Digital Identity Verification solutions, sometimes referred to as eIDV or IDV solutions, are swiftly becoming a common KYC practice. This process is paramount, whether it is simply to identify a customer or adhere to ever-tightening AML regulations.

It can be challenging to determine what qualities businesses should look for in Identity Verification (IDV) solutions. This guide dives into how eIDV practices can significantly improve a business’s client onboarding process and enable a streamlined process for regulatory adherence and operational risk management.

What is Digital Identity Verification?

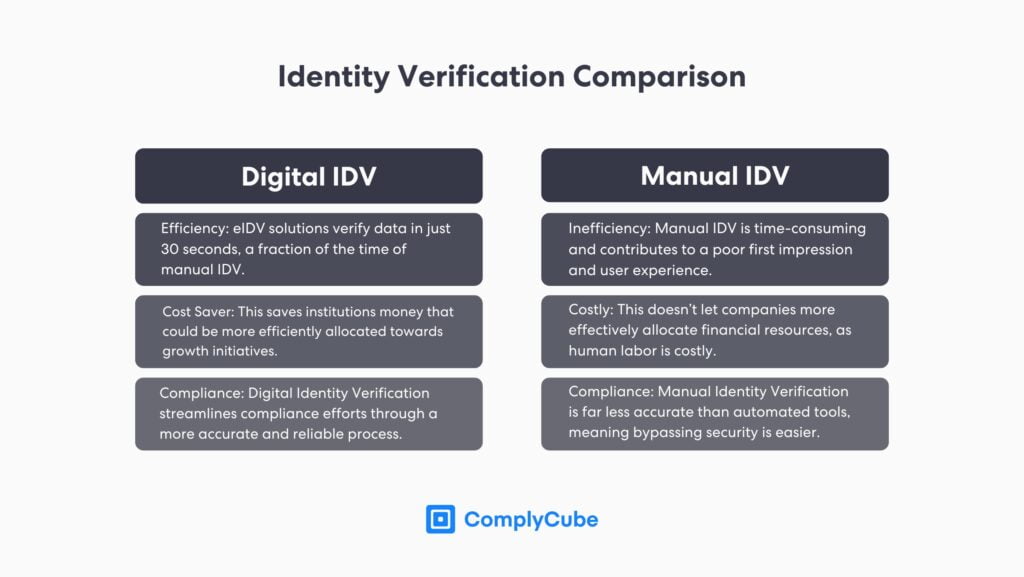

Digital Identity Verification refers to the electronic identification and authentication of user details. Before the technology-driven and digitalized global economy, IDV would be completed manually by requesting certain KYC documents and verifying this information in person (think about passport security when you go on holiday).

However, such a strategy is outdated for numerous reasons. Modern fraudulent technologies are extremely powerful. Falsified documents, deepfakes, and other AI-powered strategies can portray convincing online identities, leading to synthetic fraud, made-up identities, and other malicious eventualities.

Is Digital Identity Verification the Future?

Businesses are now turning to powerful tools for client account opening to keep pace with bad actors’ movements. Such solutions help businesses prevent fraud and identity theft and ensure compliance with the relevant regulatory authorities.

New account fraud makes up roughly 90% of all credit card fraud.

This figure shows that current Identity Verification measures are lacking. As fraudulent activity continues to rise and the methods used to power it become more sophisticated, every modern business’s compliance team should prioritize transitioning to digital Identity Verification solutions.

How do IDV Solutions Verify Users?

There are multiple national financial market regulators around the globe, each of which has its own set of rules. Most of these regulatory bodies are members of the Financial Action Task Force (FATF). The Ministers of the FATF met in April 2024 in a biannual meeting and confirmed two core features:

- Their continued recognition of the FATF as the lead global authoritative voice on AML and CTF regulation.

- Their ongoing financial support of the global institution to ensure a comprehensive service can be conducted in 2025’s assessments.

This evidences the significance of the FATF’s recommendations, and that firms around the world should commit to the advice they provide. A consistent message from the international regulator is that technology should be adopted to aid in the prevention of fraud, along with the adoption of a rigorous Customer Identification Program (CIP).

