TL;DR: This article offers a practical framework for comparing KYC platforms, covering compliance needs, technical fit, IDV and AML features, cost considerations, and future scalability. It delves into the essential features stakeholders must consider when selecting a KYC solution to meet current and future needs. Readers walk away with a bulletproof evaluation checklist to conduct a tailored KYC platform comparison, plus leading industry insights from KYC experts.

What Should be Considered When Building a KYC Platform Comparison?

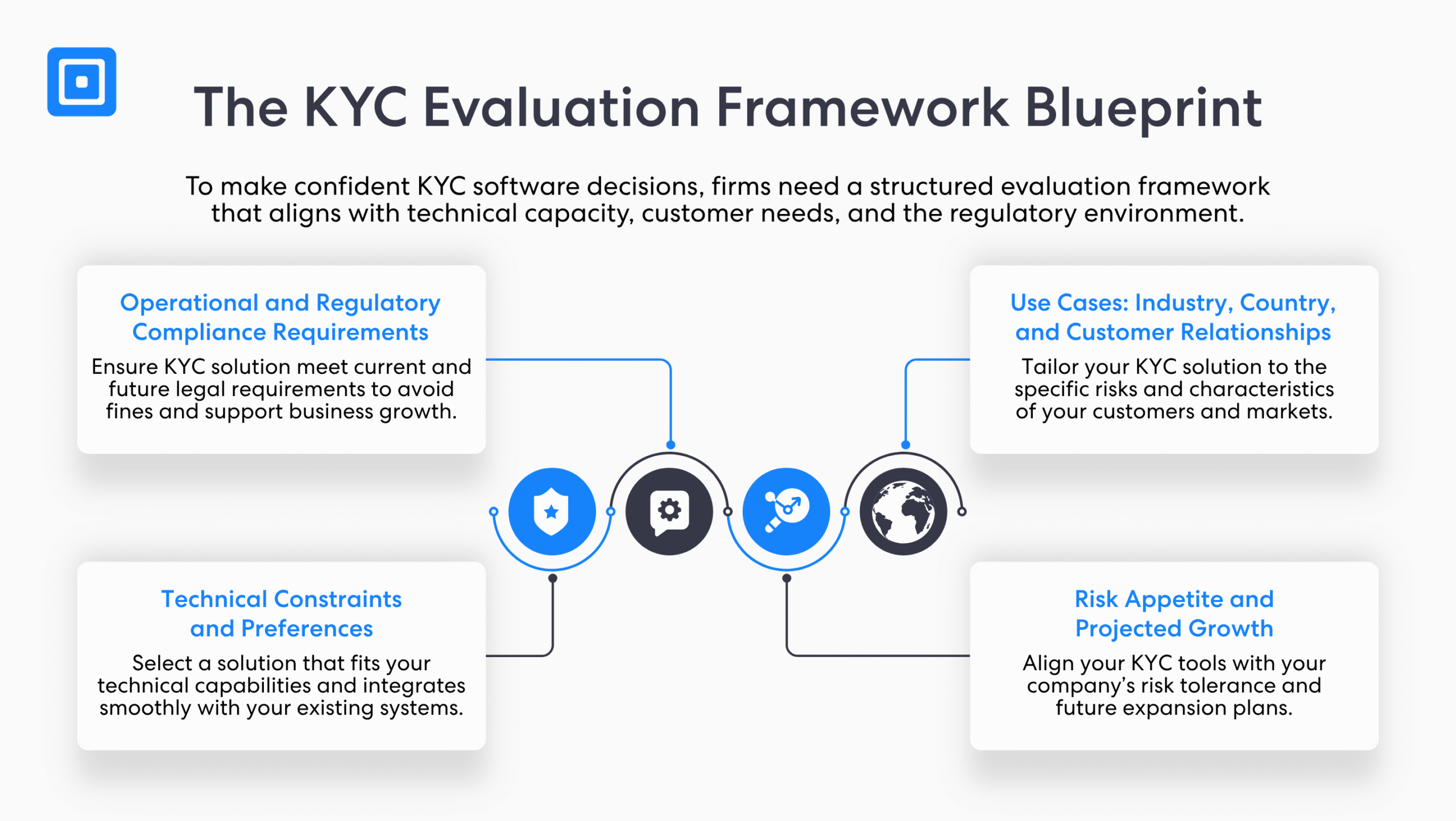

The criteria for comparing KYC providers effectively may look different to each company. Designing a tailored, well-defined KYC evaluation framework can help businesses make better-informed purchasing decisions and help firms evaluate then select the right RegTech provider for their business case. For an evaluation framework to be practical, it must align with a company’s technical capacity, customer satisfaction goals, and regulatory obligations. Without a strategic framework, comparisons can stray away easily, leading to volatile decisions.

