Know Your Customer (KYC) and Anti Money Laundering (AML) are a set of best practices and strategies to reduce the risk of fraud and remain compliant. KYC and AML compliance is not optional for financial institutions, both for preserving the company’s reputation and minimising the risk of costly fines. Yet, regulations differ between jurisdictions, from local to federal law. Penalties can be very high, and financial institutions need effective, digital, and automated strategies that apply KYC processes and AML methodology effectively across operations. This guide will explain how KYC checks facilitated by advanced Identity Verification (IDV) are beneficial for businesses and customers alike.

KYC (Know Your Customer) Checks

KYC checks are critical components of an organisation’s security processes, enhancing AML due diligence efforts. KYC verification strategies include identity verification, which drastically reduces the risk of fraudsters committing financial crimes with fake customer identification. KYC verification also makes establishing relationships with new customers easier and ensures financial institutions are well-aligned their customers from day one.

KYC compliance requires a strong customer identification program that all financial institutions must follow to verify identity and mitigate risks. This protects financial institutions and is a form of critical customer due diligence and financial transparency, helping to fight money laundering and other financial crimes.

Utilisation of KYC enables financial institutions to reduce the risk of numerous nefarious actions. This enhanced due diligence may reduce the following:

- Terrorist financing by confirming identity through more than just document verification, limiting access to financial institutions and funding for illegal acts.

- Identity theft by verifying customer information and reporting suspicious transactions.

- Money laundering risks, by ensuring the financial system can identify threats to money laundering regulations but also monitoring activity closely enough to deter money laundering from occurring within the banking sector.

- Reputational harm from thefts and attacks, as account owners generally blame the bank or other financial institutions for the associated risk, which could impact the business relationship.

- Financial penalties are levied by government organisations for failure to comply with regulatory requirements, such as those imposed by the US Patriot Act or rules established by the Financial Industry Regulatory Authority.

- Legal action by customers and third parties or reports to the Financial Crimes Enforcement Network, often due to a lack of reasonable diligence that exposes customer data.

KYC aims to minimise the risk of bad actors from infiltrating the customer onboarding process. The sector most targeted by identity fraud is financial services. Synectics Solutions, the UK’s largest syndicated risk intelligence database, predicted in 2024 that ID fraud may account for 50% of all bank-reported fraud by 2025.

The U.S Department of Treasury’s Financial Crimes Enforcement Network (FinCEN) similarly issued a notice that highlighted a “concerning increase in U.S passport cards being used to impersonate and defraud individuals at financial institutions across the country.” Businesses within financial services often have access to financial assets, making them a very lucrative target for fraudsters. For more on IDV security in banking, read “Biometric Verification: Elevating Security in Banking.”

The Risk-Based Approach to AML

When it comes to AML, customer risk management is complex but essential. A robust and effective AML approach is essential to reducing costs while meeting regulatory requirements. However, such methods can be time-consuming and can drain customer experience expectations.

Risk Profiling

Risk profiling considers customer risk by scoring the customer based on several criteria. Risk profiling focuses on a full assessment of each customer, transaction, and business relationship based on factors that have been identified by the organisation as potential risks.

Some of the most common components of a risk-based analysis include:

- Geographical factors: High-risk countries or jurisdictions with well-recognized AML/CFT concerns, such as terrorism-heavy locations or areas where previous crime has occurred.

- Customer type: PEPs, non-resident customers, complex business structures, or cash-intensive operations can also factor into risk assessment.

- Transaction patterns: Unusual, complex, or high-frequency transactions could signal risks, such as a sudden shift in account usage or high transaction values not commonly associated with the account.

- Source of funds: Known high-risk sources or unexplained income streams, often those that are on the perceived watchlist.

- Industry or occupation: Certain sectors (e.g., cryptocurrency, gaming, or import/export) may carry higher risks and must be considered.

- Lighting and Depth Perception: AI models can also use light reflection and shadows to detect liveness. Human faces reflect light differently than a flat photo or video would.