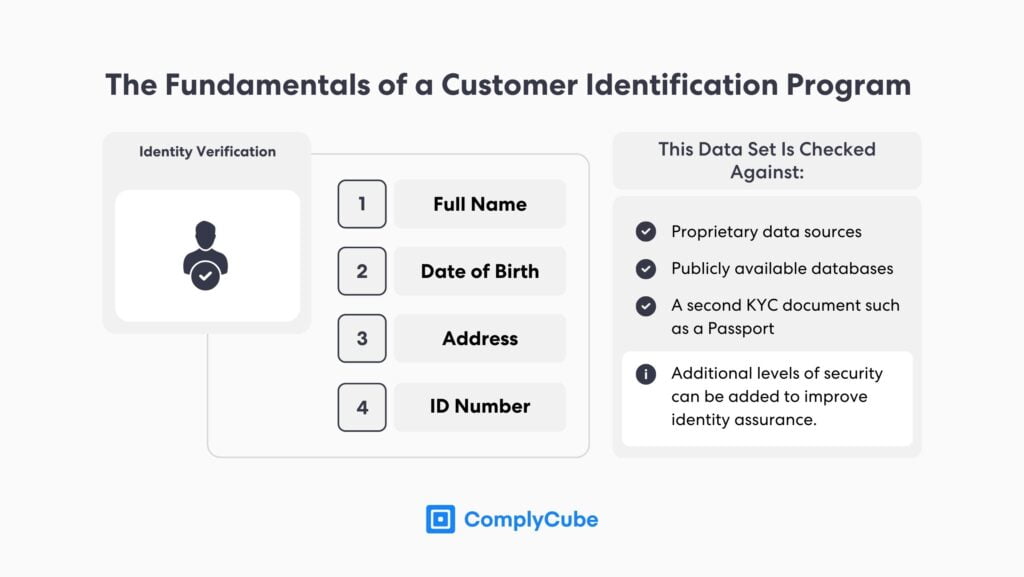

There are multiple financial regulators in America, however, the Financial Crimes Enforcement Network (FinCEN) was instrumental in developing what is now known as the Final CIP Rule between 2003 and 2004.

The Final CIP Rule mandates that banks must create an identifying program to gather a reasonable belief that a user is who they say they are. This program includes analyzing a person’s identity data, such as name, address, phone number, and birthdate.

This program was created with financial institutions in mind; however, it has more commonly been adopted by multiple other industries as the world becomes increasingly digitalized. For more information, read What is a Customer Identification Program (CIP)?

What KYC documents are needed?

Businesses need enriched customer data, and this is procured from their KYC identity documents. A person’s identity is authenticated by verifying their passport or driver’s license (or any government-issued ID) and matching this document to their face via a selfie image.

To do this successfully, businesses need to be able to quickly and accurately process one of many potential documents. Modern digital account verification demands an extremely high volume of checks simultaneously; manual identity verification no longer suffices.

This is exemplified by Revolut’s client acquisition rates in 2022 alone. The global super financial app onboarded 9.8 million new customers, which equates to over 26,500 new customers every day.

With annual revenue increasing by 45%, and over 9.8 million new customers added, the rocketship continued its ascent.

Onboarding this many users without fail and without downtime requires an extremely competitive AML, KYC, and IDV solution. These solutions have helped catalyze the firm’s ability to enter new markets quickly. For more information on Know Your Customer automation, read The Importance of Automated KYC Verification.

What is Digital Identity Verification, or eIDV?

