TL;DR: Document validation automation KYC offers a strong method for businesses to remove friction without hampering identity assurance. For regulated firms, automated KYC solutions boost operational efficiency while ensuring compliance. This guide outlines seven simple steps to achieve frictionless document verification with KYC automation.

What is Document Validation Automation KYC?

Document validation automation in Know Your Customer (KYC) processes leverages enhanced features to speed up decision-making during document verification. These key features include customizable risk rules and Optical Character Recognition (OCR) technology to capture, validate, and determine whether a customer is approved or rejected.

Companies lose up to $1 trillion annually due to inefficiencies in document processing.

Automation in document checks relies on Artificial Intelligence (AI) and Machine Learning (ML) algorithms to turn messy document submissions into reliable verification with minimal human intervention. As a result, it eliminates human error in manual review.

Thus, financial institutions can perform customer onboarding and comply with KYC and Anti-Money Laundering (AML) regulatory requirements accurately, securely, and seamlessly. Recent reports have indicated that firms lose over $1 trillion due to document processing gaps. It’s not surprising that the global automation market is projected to exceed $30 billion by 2025.

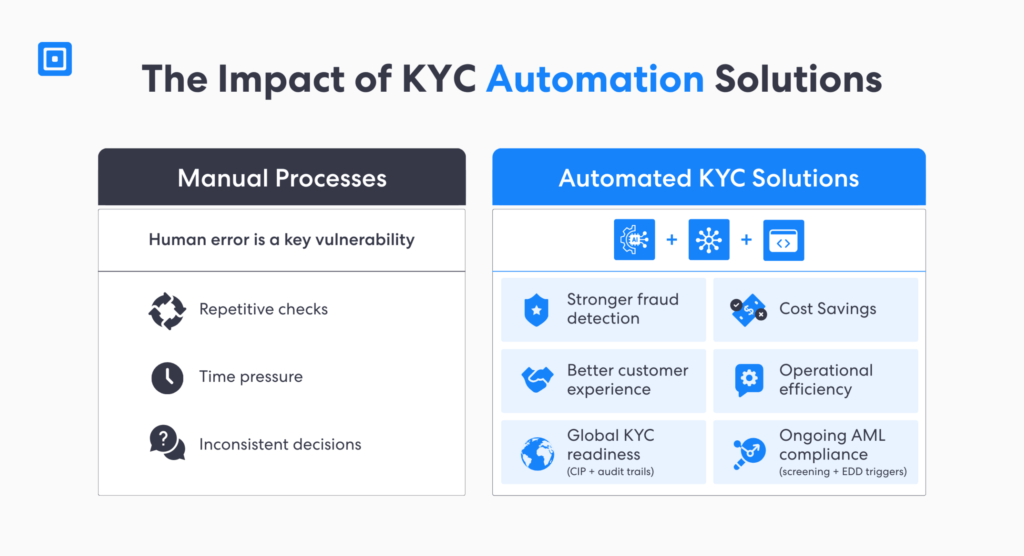

Impact of KYC Automation Solutions

The companies that will win in the next decade are those that strategically tackle AML and KYC regulations. To achieve this, a fully digitized, end-to-end, orchestrated process is required, powered by intelligent automation tools. According to RegTech Analyst, “Human error is the largest vulnerability in manual AML processes, particularly when teams are dealing with repetitive tasks under time pressure.”

Human error remains one of the biggest vulnerabilities in manual AML processes.

In RegTech, automation largely relies on a combination of artificial intelligence, ML, and integration technologies, such as Application Programming Interfaces (APIs), working together. These features work together to enrich processes such as biometric verification, sanctions screening, and ongoing monitoring, strengthening regulatory compliance. With automated processes, risk and compliance professionals can:

- Strengthen fraud detection: AI-driven tools can easily deter identity theft and flag potential risks, including false documents and deepfakes.

- Enhance the customer experience: Instant, secure verification safeguards customer transactions, boosting trust and satisfaction.

- Satisfy global KYC requirements: Build a seamless Customer Identification Program (CIP) with real-time, comprehensive audit trails to ensure regulatory compliance.

- Significant cost savings: Eliminate manual data entry and reliance on heavy staff from common processes such as document and facial recognition analysis.