The Consequences of Non-Compliance with AML Mandates

Businesses that fail to implement effective KYC strategies risk financial costs, including compliance-related fines. Yet a single instance of fraud can cause reputational damage from adverse media mentions that may far exceed direct financial losses from compliance costs.

Some of the biggest fines handed out due to lack of AML compliance include a £3B fine to TD Bank, a $35M fine to Nordea Bank, a $29M fine to Starling bank, and a $7.45M settlement for MGM Grand & The Cosmopolitan. Implementing the right solutions early on avoids these catastrophic consequences.

Also notable is that KYC and AML is not a one-time process completed at onboarding. Continuous monitoring is necessary. It enables financial organisations to monitor a customer’s behaviour over the long term while also identifying new risks as they develop.

The Need for AML Compliance Checks

AML checks specifically target activities that could indicate a higher risk of money laundering. Data from the United Nations Office on Drugs and Crime states that money laundering accounts for 2 to 5% of global GDP, equivalent to about US$800 billion to $2 trillion annually. Financial institutions and other regulated agencies must take steps to detect and prevent such activities, including terrorist financing. AML checks are a critical component of meeting AML compliance requirements.

Money laundering accounts for 2 to 5% of global GDP, equivalent to about US$800 billion to $2 trillion annually.

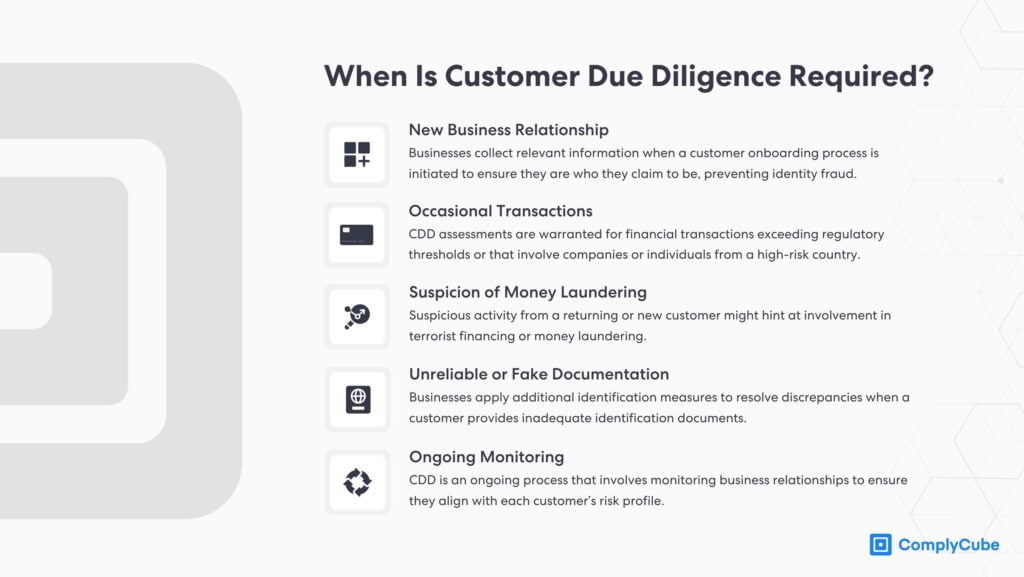

Utilisation of AML checks is needed to ensure prospective customers are not a risk to an organisation. This risk-based approach aids in identifying information that could demonstrate any red flag, to catch bad actors attempting to launder money or finance terrorism. Conducting ongoing monitoring is also critical to identify risks quickly. AML checks must include the following when it comes to customer requirements:

Customer Due Diligence (CDD)

This step verifies the prospective customer’s identity, financial behaviour, and risk profile. Standard CDD applies to all customers, while Enhanced Due Diligence (EDD) applies to high-risk customers. This includes transactions involving complex ownership structures, multi-jurisdictional customer relationships, customers from high-risk regions, and other interactions considered at higher risk. For more on Enhanced Due Diligence, read “Navigating the World of Enhanced Due Diligence.”

