Secure online transactions have become the cornerstone of trust in business as the world becomes increasingly digital. This has led to the critical importance of a strong online identity verification process. A digital KYC process that’s quickly becoming the gold standard for identity assurance is electronic Know Your Customer (eKYC). This guide covers what is eKYC solutions, their role in the Customer Due Diligence (CDD) process, verification mechanics, and their impact on global businesses in today’s digital-driven environment.

What does eKYC mean?

eKYC is the solution to modern identity authentication challenges. It is a method used to streamline how businesses confirm a customer’s identity. eKYC enables firms to fulfill digital KYC compliance and prevent financial crime and money laundering.

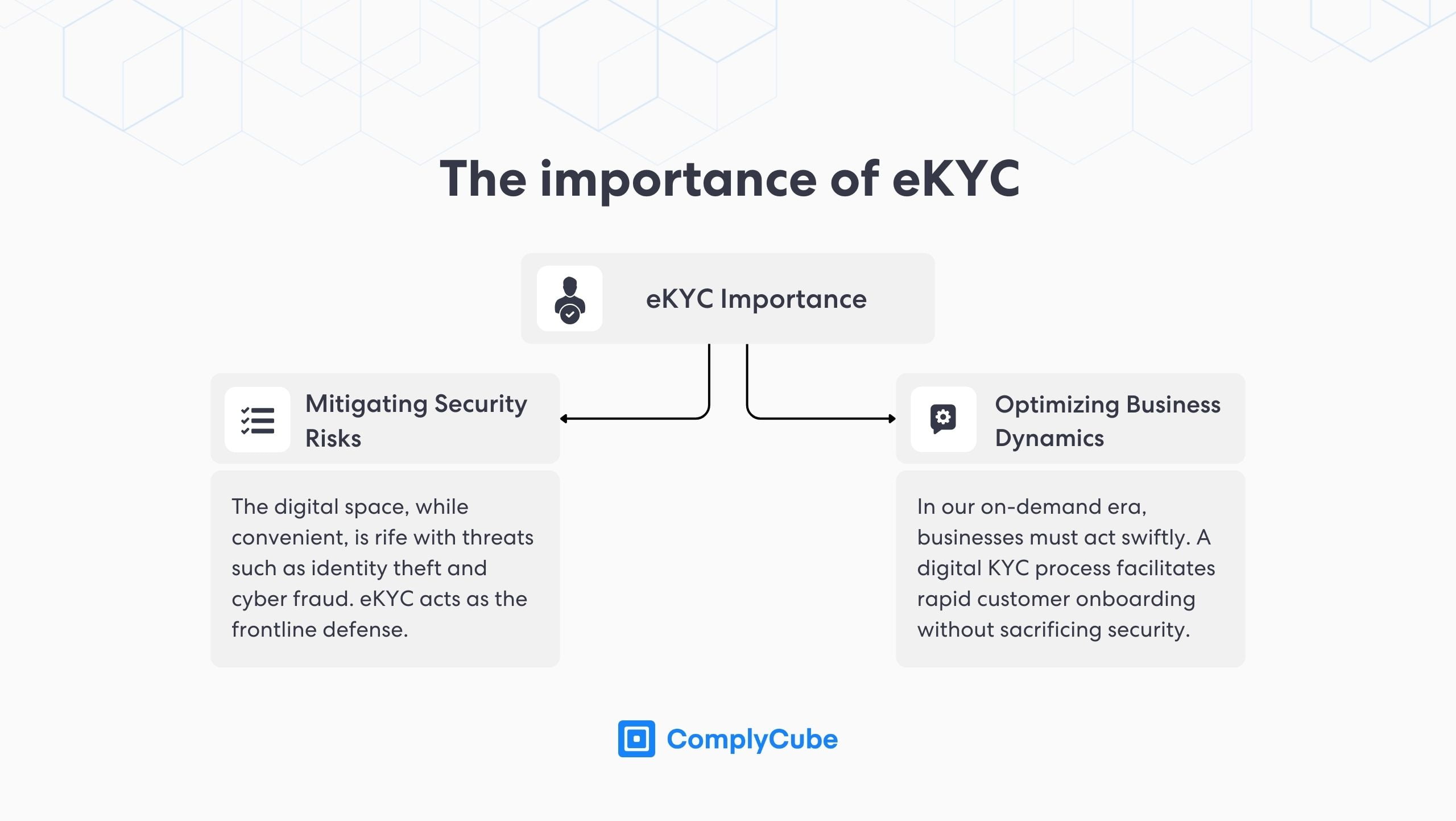

Why is eKYC Important?

Digital customer onboarding relies heavily on robust eKYC measures. eKYC enables businesses to:

- Mitigating Security Risks: The digital space, while convenient, is rife with threats such as identity theft and cyber fraud. eKYC acts as the frontline defense against these digital adversaries.

- Optimizing Business Dynamics: In our on-demand era, businesses must act swiftly. A digital KYC process facilitates rapid customer onboarding without sacrificing any security.

The electronic Know Your Customer (eKYC) market is projected to grow to around $2.79 billion by 2030.

eKYC vs. Traditional KYC Processes:

Traditional Know Your Customer methods have long relied on manual verification, requiring physical presence, paper documentation, and in-person checks. While thorough, this method often proved time-consuming and resource-intensive.

eKYC harnesses the power of technology to streamline customer identity verification using online platforms, digital documentation, and automated checks. The eKYC online process offers faster and more efficient identity verification, reduces human error, and ensures a consistent approach through a paperless process. Moreover, it can service customers globally without the limitations of physical boundaries.

The Anatomy of a Reliable eKYC Process

For financial institutions and varied other industries, understanding the electronic KYC process is vital for grasping its effectiveness in digital identity verification and preventing identity fraud:

