TL;DR: Conducting a KYC platform comparison and choosing a top rated KYC provider helps organizations balance compliance with efficiency and growth. Market leaders stand out with ID verification leader features, passive liveness detection, and risk-based workflows, all backed by trusted certifications such as ISO 27001 and UK DIATF.

Selecting a top rated KYC provider involves balancing the technological innovation of KYC features with how well it helps organizations meet regulatory compliance. The right provider can significantly impact a company’s efficiency and growth. This guide will cover the latest ID verification leader features, leading market differentiators, and practical steps for compliance teams to evaluate KYC platform capabilities confidently.

What is a KYC Provider?

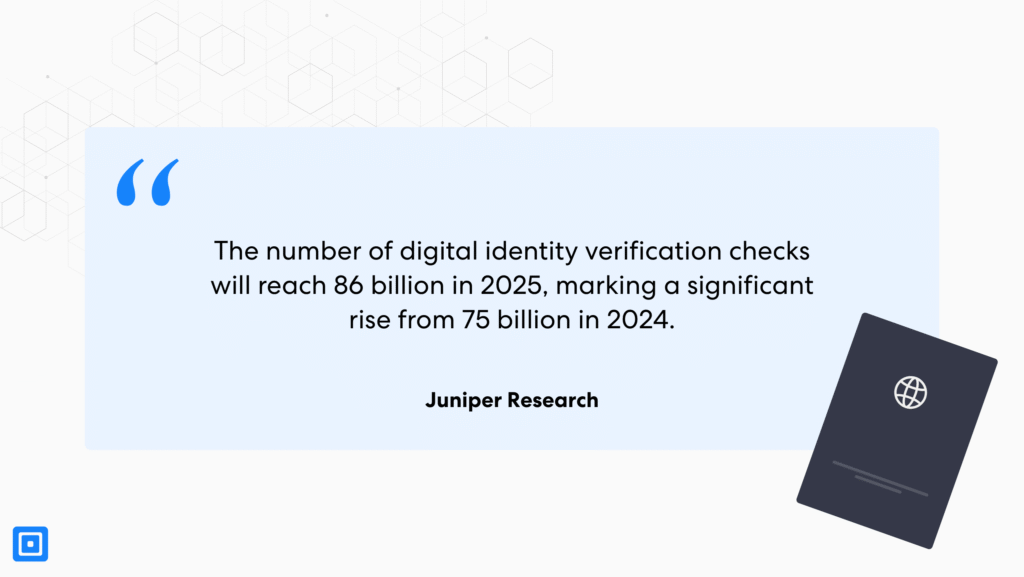

A Know Your Customer (KYC) software provider is a third-party service or technological company that supports businesses and financial institutions in ensuring customers are who they claim to be. According to Juniper Research, the number of digital identity verification checks reached 75 billion in 2024 and is projected to increase to 86 billion in 2025.

This surge highlights how KYC processes have become a key requirement for many businesses operating across multiple industries. From healthcare to crypto, firms that leverage KYC software can easily verify and authenticate their customers’ identities. Running KYC checks is essential in the fight against money laundering, identity fraud, and other financial crimes.

Main Reasons to Utilize a KYC Vendor:

- Reduce the risk of financial crime, identity theft, and money laundering.

- Optimize operational efficiency and gain a high return on investment.

- Fulfil regulatory compliance to avoid financial penalties.

- Achieve a frictionless customer onboarding journey.

- Build customer relationships on trust.

Identifying Top Rated KYC Providers

Distinguishing a top-rated KYC provider from other vendors in the market would require analyzing many different factors and data points. These factors include scalability, how well it satisfies national and international KYC regulations, and whether it supports diverse user journeys. Here are some of the non-negotiable components that can be found in the best top rated KYC software providers:

Unified Compliance Solutions with Modular Flexibility

Leading vendors offer modular compliance coverage by integrating Identity Verification (IDV), Anti-Money Laundering (AML), and Know Your Business (KYB) solutions into a single platform. Organizations can run document verification checks (IDV), assess customers’ risk profiles (AML), and perform business verification (KYB) all in one place. Firms can expect a higher return on investment with a provider supporting various checks and verification types.

Multi-Jurisdiction Compliance Coverage

Globalization has encouraged many firms to expand their operations across different regions. Thus, choosing a leading KYC software with high global coverage is key. Supporting diverse languages and document types is now a must-have for top rated KYC providers. Organizations can scale into new regions without impinging on global regulations.

