An ongoing monitoring process is a vital component of a Know Your Customer (KYC) strategy and enables businesses to ensure compliance is met with regulatory bodies. Also known as continuous monitoring, it is indispensable for mitigating money laundering risks. This guide discusses what comprises an AML monitoring strategy, its underlying technology, and how it improves compliance efforts.

KYC and AML: What is the Difference?

While these processes are connected, there are integral nuances that separate them. Both strategies, however, help fortify a business’s efforts in countering terrorism financing, monitoring suspicious activity, and adhering to regulatory requirements. Both rely on ongoing monitoring.

Know Your Customer (KYC)

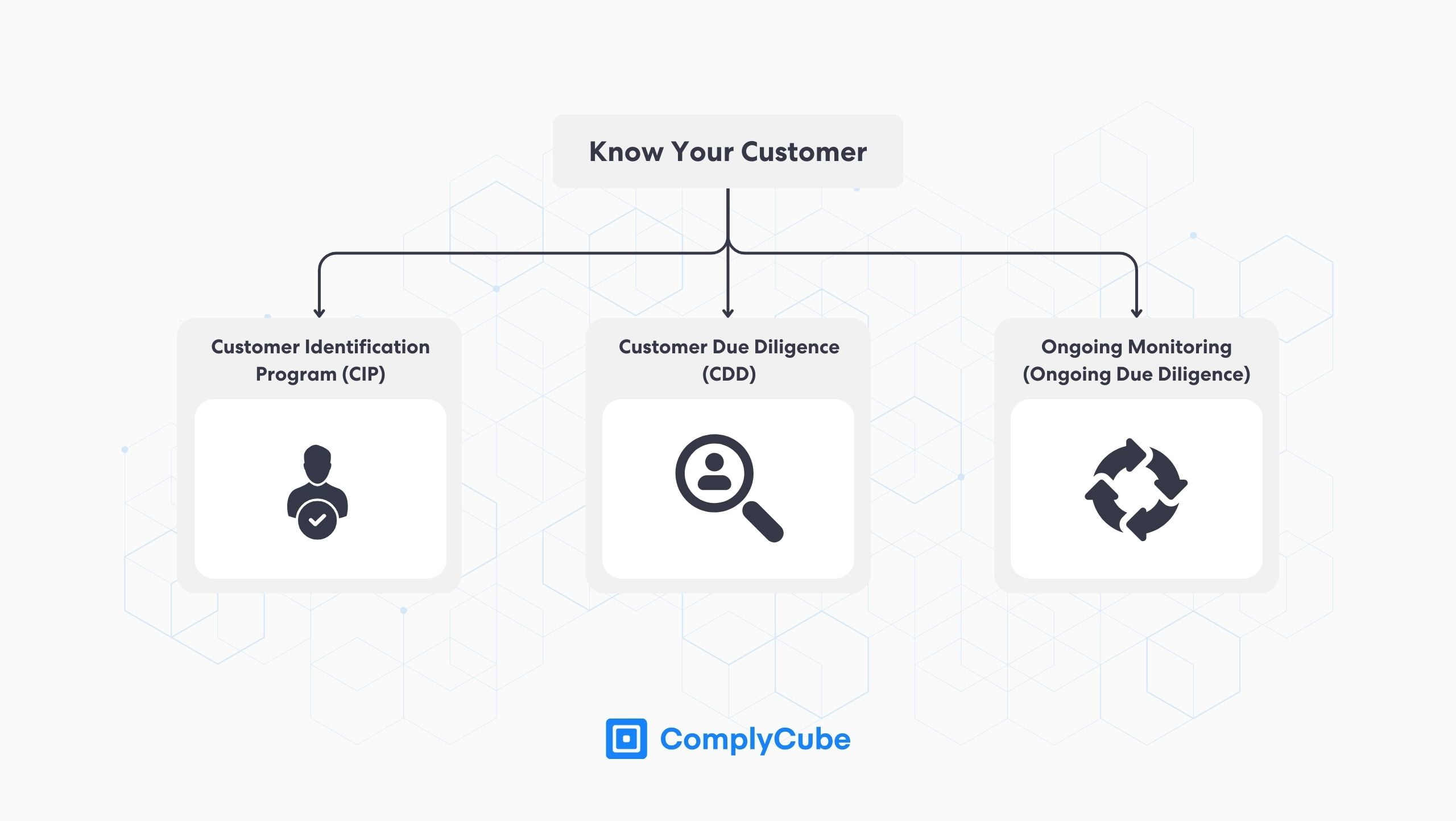

Know Your Customer is the overarching process that underpins ongoing monitoring, Anti-Money Laundering (AML), and many other Identity Verification (IDV) processes that equip businesses with the tools to identify their customers.

KYC is an extensive and dynamic process that institutions must carry out when establishing a new customer or business relationship. KYC consists of 3 essential procedures:

- Customer Identification Program (CIP)

- Customer Due Diligence (CDD)

- Ongoing monitoring

This means that KYC is not just a ‘one and done’ function. It is a process that requires fine-tuning and repeating over a user’s relationship with a business. For more detailed information on KYC Verification, read Global KYC Verification Process in 3 steps.

However, not all institutions must follow the same KYC procedure, and processes can differ vastly from one company to the next. This is because the regulatory requirements companies must meet from one sector to another are also vastly different. For example:

A bank must comprehensively identify potential risks its clients might bring. Risk assessments in the banking industry are the most laborious because banks have direct access to the financial system. This makes them the most likely target for money laundering and other financial crimes and thus have the tightest AML regulations.

An E-commerce site selling stationary would not have the same arduous regulatory requirements as the potential risks associated with the company’s operation are far less severe. For this reason, the company’s KYC strategy would likely be limited to a more basic procedure as the same level of identity assurance and customer information is not required.

This is what is known as a Risk-Based Approach (RBA). Financial Crimes Enforcement Network (FinCEN) recognizes that every industry, and every institution, has its own unique set of operational risks. For this reason, there is no one-size-fits-all methodology for Know Your Customer verification.

