Modern Know Your Customer (KYC) solutions play a vital role in helping organizations prevent money laundering, terrorist financing, and fraud. Selecting KYC software correctly can significantly improve a company’s customer relationships, regulatory compliance, and bottom line. This guide delves into the importance of KYC verification, highlights industry-specific KYC tools, and evaluates the best features for growth-stage compliance platforms.

What Shapes the Right KYC Choice: Industry and Growth Stage

Organizations should consider the regulatory requirements for their specific industry and their growth stage when selecting the best Know Your Customer (KYC) software solutions. These factors directly shape key platform selection criteria such as the required country coverage, feature breadth and depth, scalability, and integration capability.

The demand for KYC solutions has never been greater. According to statistics from Statista and CNBC, the eKYC market is expected to reach around $2.79 billion by 2030, up from $1.57 billion in 2021.

This projection directly highlights the rapid growth of KYC adoption due to the intensifying need for secure identity verification solutions and stricter compliance requirements. In addition to regulatory alignment and scalability, several factors are going to become key considerations when evaluating KYC partners, depending on industry and growth stage, including:

- Industry-Dependent Fraud Risk: Industries, such as financial institutions, that are more susceptible to money laundering and other financial crimes often have increased compliance obligations.

- Differing Customer Expectations: Companies in highly competitive industries, such as FinTech startups, must prioritize seamless Identity Verification (IDV) processes to rapidly onboard and retain customers.

- Check Volume and Scalability: The larger and more transaction-based the organization is, the higher the number of KYC checks will need to be conducted. This requires dependable KYC compliance tools that have high levels of up-time, reliable infrastructure, and a strong track record of delivering at scale.

- Budget Limitations: Small to medium-sized businesses with cost constraints may opt for simpler KYC processes than large enterprises. These established organizations typically opt for a more complex solution-set from KYC software providers, such as active liveness, 2+2 Multi-Bureau checks, or custom AML screening lists to prioritize full compliance while achieving operational efficiency gains and improved customer experience.

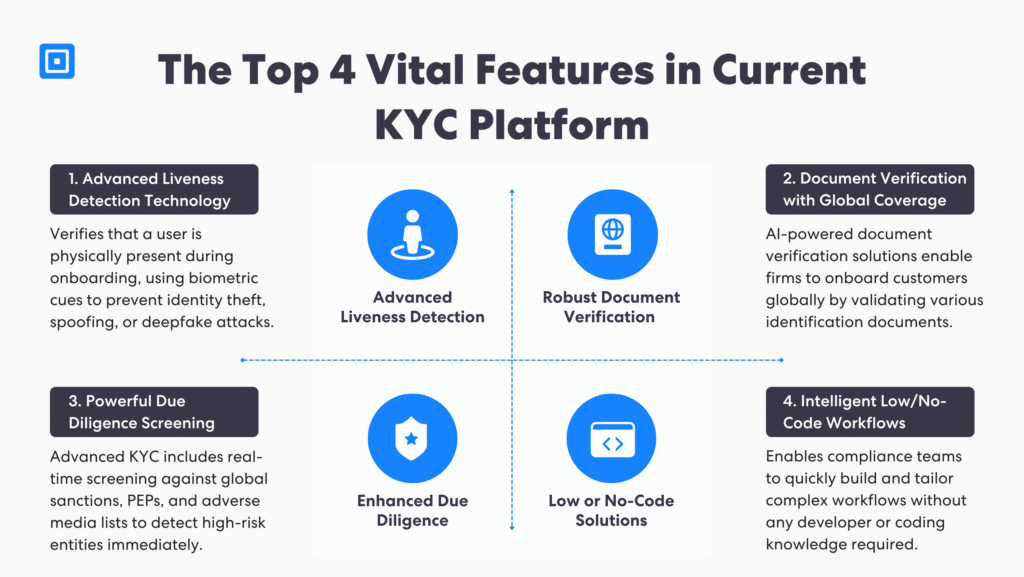

The Key Features in a KYC Platform To Opt For

Selecting the right KYC software is a strategic decision that requires looking beyond a simple list of features. Ultimately, it must meet stringent regulatory standards whilst balancing speed and accuracy. This section focuses on the core capabilites that help firms streamline identity verification, due diligence processes, and meet changing regulations:

Liveness Detection Technology

Biometric technologies refer to features that support businesses in verifying whether a user is physically present, mitigating identity theft. For instance, liveness detection uses thousands of subtle data points to ensure a customer is genuine. Liveness detection technology defends against sophisticated spoofing and deepfake attacks while maintaining seamless client onboarding.