Selecting KYC vendors is vital as enforcement actions from regulatory authorities worldwide have increased tremendously in recent years. Notable fintechs and financial institutions such as NatWest, Barclays, and Santander are not excused. In 2024, the Financial Conduct Authority issued over £176 million in fines for weak KYC procedures. This underlines the importance of creating a reliable KYC software evaluation framework.

Operational and Regulatory Compliance Requirements

Companies must list the particular KYC technology and operational support required to meet compliance requirements. While some businesses only need KYC coverage, others might require additional Anti-Money Laundering (AML), biometric verification, or real-time sanctions screening. Additionally, it is necessary to understand future business expansion goals. Firms that plan to expand operations globally must comply with international KYC regulation standards.

Use Cases: Industry, Country, and Customer Relationships

Another factor to consider is the type of customer and client a business is dealing with. For instance, if an organization deals with high-risk individuals such as Politically Exposed Persons (PEPs) or sanctioned entities, a platform that includes Enhanced Due Diligence (EDD) and ongoing monitoring is required. Furthermore, selecting a KYC solution with robust document verification and language localization support is key if operating in different countries. To learn more about how you can effectively navigate the largest challenges from EDD, click here.

Technical Constraints and Other Preferences

Every KYC service provider has its integration capability depth. For businesses that lack a dedicated technical team, prioritizing seamless integration with low/no-code solutions can be a game-changer. It enables new features to merge seamlessly into existing systems without coding or developer knowledge. Moreover, organizations that operate across multiple platforms, including web and mobile, must consider KYC software providers with API and SDKs to boost interoperability.

Risk Appetite and Projected Growth

Understanding future business goals can help ensure alignment with customer experience and compliance processes. Industry-leading KYC solutions offer scalable tools that grow and evolve with changing business conditions. Industries prone to change, such as startups and scale-ups, may need to adopt KYC and AML tools that provide high customization during the customer onboarding and verification processes.