Anti-Money Laundering (AML)

Anti-Money Laundering is a term that encompasses the policies in place to monitor, deter, and ultimately prevent any activity relating to money laundering. This involves ongoing monitoring as well as multiple other strategies.

Continuous AML monitoring is fundamental in preventing financial crime, as an individual’s circumstances are always subject to change. These changes could include:

A new job or position that brings certain authorities or exposure to financial ecosystems.

Blackmail of any kind which makes someone do things they would never usually do.

A sudden loss of financial status renders an individual desperate for money.

To avoid non-compliance and reputational damage in their field, businesses must perform continuous AML monitoring as a perpetual risk management tool in their Anti-Money Laundering strategy. For more information on automated AML and KYC processes, read The Importance of Automated KYC Verification.

What is Ongoing Monitoring?

Ongoing monitoring is the last stage in the Know Your Customer process. Following successful CIP and CDD procedures, Continuous Monitoring ensures that the information businesses have on their clients’ potential risk exposure remains up-to-date. This is crucial as customer circumstances can shift rapidly at any given moment for various reasons, such as sudden changes in financial health, legal issues, political or personal altercations, and many more.

For example, clients might become involved in money laundering activities if they are suddenly exposed to an individual or office that brings a position of influence or authority; a development like this would typically be flagged under a PEP (Politically Exposed Person) screening.

Institutions that monitor their clients on an ongoing basis have a far stronger awareness of the risks their clients might expose their business to, enabling them to make a more decisive remedial act if required. This makes ongoing monitoring fundamental to a business’s AML compliance strategy, particularly in the financial industry.

Global developments in AML and KYC regulation suggest that continuous monitoring will become increasingly integral to safeguarding the financial industry. The finance industry has embraced digitalization in many ways which has opened up new methods for money launderers to exploit the financial system.

The cryptocurrency market has enabled such a vehicle to bypass existing AML legislation which has forced global regulators to tighten their policies. The EU has agreed to introduce tougher due diligence measures on Crypto Asset Service Providers (CASPS), where ongoing monitoring of users’ profiles and transactions will become common practice.