Real-Time Screening Technologies

Real-time checks against global watchlists, sanctions databases, Politically Exposed Persons (PEPs), and adverse media sources are no longer optional. High-performing KYC technology can automate customer screening, allowing firms to monitor changes to customer data and risk without requiring any form of manual intervention. Click here to learn more about “What is a Politically Exposed Person (PEP)”.

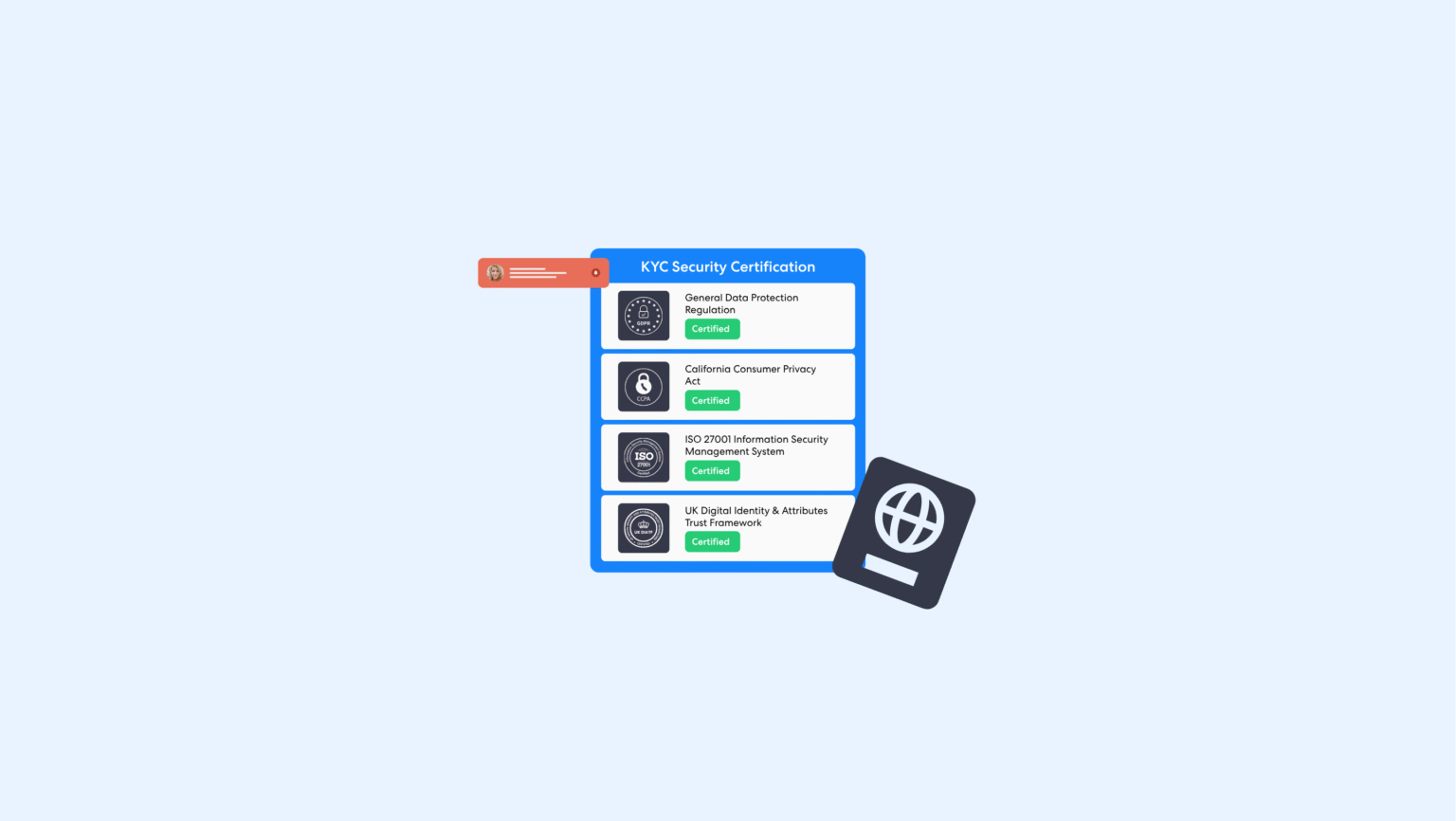

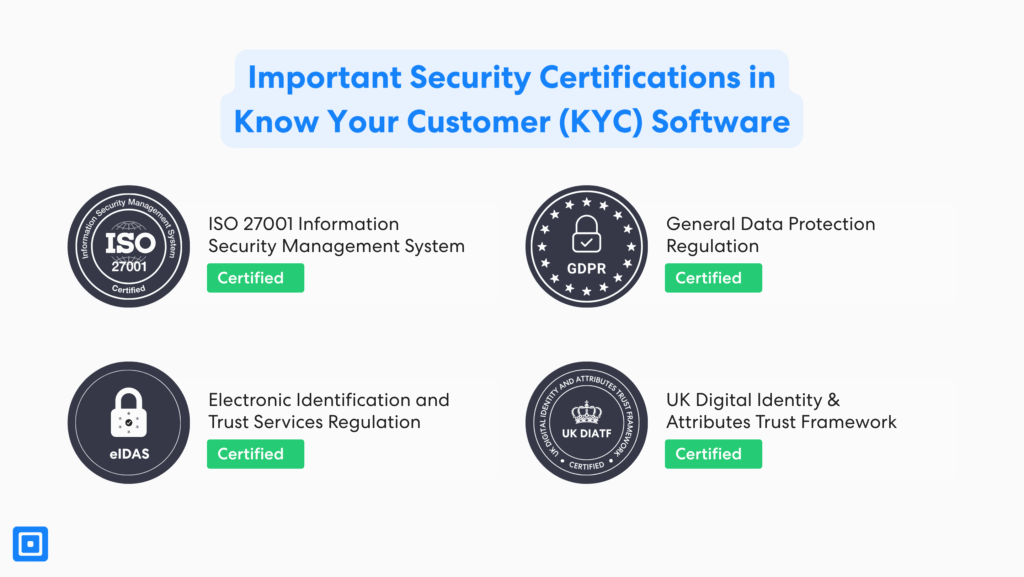

Regulatory and Security Certifications

Lastly, having trusted industry and regulatory-specific recognition and certification gives a KYC software higher credibility and trust. Certifications, including ISO 27001 and GDPR compliance, indicate high security and privacy, and ensure compliance. Additionally, country-specific certificates such as the UK Digital Identity and Attributes Trust Framework (DIATF) further reinforce operational maturity.

Specific Features That Differentiate Market Leaders in KYC and AML

What makes a Know Your Customer (KYC) solution superior is its accuracy and intelligence, not the number of tools or services it offers. Providing money laundering and fraud prevention solutions is nothing if it does not help make KYC compliance more accurate, compliant, and faster:

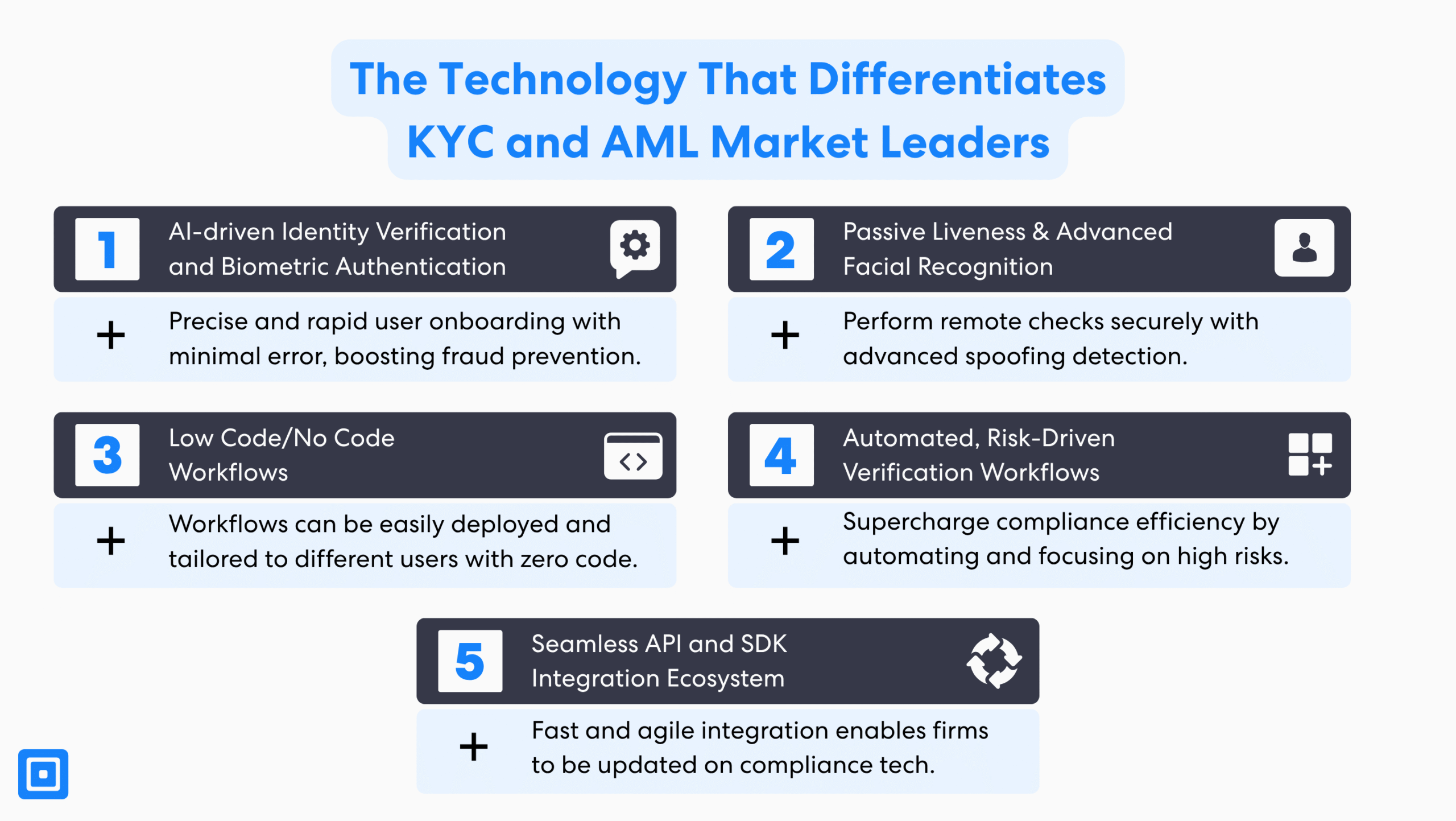

1. AI-powered Identity Verification and Biometric Authentication

Prominent KYC technology integrates artificial intelligence and machine learning capabilities in order to extract and verify various identification documents globally with millisecond accuracy. This includes identity documents such as passports, driving licenses, utility bills, and more. An example would be leveraging liveness detection or Optical Character Recognition (OCR) to process and verify German language identity documents without increasing manual work.

2. Advanced Facial Recognition Technology

Another notable KYC technology involves passive liveness verification methods. Unlike traditional active methods that require customers to turn their heads, it uses Presentation Attack Detection (PAD) technology. PAD integrates 3D facial mapping and micro-expression detection to assess aliveness. Businesses can easily perform remote identification checks and maintain a seamless user experience.

3. No-Code or Low-Code Verification Flows

The best top rated KYC providers offer drag-and-drop rule builders, enabling compliance and risk management teams to deploy risk logic without developer input or coding language. For instance, a crypto company can configure different customer onboarding workflows for two distinct types of customers without a line of code.

4. Automated and Tailored Risk-Based Workflows

KYC software that empowers a risk-based verification approach through AI and workflow automation is undefeatable. These KYC solutions trigger enhanced customer due diligence checks only when needed, based on real-time fraud detection signals. This allows low-risk customer accounts to bypass quickly while focusing manual reviews on higher-risk cases. This ensures efficient, accurate compliance and transaction monitoring with minimal effort.

5. API and SDK Integration Capabilities

APIs and mobile SDKs boost the integration process by connecting and automating workflows within existing systems. Organizations can use their current KYC process and stack additional new features once it’s deployed. APIs and SDKs make achieving a verification system that stays ahead of evolving money laundering regulations simple.

Market Recognition and Influencing Buyer Trust

Another way that top rated KYC providers gain leadership status in the KYC and AML solutions space is through industry accolades and review sites. These awards and review forums enable compliance teams to gather more information about a provider’s verification process capability, customer support, and regulatory effectiveness.

- RegTech Insight Awards: RegTech100 and FinCrimeTech50 list recognize innovative RegTech KYC solution providers that aim to prevent financial crime and money laundering.

- British Bank Awards: The RegTech Partner of the Year Award celebrates outstanding KYC software that supports financial institutions in fraud prevention efforts, as voted for by product users.

- G2: Peer review platform where product users rate and review SaaS products. All reviews are verified extensively to give customers an unbiased understanding of a product.

- TrustRadius: This site includes in-depth user reviews and ratings for specific KYC and compliance company. Reviews include the pros and cons of a product, providing detailed insights.

- Capterra: A user rating site, featuring detailed explanations of a product through customer reviews. The site offers detailed software features and pricing comparisons.

