Proof of Address Verification is a core component of a KYC strategy, giving businesses increased peace of mind over their users’ identity assurance. This guide looks at the pertinence of Proof of Address (PoA) verification in the United Kingdom, British Virgin Islands, Hong Kong, and Singapore and why businesses must verify Proof of Address Documents to prevent money laundering and terrorist financing.

What is Proof of Address Verification?

Proof of Address (PoA) verification is a core component used to authenticate an individual’s residential address via official documentation. Proof of Address documents typically consist of utility bills, bank statements, invoices, and rent/contract agreements, and more.

Verifying user address documents is a vital part of a Know Your Customer (KYC) strategy to:

- Provide further identity assurance and

- Ensure the authenticity of an individual’s supposed address.

PoA aims to enhance the security and reliability of business transactions. Verifying customers’ physical locations is essential for different industries such as financial institutions, telecommunications companies, e-commerce platforms, fintechs, crypto platforms, and many more. This process helps mitigate risks associated with fraud, identity theft, and money laundering.

Regulatory frameworks demand PoA checks to comply with international Anti-Money Laundering (AML) laws and other legal frameworks. These frameworks include the Financial Action Task Force’s (FATF) Recommendations, which safeguard the integrity of the international financial system.

Advantages of Proof of Address Verification

The advantages of PoA verification are substantial. It provides an additional layer of security, significantly reducing the risk of fraudulent activities. Accurate address verification ensures that services and products are delivered correctly, minimizing errors and associated costs.

Furthermore, by implementing rigorous PoA checks, businesses demonstrate a commitment to thorough and responsible verification practices, thereby building greater trust with their customers. In summary, PoA is an indispensable tool for ensuring the legitimacy and security of customer interactions and transactions. For more information, read a Robust Guide to Proof of Address Checks.

Automated Proof of Address

Users can submit physical documents or a paper copy online to verify addresses. These can include a mobile phone bill, utility bill, bank or credit card statement, and many more. The most vital aspect of a Proof of Address document is that it must include user address data.