What are Ongoing Monitoring Processes?

There are various ongoing monitoring strategies that a business can use; however, to do these all manually by regularly reviewing user KYC documents would take a vast amount of time – time that can be far more efficiently allocated.

This has led to a rise in KYC verification services that bear the burden of customer compliance to allow businesses to focus on growth, efficiency, and revenue drivers. Continuous monitoring is essentially the continued due diligence of users.

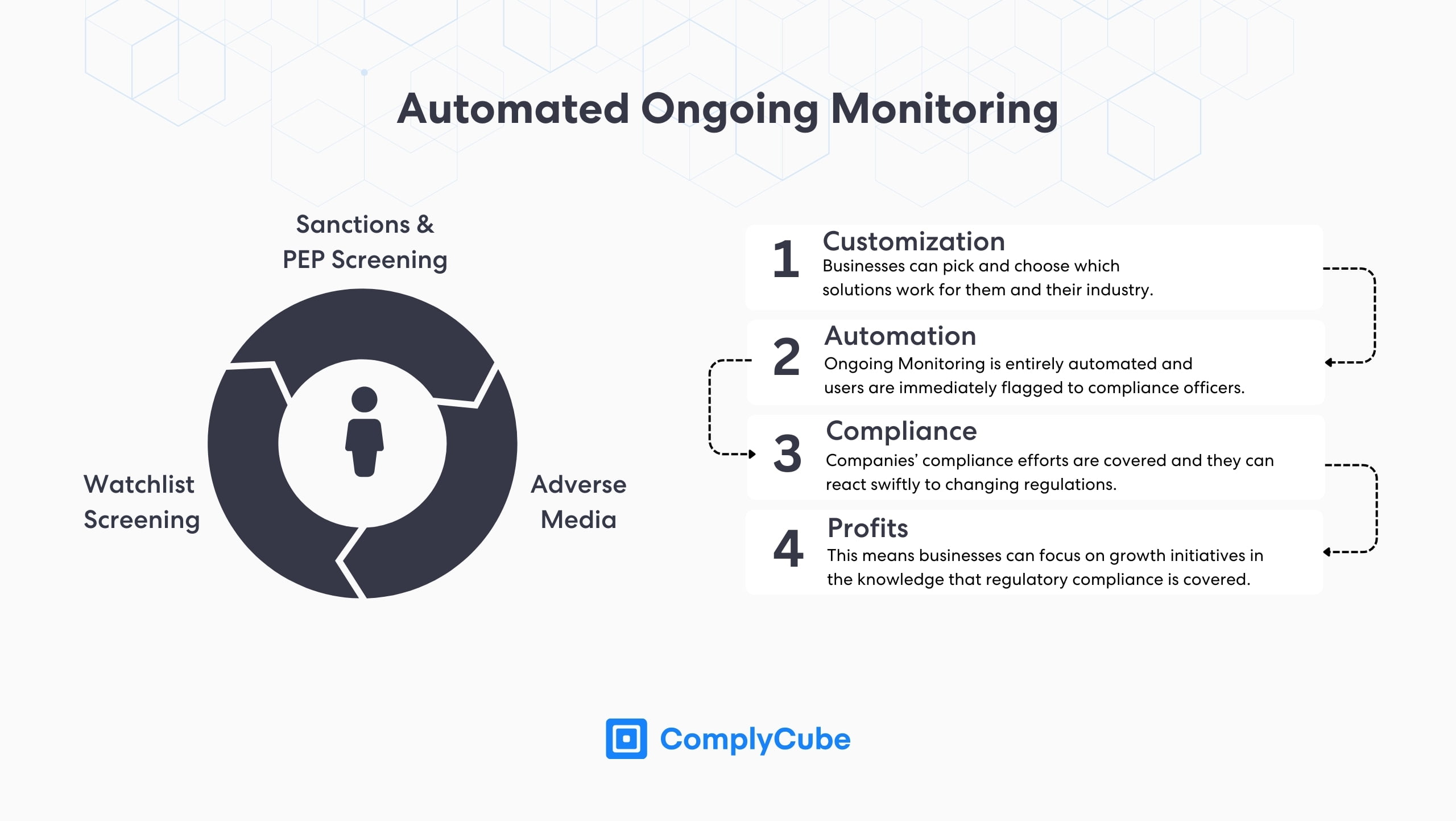

KYC providers offer clients fully automated workflows powered by state-of-the-art AI technologies. These customizable and automated services envelop wider customer due diligence and continuous monitoring processes, such as sanctions and politically exposed person screening, adverse media coverage, international watchlist screening as well as many others.

Sanctions and PEP Screening

As mentioned earlier, individuals holding a position of authority, such as a political office, pose a much greater risk to the financial system. This potential risk and wrongdoing could be due to their own corruption or blackmail. Regardless of this threat’s origins, however, it still requires stringent forewarning to institutions engaged in a relationship with them.

PEP Screening is a great risk assessment tool in the KYC and ongoing monitoring process; however, it naturally does not apply to every client. A much broader portion of clients will not have exposure to political or aristocratic influences, and therefore, PEP screening is just one of many continuous monitoring tools.