Platform Feature Prioritization

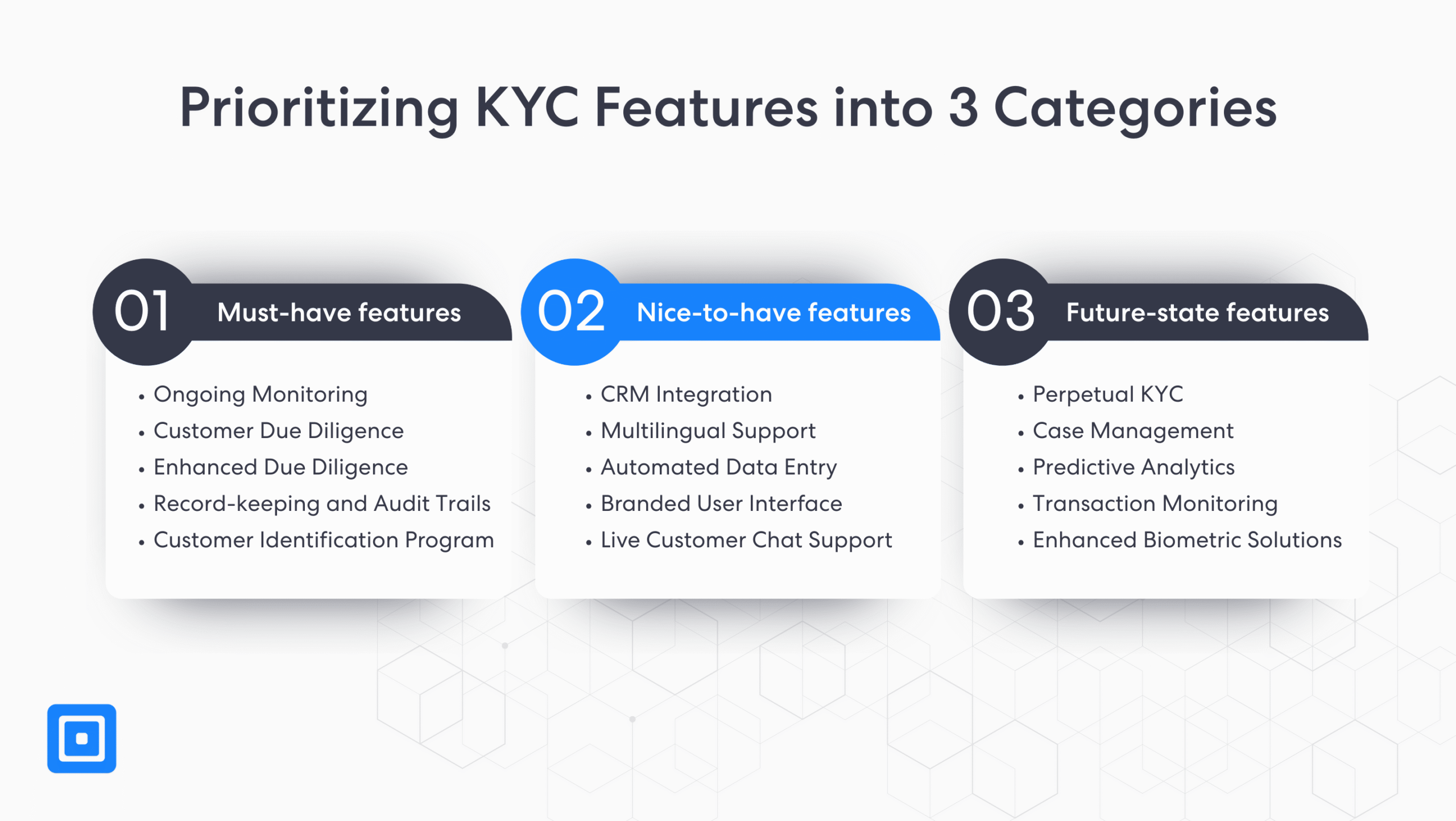

After creating an evaluation framework, it can be beneficial to segment KYC features into three categories for greater clarity: must-have, nice-to-have, and future-state features. This structure enables firms to ensure regulatory compliance while considering future goals.

The must-have features are those necessary for compliance and business continuity, such as verifying customer identities. Nice-to-have features are the tools that contribute to growth but are not critical. Tools that add to a seamless onboarding experience, such as a branded user interface, are included here. Features in the future-state segment are those that may become more important as the business expands, such as robust case management and transaction monitoring.

Identity Verification Capabilities

A central element of effective KYC software is powerful identity verification solutions. Identity verification is the process of authenticating an individual by gathering various customer data. Modern KYC solutions incorporate digital identity verification solutions, facilitating companies in customer onboarding remotely. The integral components in identity verification include:

- Identity Document Coverage: Accepts multiple types of identity documents for verification from different countries, reducing friction in the onboarding process.

- OCR and AI-powered Identity Verification: AI and Optical Character Recognition (OCR) significantly reduce human error and manual labour, resulting in precision and speed during onboarding.

- Biometric Authentication: Liveness verification guarantees that a document holder is alive and helps mitigate identity theft and deepfakes.

- NFC-Enabled Documents: Enables document screening at immediate speed, helping financial institutions and businesses with Enhanced Due Diligence (EDD) and fraud prevention efforts.

Case Study: UK Fintech Platform Slashes ID Fraud by 84% with ComplyCube’s Liveness Detection

A rapidly growing fintech platform was expanding into new markets and onboarding thousands of customers weekly. With the surge in applications came a sharp rise in fraud attempts, particularly “presentation attacks,” where fraudsters displayed stolen or fake ID documents on screens during the verification process. This compromised both compliance and customer trust prior to speaking to ComplyCube. According to the National Council on Identity Theft Protection, identity theft occurs every 22 seconds in the United States.

Challenge

- High fraud exposure: Screen-based spoofing accounted for 1 in every 20 onboarding attempts.

- User trust erosion: Legitimate customers experienced delays due to additional manual checks.

- Regulatory pressure: Regulatory oversight required stronger anti-fraud measures to meet KYC and AML obligations.

Solution

To combat this, ComplyCube integrated its Document Liveness Detection feature into the fintech’s identity verification workflow, enhancing their existing Document Checking Service. This added Presentation Attack Detection (PAD) layer identifies spoofing attempts, including 3D masks and screen replay fraud, with the following results:

Enhanced fraud resistance, with the PAD model preventing presentation attacks without interrupting user experience.

