Ensuring Know Your Customer (KYC) compliance is not just about checking boxes; it is foundational for preventing fraud, meeting regulatory obligations, and preserving customer trust. All of this, however, can come at a significant cost if not implemented correctly. Choosing the right KYC pricing models is essential. Options such as KYC per check, tiered plans, and IDV subscription pricing can all impact operational efficiency and budget.

In this guide, we break down what drives the cost of KYC, the various types of pricing models commonly offered, and how ComplyCube structures its flexible options so buyers can make more informed decisions when purchasing KYC SaaS solutions that assure KYC compliance.

The Impact of Regulatory Pressure on KYC

Compliance teams are under increasing pressure to keep up with evolving regulations while also optimizing operational efficiency. Knowing how much Identity Verification (IDV) should cost and what factors drive IDV pricing can help teams avoid overspending, forecast smarter, and invest in systems that scale with their business requirements.

In 2024, financial institutions, e-commerce platforms, and other organizations allocated $38.8 billion to KYC systems, and the market is projected to grow by 71% from 2024 to 2029.

Investment in KYC technology is critical for keeping pace with regulations and for companies to remain competitive. Both investors and consumers prefer businesses that can demonstrate trustworthiness through seamless and secure onboarding processes.

The Significance of KYC and AML Compliance

Understanding KYC pricing models is essential when making an investment decision. However, financial institutions must also consider the potential value and benefits that come from effective compliance. According to the United Nations, 2 to 5% of global GDP is laundered annually, accounting for about $800 billion to $2 trillion.

While pricing remains an important factor, the quality of KYC technology must always be the top priority due to its implications on business reputation and long-term growth. Poor KYC and AML infrastructure can lead to risks in money laundering and other financial crimes. With leading compliance software, these risks can be detected and escalated earlier to prevent further losses.

KYC Pricing is not a One-Size-Fits-All

The cost of verifying a customer’s identity can look very different depending on who and where a business chooses to operate. A lean FinTech onboarding 500 customers a month in one region faces vastly different requirements compared to a multinational bank verifying millions of users across multiple jurisdictions.

Business Operating in Regulated or High-Risk Industries

Companies dealing with high-risk industries, such as cryptocurrency, gambling, or cross-border remittances, need more stringent checks. These often include Enhanced Due Diligence (EDD), biometric liveness detection, and continuous monitoring. Each adds cost, but each is also essential to avoid non-compliance.

Abiding by Various Regulations International

Jurisdictional complexity and local regulations also determine the complete set of requirements. For example, regulations set by the Financial Conduct Authority (FCA), the Monetary Authority of Singapore (MAS), and the U.S. FinCEN often overlap but often come with their own nuances. Businesses operating across borders may need to meet varying ID verification standards, watchlist coverage, and data retention rules.

Manual versus Automated Tools

Finally, how KYC is delivered, either through manual review, partially automated, or fully orchestrated through APIs, impacts price and performance. The more integrated and automated the process, the more scalable and cost-efficient compliance becomes over time.

Key Components of an Effective KYC Verification Process

Before evaluating pricing models, it is critical to understand the foundational elements of an effective KYC process. These components ensure that financial institutions meet global regulatory expectations while managing exposure to illicit activity, including money laundering, terrorist financing, and fraud.

Customer Identification Program (CIP)

Implementing a CIP is the first step in ensuring that institutions verify the identity of individuals engaging in financial transactions. By confirming key identity documents such as name, date of birth, address, and government-issued identification, CIP plays a crucial role in deterring the misuse of financial services. Compliance with CIP is mandatory in jurisdictions across the globe, including under regulations from the Financial Crimes Enforcement Network (FinCEN), the Financial Action Task Force (FATF), and the UK’s Joint Money Laundering Steering Group (JMLSG) guidance.

Customer Due Diligence (CDD)

CDD is the process of assessing the level of risk associated with a new client and then implementing the relevant checks according to that assigned risk rating. The due diligence checks required will follow one of three processes:

- Simplified Due Diligence (SDD): For low-risk clients with minimal volume or low-value transaction activity.