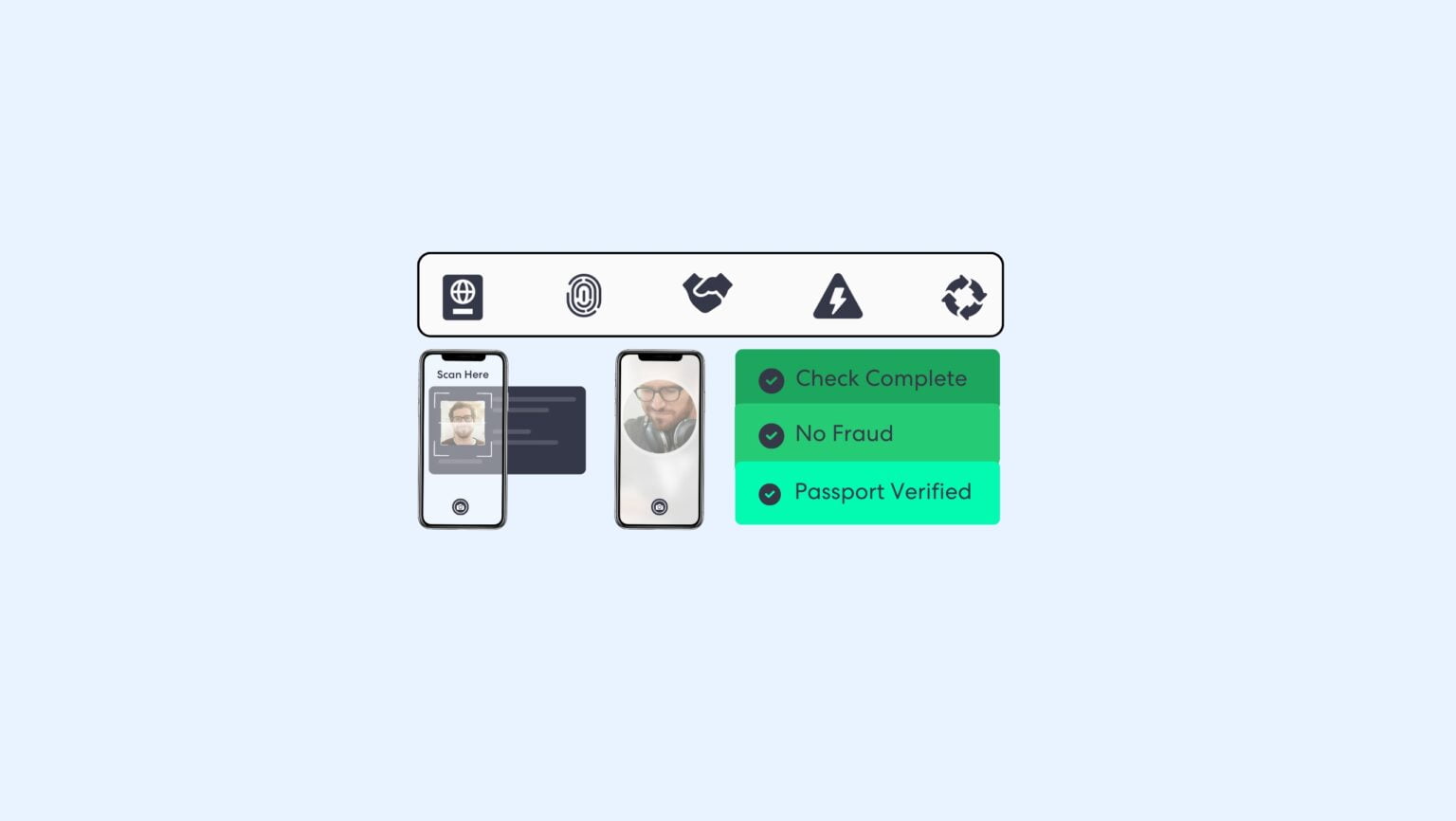

Digital Identity Verification uses advanced machine learning algorithms and artificial intelligence to extract client data at the point of their onboarding and authenticate it instantly. Verification engines are fed thousands of data entries, including global documents and individuals from around the world, to create an unbiased verification AI.

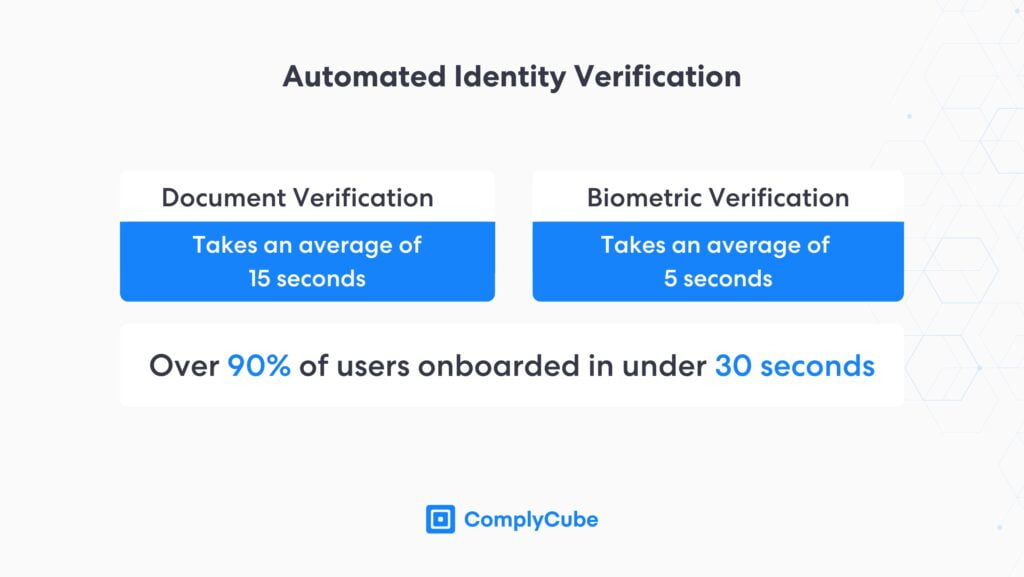

This AI powers the IDV workflow, which typically consists of document and biometric verification, providing a seamless user experience. The sophisticated technology that powers these processes can extract and verify user data in seconds, reducing client acquisition time to 30 seconds.

