For businesses distributing age-restricted products, implementing an age verification system that provides the necessary level of age assurance is crucial. Innovative age verification service solutions are transforming the landscape of Identity Verification (IDV). Through the use of advanced age verification software, businesses can ensure compliance with regulations while providing a seamless customer experience.

The necessity to implement such a process does not reside solely with distributors of age-restricted goods, however. From online services providing 18+ materials to social media platforms delivering age-restricted products and content, to supermarket-bought alcohol, age check systems must be put in place to protect children as well as businesses.

This guide digests the value of age verification solutions, including what they involve, whether your business should implement one, and why they are evolving into a modern-day requirement for most companies.

What is Age Verification?

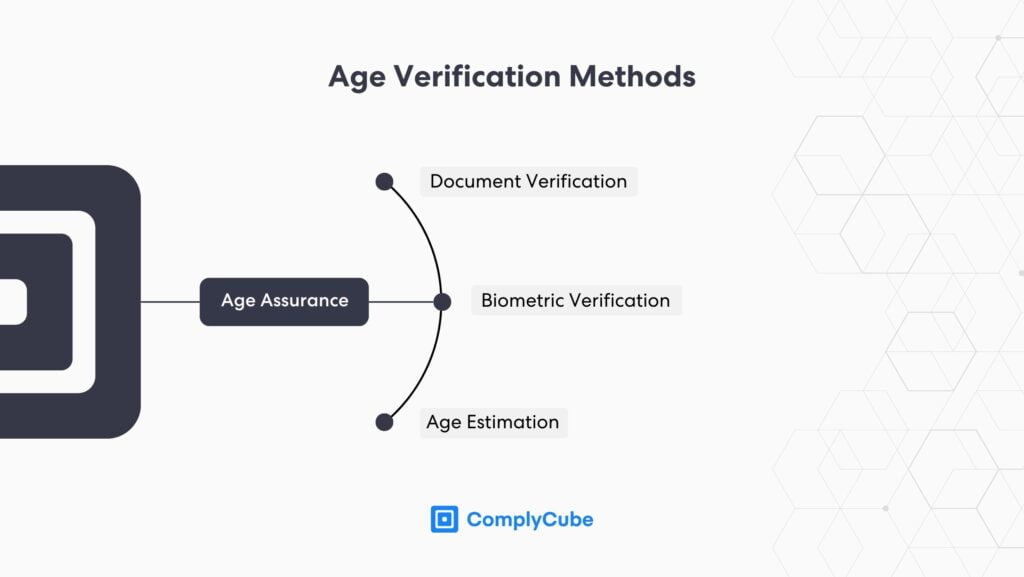

Age verification is a process that ensures users comply with the minimum age requirements by law, or an institution’s specific age verification rules, to begin a relationship with a company. This procedure can take different forms depending on jurisdictional requirements and the company’s risk appetite, including but not limited to:

Facial biometrics

Document Verification

Near Field Communication (NFC) Checks

A business will tailor the types of checks they are running based on the company’s Risk Based Approach (RBA), adjusting requirements and thresholds to verify whether a person is old enough to use a particular service or product. However, in certain situations, companies want to know the age of their users so they can adjust their product offerings based on their clients’ needs.

Online Age Verification Regulatory Changes

In response to these growing global concerns, countries are introducing advanced regulatory frameworks to encourage stronger age verification procedures, protect children online, and prevent money laundering activities. Key legislative efforts include:

- The UK’s Online Safety Bill

- The European Union’s Digital Services Act

- California’s Age-Appropriate Design Code Act

These laws are designed to endorse stricter guidelines and obligations for digital platforms, thereby introducing a safer online environment for younger users based on varying age requirements.

