Increasingly complex KYC regulations have muddied the regulatory water for some time, leading to a need for change in the compliance industry. Onboarding processes are now highly automated, and generally outsourced, to enable companies to meet compliance requirements. The increased demand for an automated KYC verification service has led to a spike in the number of KYC vendors available on the market.

Choosing the right automated KYC verification partner is a tall order. This guide will explain what a KYC verification process involves and how automated identity verification procedures streamline client acquisition processes. It will also discuss what to look for when choosing a compliance service, diving into the nuances of the technology driving the industry.

An Overview of KYC Compliance

Know Your Customer (KYC) processes envelop the strategies used in fraud prevention and the monitoring of illicit activities like money laundering and terrorist financing. The stronger the KYC verification process, the better an institution knows exactly who its customers are and the less risk the company is exposed to.

Regulatory compliance varies across industries. In banking, the requirements for KYC and Anti-Money Laundering (AML) are much stricter compared to those in the hospitality or private hire driver sectors. This difference is due to greater accessibility and opportunity to commit financial crimes.

KYC vendors offer customizable, industry-specific solutions. These services can be adjusted for varying levels of identity assurance, balancing risk and tolerance as required. They aim to reduce financial system abuse and enhance company profit through identity assurance and improved operational efficiency.

While knowing your customer can differ between industries, the key 3 steps to the process remain the same. Learn more about KYC Verification here: Global KYC Verification Process in 3 Steps.

Customer Identification Program: Obtaining customer information to create a profile including but not limited to name, address, date of birth, and a government-issued ID.

Customer Due Diligence: Comparing this information against proprietary or public data sources to validate that the information provided is correct.

Continuous Monitoring: Verifying this information on an ongoing basis as part of a real-time risk assessment.

Are Regulatory Requirements Exclusive to Financial Institutions?

Regardless of its sector, every company needs to ensure compliance with the related regulatory body is met. Organizations might not share the same compliance structure based on regulations and their risk appetite. This can be due to:

Discrepancies in company risk tolerance

Differences in company size (employees and customers)

Specific risks pertaining to particular products or services

Therefore, every company has its own unique risk tolerance and will require a specific set of KYC services tailored to its business. 3rd Party KYC vendors are becoming increasingly popular as they remove the hassle from nuanced regulation while actively improving customer acquisition rates. ComplyCube, one of the leading KYC/AML providers on the market, improves its clients’ profitability by optimizing operational efficiency and reducing customer churn.

Efficient KYC platforms enable businesses to toggle their ‘friction levels’ during customer acquisition processes. A good example of this is the use of a flexible document verification solution, where businesses can set the number of document uploads a user can ‘fail’ before being ‘passed.’

This information is immediately available to KYC analysts and forms part of the user’s risk profile. The ability to toggle between friction levels reiterates the importance of fluidity in compliance. Know Your Customer verification services are the Swiss Army middlemen between regulations and operations.

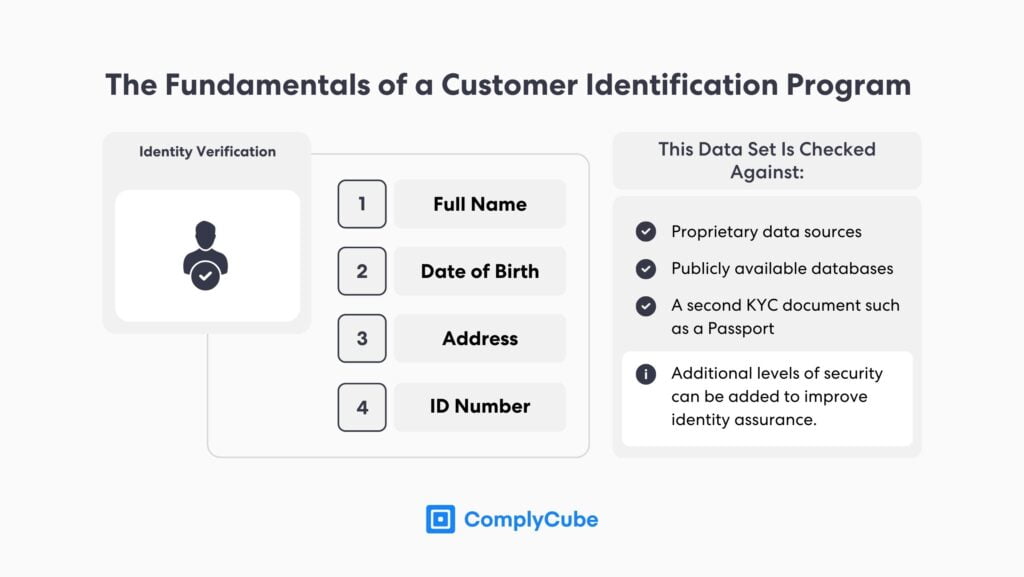

Customer Identification Program (CIP)

