Proof of Address (PoA) checks are a vital part of the Know Your Customer (KYC) process alongside Proof of Identity (PoI). They are typically used to authenticate the stated residence of an individual. This identity verification tool adds an extra layer of assurance when validating that a person is genuinely present, especially during onboarding processes such as opening a bank account, getting a new insurance policy, or registering a new SIM card.

This guide will delve into the nuances of proof of address checks, their role in modern business operations, standard methods used for validation, challenges and benefits, and how to choose the right address verification tool.

What is Proof of Address?

In essence, a proof of address is a document that confirms an individual’s current residential address at a particular location. The most common examples of acceptable documents include but are not limited to utility bills and bank statements.

Proof of address checks can apply to various sectors and safeguard businesses against fraudulent activities by adding an additional layer of verification and security. An Identity Verification (IDV) software is generally employed to facilitate this type of check.

Why is Proof of Address Essential for Businesses?

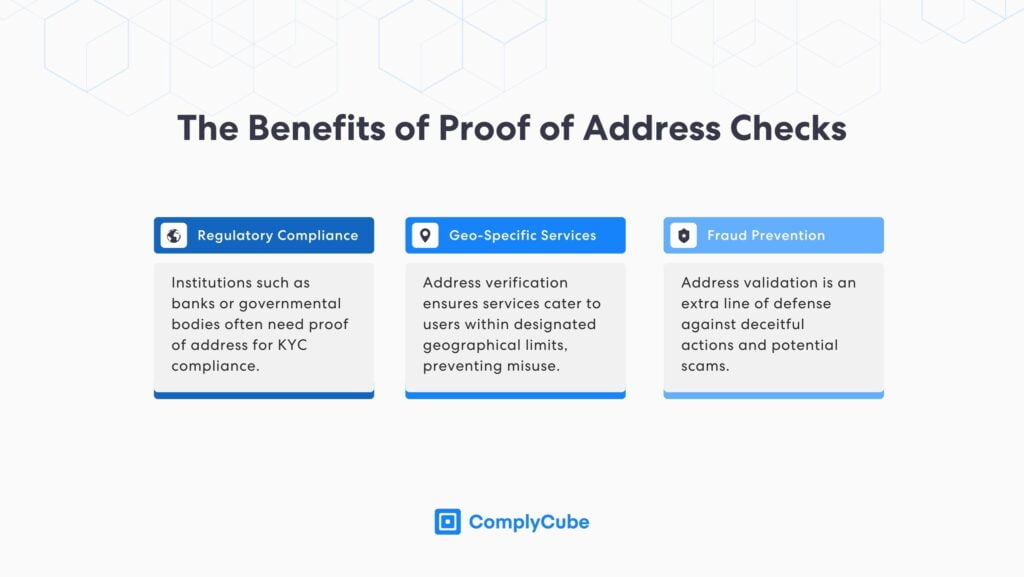

Proof of address checks establish an extra layer of trust and security in the interactions and transactions companies conduct with customers (KYC) and other businesses (KYB). This method ensures that the entities they engage with are legitimate and can be located physically, thereby mitigating risks related to fraud, money laundering, and other illicit activities. Some of the main benefits include:

Regulatory Compliance: Institutions such as banks or governmental bodies often need proof of address for KYC compliance.

Geo-Specific Services: Address verification ensures services cater to users within designated geographical limits, preventing misuse.

Fraud Prevention: Address validation is an extra line of defense against deceitful actions and potential scams.

