TL;DR: Proof of address verification (PoP or PoA verification) confirms proof of address to strengthen KYC. Modern address verification and address validation check applicant data against proof of address documents. By standardising which proof of address documents you accept, you can scale PoA verification while keeping onboarding fast and compliant.

What is Proof of Address Verification?

Proof of Address (PoA) verification is a core component that authenticates an individual’s residential address via official documentation. Proof of Address documents typically consist of utility bills, bank statements, invoices, and rent/contract agreements, and more.

Verifying user address documents is a vital part of a Know Your Customer (KYC) strategy to:

- Provide further identity assurance and;

- Ensure the authenticity of an individual’s supposed address.

Today, PoA aims to enhance the security and reliability of business transactions. Verifying customers’ physical locations is essential for different industries such as financial institutions, telecommunications companies, e-commerce platforms, fintechs, crypto platforms, and many more. Therefore, this process helps mitigate risks associated with fraud, identity theft, and money laundering.

Importantly, regulatory frameworks demand PoA checks to comply with international Anti-Money Laundering (AML) laws and other legal frameworks. These frameworks include the Financial Action Task Force’s (FATF) Recommendations, which safeguard the integrity of the international financial system.

Advantages of Proof of Address Verification

The advantages of PoA verification are substantial. It provides an additional layer of security which reduces the risk of fraudulent activities. Accurate address verification ensures that services and products are delivered correctly, minimizing errors and associated costs.

Furthermore, by implementing rigorous PoA checks, businesses demonstrate a commitment to thorough and responsible verification practices. This builds greater trust with their customers. In summary, PoA is an indispensable tool for ensuring the legitimacy and security of customer interactions and transactions. For more information, read a Robust Guide to Proof of Address Checks.

Automated Proof of Address

Users can submit physical documents or a paper copy online to verify addresses. These can include a mobile phone bill, utility bill, bank or credit card statement, and many more. The most vital aspect of a Proof of Address document is that it must include user address data.