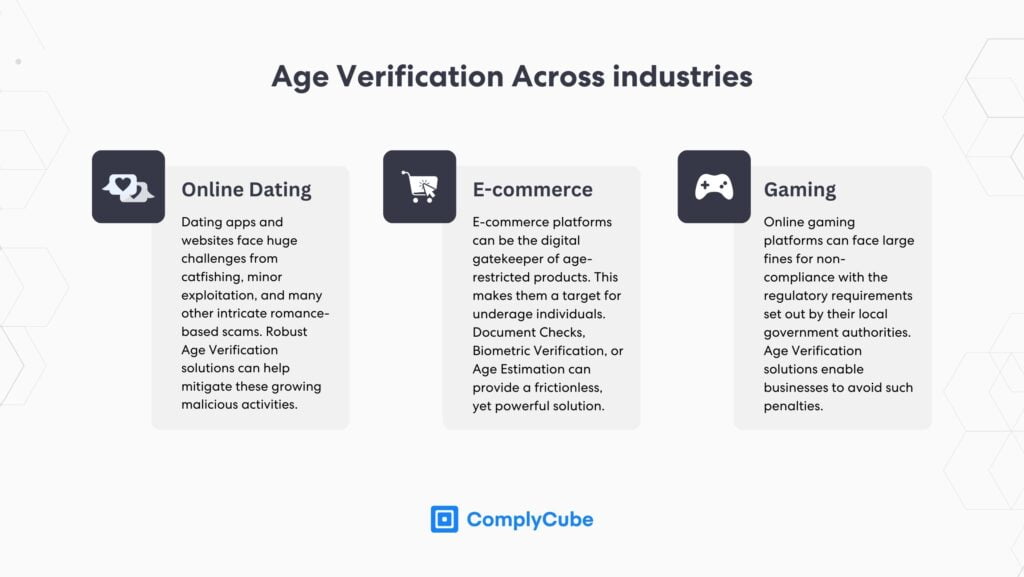

Age Verification Across Industries

The legislation surrounding age verification has shifted in recent years. From dating to banking, a reliable age verification process will ensure businesses meet compliance requirements while balancing a great user experience. The internet enabled worldwide connectivity and the discovery of previously unfathomable information. However, it also enabled the circulation and availability of content and services such as alcohol vendors, adult websites, and more, that should be restricted based on age. A reliable age verification solution will mitigate this and protect both minors and the reputation of a business.

There is no single solution to help companies verify age, with various specific regulations and standards that can be spotted across industries:

Online Dating

Dating apps and websites face huge challenges from catfishing, minor exploitation, and many other intricate romance-based scams. Robust Age Verification solutions can help mitigate these growing malicious activities and make the online dating industry a safer environment.

Learn more about it here: KYV: Online Dating Identity Verification For Safe Romance

E-commerce

E-commerce platforms can be the digital gatekeeper of age-restricted products, such as alcohol, tobacco, and more. This makes them an obvious target for underage individuals to attempt to purchase from them. Instant Document Checks, Biometric Verification, or even Age Estimation can provide a frictionless, yet powerful agent in deterring youngsters from purchasing age-inappropriate products.

Gaming

Online gaming platforms can have vastly different jurisdictional regulatory requirements. However, there is generally a consensus that individuals must be at least 18 years old, or 21 in the US, to partake in some. Institutions can face large fines for non-compliance with the regulatory requirements set out by their local government authorities. Age Verification solutions enable businesses to avoid such penalties.

While companies might share the same or similar pain points regarding age verification, this does not mean they will share the same methodologies to solve them. Businesses with the same regulatory requirements can also demand varying levels of age assurance, depending on their own corporate tolerances to risk. This means that verifying a user’s age means different things to different companies, and depending on these company-specific tolerances, age verification processes can vary.