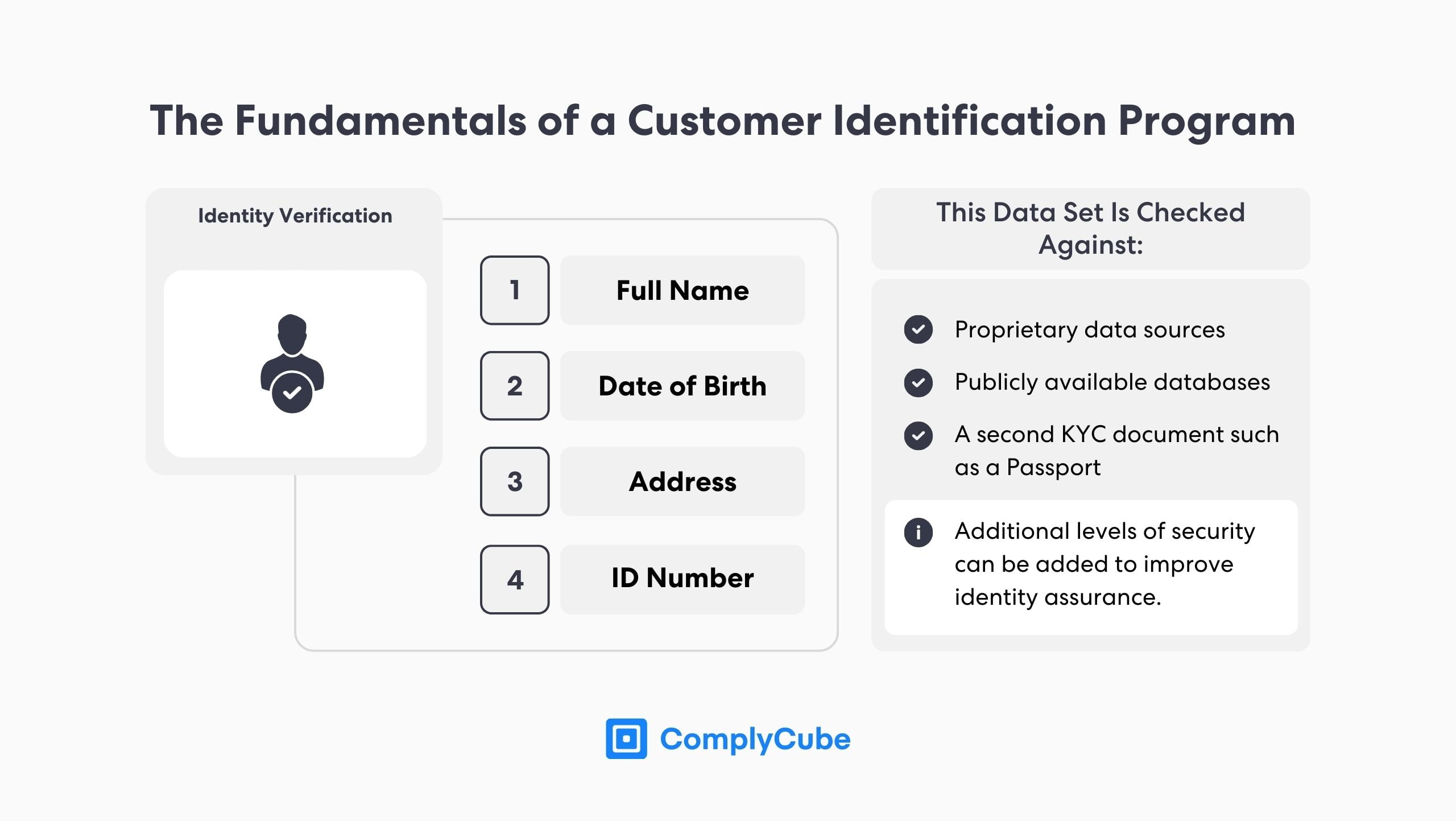

Customer Identification Program (CIP)

A CIP is vital for businesses when obtaining client information and is completed during the online registration process. When a new account is created a user enters personal details through a secure online interface. A good example is the beginning of a customer’s journey when opening a new bank account.

Automated Identity Verification (IDV)

IDV is completed to verify a customer’s identity, proving they are who they say they are. The authenticity and integrity of an individual’s collected identity data are verified through the use of artificial intelligence tools such as identity document verification, biometric data checks, facial recognition, and more. You can learn more about secure identity verification here: The Essentials Guide For Robust Identity Verification.

Customer Due Diligence (CDD)

Once customer identities are confirmed, users are subject to further checks via Anti-Money Laundering (AML) screening and comprehensive comparisons with third-party databases, known as multi-bureau. For example, a user’s residency could be compared against a credit bureau’s partnered database checks.

Feedback and Result Interpretation

The eKYC system analyzes the results verified electronically, confirming true identities or highlighting discrepancies that might need further investigation. A risk score is swiftly produced and based on a financial institution’s Risk-Based Approach (RBA), the user is automatically passed or failed.

Secure Data Storage

Verified data is securely stored, ensuring future transactions are more streamlined and protected against breaches. When choosing an eKYC provider, make sure they are compliant with your local and international data regulations.