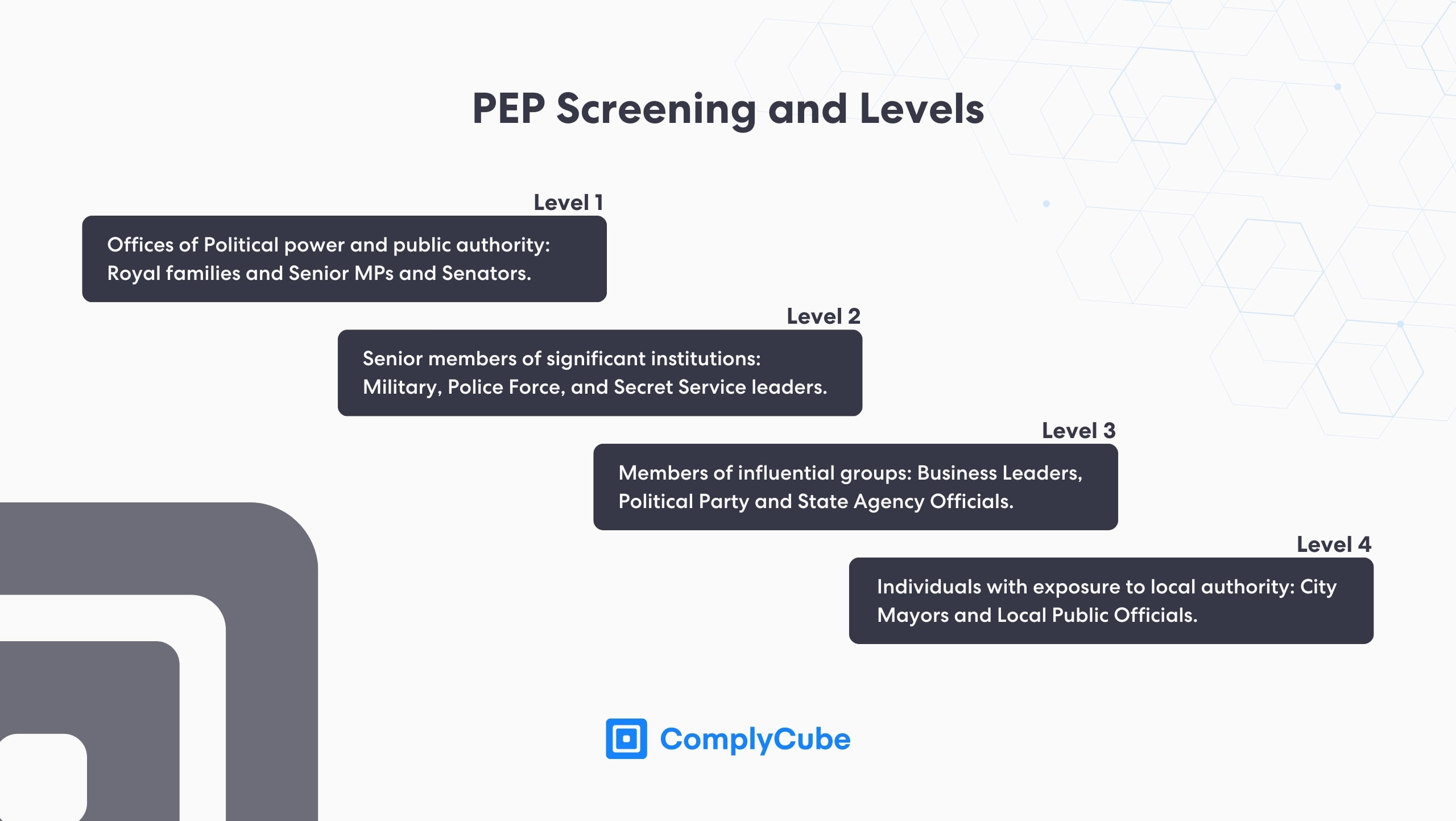

ComplyCube’s PEP Screening databases include 4 levels of political exposure, which are used to help assign a risk level to users. The lower the PEP level, the higher the client’s risk. For example, leading Senators in the US have far greater exposure to national infrastructure than local civil servants. This exposure would include a capacity for corruption in the financial system.