- Standard CDD: The default process for the majority of customers. It includes a robust assessment of an individual’s identity and behavior to mitigate potential suspicious activities.

- Enhanced Due Diligence (EDD): EDD is typically imposed for customers that are high-risk, including Politically Exposed Persons (PEPs). Further information needs to be collected, such as the source of funds, transaction patterns, geographies, and payment methods.

Ongoing Monitoring for Long-Term Compliance

KYC is not a one-time event. To maintain compliance, organizations must continually update and monitor changes in a customer’s risk profile. Ongoing monitoring can help firms promptly detect suspicious activities, including unusual transaction volumes, changes in geography, inclusion in sanctions or PEP lists, and even negative media coverage. Additionally, sophisticated KYC technology provides real-time alerts and dynamic risk evaluation of a customer’s risk profile over time.

Electronic KYC (eKYC)

Digitalization has shifted the KYC landscape from manual physical screening to rapid customer onboarding that takes place online. Electronic KYC (eKYC) uses automated tools, such as biometric authentication, Optical Character Recognition (OCR) for document parsing, and device intelligence to verify identities faster and more accurately. eKYC lowers manual review overheads and is especially useful for onboarding at scale or across multiple markets.

Comparing KYC Pricing Models

Although in-depth due diligence measures are essential for compliance, costs can escalate quickly if processes remain manual. Modern KYC software offers an automated way for organizations to implement a risk-based approach, detect suspicious activity, and meet KYC standards efficiently. Selecting the appropriate KYC pricing model according to a business’s growth rate, risk appetite, and budget can help streamline costs.

Leading platforms such as ComplyCube offer flexible pricing models to meet operational and compliance demands at every stage. These models help organizations avoid overpaying for unused services and ensure they only pay for what they need.