Document Verification with Global Coverage

Opting for KYC software with broad global coverage is crucial when operating cross-border. Organizations can perform customer onboarding by verifying different identification documents accepted worldwide. AI-powered identity verification solutions offer rapid data extraction and biometric verification to onboard legitimate users accurately, reducing drop-off rates.

Sanctions, Politically Exposed Persons (PEPs), and Adverse Media Screening

KYC software must also support Anti-Money Laundering (AML) efforts with extensive screening features. Real-time verification and ongoing monitoring help businesses screen high-risk customers to authoritative sources for sanctions and watchlists. High-risk transactions and entities that pose financial crime risks can be detected immediately, building a proactive approach to AML compliance.

Intelligent Low/No-Code Automation Workflows

The best KYC software includes low-code or no-code solutions. Compliance processes can get extremely complex easily. Thus, having the ability to design tailored and automated systems without having coding knowledge or hiring a developer is crucial. With intelligent compliance solutions, firms can build risk management, continuous monitoring, and due diligence workflows tailored to different risk levels without a line of code.

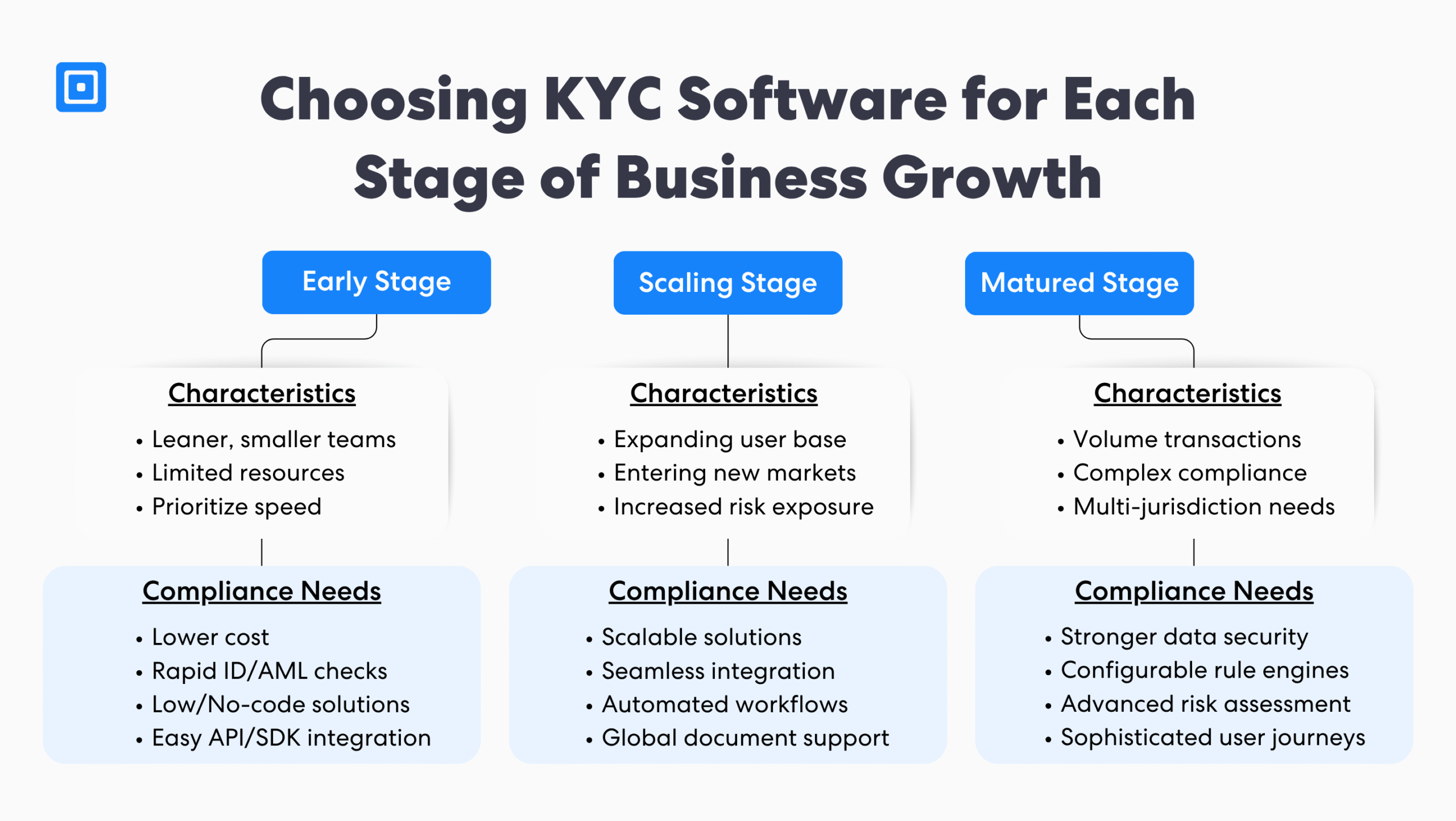

Selecting KYC Software According to Growth Stage

Organizations in various growth stages have different priorities, which shape the type of KYC and AML software to choose from. For instance, early-stage companies are typically smaller and have limited resources, forcing them to prioritize low-cost solutions and rapid identification checks. As businesses grow, they require platforms with broader coverage and stronger data security to ward off criminals and meet higher compliance obligations.

Aligning KYC solutions with current and future needs is critical to avoid painful and costly migrations. Ultimately, businesses must strike the right balance of cost-efficiency and global compliance to mitigate risk and maintain financial security:

- Early Stage: Startups and early-stage firms benefit from developer-first compliance platforms that require less technical setup. Opting for easy API integration and SDKs is vital in this stage as it delivers faster deployment rates without draining engineering resources. Organizations at this stage usually aim for rapid ID verification and basic AML checks to quickly identify fraudulent activity at a lower cost.

- Scaling Stage: Businesses expect rapid expansion at this stage as their user base and transaction volumes increase rapidly. To meet regulatory requirements, KYC processes must include higher geographic coverage and seamless integration capabilities. Companies at this stage must prioritize KYC platforms supporting a wide array of identity documents, language support, and scalable, automated workflows.