Risk-Based Screening

AML checks ensure added due diligence on certain customers, transactions, or activities based on perceived risk. This may include customers or transactions in sanctioned countries. It also places heavier requirements on perceived higher-risk financial activities, including unusual, large, or complex transactions. Customer profile risks, such as occupations in high-risk industries, are also considered. All customers that possess a higher risk in any of these or other areas must work through a more elaborate AML process to ensure safety at all times.

What Kinds of Financial Institutions Need KYC and AML?

Any type of financial transaction benefits from an effective customer identification program to establish the authenticity and accuracy of any information provided. However, some organisations must meet stricter KYC and AML compliance requirements because they involve higher risks, especially within the financial industry.

Meeting the requirements of global watchdogs working to monitor and minimise risks associated with wide-scale fraud is particularly important. Global watchdogs span through a wide range of industries, and some of the most important to know from a financial industry standpoint include organisations such as the Financial Action Task Force (FATF), a global watchdog of money laundering and terrorist financing. Sector specific watchdogs also exist, such as the Association of Chartered Certified Accountants (ACCA), which supervises the accounting industry. Let’s dive into different types of financial institutions and how they must meet the specific KYC and AML Compliance Requirements.

Retail Banks

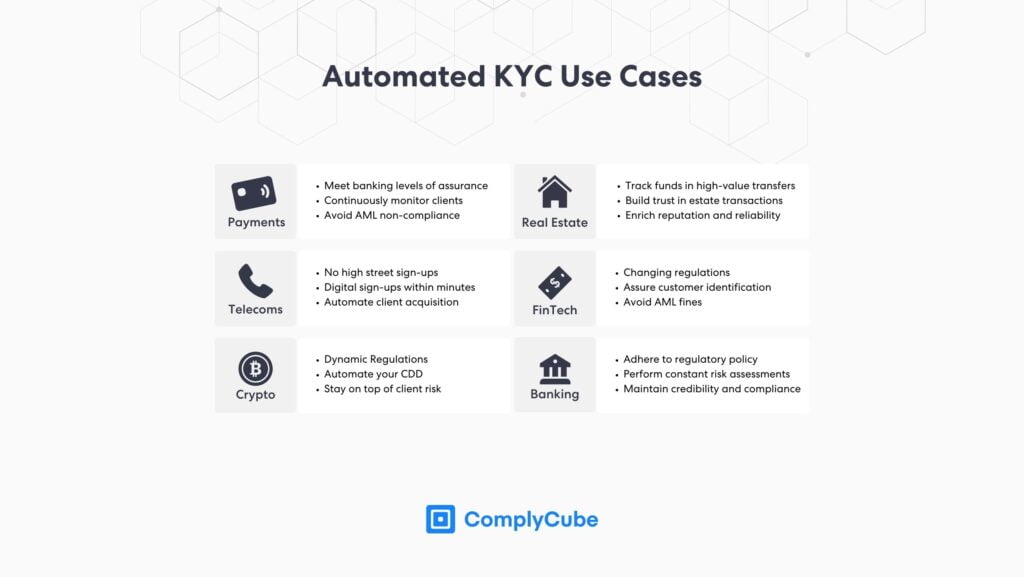

Banks are the transactional heart of the financial industry, and all must employ KYC and AML checks. These handle personal accounts for everyday financial activities like savings, loans, and payments. They screen account holders to ensure their identities match the documentation and assess risk. When out-of-place transactions occur in customer accounts, automated tools alert the bank to investigate, potentially minimising risk before transactions are complete.

Banks are often targeted by identity fraud and used for illicit practices such as money laundering. Therefore, these organisations must verify the identity and financial integrity of new and existing customers by continuously monitoring transactions, suspicious activities, or criminal behaviour.