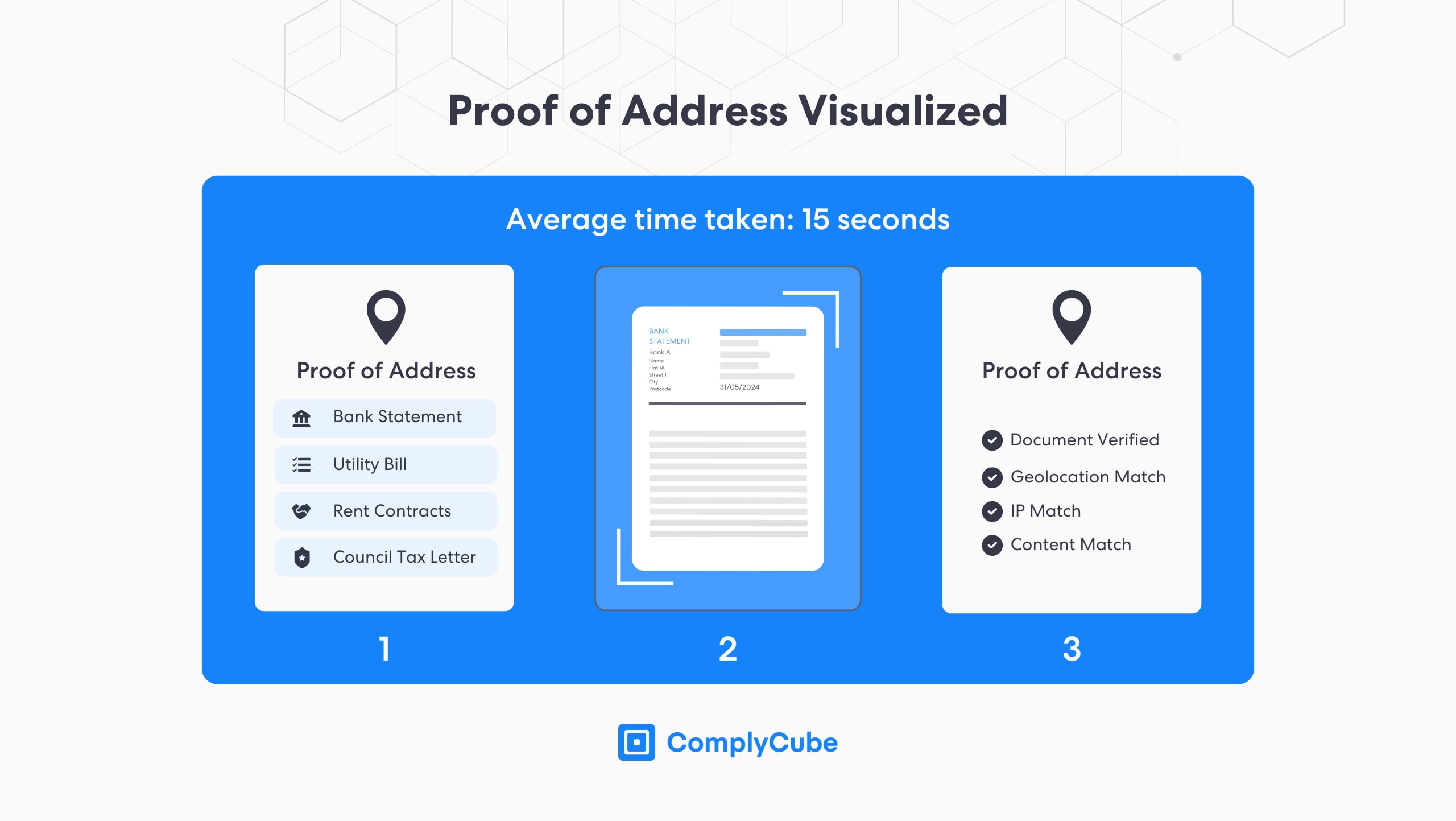

Modern Proof of Address verification uses advanced AI technologies to perform 3 types of analysis on a document instantly.

- Fundamental client data analysis, matching the submitted information during the client acquisition phase to the information on the document.

- Content analysis, confirming whether the information on the page is within the required data (i.e., 3 months).

- Geolocation analysis, determining whether the client’s IP address used to upload the document is within a reasonable distance from their residency.