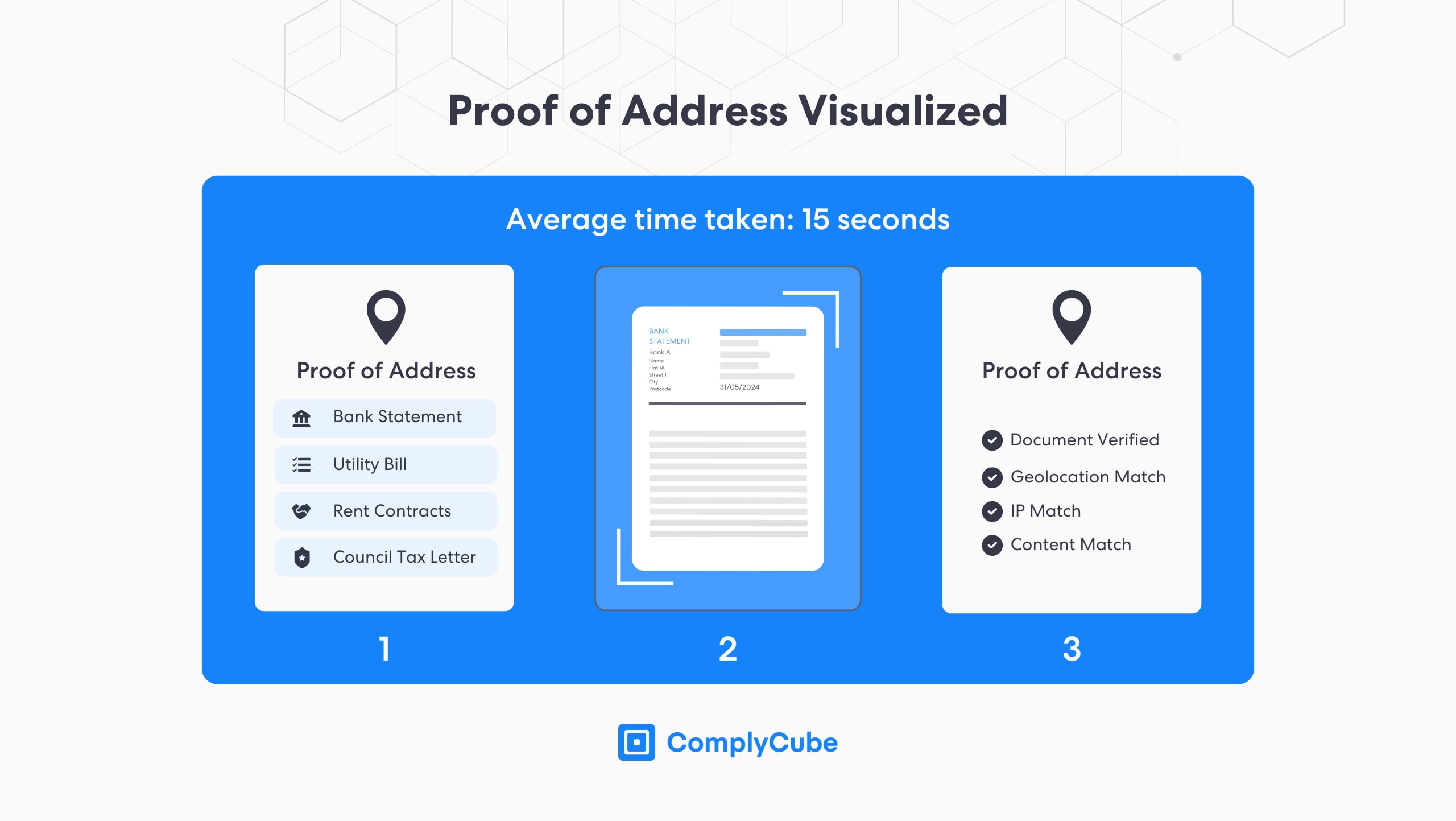

These days, modern Proof of Address verification uses advanced AI technologies to perform 3 types of analysis on a document instantly.

- Fundamental client data analysis, matching the submitted information during the client acquisition phase to the information on the document.

- Content analysis, confirming whether the information on the page is within the required data (i.e., 3 months).

- Geolocation analysis, determining whether the client’s IP address used to upload the document is within a reasonable distance from their residency.

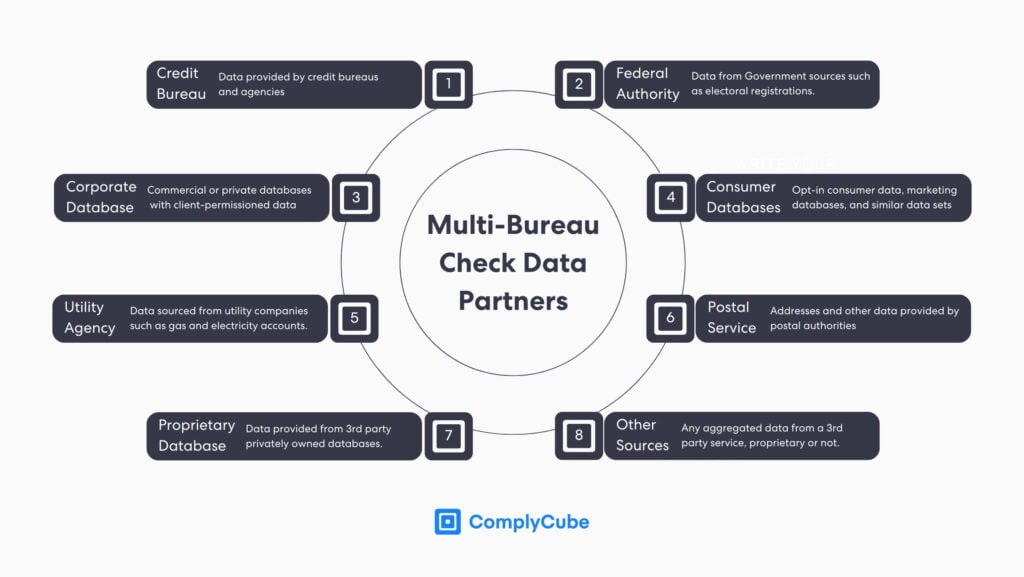

The information attained in this process can be ratified with a multi-bureau verification process, which compares the information obtained from partner databases, including those of a postal service credit union.

Regional Proof of Address Verification and Accepted Documents

Proof of Address Verification follows similar standards globally; however, there are minute discrepancies in policy and accepted documents between national jurisdictions. Always check with your local regulator for contemporary information on Proof of Address best practices.

Proof of Address Verification in the UK

Proof of Address verification is governed by the Financial Conduct Authority (FCA) regulations. The FCA requires banks and other FIs operating in the UK to implement stringent Know Your Customer (KYC) procedures. These regulations prevent fraud, money laundering, and other financial crimes, thus safeguarding both the institutions and their clients.

Accepted Forms of Proof of Address

To comply with these regulations, institutions must ask their users to present valid proof of address when opening a credit or bank account or engaging in various other financial activities. Accepted documents for verifying proof of address include:

- A recent bank statement from the applicant’s current bank.

- Bills for services like gas, electricity, water, or internet that are linked to the property.

- Letters from recognized public authorities or public servants.

- Current rental agreements with signatures from both the landlord and tenant.

- Recent credit card statements showing the applicant’s address.

- A document from an employer confirming the employee’s address.