- Operational efficiency: Streamline identity verification and risk management by focusing on high-risk cases.

- Ongoing compliance with AML regulations: Continuously screen against external databases, adverse media screening, and enhanced due diligence triggers.

Harry V, AML specialist at ComplyCube, adds, “The largest benefit of automated KYC and AML tools includes speed, enhanced customer experience, and cost savings.” The benefits of KYC automation tools for document checks are vast; however, if not implemented correctly, they can lead to compliance fragmentation.

Step 1: Identify Friction Hotspots

KYC automation solutions are not the end-all, be-all for enhanced customer onboarding. To start automating processes, it is important to build a strong foundation for identity verification. If automation is layered before the KYC journey is considered, it can lead to wasted time and cost. Compliance teams are recommended to map the end-to-end workflow and clearly understand the common friction points.

For example, financial institutions must build standardized policies, including defining workflow steps, risk models, and approval thresholds that can be digitized directly into rules and decision engines. Additionally, gaining clarity into customers’ pain points when onboarding is crucial. Faster time-to-value is achieved by knowing how to automate the right things, not everything.

Step 2: Map KYC Processes Around Risks

Next, firms must create clear exception paths for document verification results. Instead of routing every case to senior management, build workflow automation routing with a risk-based approach. According to the Financial Action Task Force (FATF), a risk-based approach enables financial institutions to address money laundering risks more effectively. Practical examples include:

- Low-risk document result example: Standard utility bill or passport scan: Address matches application form, format checks pass, no tampering detected: Immediate KYC completion

- Medium-risk document result example: Minor OCR confidence issues (e.g., faded address): Request single re-upload with specific guidance rather than full re-documentation

- High-risk document result example: Sanctions/PEP fuzzy match high risk score: Escalate to compliance with full candidate list, match scores, and source documents

Step 3: Customer-Focused Document Verification Guides

Continuing from above, creating a seamless customer onboarding process begins at the first interaction. When users submit poor images or incomplete customer information, it signals friction. Regulated entities and other financial institutions must implement standardized guides and user prompts during the document checks.

For example, during the identity verification process, firms are recommended to include smart forms and clear instructions, with multi-language support. When verifying customer identities from high-risk jurisdictions, the smart forms can include additional questions to maintain compliance. On the other hand, low-risk users can onboard more quickly with fewer steps.

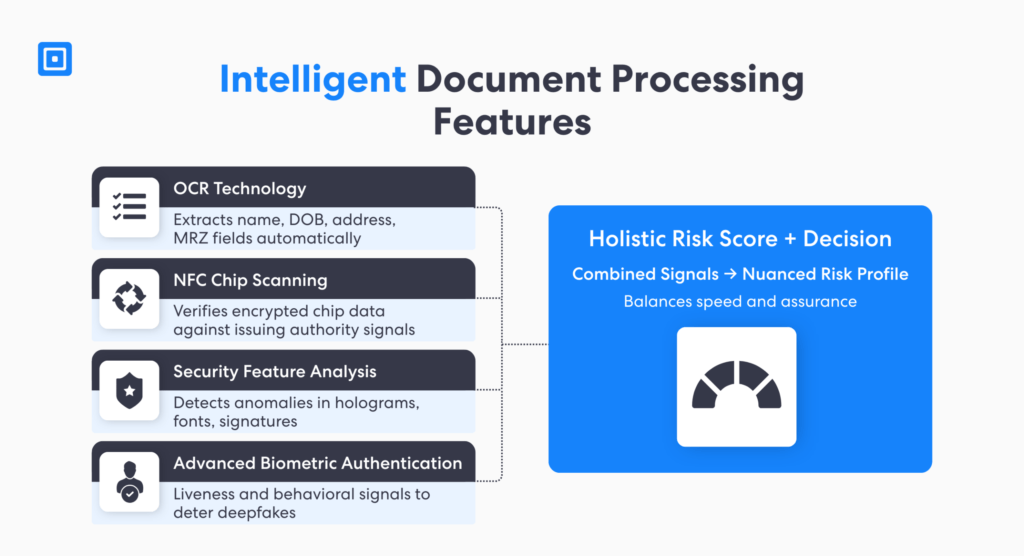

Step 4: Layer Intelligent Document Processing Features

Moving on, document validation automation KYC works best with multiple signals rather than a single factor that passes or fails. Features such as OCR customer data extraction, NFC chip scanning, and security feature analysis enhance KYC compliance by combining multiple fraud risk signals to build a holistic customer risk scoring profile.