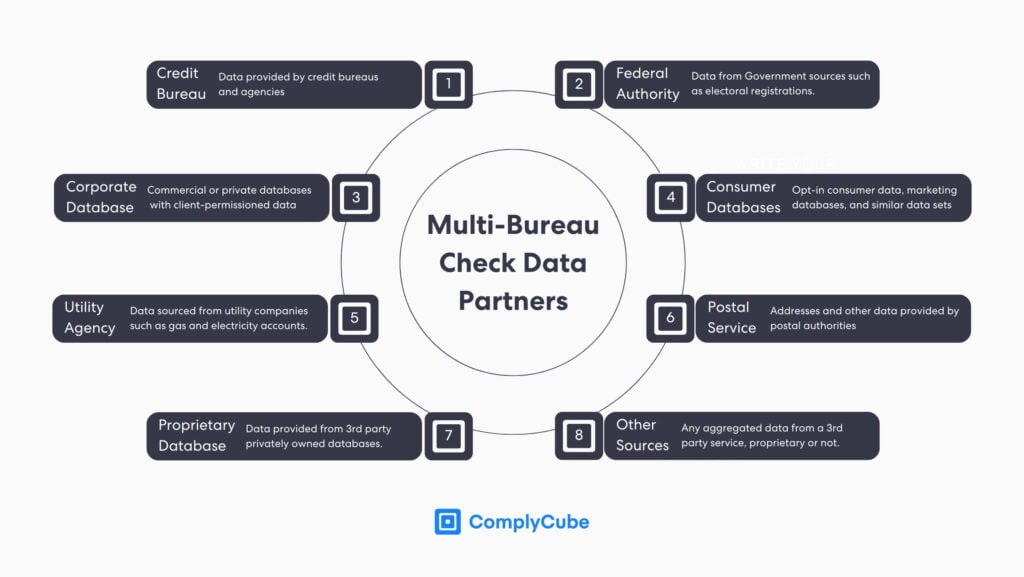

The information attained in this process can be ratified with a multi-bureau verification process, which compares the information obtained from partner databases, including those of a postal service credit union.

Regional Proof of Address Verification and Accepted Documents

Proof of Address Verification follows similar standards globally; however, there are minute discrepancies in policy and accepted documents between national jurisdictions. Always check with your local regulator for contemporary information on Proof of Address best practices.

Proof of Address Verification in the UK

Proof of Address verification is governed by the Financial Conduct Authority (FCA) regulations. The FCA requires banks and other FIs operating in the UK to implement stringent Know Your Customer (KYC) procedures. These regulations prevent fraud, money laundering, and other financial crimes, thus safeguarding both the institutions and their clients.

Accepted Forms of Proof of Address

To comply with these regulations, institutions must ask their users to present valid proof of address when opening a credit or bank account or engaging in various other financial activities. Accepted documents for verifying proof of address include:

- A recent bank statement from the applicant’s current bank.

- Bills for services like gas, electricity, water, or internet that are linked to the property.

- Letters from recognized public authorities or public servants.

- Current rental agreements with signatures from both the landlord and tenant.

- Recent credit card statements showing the applicant’s address.

- A document from an employer confirming the employee’s address.

Typically, any form of PoA document you receive should be no more than 3 months old to ensure institutions comply with the highest compliance standards. This is generally a global standard but can vary depending on circumstance and local jurisdiction.

Extenuating Circumstances

There are certain instances when banks and FIs accept alternative documents; these may include:

- Individuals claiming benefits: An entitlement letter or identity confirmation issued by the government or local authority can be used by individuals claiming benefits.

- Students: A passport accompanied by a university acceptance letter may suffice for students.

- Travelers: A letter from a local authority can be provided and used instead.

- Homeless individuals: A letter from a warden or homeless shelter.

- Asylum Seekers: An application registration card issued to asylum seekers can be used.

Proof of Address Validation in the British Virgin Islands

Firms operating in the British Virgin Islands (BVI) must be licensed with the BVI Financial Services Commission (FSC). Licensed firms must comply with the FSC’s regulations to help mitigate illicit financial activity such as money laundering. Registered firms acknowledge the following as acceptable proof of address documents:

- Utility and mobile phone bills: Bills for services like water, electricity, or gas, provided they are no older than three months.

- Bank statements: Recent bank statements indicating the individual’s residential address.

- Credit card statements: Statements that clearly show the individual’s residential address.

- Mortgage or credit union statements: Documents indicating the individual’s address.

- Local authority documents: Local authority tax bills or council rent cards.

- Municipality Statements: Statements of the residential address issued by the local municipality, notary, or banker.

- National identity card or driving license: If these documents include the residential address and are not already used for identity verification.

Proof of Address in Hong Kong

In Hong Kong, PoA verification is an essential step in most financial and legal processes. It enables compliance with the Hong Kong Monetary Authority’s (HKMA) and the Securities and Futures Commission’s (SFC) AML regulations.

The Hong Kong government strongly advocates for rigorous KYC processes, including adherence to its Proof of Address policy. Acceptable proof of address documents include:

- Utility Bills

- Communicational Services

- Bank Statements

- Government Documents

- Tenancy Agreement

- Employment Documents

- Property Ownership Documents

- Government-Issued ID

The HKMA established its own criteria for Hong Kong firms to relay to individuals when they submit their PoA documents.