Investment Banks

These institutions perform market-based transactions on behalf of corporations or governments and must screen transactions to prevent market manipulation or insider trading. They must also work to pinpoint bad actors who may be laundering money through fake organisations. Monitoring global sanction lists can also facilitate ongoing oversight, anti-money laundering efforts, and better risk assessment.

Corporate Banks

They work with businesses and large corporations, and require verification of the legitimacy of prospective clients and partners. Assessing financial activities and credit risk is key. Ongoing monitoring can provide insight into fraudulent activity happening within the business. KYC documents and regulatory methods aid in identifying information that could expose these banks to wide-scale fraud.

Payment Service Providers (PSPs)

Companies like PayPal, Venmo, and Stripe facilitate digital payments and transfers. They must adhere to KYC and AML requirements to ensure secure payment processing and prevent misuse. They tend to operate on a global scale. The risks are higher, yet because consumers demand fast and effortless transactions, these organisations face some of the most challenging processes for achieving KYC and AML compliance. Key strategies they must maintain include:

- Transaction Monitoring: PSPs track payments in real-time to identify suspicious patterns. They must be able to put a stop to transactions that could be deemed fraudulent.

- Sanctions Screening: PSPs screen customer information against international sanctions lists to prevent unauthorised payments. However, ongoing monitoring for bad actors and an enhanced focus on key risks to changing global threats make these steps more challenging. For more on Sanctions Screening, read “What is Sanctions Screening?”

Insurance Providers

Insurance companies rely on KYC and AML checks to verify the legitimacy of customers’ funds and confirm the validity of claims. Insurance companies must spot, for example, numerous policy updates or changes against non-associated clients and beneficiaries. Some of the areas of focus here include:

- Premium Payments: Ensuring that premium payments are legitimate and traceable to the customer’s known source of income.

- Claims Payouts: Insurance firms must verify that payouts are going to the correct, verified individual and are not being processed for criminal purposes. Verification of policyholder identification and authentic claims is critical.

- Risk Profiling: AML checks help insurance companies assess financial risks associated with underwriting new policies. They can also be crucial in maintaining healthy accounts by ensuring a constant focus on changing customer behaviour and risk factors.

Investment Firms & Brokers

Investment firms and brokerage houses are tasked with ensuring that clients are legitimate and their trades and investment behaviours do not violate market laws. Investment firms and brokers must adhere to some of the strictest standards and be high targets for threats. To minimise risk, they must focus on these key areas:

- Client Identity Verification: Before allowing clients to trade on their platforms, investment firms ensure that they are legitimate and compliant with regulatory standards. This includes verifying the source of invested money and account beneficiaries.

- Trade Monitoring: Investment brokers monitor trades for evidence of market manipulation or insider trading. Identifying potential fraud quickly may minimise risks.

- Risk Analysis: Investment firms assess customers for financial risks, particularly if their accounts are linked to criminal activity or sanctions violations. This process must be continuous as conditions change.

Cryptocurrency Exchanges

Cryptocurrency exchanges like Binance, Coinbase, and others must conduct KYC and AML checks because cryptocurrency transactions are less transparent than traditional fiat currency transfers. Key focuses include:

- Sanctions List Screening: Screening customers against global and national sanctions lists to ensure compliance and then monitoring this over time to pinpoint suspicious restrictions.

- Customer Screening: Verifying the identity of cryptocurrency buyers and sellers to prevent financial crimes. As a target for criminal activity, cryptocurrency organisations must consistently monitor for any suspicious insights to support anti-money laundering initiatives.

For more on how businesses within the crypto sector can implement the necessary AML and KYC controls, read through ComplyCube’s Trust Node.

KYC and AML Checks With ComplyCube

KYC procedures that support streamlined verification of a customer’s identity can meet all due diligence requirements without slowing down digital processes. Mitigate compliance and fraud risks by implementing state-of-the-art KYC and AML checks.

To safeguard your organisation with advanced AML and KYC checks, reach out to ComplyCube’s expert compliance team.