Improved identity assurance, verifying that both selfie and document submissions are genuine and unaltered.

Results within 3 months

84% reduction in screen-based fraud attempts.

30% faster onboarding for legitimate customers, cutting KYC completion from minutes to seconds.

Straight-Through Processing (STP) rate of 98% with 100% uptime.

92% customer satisfaction score, up from 84%.

Anti-Money Laundering Capabilities

Beyond identity checks, the best KYC software providers ensure compliance with evolving AML regulations. AML compliance mandates businesses to support ongoing fraud prevention solutions with sophisticated risk management and EDD:

- PEPs, Sanctions Screening, Adverse Media Checks: Secure compliance by screening customers against global watchlist and sanctions list to ensure prompt detection of high-risk profiles.

- Configurable Risk-Based Rules Engine: Firms can use dynamic workflows tailored to risk levels. For example, high-risk individuals undergo EDD while low-risk customers get onboarded faster.

- Ongoing Monitoring: Continuously screens and alerts businesses of any new risk from a change in a customer’s risk profile, making fraud prevention a proactive process.

- Regulatory Reporting: Audit trails and compliance activities are logged and easily accessible. This helps satisfy regulatory authorities’ reporting requirements.

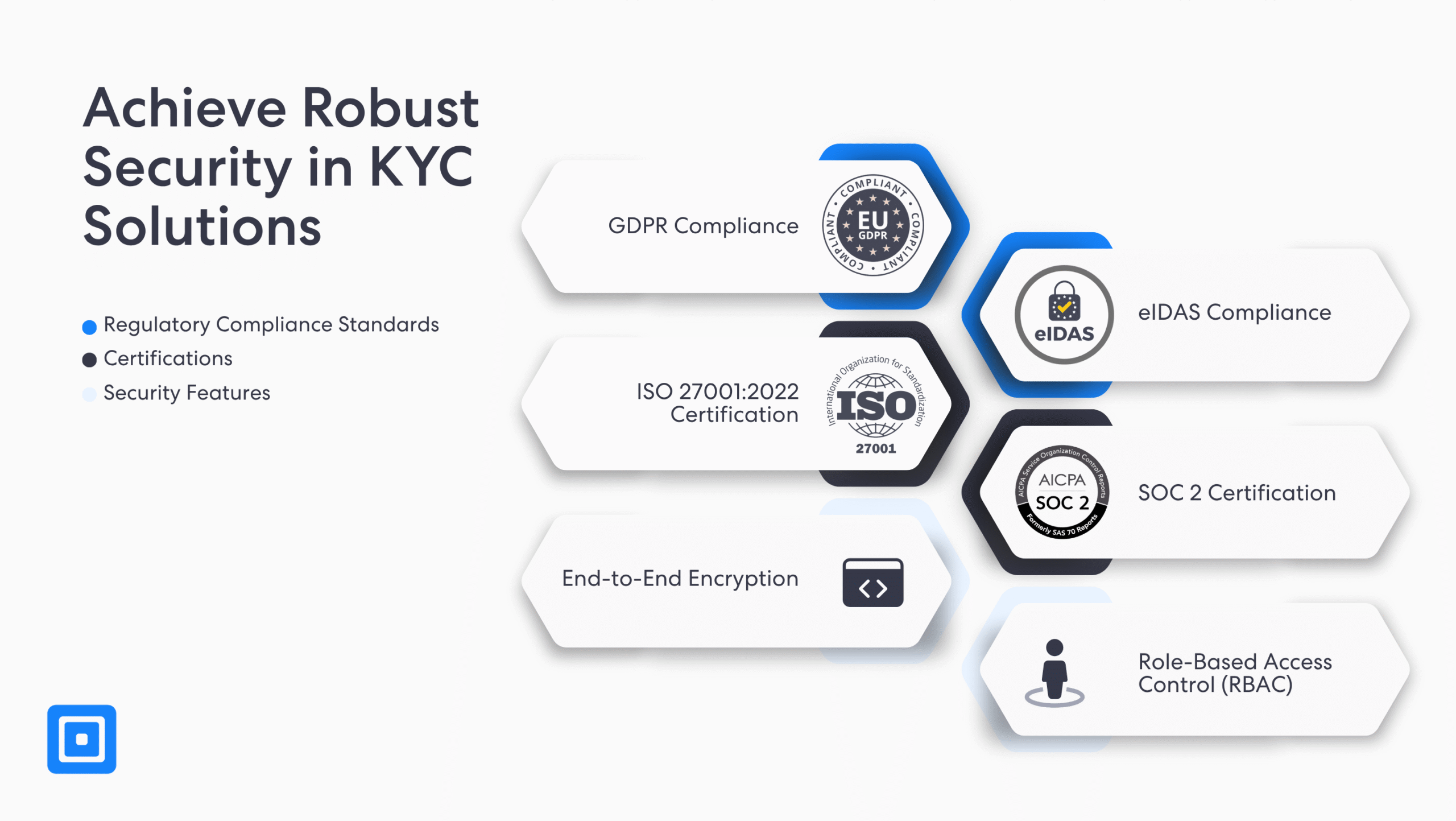

The Value of Security Certifications

When selecting KYC solution, trust and security are non-negotiables. KYC vendors that can demonstrate proven and reliable compliance will empower businesses with confidence and peace of mind. The three core areas to look for include industry or jurisdiction certifications, security features, and regulatory standards. Certifications highlights that a vendor meets rigorous and recognized benchmarks, security features provide robust protection, and regulatory standards maintain legal compliance:

Compliance with GDPR and eIDAS

GDPR and eIDAS-certified KYC and AML solutions safeguard sensitive personal information with secure data storage capabilities. Organizations partnering with these vendors also gain trust from customers who feel assured that their financial transactions and information are protected.

ISO 27001:2022, SOC 2, and ISO 9001:2015 Certifications

Certifications such as the ISO 27001:2022, SOC 2, and ISO 9001:2015 demonstrate high data security and quality standards. The best KYC compliance solutions leverage these certifications to provide clients with top-tier defense against data breaches.

End-to-end Encryption and RBAC

End-to-end encryption and Role-Based Access Control (RBAC) supply organizations with high security protection and control over data management. Firms can choose to give access to specific team members, mitigating the threats of data violations.

Choosing the Right KYC Provider by Cost