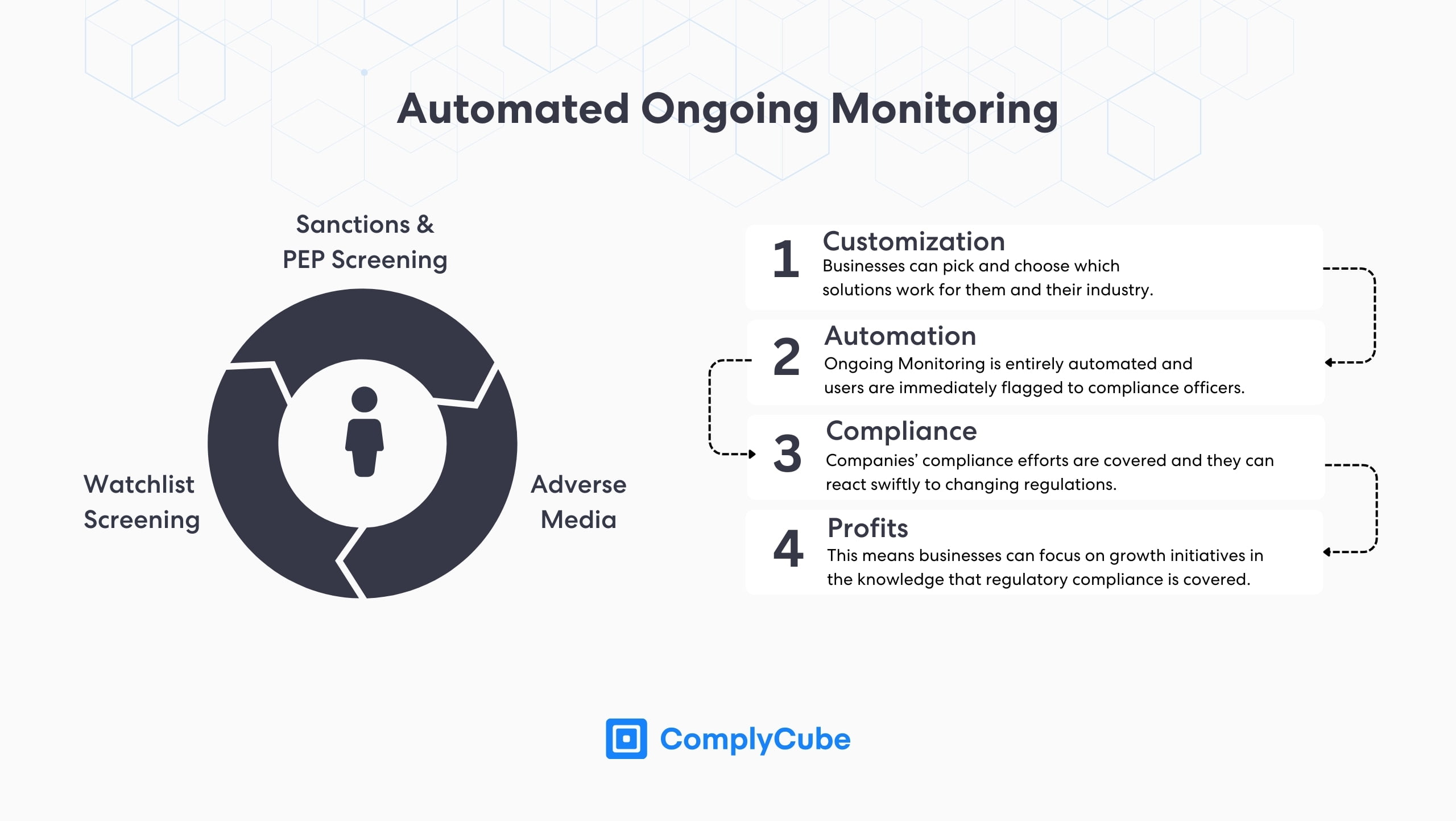

Ongoing monitoring

eKYC verification not only streamlines initial identity assurance but also facilitates continuous monitoring, ensuring ongoing trust and compliance in digital interactions. In the modern era, this is a vital solution for ensuring users’ KYC compliance arrangements do not change.

Choosing the Right eKYC Provider

To stay on top of your business’s eKYC needs, ensure scalable growth, and promote anti-money laundering, partnering with the right provider is essential. Here’s a guideline to ensure a selection that matches your required electronic identification standards:

- Reputation and Track Record: Research potential providers’ market reputation and past performance. Examining client feedback, reviews, and success stories can offer a clear picture.

- Technological Capabilities: Ensure your chosen provider is at the forefront of technology, using tools such as AI, facial biometrics, automatic video identification, and other cutting-edge verification methods.

- Regulatory Requirements Compliance: The provider should be well-versed with global and local KYC policies and regulations, ensuring adherence to worldwide data privacy norms.