Pain Points Solved by an Age Verification System

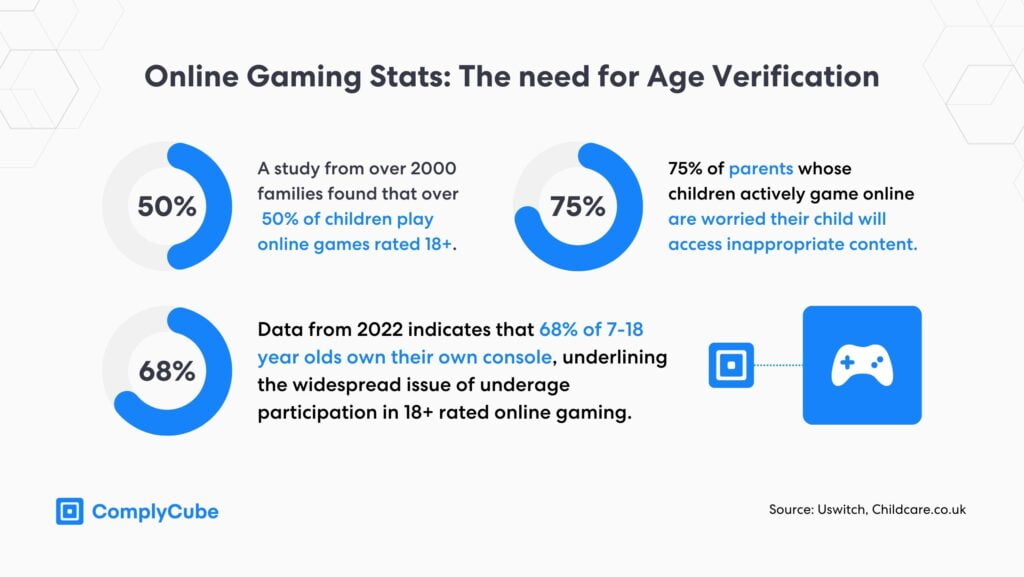

A study from over 2000 families found that over 50% of children play online games rated 18+. Additionally, data from 2022 indicates that 68% of 7-18 year olds own their own console, underlining the widespread issue of underage participation in 18+ rated online gaming.

A study from over 2000 families found that over 50% of children play online games rated 18+.

While this is a hard challenge to regulate, there are solutions available. Age verification services provide state-of-the-art technologies that streamline customer acquisition without jeopardizing the integrity of the data extraction. This allows for swift and uncomplicated customer onboarding processes.

Authenticating KYC documents that verify user age can be a large pain point that companies struggle to solve independently. This is especially true when high levels of age assurance are required, and institutions must verify that document against other measures, such as a selfie check.

KYC and age verification solutions do the heavy lifting for businesses wherever they are in their growth trajectory, and these solutions can scale with a business whether they require 1,000 checks a year or 100,000. These services include, but are not limited to:

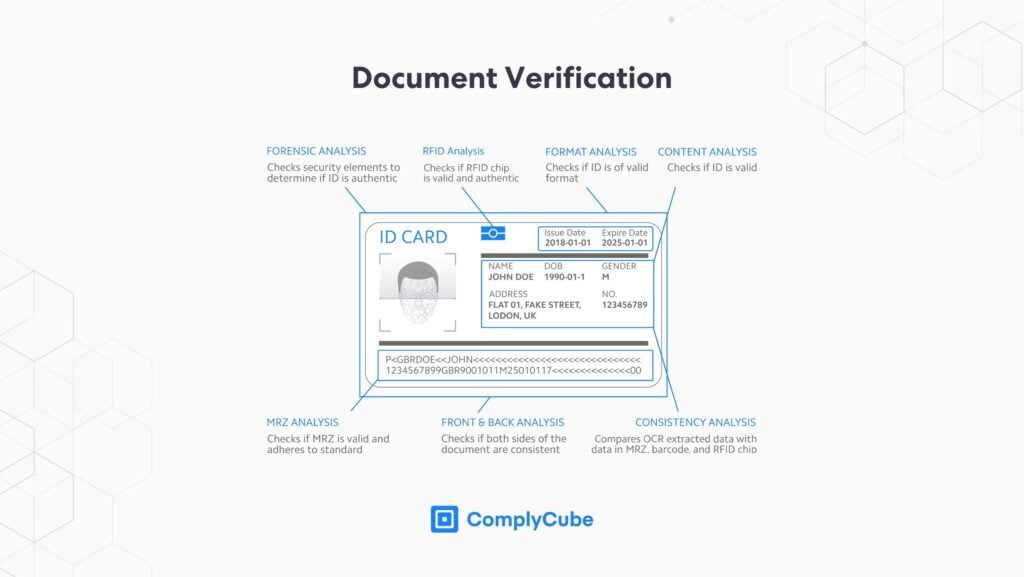

Document Verification

Document verification is a cornerstone in any KYC strategy, providing essential insights into a user’s identity. Document check solutions use state-of-the-art AI to authenticate documents running ID analysis on up to 25 data points. This new technology means customer onboarding can be completed in a total of minutes instead of hours:

This solution mitigates false positives by proving more efficient and precise by reducing human error and improving a company’s scalability as customer onboarding can occur in minutes instead of hours, or longer.

Enriched precision: AI-powered Document Verification significantly reduces false positives by achieving a level of precision. Via instant analysis of various data points, it facilitates the more reliable detection of authenticity.

Increased volume: Document Verification services conduct checks at a far greater speed than manual processes could. This substantially reduces the net time of customer acquisition and contributes to reduced customer churn.

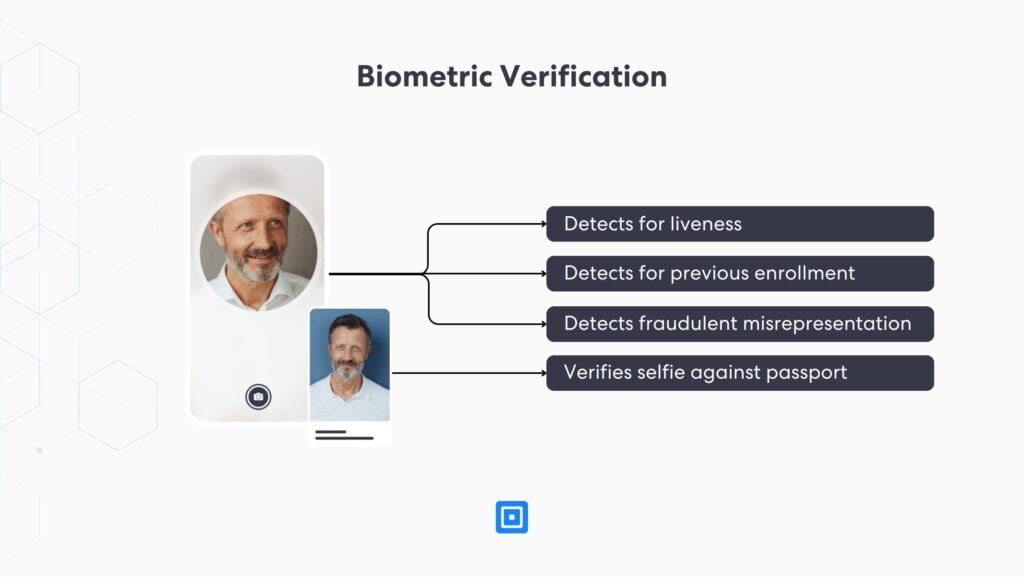

Biometric Verification

Companies looking for a lower level of age assurance can employ an age estimation solution based on biometric verification to estimate the age of their potential customers. However, in other cases, selfie checks can be used as a secondary method alongside document authenticity checks to enable businesses to verify the live presence of a person. Best-in-class face recognition engines that power these methods utilize 3D face maps with Presentation Attack Detection (PAD) to determine if the user is genuine.

This check determines the legitimacy of a user’s presence by examining micro-expressions and skin texture. It identifies potential pixel alterations, and distinguishes between masks and disguises, along with multiple other exclusive techniques to test for image or video tampering.

Age Estimation

Using advanced AI-powered face recognition technology, age estimation solutions instantly give an approximation of a user’s age. This service leverages the same liveness and spoof detection technology in a Biometric check. This provides a one-step, smooth age verification experience for age-restricted content.

Age estimation is a great option for businesses providing age-gated goods or services that require limited onboarding friction and regulatory compliance. It can be performed anywhere and anytime, meaning customers are always just a selfie away from action.

If you are looking for a partner in age verification or services pertaining to any one of KYC, AML, and IDV, contact one of our specialists today.