- The name and address must be consistent between the claimed residential address and the information on the document.

- The document must be within the established timeliness threshold.

- Documents must be fully legible and untampered; AI-powered verification tools detect pixel tampering in seconds.

- The document must originate from an authorized entity, such as a government agency, Financial Institution or creditor, utility service, or employer.

PoA Verification in Singapore

Similarly to Hong Kong, the UK, and the BVI, PoA verification is a vital compliance component across many industries. It enables businesses to comply with the AML regulations established by the Monetary Authority of Singapore (MAS).

Acceptable Proof of Address documents in Singapore

- National Registration Identity Card (NRIC) of Singapore residents.

- Passports provided they are updated

- Bank or credit card statements

- Public authority letters

- Mortgage agreements

- Car registration documents

- Insurance policies

- Utility bills

- Employer or similar institutional letters

Acceptable documents share the same features. They are typically connected with a federal or trusted institution with a strong compliance record. PoA verification is designed to instill trust; therefore, compliant firms will only accept documents providing the same degree of trust.

About ComplyCube’s Proof of Address Verification Service

Documents such as library cards, photocopied papers, or anything not registered by a verified government or trusted authority will not suffice. Having said this, AI is more frequently being used to supply criminals with the capacity to dupe institutions, bypassing the security of the financial system.

AI-powered verification tools, such as ComplyCube’s Proof of Address check, are paramount to safeguarding the modern financial industry. AI and automation are frequently highlighted as two technologies that FIs must adopt to help prevent money laundering at its root.

Criminals are more commonly using AI related technologies to bypass traditional financial industry security measures. As this issue continues to gain notoriety, it has garnered increasing interest from international law enforcement and national regulatory agencies.

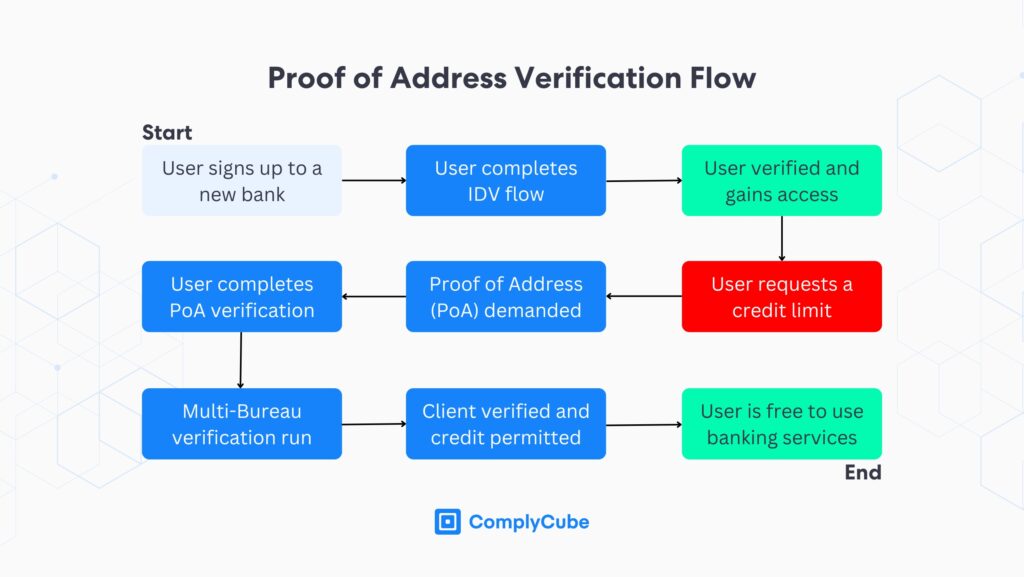

ComplyCube’s Proof of Address solution is customizable alongside its suite of other Know Your Customer services and can be integrated into one seamless workflow. Focusing on customizability and excellent customer satisfaction, they have received numerous user experience awards in 2024 alone. For more information, contact one of their KYC and AML experts today.