Regulations for Anti-Money Laundering (AML) compliance in the financial sector constantly evolve to prevent advanced financial crime and money laundering techniques. Financial institutions and banks that fail to keep up with these evolving global regulatory standards can face harsh penalties, such as massive million-dollar fines, reputational damages, or even being forced to shut down. This is why choosing the right AML compliance software is vital. This guide will compare the best AML solutions for banking, showcasing their key features, AML compliance capabilities, and suitability for various banking activities. Read more to discover the top 10 AML software for banks and regulated firms.

The Importance of AML Software for Banks and Regulated Firms

Anti-Money Laundering (AML) software solutions are key in preserving the integrity of the global financial system. Selecting the right AML software provider supports banks and other financial institutions in adhering to strict regulatory compliance, preventing financial crime risks, and supporting fraud prevention efforts. As criminals execute more sophisticated money laundering schemes, organizations now face immense pressure from regulators to implement advanced transaction monitoring and risk management solutions.

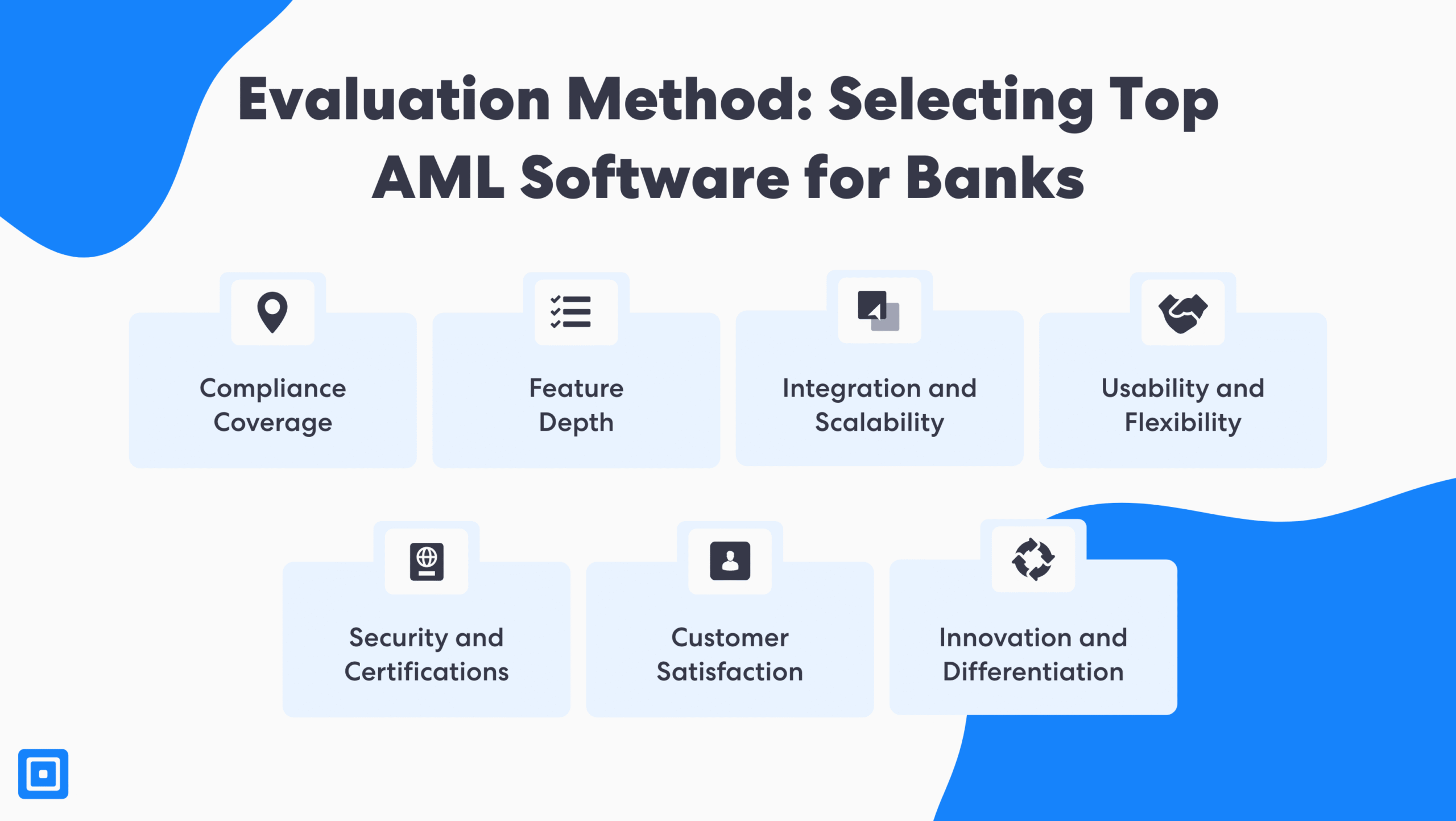

Evaluation Methodology: How We Selected the Top AML Software for Banks

The selection of the top AML software was based on a comprehensive analysis of product performance, regulatory alignment, user experience, and market recognition. It has also integrated objective, reliable software solutions from unbiased SaaS review platforms such as G2 and TrustRadius, and several findings from recent analyst reports.

