challenge in FinTech firms is the high rate of false positives. To overcome this challenge, FinTech firms must choose tools that offer customizable fuzzy-matching thresholds to lower false positives.

Case management, logs, and audit readiness

To meet stringent audit reporting requirements, financial institutions need comprehensive case management. Case management supports global watchlist screening efforts by ensuring a thorough audit trail of key compliance activities. Compliance and risk assessment teams can conduct investigations and monitor key trends such as false negatives when screening customers. The benefit is two-fold: adhere to strict reporting rules by government agencies and optimize operational efficiency.

Automatic screening for cost optimization

For fast-paced, high-growth FinTechs, investing in AI-driven automated screening tools is important. It streamlines compliance workflows by eliminating manual screening. For Fintechs, this means reduced human error and cost. These systems can learn from past patterns to produce accurate screening results, reducing false positives. Additionally, an all-in-one regtech software unifies ongoing monitoring and EDD into a single solution, ensuring robust compliance coverage.

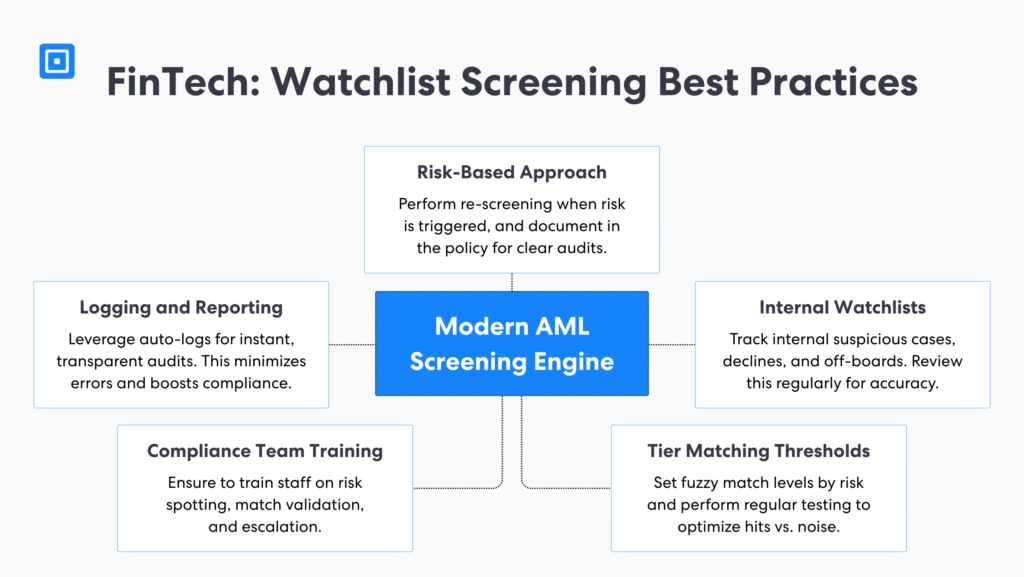

Watchlist Screening Best Practices for FinTech Regulatory Compliance

For FinTechs, customer trust and credibility are vital. This is especially true given the industry’s competitive nature. According to Juniper Research, the adoption of digital wallets in the fintech and payments markets is expected to increase by 15.3% by 2029, representing a 52.6% growth from 2024. A strong global watchlist screening framework can enhance regulatory, investor, and customer trust.

The Wolfsberg Group, an association of 12 global world banks including Citibank, Barclays, HSBC, and Santander, sets out the Financial Crime Principles to underpin the best practices for financial companies to mitigate ML and TF risks.In particular, under its Principles, screening programs must remain dynamic, risk-based, and operational across the customer lifecycle:

1. Dynamic Screening with an RBA

Screening checks must occur at initial onboarding and repeat consistently where risk occurs. Additionally, FinTechs must document these scenarios in policy to provide transparent, defensible audit trails. You can learn more here: What is a Risk-Based Approach (RBA)?

2. Build and Monitor Internal Watchlists

In addition to external databases, every FinTech must maintain its own internal watchlists. This list must document suspicious activity, entities declined, and off-boarded customers. Also, to remain accurate and avoid bias, it must be reviewed periodically.

3. Tier Matching Thresholds

Every FinTech must implement tier-matching logic based on entity type, geography, and product risk level. For instance, platforms operating across high-risk jurisdictions must apply tighter thresholds. Back-testing and sampling against known matches can balance sensitivity and efficiency.

4. Training Compliance Teams

For strong governance, FinTech companies must maintain reliable training programs on contextual risk analysis and escalation criteria. For example, differences between “true” and “false” matches are vital during data quality issues, such as misspellings.

5. Logging and Reporting

Full traceability supports effective risk assessment decisions. To support this, risk management teams must be trained to keep internal audits up to date. Leveraging robust case management systems with automatic logging reduces human error and supports real-time audit changes.

Key Takeaways

Watchlist screening checks customers and entities against multiple data sources, which include sanctions, PEPs, and adverse media lists.

The FATF outlines key recommendations for FinTechs, including a risk-based approach and enhanced due diligence to support effective AML programs.

Robust case management supports FinTech firms in meeting regulatory reporting needs and provides a defensible audit trail of key screening activities.

The Wolfsberg Group outlines dynamic, tiered matching thresholds, with higher-risk scenarios requiring tighter thresholds and enhanced fuzzy matching.

Real-time, automated watchlist tools enable FinTech firms to streamline AML compliance, enhancing verification accuracy and speed.

Comprehensive Anti-Money Laundering Watchlist Screening Solutions

Investment in robust watchlist screening solutions is vital for helping FinTech operations ensure compliance with AML regulations. By partnering with an all-in-one AML provider that offers enhanced PEP and sanctions screening, continuous monitoring, and case management, businesses can reduce complexity and streamline compliance workflows. Moreover, ComplyCube offers over 2,000 trusted global lists across 230 countries to help firms implement strong Anti-Money Laundering and fraud prevention practices. To learn more, speak to a member of the team today.

Frequently Asked Questions

What is the purpose of the watchlist?

A watchlist is a database of high-risk individuals or entities that have been shortlisted for their involvement in sanctions, money laundering, or other illicit activities. Watchlists play a crucial role in Anti-Money Laundering programs by helping organizations identify and avoid dealing with these parties.

What is watchlist screening due diligence?

Watchlist due diligence refers to the process of verifying user information against these lists (wanted list, sanctions database, PEP list) during the KYC and AML process. Under the FATF, watchlist screening enables businesses to assess risk by cross-checking against official lists, including the UN list, Interpol, and the UK Sanctions Lists.

What are watchlist screening challenges for fintechs?

Due to the global, high-transaction nature of FinTech businesses, regulatory scrutiny is common. FinTech companies struggle to balance sensitivity to name variations and fuzzy matching errors that affect operations. This results in a poor alert system and a high rate of false positives. To counter this challenge, fintech firms must leverage automated, customizable screening solutions and set matching thresholds in proportion to the risk a customer/entity poses.

Best practices for effective watchlist screening?

According to global bodies such as the FATF and the Wolfsberg Group, adopting a risk-based approach to AML screening is crucial. Furthermore, robust case management and staff training are encouraged to provide strong governance and audit preparedness. AI-driven tools can remove reliance on manual review, saving time and cost for scaling businesses.

How to select the best watchlist screening provider?

To select the best watchlist screening provider, consider your business’s coverage and risk environment. Choosing providers with broad coverage, real-time updates, robust integrations, and advanced AI and machine learning helps with scalability and cost effectiveness. Additionally, customizable matching threshold and fuzzy matching support a risk-based approach under FATF.