An IDV system can be strengthened with address verification or with multi-bureau checks to achieve greater identity assurance. These processes are fully customizable and programmable, meaning that eIDV solutions can be tailored to any unique business’s requirements.

Why Adopt IDV Systems Now?

Key regulators worldwide are recommending switching to technology-powered, automated solutions. The FATF has encouraged this initiative for a number of years now, and the US Department of Justice’s 2024 report on illicit finance further corroborated this.

The FATF’s 5th round of Mutual Evaluations starts in 2025 and it is highly anticipated that these automated systems will play a vital role in many region’s performance. For this reason, many regulators suggest integrating with an AML and KYC partner as a subject of priority.

eIDV Solutions for a Streamlined Customer Onboarding Process

eIDV solutions allow businesses to tackle fraudulent behavior and significantly improve their compliance with local and international AML and KYC regulations.

Document Verification

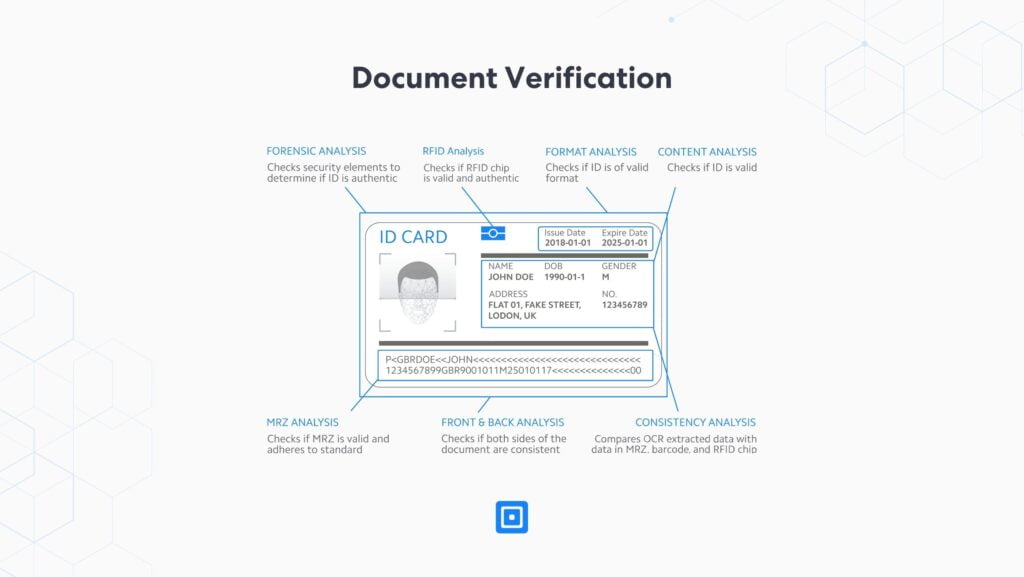

Document verification provides a high level of assurance that the document provided is authentic. Leveraging custom AI-powered verification engines, these systems can swiftly analyze multiple critical data points simultaneously, ensuring a comprehensive verification of the document.

Passports, driving licenses, or any government-issued ID are created with multiple purpose-built security features, including Near-Field Communication (NFC) technology. This short-range wireless technology enables data exchange between devices without a reliance on the internet and provides a more precise data transaction for ID cards and passports that contain RFID chips.

When scanned by an NFC-capable device, the chips’ encrypted data is read and validated. Advanced verification systems utilize NFC to confirm the authenticity of digital documents and ensure data consistency, enhancing security and streamlining identity confirmation. If your business is looking for a document authentication solution, read What is Document Verification?