By combining these advanced technologies, financial institutions can develop nuanced risk profiles that balance speed, security, and ensure compliance. Moreover, it eliminates manual review and the potential for human error, enabling smarter detection of suspicious activity:

- OCR Technology: Automatically extracts customer information, including full name, date of birth, and address from visible document zones and MRZ during the document verification process.

- NFC Chip Scanning: Scans encrypted chip data from government-approved ID, such as a passport, to instantly verify customer identity against issuing authorities.

- Security Feature Analysis: Leverages machine learning to analyze key features on documents such as holograms, signatures, and fonts for potential suspicious activity.

- Advanced Biometric Authentication: Combines behavioral data beyond document data using liveness detection technology. Detects deepfakes or potential risks of identity fraud.

Step 5: Implement pKYC for Ongoing Monitoring

pKYC, also known as perpetual know your customer solutions, strengthens Anti-Money Laundering (AML) compliance. The process occurs throughout the customer lifecycle journey, beyond customer onboarding. During pKYC, businesses shift away from manual KYC processes, such as periodic re-verification, towards automated KYC verification with up-to-date customer information.

pKYC relies on real-time data feeds from trusted databases, including watchlist and adverse media coverage that flag high-risk individuals or entities. As a result, customer risk profiles are always refreshed without constant re-verification interruptions. For customers with soft triggers, such as expired IDs or address updates, pKYC offers a simple frictionless re-verification process.

Case Study: Boosting Customer Onboarding with Automation

Lycamobile, the leading telecom operator faced complex and manual customer verification processes. This meant higher customer drop-out and pressure on their bottom line. The firm required enhanced biometric and document verification checks to speed up onboarding.

Increased SIM Activation Rates

To boost SIM registration, the firm partnered up with ComplyCube, the award-winning AML and KYC automation platform. ComplyCube offers secure end-to-end automation tools to verify customer biometric data and document submission at scale.

Outcomes

Lycamobile was able to leverage ComplyCube’s solutions to speed up identity verification processes, accounting for 18% higher customer acquisition rates.

The firm streamlined its customer verification process, making it straightforward for users to submit their documents, which led to 63% lesser cost-per-SIM activation.

Additionally, operating in over 250 countries and territories, ComplyCube supports Lycamobile in building its global customer base while maintaining compliance.

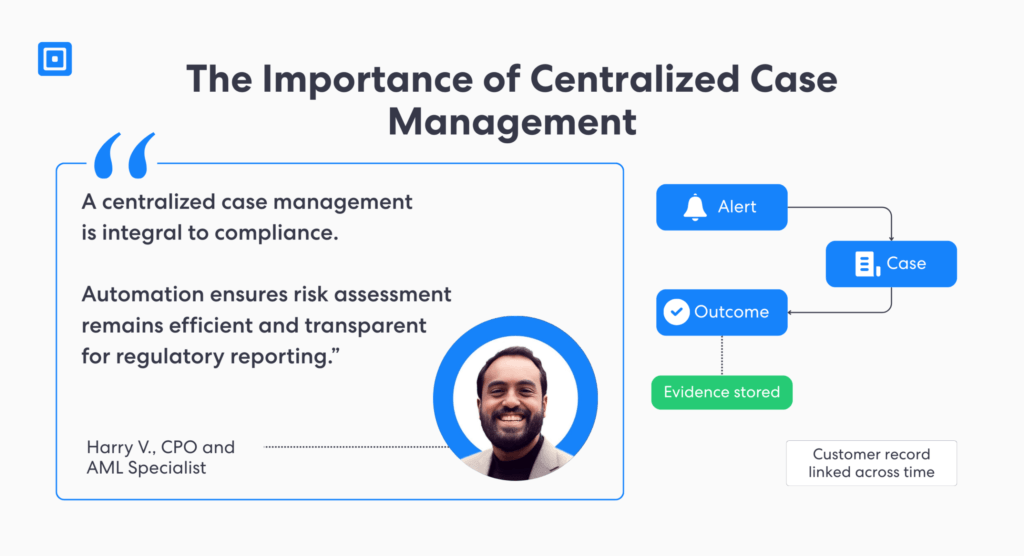

Step 6: Adopt Strong Central Case Management

To further align automated KYC checks to regulatory requirements, financial institutions must invest in a robust case management solution. Case management refers to the process of tracking, investigating, and resolving any compliance activities. “A centralized case management system is integral to compliance. Automation ensures risk assessment remains efficient and transparent for regulatory reporting,” adds Harry V.