What Counts as Proof of Address? Common Documents

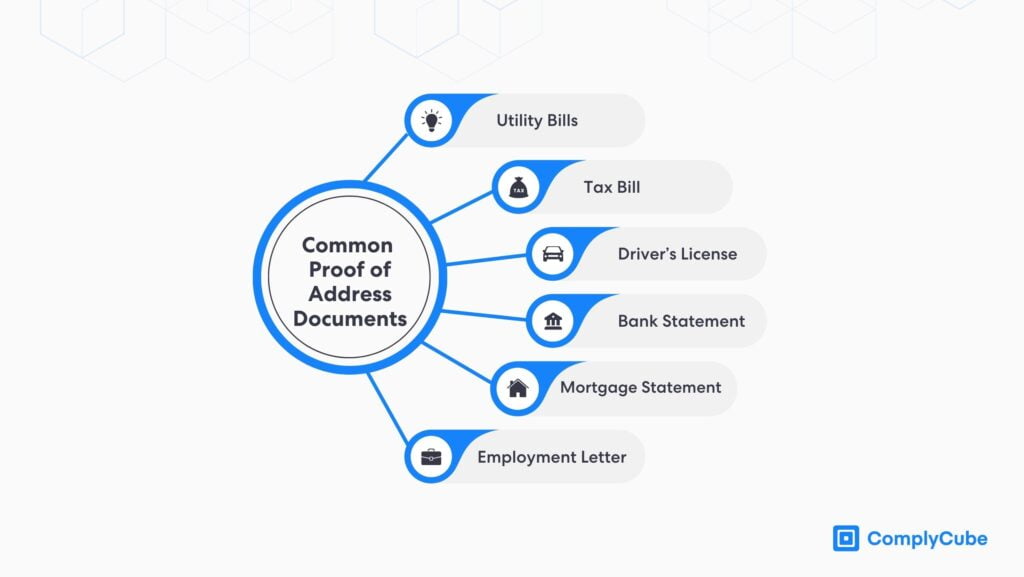

A proof of address check validates that an individual’s stated residence is genuine and supported by reputable sources. Although several documents can confirm a correct address, some are more common:

Utility bills (phone, gas, water, electricity, and other documents)

Tax bill

Valid driver’s license

US social security card

Bank or credit card statement

Lease agreement or mortgage statement

Employment letter

A widely acceptable proof of address document is the utility bill. Ranging from electricity and water to telephone and internet bills, these monthly statements are issued by service providers and reflect the recipient’s name and current address. Given their regular issuance and direct link to residential service, utility bills are seen as reliable indicators of a person’s residency. However, it’s important to note that most organizations require these bills to be recent, typically dated within the last two or three months, to ensure the address is current.

Another prominent proof of address document is a bank statement. These statements consist of monthly or quarterly summaries provided by financial institutions detailing an account holder’s transactions. Apart from its primary purpose of financial record-keeping, a bank account statement has the account holder’s name and address, making it suitable for address verification.

In certain situations, the same documents can’t be used for both PoA and PoI. Suppose an ID card, passport, driver’s license, or other acceptable document issued by government agencies is utilized for one part of the process. In that case, it can’t be employed for the other despite being an otherwise valid proof of address.

What Constitutes a Valid Proof of Address?

Recognizing a legitimate proof of address goes beyond just an official-looking document. The main aspects you have to take into account are:

Issue Date: An essential piece of data given that some proof of address documents will not be accepted unless issued recently.

Clear Details: The document should display essential information like name, address, and date.

Businesses will generally opt for an IDV provider to simplify the validation process. A cutting-edge identity verification platform uses advanced Optical Character Recognition (OCR) technology and decision-making algorithms to extract key details from the proof of address documents, which are then cross-verified with the information provided by the client and geolocation data.

Optical Character Recognition for Proof of Address Checks

With a foundation in computer vision, Optical Character Recognition (OCR) technology converts different types of documents, such as scanned paper documents, PDFs, or images captured by a digital camera, into editable and searchable data. The technology works by scanning and identifying text characters and symbols within an image and then converting them into machine-encoded text.

OCR facilitates the extraction of textual information from proof of address documents, thereby aiding in data processing, management, and analysis without manual data entry. It is a crucial tool in modern identification data management and automation practices.

Learn more about the topic here: What is Document Verification?

Improved Accuracy with Geolocation Data

Cross-referencing the data added by the customer with geolocation data offers an increased level of assurance when it comes to proof of address checks. While not yet fully endorsed by regulators, it’s recognized in the FATF’s guidance on digital identity and its potential for AML/CFT. Businesses can pinpoint a user’s location using data points such as Wi-Fi positioning, IP data, GPS, and cell tower trilateration. However, user consent is crucial to GDPR compliance, as well as for other privacy laws. Leveraging geolocation can streamline resources and expedite proof of address verification.

