👋 Welcome back to CryptoCubed!

Many crypto cases are taking over news headlines like a storm this month. In this edition of CryptoCubed, we look at the hottest crypto cases across the globe, including Canada’s historic record-breaking $177 million fine against Cryptomus and Dubai’s ongoing enforcement sweep on virtual asset firms.

Meanwhile, crypto has intertwined with politics in the US, as Donald Trump pardons Binance founder, Changpeng Zhao. Across the UK and Australia, regulators reinforce consumer protection, warning all firms to comply strictly with laws to ensure market integrity and transparency. Let’s dive in!

Cryptomus Faces Historic $177 Million Fine for AML Violations

Xeltox Enterprises Ltd, operating under the name Cryptomus, has amassed fines worth $C177 million (about $USD 126 million) for heavy violations of Anti-Money Laundering (AML) and Counter-Terrorist Financing (CTF) laws. Cryptomus now holds the record for one of the largest fines levied on a crypto firm by Canada’s regulator, Financial Transactions and Reports Analysis Center of Canada (FINTRAC).

The penalty was appropriate based on the nature of the violations, the volume of the instances, and to ensure compliance within a high-risk sector.

FINTRAC’s examination revealed that the firm accounted for 2,593 instances across six violations under the Proceeds of Crime (Money Laundering) and Terrorist Financing Act. Out of them, 1,068 of transactions that involved darknet markets and virtual currency wallets tied to criminals such as sexual child abuse trafficking were not reported to FINTRAC, despite large grounds to suspect suspicious transactions.

Amongst its violations, Cryptomus failed to evaluate and document money laundering risks, neglected to report transactions exceeding $10,000, and did not maintain updated AML policies approved by a senior compliance officer. Additionally, the firm had not followed mandated rules regarding transactions linked to Iran. The case underscores the present vulnerabilities and gaps that can still occur in the cryptocurrency world, calling on regulators for heightened oversight.

For more on this story, click here.

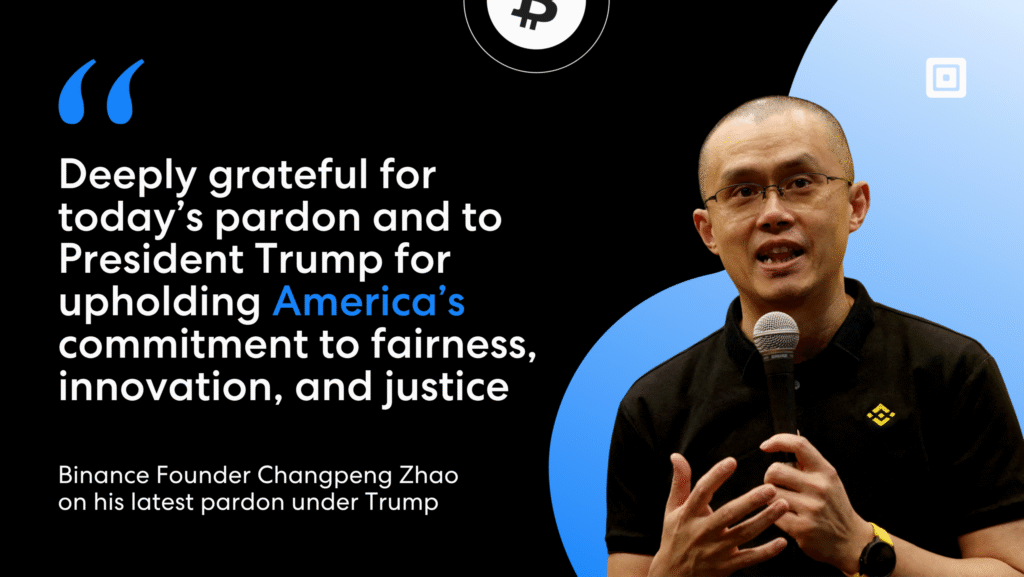

Donald Trump Pardons Binance Founder Changpeng Zhao

Trump formally pardoned former Binance CEO Changpeng Zhao this month, absolving him of any criminal record and legal restrictions, such as business activities or traveling, resulting from the conviction. Back in 2023, Zhao had pleaded guilty to AML violations that enabled criminals to move money via his company, Binance. He served four months in prison, ending in September of 2024, and resigned as CEO at that time.

Deeply grateful for today’s pardon and to President Trump for upholding America’s commitment to fairness, innovation, and justice. – Changpeng Zhao, Binance Founder

Also known as one of the richest men in cryptocurrency, Zhao founded Binance in 2017. Binance’s growth was quick, and it did not take long for the crypto exchange to claim the title of the world’s largest cryptocurrency exchange by trading volume. However, due to its rapid expansion, the firm had faced multiple AML and CTF penalties from regulators worldwide. This includes the $4.3 billion fine handed out by the U.S. Department of Justice (DOJ) in 2024 and the $2.25 million penalty by India’s Financial Intelligence Unit (FIU).