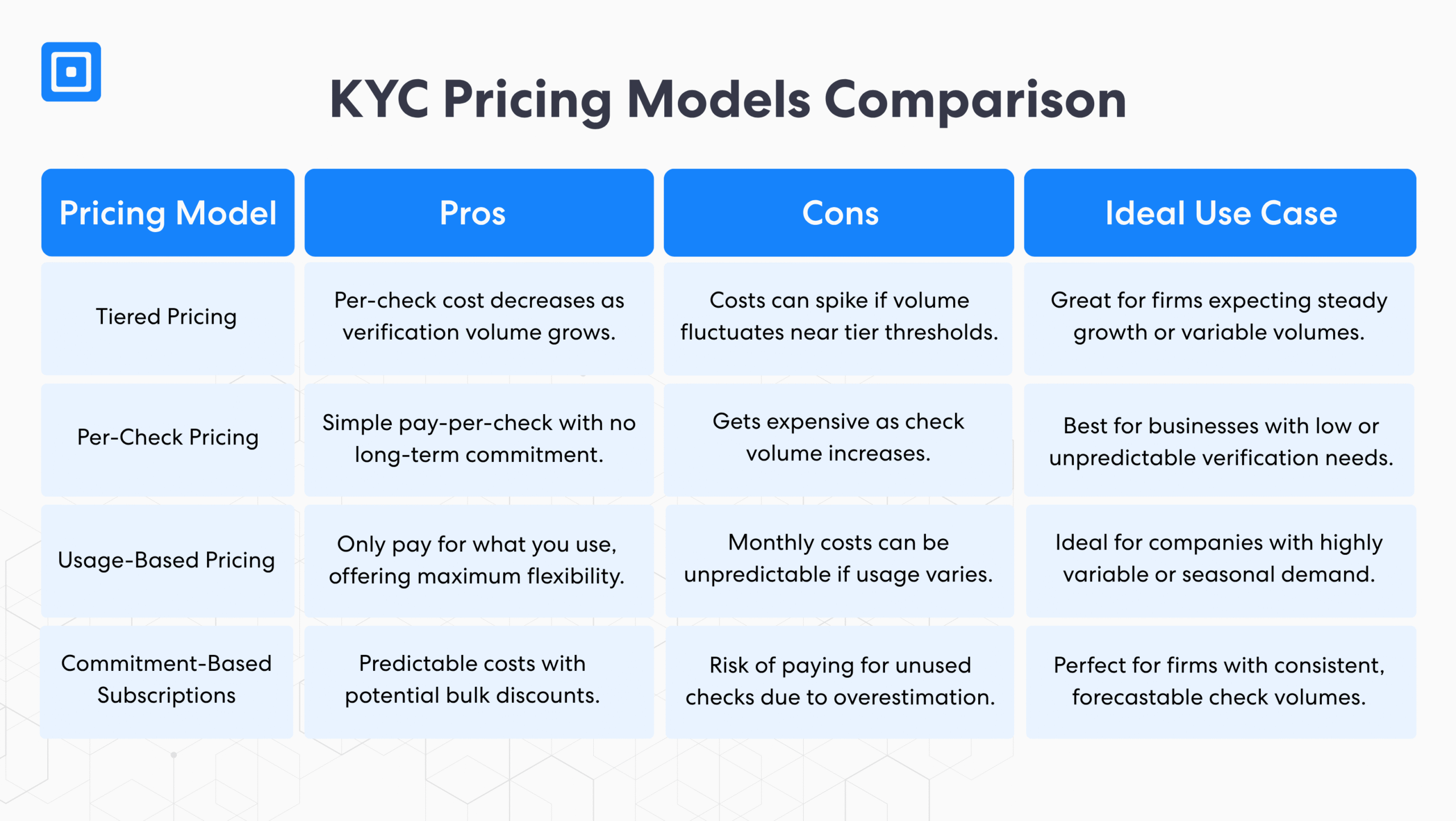

Tiered Pricing

Tiered pricing follows a volume-based model where organizations are charged based on specific brackets, such as 0–1,000 verifications, 1,000–10,000, etcetera. Each tier typically includes core or recurring services, such as ID document validation, sanctions screening, and biometric and liveness checks. The price-per-check typically decreases as usage scales, resulting in more cost-efficient onboarding per customer. This model benefits companies with growing verification volumes or forecastable growth patterns.

Per-Check Pricing

Per-check pricing works on a fixed fee for each verification, enabling businesses to access identity verification tools at lower volumes. Entrepreneurs, startups, or firms with irregular onboarding patterns are often attracted to per-check pricing as they may not have certainty over future volumes and cash flow. While this model is flexible, it can lead to higher costs if not actively monitored, particularly as transaction volumes grow or additional services are integrated.

Usage-Based Pricing

Customers are charged according to their actual consumption of products and services. This means that no matter how many checks are conducted, each service will have a fixed price without discounts as the volume or range of services utilized increases. This is useful for firms with low check volumes and is often offered on a pay-as-you-go basis, whereby the client is charged in arrears based on their actual usage. However, since costs are always a variable in this scenario, it can lead to budget planning challenges.

Commitment-Based Subscriptions

These models use verification credits, which are included in the subscription and can be used over a defined period, such as monthly or annually. These plans often bundle multiple services into a robust compliance allowance, including Know Your Business (KYB) checks, liveness detection, and watchlist screening. Customers can benefit from reduced rates on products or services based on their level of commitment over a given period. This model offers predictability with a committed balance, making it attractive to growing, profitable businesses with cyclical demand.

How to Choose a Suitable KYC Pricing Model for Your Business

Selecting a KYC solution involves more than just compliance. Companies must also consider if the system fits operational goals, scales efficiently, and contributes to a better customer experience. The right pricing model should support these outcomes while staying within budgetary constraints. Below are the core considerations institutions should weigh when evaluating any KYC provider or pricing structure:

- Accuracy: Data quality and system adaptability are key to ensuring accurate results. False positives, mismatches, or incomplete verifications can cause compliance gaps, slow down onboarding, and increase business costs. Providers should offer advanced OCR, highly accurate biometric verification, and consistent data validation across jurisdictions.