A Customer Identification Program is the process companies follow to prove who it is they are dealing with. The typical data required from a new customer when they open a new account is as follows:

Full Name

Address

Date of Birth

Government-issued ID

However, this model of information is subject to change depending on the level of identity assurance that is mandated by industry regulators. A financial institution, for example, would need a higher level of identity assurance to verify customer authenticity.

This information is then checked via various KYC procedures and underpins the importance of flexibility in eKYC solutions. Comparing banks and delivery services again, a bank will require far more than a biometric check to meet its obligations of verifying customer identity.

The likelihood of a banking service being leveraged to abuse the financial system is far higher than a takeaway service. As such, banks represent the pinnacle of Know Your Customer verification and it is almost guaranteed that at some point in the money laundering process, a bank will have been at risk of being abused.

What is Identity Verification?

Most companies onboarding new customers must have a procedure to validate that they are who they say they are and this process is called Identity Verification (IDV). In the context of eKYC services, this is done digitally and in a variety of methods. Learn more about eKYC here: What is eKYC (electronic Know Your Customer)?

Depending on the level of identity assurance required by an industry, IDV can be done in different ways, including but not limited to:

Document Verification: Users upload a clear image of their passport, driver’s license, or other document that details personal information.

Biometric Verification: The user is verified by uploading a live selfie which is compared to the image on the supplied document, such as a passport.

Multi-Bureau Check: Client information is ratified against trusted third parties to provide assurance that they are who they say they are.

Automated KYC procedures combine IDV with thorough customer due diligence (CDD). This onboards clients in one seamless process, both confirming the acquired data and reducing the process to a matter of seconds.

Proof of Address Verification

Proof of Address (PoA) checks are one part of the IDV process. They provide another level of assurance to prove that the customer is who they say they are and they are providing correct information. For a Proof of Address check, this includes:

Client Validation

Content Analysis

Geolocation Analysis

PoA verification, such as analyzing a utility bill, provides the service provider with basic information about a user. ComplyCube’s extraction technology takes this data and matches it against the provided information from the user upon their sign-up. For some services and industries with less of an obligation to curb money laundering, this is a satisfactory check. Learn more about PoA here: A Robust Guide to Proof of Address Checks (PoA)

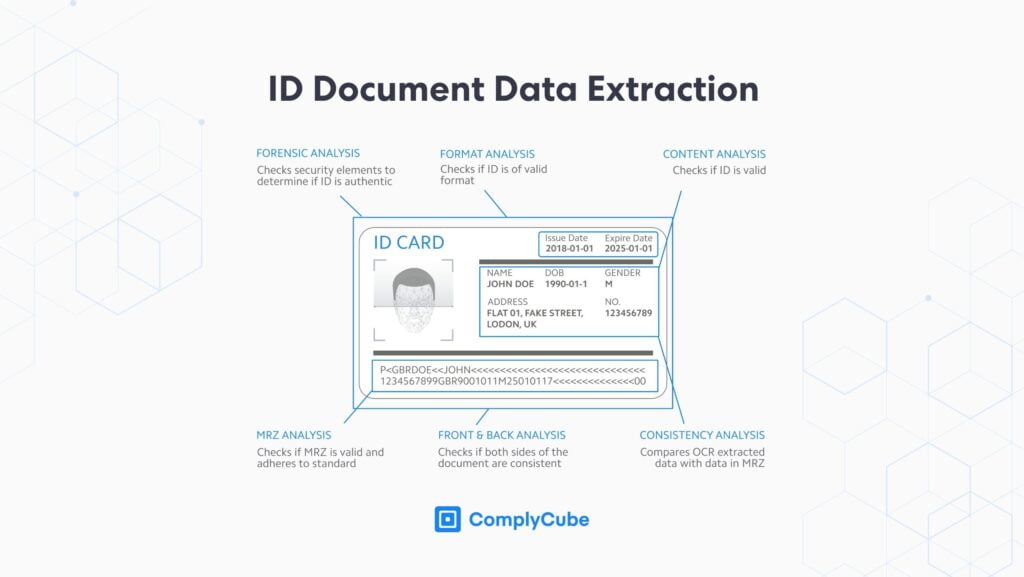

Document Checks

Proof of Address checks do not provide a high enough level of assurance for banks, FinTechs, and other financial institutions. In the finance industry, document verification is a key IDV solution. The process involves stringent analysis of identity documents such as government-issued IDs, passports, and more.