Watchlist Screening

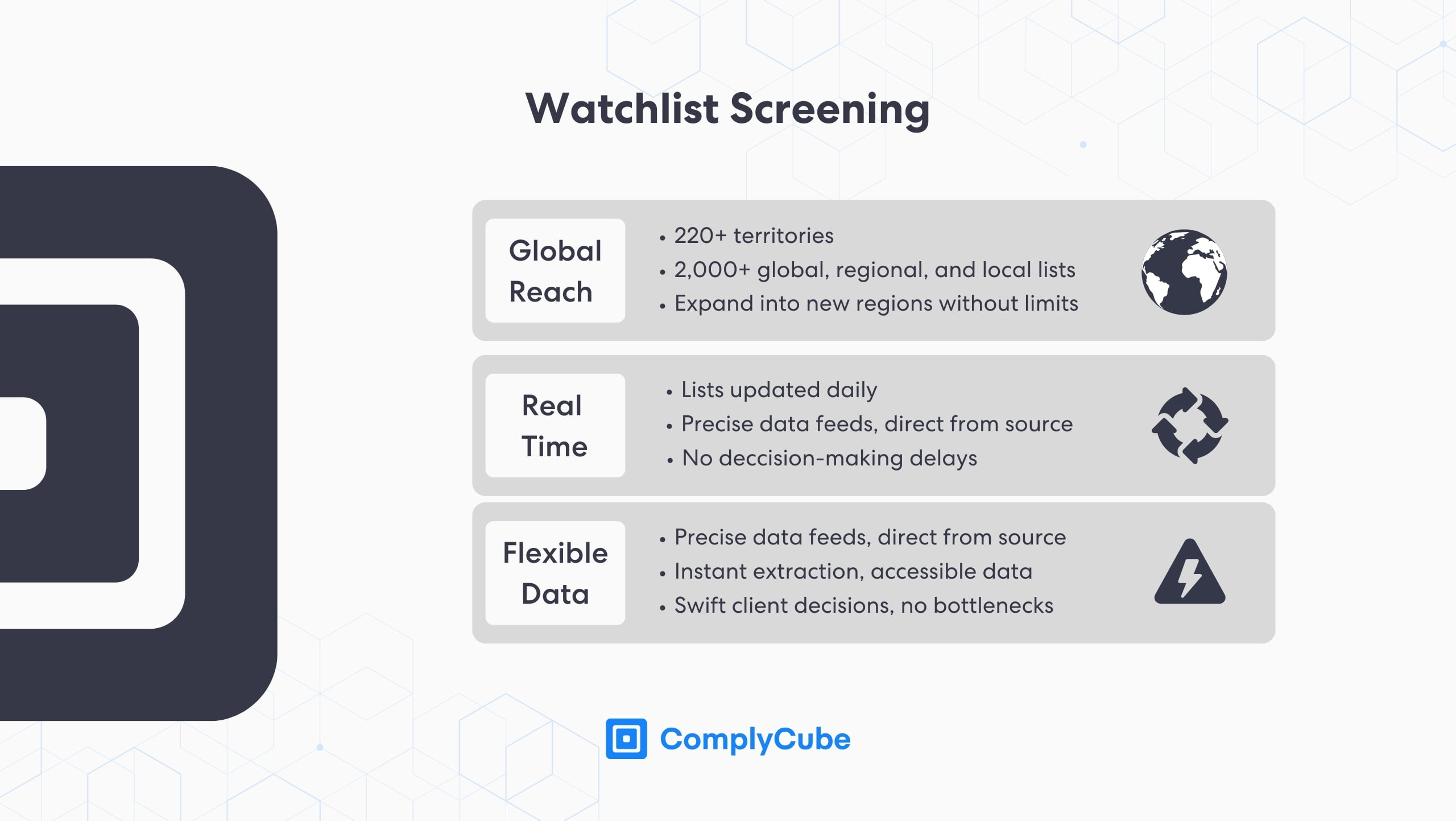

Combining automation with a broad range of international and local watchlists provides an all-encompassing solution to background checking. Once a company has the required information about a new user – underlining the importance of KYC verification services – it can generate an incredibly accurate understanding of whether that individual poses a potential risk.

Watchlist Screening is typically updated around the clock, with new profiles and data integrated every day, providing a comprehensive service. This ensures businesses that employ these services are in a dominant position when it comes to compliance requirements.