Key Factors Considered:

- Compliance Coverage: The AML software’s competency to tackle international regulatory compliance standards. Popular ones include the Financial Action Task Force (FATF), EU Anti-Money Laundering Directives (AMLD), and Financial Conduct Authority (FCA).

- Feature Depth: The key features in AML screening solutions include real-time transaction monitoring, sanctions screening, adverse media checks, risk management, and auditable reporting.

- Integration and Scalability: This factor incorporates whether the Anti-Money Laundering (AML) software has APIs, SDKs, and other integration capabilities to facilitate business expansion over time.

- Usability and Flexibility: This covers how simple the platform is to navigate, whether the AML processes are customizable, and if it includes no-code/low-code solutions to simplify compliance.

- Security and Certifications: Advanced security frameworks and certifications, such as alignment with UK DIATF, SOC 2, and GDPR requirements for regulated industries.

- Customer Satisfaction: Objective customer reviews that determine if the AML software is meeting high usage and client satisfaction levels. Customer support responsiveness and ease of implementation are also considered.

- Innovation and Differentiation: The use of Artificial Intelligence (AI), ML, and explainable compliance features that enhance detection accuracy, risk prediction, and support regulatory reporting.

This multi-criteria evaluation method guarantees a holistic view of each AML software solution and how it can empower compliance professionals to maintain compliance across the banking sector. Read below to learn more about each platform and how it supports businesses meeting AML regulations.