Passports contain personally identifiable information (PII) such as the Machine-Readable Zone (MRZ) number and embedded advanced security protocols including a Radio-Frequency Identification chip (RFID). With the help of modern technology, for instance, Optical Character Recognition (OCR) and Near Field Communication (NFC), a 3rd party KYC verification service can help businesses verify and onboard their customers with peace of mind.

Leading IDV/KYC solution providers such as ComplyCube use proprietary technology to instantly verify up to 25 data points, check for inconsistencies throughout the document, and match the data to information provided via an alternative verification method. For the highest level of clarity for data extraction, businesses can opt for NFC verification. Learn more about document verification here: What is Document Verification? An In-depth Look at ID Verification.

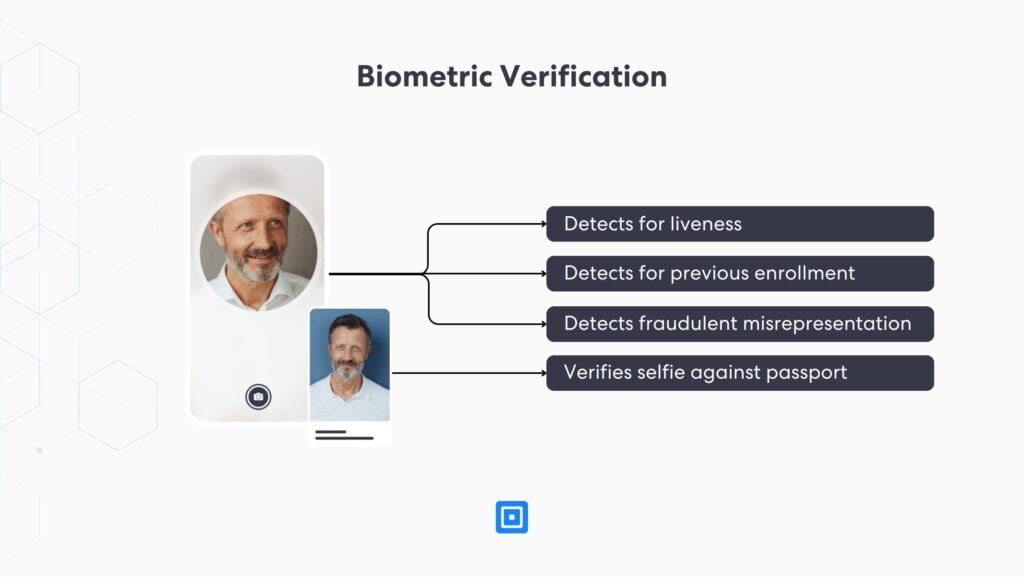

Biometric Verification

Biometric authentication is a key identity verification solution required when institutions need a deeper understanding and confirmation of their clients’ identity. This type of check verifies an uploaded selfie, taken during customer onboarding, against the user’s document image.

An efficient KYC verification service uses AI-powered biometric checks to ensure that the individual on the other side of the process is unequivocally who they say they are and to curtail identity theft. Some of the key features to look for when choosing a facial recognition solution include:

Liveness Detection: Using advanced Presentation Attack Detection (PAD) technology to analyze microexpressions, skin texture, pixel manipulation, and more, to establish the genuine presence of the customer.

Face enrollment: Immediately checks for previous enrollment of the same face and flags as an investigative requirement if it has been used before.

Spoof Detection: Detects deepfakes and misrepresentations in the uploaded selfie through an AI-powered algorithm. This could come via a printed photo, 3D life-like masks, video replays, and network spoofing.

Redaction Capabilities: Blurrs out images or other Personal Identifiable Information (PII) based on different jurisdictional requirements.

- Face Authentication: Matches a client’s facial features with their previously registered face, enabling strong, passwordless authentication, routine re-verifications, account unlocks, and more.

Multi-Bureau Verification

Multi-bureau checks are used as a further measure to corroborate that a customer is who they claim to be. Data partners, such as credit unions, have a global reach and can instantly corroborate customer details. Institutions can specify whether a customer’s data must be verified against a single data partner or a minimum of 2 independent sources, known as ‘2+2 verification’.