Biometric Verification

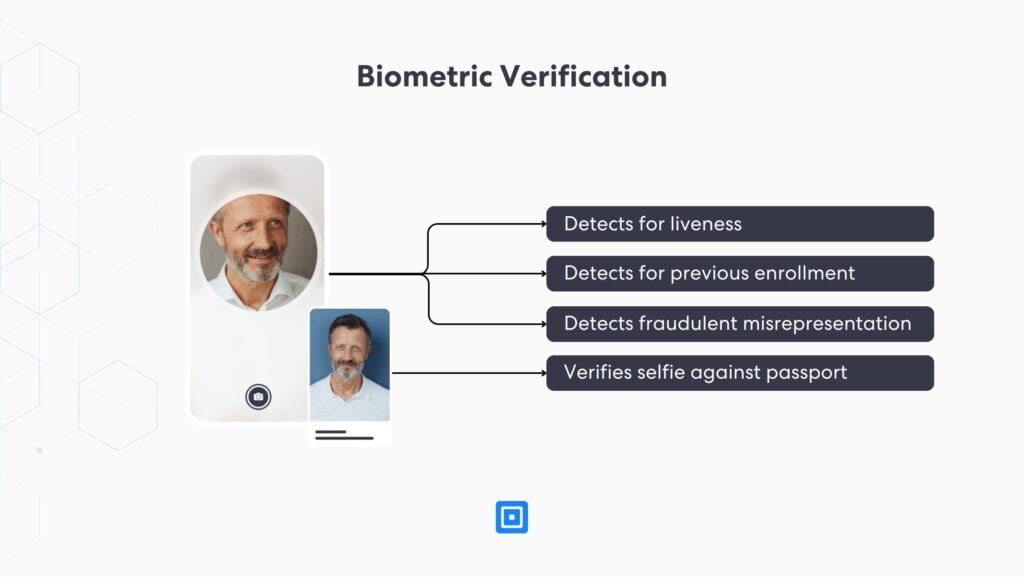

Biometric verification is now a critical component of modern Customer Identification Programs, providing high assurance of a user’s identity. It involves matching a live selfie to an ID photo and utilizes similar advanced machine learning processes to confirm the authenticity of the selfie.

Presentation Attack Detection (PAD) is a technology that is employed to analyze facial features in 3D, assess skin textures, detect tampering, and recognize disguises, such as masks. This innovative technology ensures rapid and accurate misrepresentation detection, enhancing the efficiency and reliability of client onboarding processes.

Address Verification

Proof of Address (PoA) verification analyzes documents like utility bills and bank statements. It extracts and matches personal details with client data to validate the PoA. When completed digitally, the geolocation of the PoA document can be cross-checked against the user’s IP to bring about an additional layer of identity assurance.

Proof of Address is an increasingly important check to gain identity assurance. To learn more about IP validation, geolocation matching, and PoA verification in Britain, the British Virgin Islands, Singapore, and Hong Kong, read The Pertinence of Proof of Address Verification.

Multi-Bureau Verification

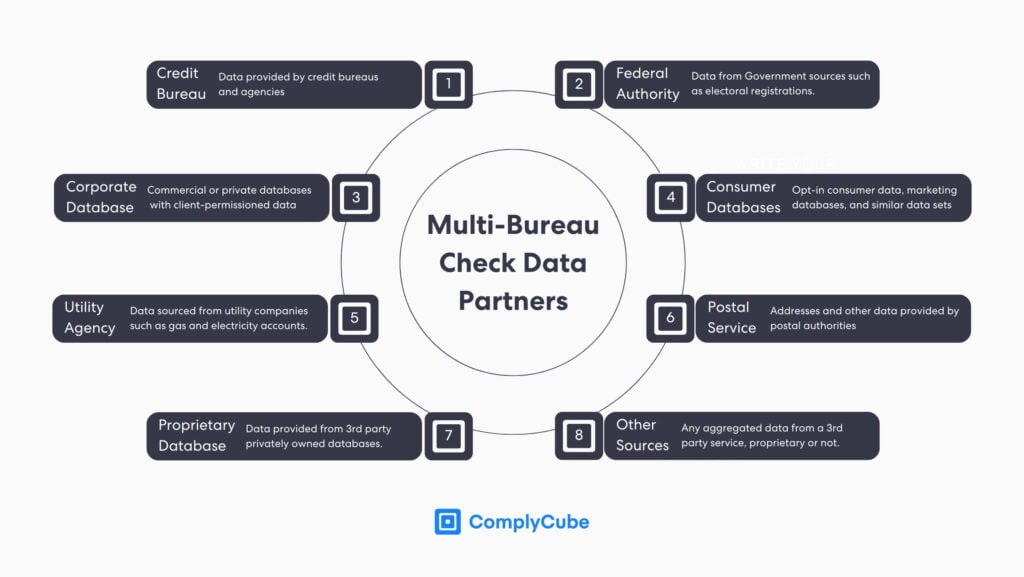

A Multi-Bureau Check enhances trust by providing a thorough financial and background verification and examining multiple data sources, such as credit bureaus, simultaneously. This approach deepens the vetting process, which is typically used to bolster identity assurance for significant corporate decisions, such as loan applications.