Top 10 AML Software for Banks and Regulated Firms

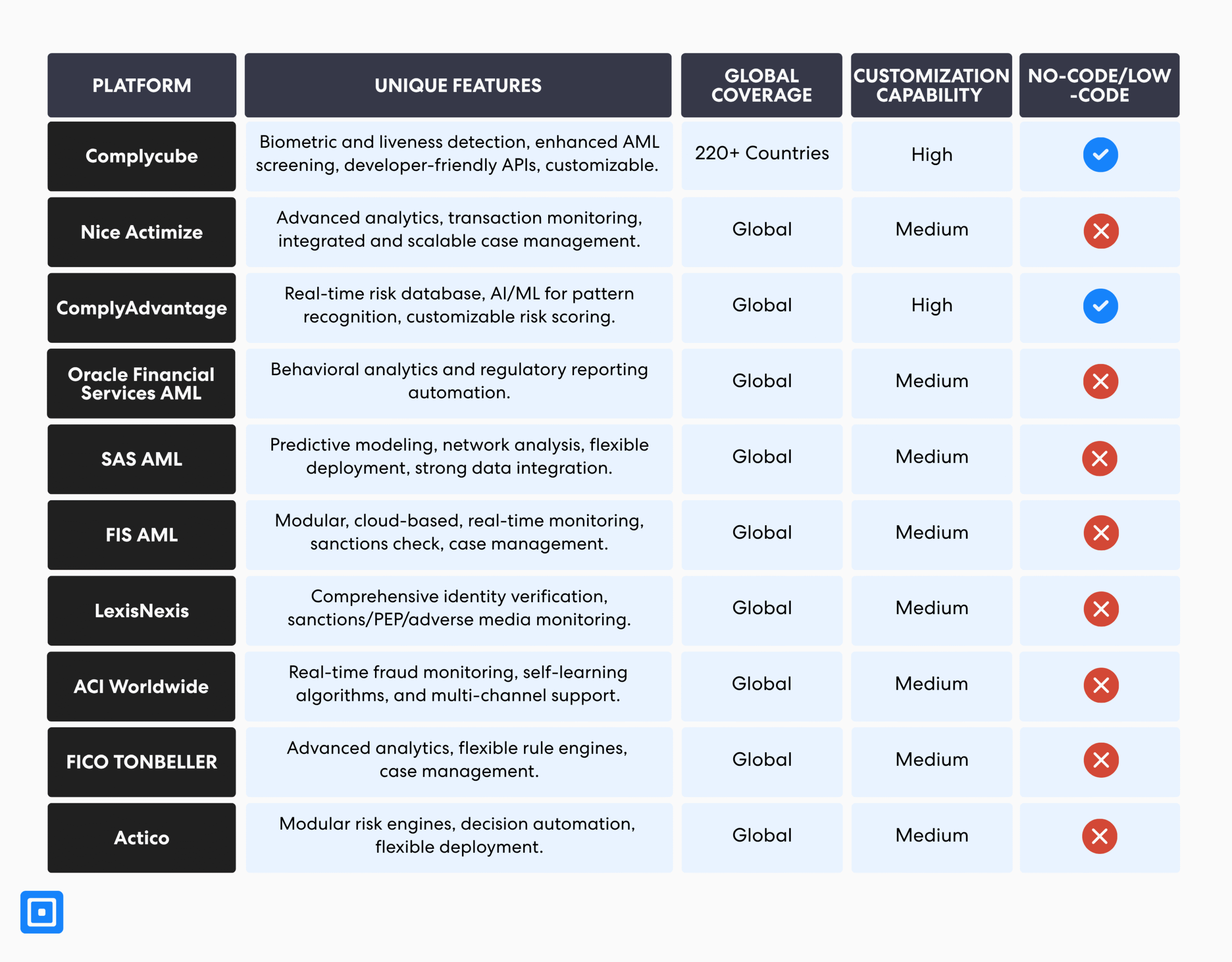

Now that the key considerations behind the selection have been outlined, this section explores each company that made it in the “Top 10 AML Software” list, highlighting niche product features. This list aims to empower organizations in the financial sector to understand which AML providers serve their needs best:

1. ComplyCube

ComplyCube is a global provider of AML and KYC. The FinCrimeTech50 company is known for its unified, all-in-one compliance tools. ComplyCube’s platform is built for companies that need high performance, flexibility, and a global footprint in their AML operations. The platform features real-time AML transaction monitoring, liveness detection, and adverse media screening tools, supporting over 220+ countries. On G2, a leading SaaS review platform, clients in the financial services industry have noted ComplyCube’s seamless integration and scalability capacity, and many have mentioned the outstanding customer success support.

ComplyCube has been instrumental in automating our due diligence and onboarding processes. Their API is well-structured, making integration seamless, and the platform scales well as we expand into new markets.

Built with developers in mind, ComplyCube is one of the top no-code AML providers in the market, offering unmatched customization and speed-to-deployment. Additionally, the platform is fully certified and compliant with GDPR, eIDAS, and the UK DIATF.

Key Features:

- Real-time global watchlist screening

- Biometric liveness detection

- No-code workflow automation

The ComplyCube platform is best for banks seeking a developer-friendly, comprehensive Anti-Money Laundering solution with customizable workflows.

Click here to learn more about ComplyCube and its Leadership Status in AML in the G2 Spring Report Awards.

2. Nice Actimize

Nice Actimize is a global provider of financial crime prevention and compliance solutions. The platform delivers a suite of AML tools, leveraging AI and machine learning to provide coverage across diverse financial markets. The company adopts a customer-first approach, ensuring that financial risk management capabilities are flexible to a business’s needs. Additionally, NICE Actimize has achieved awards, such as being a leader in The Forrester Wave™: Anti-Money Laundering Solutions in criteria such as data integration and watchlist management.

Key Features:

- Advanced analytics for transaction monitoring

- Real-time fraud detection

- Integrated case management

Nice Actimize suits large financial institutions requiring scalable AML tools, risk, and case management features.

3. ComplyAdvantage

ComplyAdvantage emphasizes using AI to deliver real-time risk data and monitoring to support financial institutions in identifying and preventing financial crime risks. The platform is known for its continuously updated database, gathering many data points daily, so compliance teams are empowered and informed about threats. The platform’s intuitive interface is also noted for its simple customer screening and rule customization.