- Seamless Integration Capabilities: Your eKYC solution should easily meld with your current digital ecosystem, offering minimal disruptions and maximum efficiency.

- Robust Customer Support: A provider’s value is also in their post-integration support. A dedicated, responsive team is indispensable for addressing concerns or optimizations.

- Value for Money: An effective eKYC provider should offer top-notch services that align with your budgetary constraints without compromising quality.

With these criteria in mind, businesses and economic agents can confidently navigate the eKYC online services landscape, ensuring they partner with an entity that truly complements their identity verification objectives consistently, securely, and efficiently.

eKYC Processes: Benefits and Challenges

While it offers numerous benefits, it’s crucial to acknowledge the accompanying challenges. Understanding both sides of the coin can help businesses implement eKYC processes and solutions more effectively.

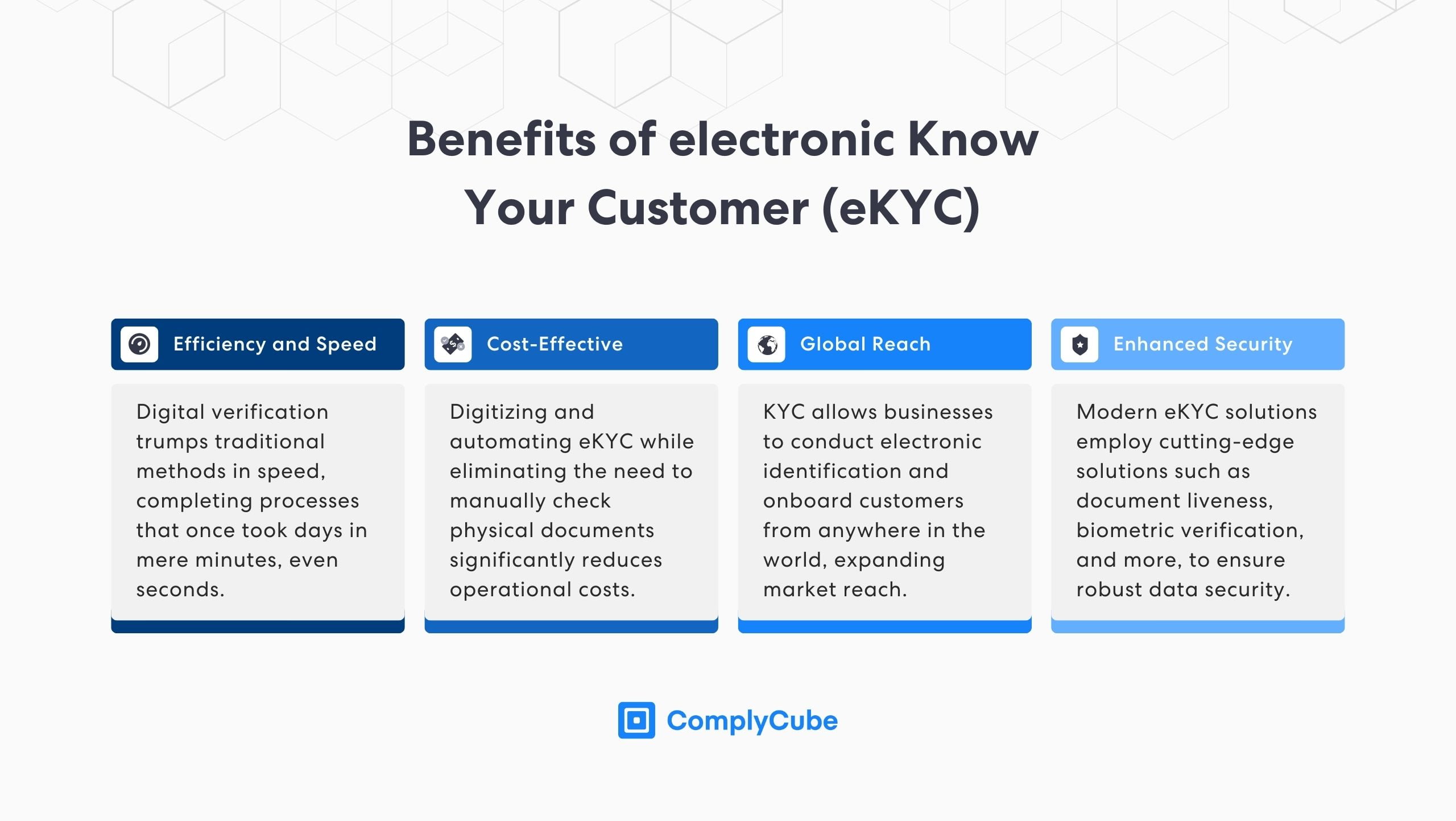

Benefits of eKYC:

- Efficiency and Speed: Digital verification trumps traditional methods in speed, completing processes that once took days in mere minutes, even seconds.

- Cost-Effective: Digitizing and automating the eKYC services while eliminating the need for manually checking physical documents significantly reduces operational costs.

- Global Reach: KYC allows businesses to conduct electronic identification and onboard customers from anywhere in the world, expanding market reach.

- Enhanced Security: eKYC solutions employ cutting-edge technologies such as document liveness, biometric verification, and AI, ensuring compliance with data protection regulations.