As customer data evolves, an automated case management tool will link them back to the same underlying customer or entity. As a result, businesses prevent fragmented views of risk. Furthermore, behavioral and transaction patterns form across time, and this data can be fed back into customer automation rules to further enhance detection precision.

Step 7: Testing and Reiteration

In order to plug any gaps in the document verification KYC automation process, testing is key. To elaborate, testing and reiteration need to be an ongoing risk-driven discipline. For example, data analysis for crucial metrics such as false positives, false negatives, time for manual data entry, and customer satisfaction scores must be recorded and fed into test suites. Testing must be part of the implementation and change management plan:

- Gain clarity on risk environment: Map regulatory and operational risks to guide which scenarios need the most rigorous testing.

- Define clear success criteria: Establish benchmarks for match rates, negative thresholds, and fuzzy matching tolerance levels.

- Parallel-run phases: Perform automated KYC checks along current processes to compare outcomes and model reliability.

- Strong change management: Log new document type, geography, session version to maintain auditable evidence of results and system behavior.

Key Takeaways

Document validation automation KYC refers to the use of enhanced features, such as AI, to accelerate the verification of customer identity.

AI and machine learning are tools used to drive automation in KYC and AML solutions, making compliance more secure and accurate.

To implement automation, businesses must investigate what customer experience friction exists in their current document verification process.

Beyond identity verification, firms can reap the biggest benefit when using automation for ongoing compliance, such as pKYC and auditing.

Effective automated document verification layers OCR technology, NFC scanning, biometric verification, and security feature analysis.

ComplyCube’s Automated KYC/AML Solutions

ComplyCube specializes in secure end-to-end automation for anti-money laundering and identity verification services. Our AI-driven verification reduces false positives, accelerates onboarding, and adapts to any market or regulatory framework. Unlike legacy providers, we deliver fully automated checks, rich case management, and all-inclusive pricing – no add-ons, no hidden costs. Speak to a member of the team to learn more today. To learn more, speak to a member of the team today.

Frequently Asked Questions

What is an automated KYC process?

An automated Know Your Customer (KYC) process uses enhanced technologies such as AI, machine learning algorithms, and Optical Character Recognition (OCR) to accelerate identity verification. It moves away from manual reviews and human effort by relying on risk-based models. As a result, customer data can be verified more securely and quickly.

How does document validation automation KYC reduce onboarding friction?

Document verification within KYC automation makes use of cutting-edge features, such as OCR technology and NFC chip reading, to streamline customer onboarding. It eliminates human intervention and utilizes automatic risk-based approaches during document analysis. As a result, low-risk customers can onboard quickly, while high-risk users will escalate to more verification.

What should KYC automation logs include for audits?

In order to meet KYC regulations, automation logs for audits must provide a transparent and comprehensive record of the entire customer onboarding process. These logs provide a defensible demonstration of compliance activities, which include the checks run, customer data collected, match results, decision rules applied, timestamps and suspicious activity.

How can financial institutions implement automated KYC solutions effectively?

Key strategies to implement automated KYC solutions include integrating AI, OCR technology, and machine learning algorithms. These technologies support automated data collection, real-time risk assessments, and continuous monitoring for compliance

How does ComplyCube’s document verification KYC automation tools ensure compliance?

ComplyCube’s AI-driven and PAD Level 2-certified platform streamlines KYC and AML processes. It utilizes a cutting-edge OCR engine to extract over 13,000 types of documents across 250+ territories. ComplyCube’s solutions align with international regulatory standards, including the FATF, FinCEN, and FCA, to combat identity theft and money laundering efficiently.