Leading KYC/AML solutions consider a client as verified when a bureau has matched at least their name and one more attribute. This can be as follows:

Name and Date of Birth match

Name and Address Match

Name and ID number match

How an Automated KYC Verification Service can Revolutionise Customer Acquisition and Business Operation

Once businesses are happy that they know who their customer is, they can begin their customer due diligence process. This can range from basic customer due diligence to enhanced due diligence.

State-of-the-art KYC providers offer automated services that perform the checks seamlessly and in no time. It is important to note that the due diligence process can also be completely customizable. AI-powered automated KYC solutions are designed with the clients’ operational preferences and flexibility in mind.

How does this Maximise Profit?

Automating every step in the KYC process eradicates human error from customer verification. This reduces the number of false positives creeping into customer reports.

A false positive is an error in reporting – a false alarm. It is an alert into something about the user profile that indicates that an investigation is required from an MLRO, a compliance or KYC analyst. An alert may also be triggered as a cautionary measure when there’s a potential similarity with the data of a customer who’s already enrolled or a PEP match. Automation and digitalization reduce the time spent on manual tasks and allow employees to focus on more important cases.

Improved Customer Onboarding

Digital KYC processes also enhance the customer onboarding process when transitioning from potential customers to real customers. Swifter and more efficient customer experiences equate to happier customers, but more importantly, they prevent customer churn which leads to a loss in revenue.

Improved Data Capabilities

Automating KYC with advanced technology provides a customer data storage system, that is both malleable and secure. This allows KYC analysts to perform tasks with a far greater scope of efficiency as client data can be seamlessly extracted and integrated as per the business’s operation.

Regulatory & Anti Money Laundering Compliance

Last but not least, automated KYC processes facilitate the adoption of new and updated policies. Thus, automating a KYC verification process will become increasingly integral as the modern-day risk mitigation strategy for battling money laundering and other financial crimes. With the help of a combined CIP, CDD, and Ongoing Monitoring workflow, KYC specialists can prioritize the more pertinent issues and improve operational efficiency.

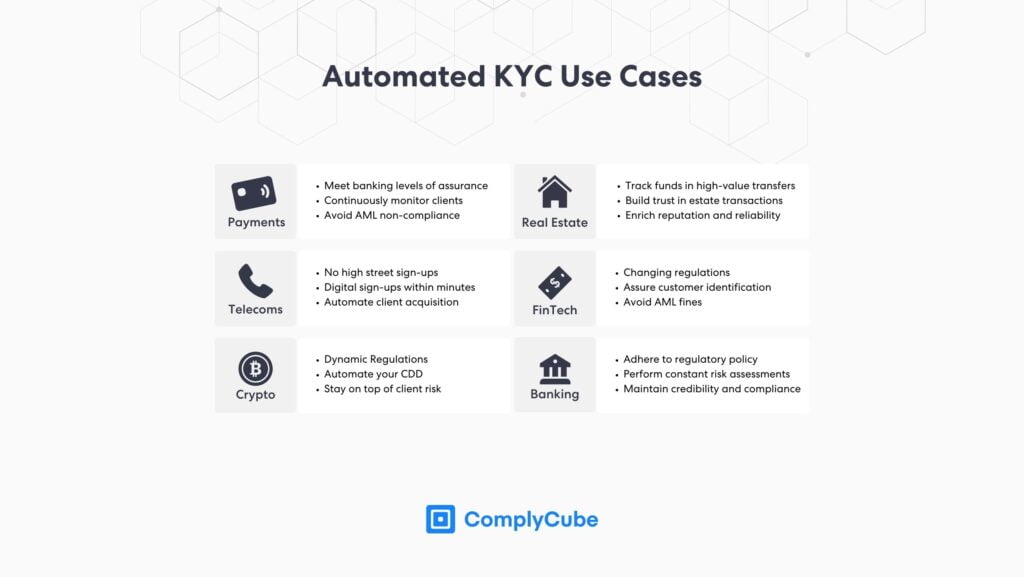

KYC Verification Service Industry Use Cases

As regulatory demands become stricter in the global economy, the scope of KYC solutions is expanding beyond traditional financial sectors. In an era where businesses are seeking ways to refine their processes, embracing automated KYC verification is becoming an increasingly obvious choice. Regardless of their use case, companies can significantly enhance efficiency across various levels by integrating an automated Know Your Customer system into their operations.