What to look for in an Age Verification System

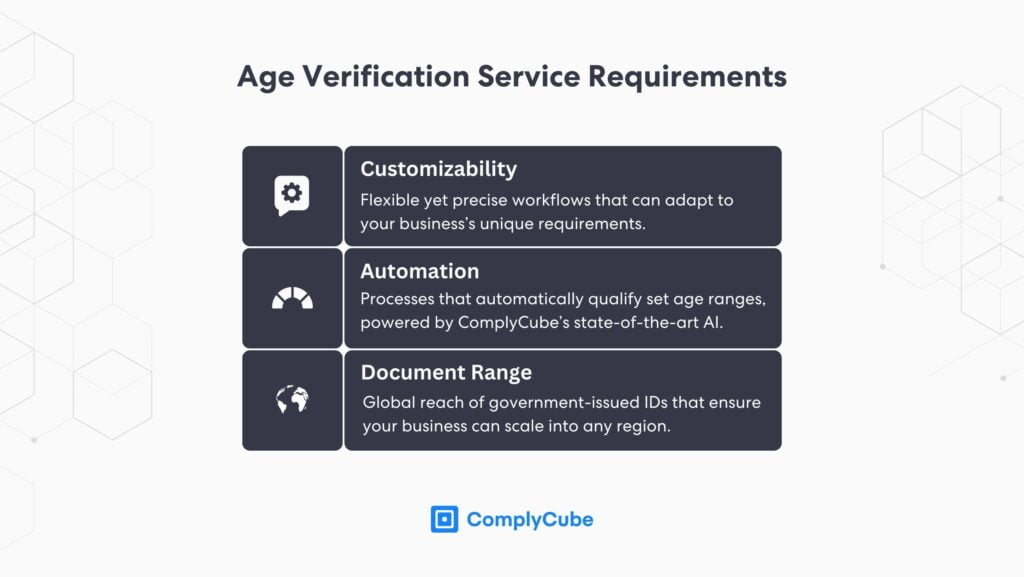

Age Verification is often a subsector of a broader Know Your Customer strategy. This makes it very possible for both services to be provided by the same company. For this reason, many of the key metrics to look for in Age Verification are similar to that of a KYC provider. However, 3 core features to watch out for are:

Customizable Workflows

As previously discussed, age verification and the wider Know Your Customer (KYC) process, is an issue that demands precision and flexibility. The solution chosen by a dating app may be too brittle for a bank, and this is due to the industry-specific demands that are placed on age verification systems.

Age verification and KYC solutions are optimized for customizability and flexibility. This flexibility in their services means their solutions are optimized for any company in any industry and has been a key driver in their early growth.

Automated and Intuitive Acquisition Processes

This portal enables the toggling of friction levels in customer acquisition processes, enabling clients to determine their own thresholds that power their business decisions. For example, businesses can choose to automatically flag users aged 21 or younger.

This is a core element of age verification Service principles. Friction toggling is crucial for Identity Verification and KYC processes to be conducted autonomously and at scale, facilitating smooth client acquisition while mitigating the number of false positives.

The Breadth of Document and Compliance Coverage

Automation and customizability are fundamental principles an age verification provider should deliver. However, ensuring the solutions chosen are operable to your required standards in your country, region or a global level is vital.

A primary concern could be the range of accepted documents your provider works with. ComplyCube’s list of document and compliance coverage spans 220+ territories with over 13,000 document types, ensuring that they have a broad range of business regions and potential needs covered. This underlines the company’s commitment to the business mission – building trust at scale.

Does Your Business Require an Age Verification System?

ComplyCube is at the forefront of identity and age verification, providing industry-leading solutions that protect both individuals and the reputation of businesses. With proprietary AI-powered document verification, biometric verification, and age estimation solutions that can be customized preferentially, ComplyCube is swiftly becoming the go-to in identity verification solutions.

If you are looking to add an age verification process or any IDV, KYC, or AML solution to strengthen your company’s operations, get in touch with one of our specialists here.