- Scalability and Adaptability: KYC compliance systems and rules are constantly evolving. Solutions must be able to adapt and grow over time as threats and regulations change.

- Cost Predictability: Whether using per-check, usage-based, or tiered models, pricing must reflect the business’s actual needs. Unexpected cost spikes often stem from unmonitored volume, misaligned contract structures, or hidden fees. Businesses must seek transparent, predictable pricing aligned with transaction volume and operational complexity.

- Reporting and Audit Readiness: Effective KYC platforms should include robust reporting tools that meet audit and regulatory requirements. These capabilities support internal compliance functions and provide clear documentation in the event of supervisory reviews or enforcement action.

- Customer Experience: Frictionless onboarding has become a competitive differentiator. A KYC system should strike the right balance between thorough verification and speed. Smart workflows, such as dynamic risk scoring and passive biometric checks, can fast-track low-risk users while flagging anomalies for further review.

ComplyCube’s Approach to KYC Pricing

ComplyCube offers versatile pricing options that cater to businesses of all sizes. With flexible identity verification pricing and a comprehensive suite of modular KYC services, firms can select the right plan and scale according to their growth stage, compliance needs, and technical requirements. What sets ComplyCube’s KYC plan apart is its ability to adapt to different business needs:

Basic Plan

Ideal for startups and early-stage businesses, the basic plan provides essential KYC tools through a monthly commitment model. Clients are allocated a monthly balance of verification credits that can be applied across various services, including ID document verification, passive biometric and liveness selfies, global AML and watchlist screening, and database checks.

Growth Plan

The growth plan is designed for scaling businesses requiring comprehensive compliance and includes advanced KYC and AML features. Packages in this tier are tailored to meet specific customer needs, with a greater commitment to unlocking more cost-effective verification rates. In addition to all features included in the basic plan, the growth plan provides:

- Risk profiling and scoring for optimized decision-making

- Know Your Business (KYB) with detailed company insights

- Advanced document verification using Near Field Communication (NFC) technology

- Active liveness detection via video

- Age estimation capabilities with a single selfie

- International authoritative database checks (eIDV)

- Proof of address verification with OCR

For businesses requiring more extensive compliance solutions, this plan comes with everything a growing business needs for peace of mind. For a complete list of features, visit ComplyCube’s pricing page.

Enterprise Plan

This plan combines ComplyCube’s full suite of compliance solutions, which are purpose-built for global businesses. Businesses in the enterprise plan can expect premium features, with custom pricing structures and enterprise-grade solutions for comprehensive risk management and scalability. In addition to all features included in the basic and growth plan, the enterprise plan provides:

- Custom screening lists tailored to business risk appetite

- 2+2 multi-bureau checks for enhanced identity assurance

- Advanced case management for streamlined investigations

- Full customized data retention policies

- White labeling for brand integration

- Dedicated infrastructure for security and performance

This plan is trusted by Tier 1 and Tier 2 global enterprises worldwide, including Citibank, Lyca Mobile, and AXA. Businesses can expect 100% service uptime from ComplyCube’s cutting-edge waterfall mechanism and an average ROI of 6.2x. Check out the full list of features in this plan.

Achieve Unmatched Compliance Without Compromising on Cost

Meeting KYC obligations is more than just a regulatory necessity; it is a strategic advantage. Whether aligning with Financial Crimes Enforcement Network (FinCEN) mandates, FATF Guidelines, or satisfying local regulators, organizations must balance robust AML controls with operational efficiency and seamless user experiences.

ComplyCube’s unified platform includes everything from biometric verification to global watchlist screening, all underpinned by industry-leading certifications such as ISO 27001:2022, ISO 30107, and UK DIATF. Talk to our compliance experts to learn more about how ComplyCube can enable you to achieve smarter, more cost-effective compliance strategies.