Payments

Businesses can meet banking standards of identity assurance with an automated and customizable workflow of Know Your Customer checks. KYC vendors allow companies to react to changing client circumstances, such as political exposure and adverse media relations, while reducing these operational expenses by around 50%.

Real Estate

Real Estate is a frequently abused industry due to the high-value nature of the transactions. Some of the largest challenges facing this sector are the lengthy, manual, and time consuming KYC processes on large corporate entities. An automated and efficient KYC/KYB procedure will build trust and efficiency in transactions that separate businesses from competitors and benefit from an enriched reputation.

Telecoms

The days of high-street sign-ups are gone, with the entire process of telecom client acquisition moving more and more to an online environment. With digital KYC solutions, telecom providers can reduce the cost of SIM activation by over 63%, verifying users in under 15 seconds.

FinTech

Alleviating the threat of suspicious transactions, meeting the increasingly complex KYC & AML compliance standards, and simultaneously providing a seamless customer experience can be difficult. KYC providers significantly streamline due diligence processes, reducing customer acquisition costs by up to 73% with onboarding times cut down from days to minutes.

Crypto

With regulations evolving nearly as fast as the technology underpinning it, cryptocurrency protocols and projects require an automated workflow for KYC checks. An effective KYC verification service can onboard up to 98% of customers with precision in under 30 seconds. As cryptocurrency exchanges become a more common vehicle for money laundering, creating accurate client profiles will help crypto companies avoid fines.

Banking

Maintaining a bank’s reputation is the utmost priority regarding compliance and Identity Verification. eKYC solutions can reduce customer acquisition costs by over 73%. These automated processes not only improve the customer experience but also free up time for employees to focus on other activities, such as monitoring financial transactions.

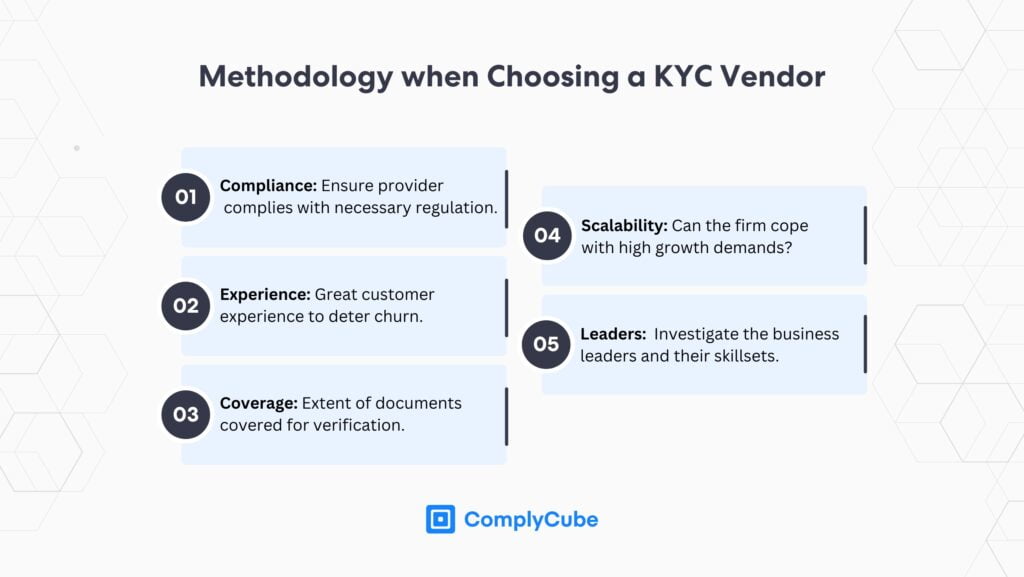

Choosing your Automated KYC Verification Service

For a high level of flexibility, effective KYC vendors provide a fully customizable suite of integrations that are designed to enhance business operations. When looking for a provider, ensuring they have the necessary infrastructure is critical:

Check that they comply with all relevant KYC and AML regulations.

Make sure the customer journey is seamless and won’t foster failed signups.

Check the breadth of documents they work with and from which authorities.

Ensure your provider can scale at your rate of growth.

Investigate who leads the business and what their background is.

ComplyCube removes the headache of policy compliance by bridging the gap between regulation and operation. If you’re looking to improve client acquisition and regulatory know-how, get in touch with our team of IDV, KYC & AML specialists.