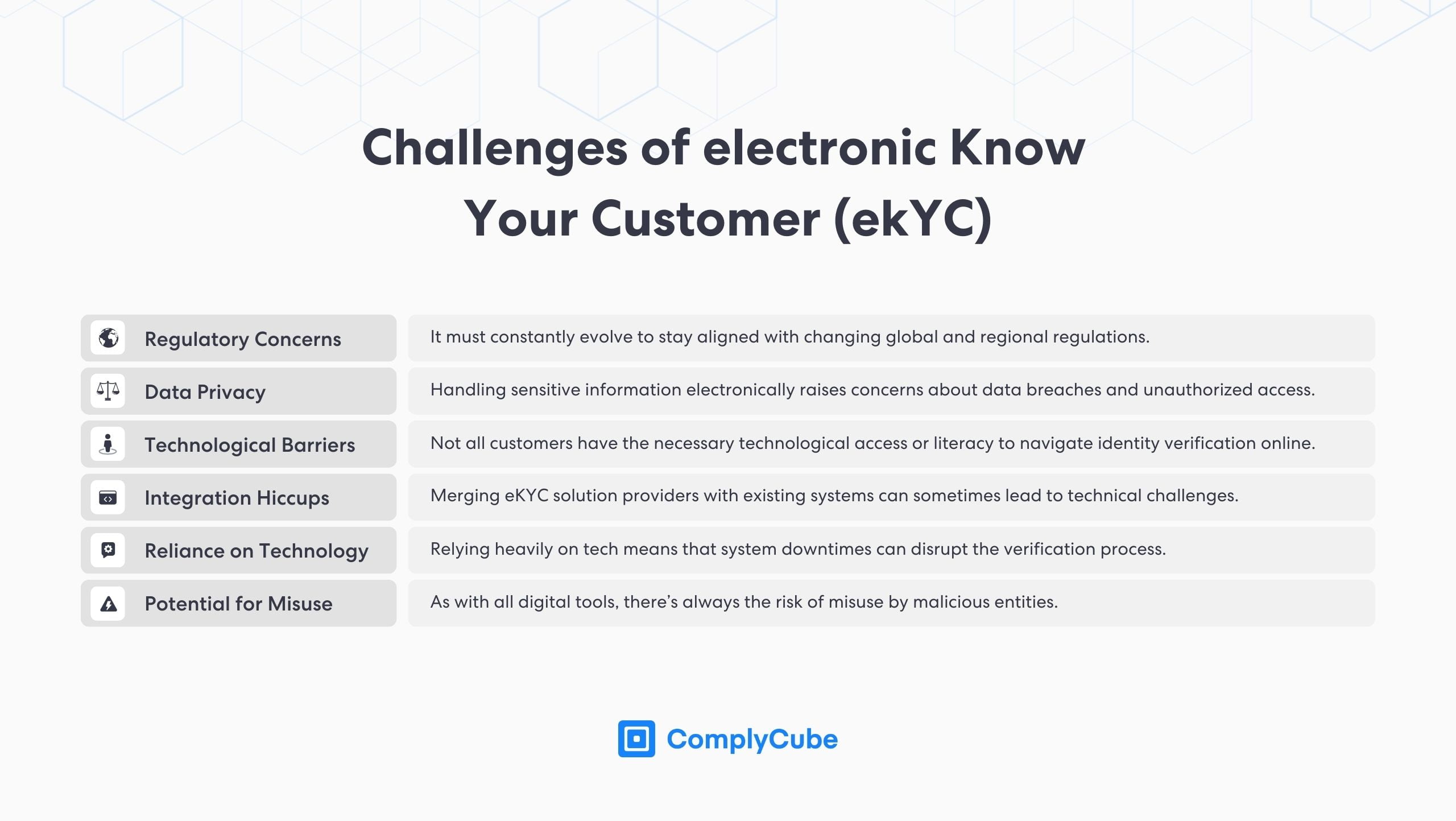

Challenges of eKYC:

- Regulatory Concerns: It must constantly evolve to stay aligned with changing global and regional regulations.

- Data Privacy: Handling sensitive information electronically raises concerns about data breaches and unauthorized access.

- Technological Barriers: Not all customers may have the necessary technological access or literacy to navigate online identity verification processes smoothly.

- Integration Hiccups: Merging eKYC solution providers with existing systems can sometimes lead to technical challenges.

- Dependency on Technology: Relying heavily on tech means that system downtimes can disrupt the verification process.

- Potential for Misuse: As with all digital tools, there’s always the risk of misuse by malicious entities.

Recognizing both the advantages and challenges of eKYC allows businesses to make informed decisions, optimizing their customers’ identity verification processes while navigating potential pitfalls.

Sectors Thriving on eKYC

As the digital era evolves, eKYC has become a cornerstone for various sectors, ensuring secure and streamlined identity verification. The application of eKYC is resonating across diverse industries, each leveraging its capabilities to enhance operations. Here’s an insight into some sectors that are truly capitalizing on eKYC solutions:

Banking & Financial Institutions

The bedrock of many modern banking operations, eKYC provides a swift and secure customer onboarding process for bank account opening. It is also crucial to meet ongoing due diligence obligations during the life of the customer relationship, preventing financial crimes and money laundering and enhancing user trust in the financial sector.