The pardon came about after large lobbying efforts by Zhao and Binance, including legal experts tied to the Trump Administration. This case highlights Trump’s move to support the country’s growing cryptocurrency sector. It also underscores the intricacies of politics, power, and crypto. The pardon has lifted Zhao from certain criminal convictions, enabling Binance to have a stronger footing in the U.S.

For more on this story, click here.

19 Virtual Asset Firms in Dubai Charged up to $163,000

Dubai’s watchdog, the Virtual Assets Regulatory Authority (VARA), has fined 19 cryptocurrency firms with penalties up to AED 600,000 (approximately $USD163,000) for operating without a valid license and marketing breaches. The firms involved in this web of penalty include UAEC Digital Fintech FZCO, Morpheus Software Technology FZE (FUZE), Hatom Labs, and Triple A Technologies.

VARA will continue to take proactive measures to uphold transparency, safeguard investors, and preserve market integrity.

In 2024, VARA, the regulatory authority overseeing virtual asset firms operating in Dubai, set marketing regulations mandating firms to seek approval before promoting crypto-related advertisements. This is part of Dubai’s larger move to safeguard its citizens, businesses, and investors, as well as promote a fair and safer financial ecosystem. Any marketing materials used to promote guaranteed returns on crypto without clear disclaimers of potential risk involved are deemed significant violations.

Additionally, under Dubai’s AML law, all crypto and virtual asset providers must obtain a VARA license to operate within the country. The 19 companies were immediately required to cease operations while investigations to remediate the issues are ongoing. The VARA stance towards crypto space highlights its balanced approach between encouraging innovation and maintaining stringent guardrailes in the industry.

For more on this story, click here.

UK Crypto Advisor fined £100,281 for Insider Dealing

Neil Sedgwick Dwane, an experienced financial professional in the UK, was fined £100,281 by the Financial Conduct Authority (FCA) for abusing his power while working as an advisor for ITM Power PLC. In 2022, Dwane assessed insider information about an announcement made by ITM to the market. With this knowledge on his side, Dwane sold shares worth £124,287.

Trading on inside information while in a position of trust rigs the system and undermines the integrity of the market.

ITM’s share price fell by 37% after the market announcement, and Dwane leveraged this by purchasing shares worth £140,700 after the price fell, ultimately profiting £26,575 in his pocket. Based on FCA investigations, he did not gain ITM’s prior approval before dealing with these shares. The FCA remains steadfast in its ruling, mentioning that the abuse of sensitive financial information must apply to anyone fairly, not just directors and executives.

Insider dealing creates gaps for criminals to exploit and launder money through crypto assets. The FCA describes this case as dishonest, unfair, and of huge risk to the country’s efforts of preventing money laundering and other financial crimes. This case underscores the intersection of AML compliance and market abuse control as regulators work their way in preventing any vulnerable loopholes within the financial hub.

For more on this story, click here.

Crypto ATM Operators in Australia Tied to Scams

Australian-based ATM cryptocurrency, Cryptolink, was fined $A56,340 (approximately $USD 37,000) for weaknesses in its AML program. Australian Transaction Reports and Analysis Center (AUSTRAC) found that the company had not reported large transactions required under the country’s AML law. Cryptolinks ATM enables individuals to buy and sell crypto such as Bitcoin and Ethereum quickly without face-to-face interaction.

Australians lose millions of dollars each year to scams linked to cryptocurrency ATMs, with older people being common targets.

Due to their rapid transaction speeds and 24-hour access, ATM operators are seen as attractive hotspots for fraudsters and scammers to exploit. Operators that fail to implement the required due diligence and compliance frameworks to prevent these illegal activities can be penalized heavily. According to the Australian Federal Police (AFP), Australians lose millions of dollars to scams involving crypto ATMs yearly.

AUSTRAC has ramped up its oversight over crypto ATM operators, as the country has the third-highest number of crypto ATMs globally, just behind Canada and the US. To ensure the impact of scams remains low, ATM operators have been subject to heightened regulations, with Australian crypto ATM operators facing a $5,000 limit on cash deposits and withdrawals at each time.

For more on this story, click here.

Time for Your Monthly CryptoCubed Poem

So you’ve made it to the end of our newsletter. It’s time to enjoy a little satire, worthy reader, you’ve earned it.

🔥THE CRYPTO CUBED POEM: OCTOBER🔥

Coins spin fast through storm and flame,

Regulators step in quickly to tame.

From Canada’s gaze to Dubai’s might,

New rules rise to guide the fight.

Zhao walks free, his chapter turned,

While lessons from the markets burned.

Fraud and fear still haunt the chain,

Yet hope and progress shall remain.

Click here to learn more about how ComplyCube supports cryptocurrency firms in maintaining global AML and KYC compliance.

Stay tuned for our next newsletter and have a great day ahead!