Typically, any form of PoA document you receive should be no more than 3 months old to ensure institutions comply with the highest compliance standards. This is generally a global standard but can vary depending on circumstance and local jurisdiction.

Extenuating Circumstances

There are certain instances when banks and FIs accept alternative documents; these may include:

- Individuals claiming benefits: An entitlement letter or identity confirmation issued by the government or local authority can be used by individuals claiming benefits.

- Students: A passport accompanied by a university acceptance letter may suffice for students.

- Travelers: A letter from a local authority can be provided and used instead.

- Homeless individuals: A letter from a warden or homeless shelter.

- Asylum Seekers: An application registration card issued to asylum seekers can be used.

Case Study: Mule Accounts Opened Using PoA-style documents

Problem

In India, police reported a cyber-fraud scheme where a suspect obtained victims’ personal documents. They used them to open bank accounts that were later misused to route illicit funds. The issue surfaced when a victim received a notice about suspicious transactions.

Solution

If the bank had used stronger PoA verification at onboarding, the fraud likely would have failed. This would be due to mismatched details, tampered documents, or an IP/location mismatch. It could have flagged the application before the account was opened.

Outcome

- Fewer accounts opened with misused PoA documents (e.g., electricity bills supplied without genuine customer control).

- Stronger onboarding decisions through data + content + geolocation verification layered together.

- Improved defensibility with tamper detection and clearer evidence trails for review.

Proof of Address Validation in the British Virgin Islands

Firms operating in the British Virgin Islands (BVI) must be licensed with the BVI Financial Services Commission (FSC). Licensed firms must comply with the FSC’s regulations to help mitigate illicit financial activity such as money laundering. Registered firms acknowledge the following as acceptable proof of address documents:

- Utility and mobile phone bills: Bills for services like water, electricity, or gas, provided they are no older than three months.

- Bank statements: Recent bank statements indicating the individual’s residential address.

- Credit card statements: Statements that clearly show the individual’s residential address.

- Mortgage or credit union statements: Documents indicating the individual’s address.

- Local authority documents: Local authority tax bills or council rent cards.

- Municipality Statements: Statements of the residential address issued by the local municipality, notary, or banker.

- National identity card or driving license: If these documents include the residential address and are not already used for identity verification.

Proof of Address in Hong Kong

In Hong Kong, PoA verification is an essential step. It enables compliance with the Hong Kong Monetary Authority’s (HKMA) and the Securities and Futures Commission’s (SFC) AML regulations.

The Hong Kong government strongly advocates for rigorous KYC processes, including adherence to its Proof of Address policy. Acceptable proof of address documents include:

- Utility Bills

- Communicational Services

- Bank Statements

- Government Documents

- Tenancy Agreement

- Employment Documents

- Property Ownership Documents

- Government-Issued ID

Ultimately, the HKMA established its own criteria for Hong Kong firms to relay to individuals when they submit their PoA documents.

- The name and address must be consistent between the claimed residential address and the information on the document.

- The document must be within the established timeliness threshold.

- Documents must be fully legible and untampered; AI-powered verification tools detect pixel tampering in seconds.

- The document must originate from an authorized entity, such as a government agency, Financial Institution or creditor, utility service, or employer.

PoA Verification in Singapore

Similarly to Hong Kong, the UK, and the BVI, PoA verification is a vital compliance component across many industries. In fact, it enables businesses to comply with the AML regulations established by the Monetary Authority of Singapore (MAS).

Acceptable Proof of Address documents in Singapore

- National Registration Identity Card (NRIC) of Singapore residents.

- Passports provided they are updated

- Bank or credit card statements

- Public authority letters

- Mortgage agreements

- Car registration documents

- Insurance policies

- Utility bills

- Employer or similar institutional letters

At present, acceptable documents share the same features. They are typically connected with a federal or trusted institution with a strong compliance record. In other words, PoA verification is designed to instill trust; therefore, compliant firms will only accept documents providing the same degree of trust.

Key Takeaways

- Strong PoA supports KYC by confirming a customer’s true residence and reducing fraud.

- Most programmes expect recent PoA documents (often within ~3 months).

- The UK, BVI, Hong Kong, and Singapore each have different acceptable PoA criteria.

- Automated PoA can combine data matching, content checks, and geolocation matches for faster decisions.

- Reliable PoA depends on legible, untampered documents from trusted issuers.

About ComplyCube’s Proof of Address Verification Service

Library cards, photocopied papers, and documents not issued by a verified government or trusted authority don’t qualify as proof of address. At the same time, criminals use AI to create convincing fakes that can slip past legacy checks and undermine financial system security.