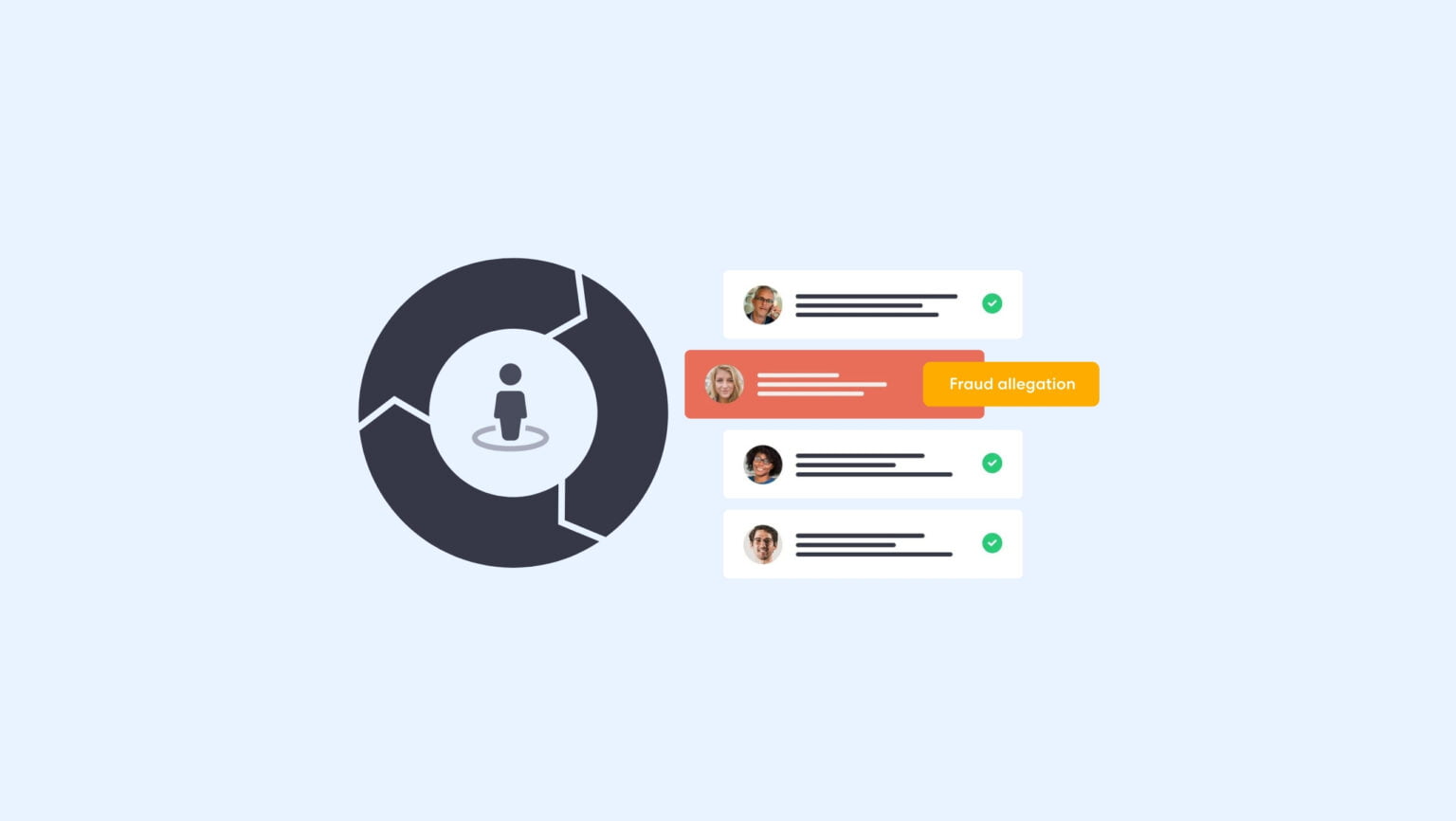

Adverse Media

Integrating media databases into risk profiling is a cornerstone of contemporary screening efforts. Leading ongoing monitoring processes are characterized by its partnerships with hundreds, if not thousands, of media outlets to compile an exhaustive Adverse Media solution. This infrastructure empowers companies to conduct real-time screening of clients for negative press coverage in a wide array of malicious activities.

Conducting Adverse Media checks manually would require an overwhelming amount of time and resources, and the process would not nearly be completed as sufficiently as with an automated and AI-powered solution. This gives way to the surge in machine learning technologies that continue to shift the regulatory compliance industry.

How do KYC Solutions Improve Ongoing Monitoring?

KYC solutions, or eKYC services, are becoming an industry standard for continuous monitoring and related AML pain points. Typically, these providers automate an entire workflow that is adapted and customized to a client’s bespoke requirements.

Combining automation, flexibility, and customizability means that ongoing monitoring, as well as other KYC processes, are extremely streamlined. ComplyCube provides these solutions from the comfort of an all-in-one, user-friendly platform for compliance officers to work with.

The company’s KYC and AML portal is one of its largest value propositions and serves as the hub for its suite of IDV and due diligence procedures. All customer data is readily available and sorted into risk profiles, the thresholds of which are also customizable to increase operational efficiency based on specific corporate RBAs. This makes the job of adhering to tough regulations, such as the FATF AML/CTF Standards, far easier to accomplish.

How to Choose a KYC Provider

Automated ongoing monitoring helps businesses improve operational efficiency, reduce false positives, and cut costs. With the help of state-of-the-art artificial intelligence, eKYC providers bridge the gap between regulation and operation.

If your business needs to conduct ongoing monitoring as a part of its KYC strategy, then it might be time to start investigating KYC services. ComplyCube provides a suite of automated AML, KYC, and IDV solutions wrapped up in one user-friendly platform.

The AI-powered platform is an industry leader based on the breadth of scope of operations, a good metric for grading KYC solution providers. ComplyCube is licensed in over 220 regions and facilitates over 13,000 documents, enabling it to scale with any company’s growth demands.

Whether you are looking for a partner to perform ongoing monitoring or want to find out more about Know Your Customer solutions, ComplyCube is a good place to start. Get in touch with one of their AML, KYC, and IDV specialists today.