Industry-specific Applications of Proof of Address

From ensuring compliance to combating fraud, proof of address is critical in safeguarding both businesses and consumers. Different sectors have unique ways of harnessing address verification to suit their distinct needs:

Crypto, Banking & Finance: Utilized during bank account openings, loan applications, and other financial transactions to verify the account holder’s identity and to ensure compliance with anti-money laundering (AML) regulations.

Government Services: Individuals must provide proof of residence to gain access to welfare benefits or local voting privileges.

Real Estate & Property Rentals: Essential during property leasing or purchase to authenticate the identity of potential tenants or buyers and to prevent fraudulent transactions.

Telecommunications: Whether setting up new service contracts or verifying existing ones, telecom companies regularly seek address proof.

E-commerce and Online Retailers: Integrated into online payment gateways to confirm the authenticity of a buyer’s address, aiding in fraud prevention and ensuring the accurate delivery of products.

The Inherent Challenges of Address Verification

Navigating the diverse landscapes of global regulatory requirements represents a prominent challenge in administering PoA checks effectively. Different nations, and even different states or provinces within the country, uphold varying rules concerning what documents they accept as valid proof. These regulations demand continuous attention and flexibility from organizations to ensure compliance.

Multinational businesses, in particular, find themselves entwined in a complex web of local and international laws that dictate the specifics of conducting, recording, and storing address verification details, frequently requiring them to tailor their processes to cater to each market.

Moreover, the proliferation of digital documentation and online transactions has generated distinct challenges related to fraud and data security. While technology provides innovative tools and streamlined processes for verifying addresses, it simultaneously introduces avenues for malicious actors to forge proof of address documents and manipulate systems.

Many businesses are turning to identity verification software for eKYC to tackle these challenges. Advanced IDV platforms streamline the verification process, ensuring accuracy and compliance. With the ability to rapidly assess various global proof of address documents, this tool significantly reduces fraud risks, optimizes operational efficiency, and fortifies user trust, marking it a core asset in modern identity verification.

Learn more about the topic here: What is eKYC (electronic Know Your Customer)?

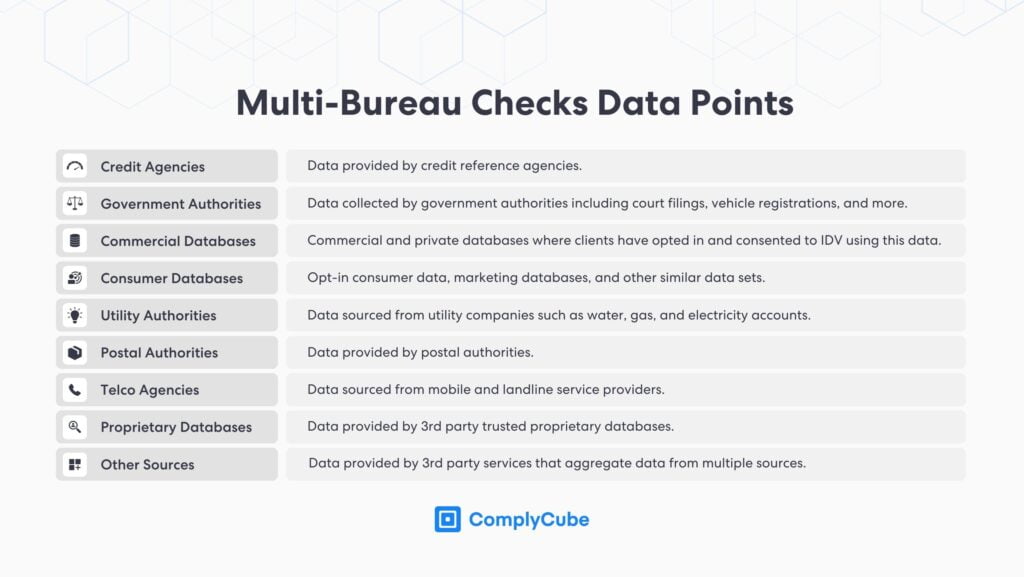

Multi-bureau Checks Layer for Increased Accuracy

For businesses seeking an increased level of identity assurance, layering multi-bureau checks on top of PoA verification increases precision. Instead of solely relying on a single data source, top-tier identity verification providers harness vast networks, drawing from credit reference agencies, government bureaus, utility authorities, and a variety of commercial and proprietary databases. This broad-spectrum approach ensures that customer details, whether it’s a name, address, date of birth, or social security number, are corroborated swiftly against a myriad of trusted, authoritative sources.