Case Study: Commonwealth Bank of Australia (CBA) Faces AU$700M Penalty

Challenge:

In 2018, the Commonwealth Bank of Australia (CBA) was fined AU$700 million by AUSTRAC after it failed to report 53,500 suspicious transactions. The root cause was outdated and manual KYC/AML systems, which were unable to monitor transaction flows effectively or escalate risks at scale. This left the bank blind to systemic compliance failures over several years.

Impact:

The penalty was one of the largest in AML history, sparking intense regulatory scrutiny and damaging CBA’s reputation as a trusted financial institution. The scandal forced a costly system-wide remediation program, requiring significant resources to modernize compliance processes. It also underlined how legacy KYC solutions put institutions at massive financial and reputational risk.

How ComplyCube Could Have Helped:

ComplyCube’s real-time AML screening, automated suspicious activity alerts, and seamless API integrations would have enabled CBA to detect and escalate issues before they became systemic. With AI-driven fraud detection and configurable workflows, CBA could have reduced reliance on manual reporting, ensuring full compliance while streamlining operations.

Important Security Certifications in Know Your Customer (KYC) Software

Attaining security certifications assures organizations of a vendor’s credibility and commitment to secure KYC, AML, and identity verification solutions. This includes biometric verification, digital identity verification, and data management processes. They ensure compliance through strong document management and reporting tools.

- ISO/IEC 27001:2022 (Information Security Management): These certifications demonstrates that a KYC provider complies with implementing and maintaining an Information Security Management System (ISMS). It proves that KYC software manages ID verification and KYC data under globally recognised security regulations.

- UK Digital Identity and Attributes Trust Framework (DIATF): The UK DIATF is a certification with rigorous requirements. KYC software that is UK DIATF-certified meets high standards in compliance processes, demonstrating quality management and security in digital identity verification solutions. Learn more about the UK DIATF framework by clicking here.

- Electronic Identification and Trust Services Regulation (eIDAS): eIDAS is an EU regulation that highlights standards in electronic identity verification and trust services. Vendors with eIDAS certification meet stringent KYC compliance requirements, enabling them to deliver electronic signatures and biometric verification solutions across EU member states.

Key Takeaways

- Top rated KYC providers drive compliance, fraud prevention, and efficiency.

- Unified IDV, AML, and KYB solutions deliver scalable compliance at lower cost.

- AI-powered verification and risk-based workflows set leaders apart.

- Global coverage and certifications like ISO 27001 build trust and credibility.

- ComplyCube combines all these strengths into a trusted, award-winning KYC platform.

Strengthen KYC Compliance with Leading Software Providers

Prominent KYC software leaders introduce smarter and innovative identity verification and KYC solutions to make regulatory compliance significantly faster and more accurate. From AI-powered identity verification and passive liveness detection to no-code solutions, financial institutions can expect accelerating growth and cost-effective compliance processes. Businesses can select a true compliance partner by prioritizing regulatory credibility, scalable automation, feature accuracy, and constant innovation.

ComplyCube is an award-winning AML and KYC platform trusted by institutions such as Lyca Mobile, MoneySmart, and high-growth FinTechs. To learn more, contact a team member.

Frequently Asked Questions

What is a KYC provider and why is it essential for compliance?

A KYC provider is a third-party platform that verifies customer identities to meet regulatory requirements. It helps businesses prevent fraud, ensure Anti-Money Laundering (AML) compliance, and build trusted customer relationships.

How do top rated KYC providers help organizations reduce financial crime risks?

Leading KYC providers use AI-powered identity verification, biometric checks, and real-time screening against sanctions, PEP, and adverse media lists. These capabilities detect fraud early and minimise risks such as money laundering and identity theft.

Which features set top rated KYC providers apart from other vendors?

Top rated KYC platforms offer advanced capabilities such as passive liveness detection, no-code workflow builders, risk-based verification, and API integrations. These features improve accuracy, compliance efficiency, and customer experience.

Why are global coverage and security certifications critical in KYC software?

Global document support ensures firms can expand across regions without breaching regulations. Certifications such as ISO 27001, eIDAS, and UK DIATF prove a provider’s commitment to data security and compliance, increasing trust and credibility.

How can businesses evaluate and select the best KYC provider for their needs?

Organizations should assess KYC vendors on scalability, regulatory compliance, security credentials, and market recognition. Prioritising unified IDV, AML, and KYB capabilities ensures cost-effective compliance and sustainable growth.