- Matured Stage: Organizations at this stage are typically larger, established enterprises with a greater appetite for credible solutions that can handle high volumes without compromising user experience and security. Features such as advanced risk assessment tools, role-based data management and access controls, and configurable rule engines are widely valued. These features help organizations meet stringent KYC requirements across multiple jurisdictions and seamlessly maintain the security of customer data.

Industry-Specific Compliance Pain Points and What to Consider

Selecting providers that can address industry-specific pain points is critical to making an informed purchasing decision. This helps ensure that the solutions chosen are tailored to the industry’s unique challenges and operational nuances.

Telecom Companies

Telecom and mobile operators commonly experience challenges in identity verification under tight activation windows and in maintaining full audit logs. Companies in this sector must focus on selecting KYC vendors with dynamic verification processes, risk reporting capability, and multilingual support.

Financial Technology Firms (FinTech)

The most significant pain point for FinTechs is keeping up with evolving global regulations. Frameworks across different regions, such as eIDAS or FATF-aligned compliance standards, can be particularly challenging. FinTech companies need KYC software with broad global coverage and automated Customer Due Diligence (CDD) tools to minimize potential risks and ensure compliance. Furthermore, ensuring a provider has security certifications such as ISO 27001 and is GDPR compliant is crucial.

Accounting Organizations

Accounting firms are prone to data breaches due to access to sensitive audit trails and financial records. The challenges faced by firms in this sector include the increasing complexity of compliance reporting requirements and the slow adoption of modern technology. As a result, accountancy organizations that fail to prioritize KYC technology risk falling behind in both security and regulatory standards. Businesses in this sector must adopt KYC solutions featuring automated workflows, transparent data management, and robust case management to ensure compliance and resilience against evolving threats.

Crypto and Virtual Asset Providers (VASPs)

Due to their fast-moving nature, regulatory authorities are closely scrutinizing crypto platforms. Crypto and VASP firms often face severe penalties due to weak AML and risk reporting processes. Thus, leveraging perpetual monitoring, also known as perpetual KYC solutions, enables them to assess updated customer information and risk profiles in real time. AI and machine learning are used to support enhanced identity verification models, detect AI-generated fraud, and protect businesses and their customers from scams.

Aligning Strong KYC Solutions to Long-Term Strategy

KYC technology can benefit all regulated businesses dealing with significant financial transactions and user data, not just financial institutions. KYC software enables organizations to adhere to global regulations and verify client identities, preventing fraud and other illicit activities. Firms can make an informed KYC purchasing decision by combining industry-specific context and organizational operational maturity. Learn more about ComplyCube’s unified KYC platform.