With options such as the “2+2 verification” feature, leading providers enable a verification process that demands data validation against at least two distinct sources, reinforcing the dependability of the checks. Enhanced by cutting-edge technologies such as intelligent matching engines, which employ fuzzy matching and source data deduplication, IDV platforms offer an elevated standard of identity assurance in the broader AML/KYC framework.

Choosing the Right Proof of Address Validation Tool

The digital age offers an array of KYC tools tailored for swift and accurate proof of address checks. However, finding the best-suited solution for your business requires

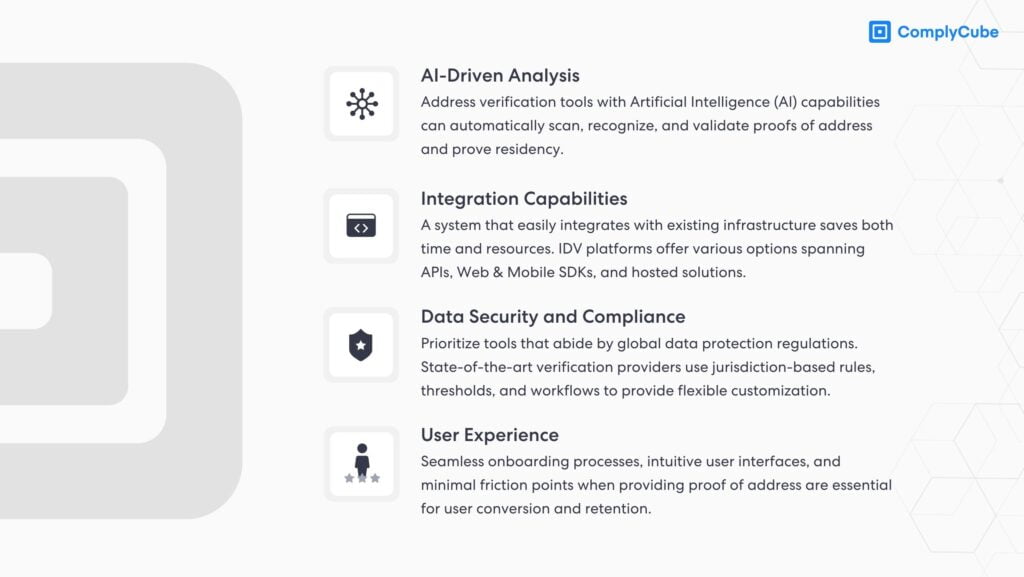

AI-Driven Analysis

Address verification tools with Artificial Intelligence (AI) capabilities can automatically scan, recognize, and validate proofs of address and prove residency.

Integration Capabilities

A system that easily integrates with existing infrastructure saves both time and resources. IDV platforms offer various options spanning APIs, Web & Mobile SDKs, and hosted solutions.

Data Security and Compliance

Prioritize tools that abide by global data protection regulations, ensuring user information remains secure. State-of-the-art verification providers use jurisdiction-based rules, thresholds, and workflows to provide flexible customization.

User Experience

Seamless onboarding processes, intuitive user interfaces, and minimal friction points when providing proof of address are essential for user conversion and retention.

When evaluating potential tools, businesses should consider their specific needs, the volume of verifications, and the solution’s scalability. Seeking testimonials and reviews and running pilot tests can also help companies make an informed choice

Conclusion

In our interconnected global landscape, the relevance of an efficient and accurate proof of address system stands stronger than ever. Beyond compliance, it’s about building trust, ensuring genuine interactions, and adapting to the ever-evolving digital realm. As businesses look forward, integrating robust address verification tools is not just a choice but a necessity.

Looking to the future, for businesses aiming to stay both protected and competitive, embedding robust proof of address verification tools is less of an option and more of a compelling necessity.

Looking for a global compliance platform for Proof of Address Checks? Get in touch with us today!