Key Features:

- Real-time risk database updates

- Machine learning for pattern recognition

- Customizable risk scoring

ComplyAdvantage is for banks that need dynamic risk assessment features and real-time data feeds to make proactive, informed decisions.

4. Oracle Financial Services AML

Oracle Financial Services provides a suite of AML and financial crime compliance solutions, including the recently announced Automated Scenario Calibration (ASC) Cloud Service. This service automates the manual process of scenario tuning, enabling banks to streamline compliance efforts and reduce costs. Oracle’s solutions are tailored to meet AML requirements, offering flexibility and security through Oracle Cloud Infrastructure.

Key Features:

- Behavioral analytics

- Entity resolution

- Regulatory reporting automation

The Oracle Financial Services AML software is for financial institutions seeking robust integration and advanced analytics, and firms seeking comprehensive regulatory reporting features.

5. SAS AML

SAS Anti-Money Laundering prides itself on its advanced AI and machine learning-driven solutions, which enable a proactive approach to risk management, scoring, and alert generation. The platforms boast a wide array of integrations with various banking systems and regulatory frameworks, making compliance seamless and simple for clients.

Key Features:

- Predictive modeling

- Network analysis

- Flexible deployment options

SAS Anti-Money Laundering is for firms in highly regulated industries looking for a platform with strong integration and scalability with existing systems.

6. FIS AML Software

FIS offers a range of modular, cloud-based platforms such as the AML Compliance Manager, designed to transform financial crime detection. FIS AML suites support firms in making informed compliance decisions faster through automation, eliminating manually intensive tasks and contributing to operational efficiency. FIS AML provides a unified interface for case management and customer behavior monitoring.

Key Features:

- Real-time transaction monitoring

- Sanctions check

- Case management workflows

FIS AML solutions are well-suited for organizations seeking analytics, AI-powered detection, and cloud-based automation to reduce manual work.

7. LexisNexis Risk Solutions

LexisNexis Risk Solutions provides end-to-end AML solutions that adapt to specific business needs and risk tolerances. Their tools help fortify compliance strategies against regulatory requirements, enabling institutions to meet expectations and thrive in a competitive global market. The RiskNarrative® orchestration platform offers extensive AML transaction monitoring rules, covering a range of scenarios to highlight anomalous behaviors and mitigate risks.

Key Features:

- Comprehensive identity verification

- Sanctions and PEP screening

- Adverse media monitoring

LexisNexis Risk Solutions is suited for institutions in regulated industries that require high levels of customer due diligence and risk assessment.

8. ACI Worldwide

ACI Worldwide offers real-time payment solutions with integrated fraud detection, utilizing self-learning algorithms that leverage information flows across its global footprint. Their AML screening solutions comply with PCI DSS v4.0, Know Your Customer (KYC), and sanction screening requirements, providing a holistic approach to financial crime prevention.

Key Features:

- Real-time fraud monitoring

- Machine learning algorithms

- Multi-channel payment support

ACI Worldwide’s AML software platform is designed to support businesses operating at scale across global markets. It facilitates organizations such as payment companies, banks, and payment service providers with real-time transaction screening.

9. FICO TONBELLER

FICO TONBELLER’s Siron AML solution is a transaction monitoring platform that helps AML compliance officers keep up with new threats and compliance with evolving legislative requirements. The solution includes alert processing tools for false positives analysis, case management tools for scenario customization, and a rule editor for modifying the software.

Key Features:

- Risk-based transaction monitoring

- Customer due diligence

- Regulatory reporting

FICO TONBELLER’s Siron AML is for banks and financial institutions seeking control over customizable risk management tools according to business needs.

10. Actico

Actico’s solutions are created for banks that need automated compliance processes and flexible rule management tailored to various risk appetites. The platform leverages automation tools so compliance officers can efficiently meet compliance and risk management expectations.

Key Features:

- Rule-based decision engines

- Workflow automation

- Real-time monitoring

The Actico AML software is for organizations seeking regulatory technology with compliance automation technologies and flexible rule management.

The Future of AML Technology for Regulated Industries

Future AML software for banks will leverage explainable AI and advanced machine learning to enhance the accuracy of detecting suspicious transactions and payment fraud. As financial crime evolves, next-generation AML platforms will enable organizations to proactively spot and investigate unusual behavior, reducing false positives and streamlining compliance processes while ensuring robust protection against emerging threats. For more information on how you can integrate advanced AML infrastructure, contact one of our compliance experts.