The graphic below details a list of ComplyCube data partners; however, their range of partners is not limited to these data sets alone. The more data partners a firm has, the stronger service the company can provide for enhancing identity assurance.

Benefits of Digital Identity Verification

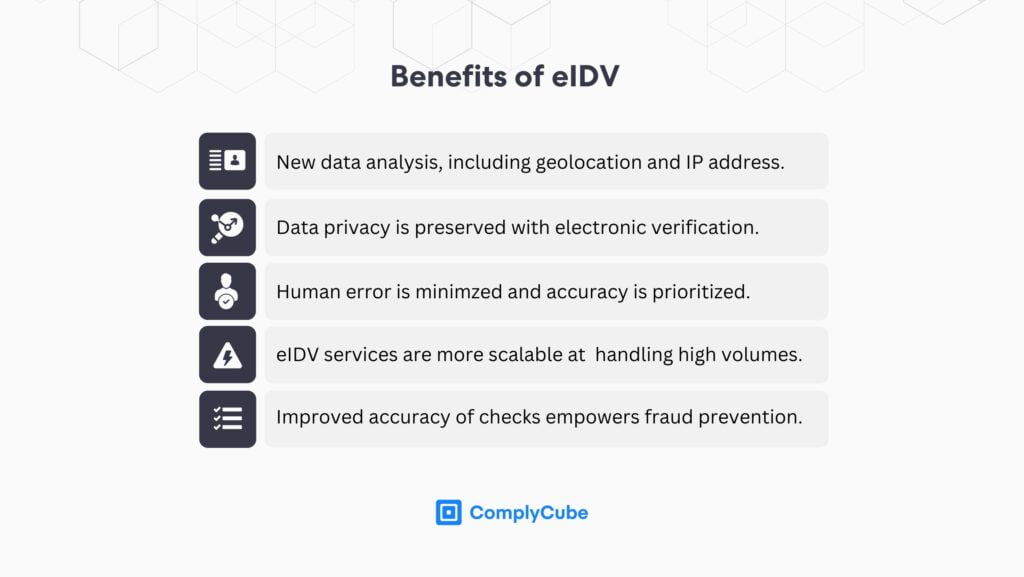

The benefit of adopting eIDV solutions is to reduce fraud risks while generating more value for businesses. The constant threat of fraudsters in both traditional and emerging markets has demanded a higher precision of risk analysis.

- Digital Identity Verification opens doors to new data. When organizations verify client data electronically, such as with a utility bill, the document’s geolocation can be matched against a user’s IP address.

- Transacting this data electronically reduces the risk of data compromization. ComplyCube adheres to the most rigorous data privacy laws, including GDPR, ISO 27001, and many others.

- These technologies minimize human interference with the ID verification process. This leads to a significant reduction in human error and increases the rate at which new customers are accepted, revolutionizing client acquisition conversion rates.

- A digital transition also enables a far more scalable service. Automation is at the core of eIDV, and solutions allow businesses to minimize spending on labor costs while onboarding faster.

- Lastly, automated IDV solutions are proven to be more accurate, empowering a firm’s ability to prevent fraud. The automation of these tasks is carried forward in the Customer Due Diligence (CDD) process, providing a seamless and reliable KYC procedure from end to end.

About ComplyCube’s Digital Identity Verification Solution

ComplyCube is an award-winning IDV solution provider, demonstrated by their nominations from TrustRadius in their ‘Best Of’ awards category. This recognition celebrates the development ComplyCube has forged into its IDV and KYC offerings.

Their IDV solutions offer a comprehensive approach to managing the multifaceted challenges of modern Identity Verification online. From advanced biometric checks to multi-bureau and document verification, ComplyCube equips businesses with the tools necessary to streamline customer acquisition, enhance their AML compliance, and effectively combat fraud.

For more information, visit their website homepage to browse their suite of IDV solutions. Alternatively, get in touch with one of their agents to find out how they can tailor an Identity Verification strategy to suit your business’s needs.