Telecommunications

As subscribers and services grow, telecommunication providers use electronic KYC practices to validate user identities, making legal procedures for registering new users and SIM activations smoother.

Real Estate & Property Management

eKYC assists in verifying both buyers’ and sellers’ identity documents, streamlining customer onboarding, property transactions, and rental agreements while preventing money laundering, identity fraud, and other financial crimes.

Travel & Hospitality

For online bookings and check-ins, e-KYC provides an additional layer of verification, enhancing customer trust and ensuring genuine reservations.

The Future of Electronic Know Your Customer

As we cast our gaze forward into the evolving landscape of identity verification:

- Technological Fusion: The merging of groundbreaking technologies such as Blockchain and AI is set to amplify the efficiency and reliability of eKYC processes and online procedures.

- Enhanced Security Protocols: With the digital landscape continually shifting, there will be a heightened focus on continually adapting digital customer onboarding and reinforcing electronic KYC processes to counter emerging digital challenges.

About ComplyCube’s eKYC Solution

eKYC isn’t just another digital trend; it’s a foundational element in the blueprint of future digital interactions. As businesses navigate the digital age, eKYC stands out as an invaluable ally, offering the speed, security, and adaptability required to prevent terrorist financing. Learn more about how you can rapidly integrate eKYC solutions today. Speak to a member of the team.