As a result, AI-powered verification tools such as ComplyCube’s Proof of Address check play a central role in safeguarding today’s financial industry. Regulators and industry guidance often point to AI and automation as essential for stopping money laundering at the onboarding stage

Criminals increasingly use AI-driven tools to bypass traditional security controls in the financial industry. As this issue continues to gain notoriety, it has garnered increasing interest from international law enforcement and national regulatory agencies.

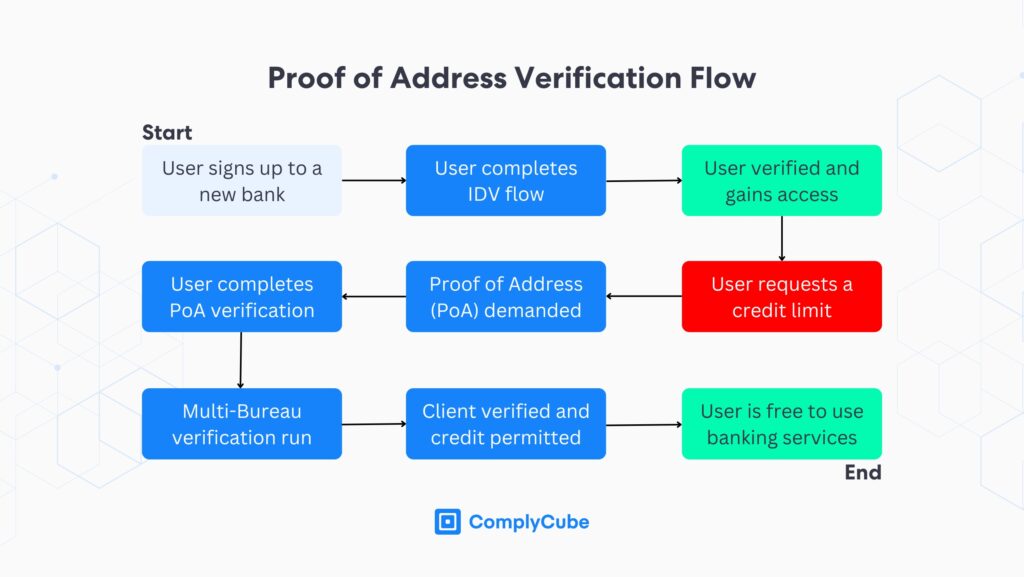

ComplyCube’s Proof of Address solution is also customizable. It can be used alongside Know Your Customer services and can be integrated into one seamless workflow. Focusing on customizability and excellent customer satisfaction, they have received numerous user experience awards in 2024 alone. For more information, contact one of their KYC and AML experts today.

Frequently Asked Questions

In the UK, why do banks use proof of address verification during KUC, and what does the FCA expect?

In the United Kingdom (UK), proof of address verification is governed by Financial Conduct Authority (FCA) regulations. It is used when customers open bank/credit accounts or perform certain financial activities, because FCA-aligned KYC helps prevent fraud, money laundering, and other financial crimes. It protects both financial institutions and their customers by providing additional identity assurance and confirming the authenticity of a claimed UK residential address.

Across the UK, Hong Kong, Singapore, and the BVI, how recent must proof of address documents be for address verification?

Proof of address requirements follow similar global standards but differ slightly by jurisdiction. It highlights the common compliance expectation that a proof of address document should be no more than ~3 months old. For the purpose of businesses operating across these regions, they should apply local rules all while maintaining a consistent recency threshold for PoA verification/address validation.

In Hong Kong, what criteria should businesses follow to validate proof of address documents under HKMA/SFC-style expectations?

For Hong Kong, PoA verification supports compliance with Hong Kong Monetary Authority (HKMA) and Securities and Futures Commission (SFC) AML regulations. The criteria includes that name and address must match between the claimed residence and the document, the document must be within the timeliness threshold, it must be fully legible and untampered, and it must come from an authorized entity such as a government agency, financial institution/creditor, utility provider, or employer. Together, it forms a practical framework for Hong Kong proof of address validation.

How does automated proof of address verification work for global address verification (UK, BVI, Hong Kong, Singapore)?

Modern automated PoA verification uses AI to instantly run three checks on proof of address documents. The three checks are fundamental client data analysis (matching onboarding-submitted details to the document), content analysis (confirming required parameters such as recency, e.g., “3 months”), and geolocation analysis (assessing whether the upload IP address is within a reasonable distance of the claimed residency). Results can be ratified through a multi-bureau verification process using partner databases supporting scalable address validation across multiple jurisdictions.

How does ComplyCube support proof of address verification for businesses operating in the UK, Hong Kong, Singapore, and the BVI?

ComplyCube’s Proof of Address check is an AI-powered verification tool that helps businesses validate proof of address documents (rejecting low-trust evidence like library cards or photocopied papers). It can be customized alongside ComplyCube’s wider Know Your Customer services and integrated into one seamless workflow.