While establishing robust verification systems is essential, the cost of KYC verification can be overpriced for many. To prevent overspending and painful migrations down the road, companies must take proactive steps to assess pricing before committing:

- Breakdown Cost of KYC Checks: It is vital to request clear, upfront pricing of KYC procedures. Some vendors may charge an extra cost once verification volume increases. Firms must ensure to clarify questions regarding extra features, such as case management or multi-bureau checks.

- Hidden Cost: While uncommon, another possible challenge is hidden fees. Decision makers must have full visibility of contractual obligations to avoid additional charges arising from customer support, platform training, or data exports.

- Contractual Flexibility: In the worst-case scenario, companies might outgrow certain compliance providers due to changing business needs, forcing them to look for other options. Remember to check contracts for minimum commitments, renewal clauses, and exit fees to ensure seamless migration.

Key Takeaways

- Implement a structured evaluation framework to choose the right KYC platform

- Must-have, nice-to-have, and future-state features clarify vendor capabilities and priorities

- Scalable solutions support regulatory compliance and business growth over time

- Signal trust and security with certifications such as ISO 27001:2022 and GDPR compliance

- Clear pricing and contract terms help prevent costly migrations and hidden fees

Creating a Fit-for-Purpose KYC Platform Comparison

Designing an evaluation checklist when determining compliance solutions may look different for each company. While checking off features might sound reasonable, considering other factors like security certifications, cost, and user experience is imperative. Considering future-state features, such as diverse customer identity verification methods and ongoing KYC risk assessment, can be monumental in supporting business growth.

Safeguard your business with ComplyCube’s award-winning KYC and AML platform. Streamline customer onboarding with robust verification processes catered to your unique needs. Speak to a member of the team today.

Frequently Asked Questions

What should I look for when comparing KYC platforms?

Focus on compliance capabilities, technical integration options, identity verification tools, AML features, pricing transparency, and future scalability.

What technical features should a KYC solution offer?

Key features include API and SDK support, low-code or no-code integration, biometric verification, OCR, and support for NFC-enabled documents.

How can I manage KYC verification costs effectively?

Request clear pricing breakdowns, check for hidden fees, and review contract terms to ensure flexibility and avoid overspending.

What role do certifications play in choosing a KYC provider?

Certifications such as ISO 27001:2022, SOC 2, and GDPR compliance demonstrate strong data security, privacy protection, and regulatory alignment.

How can businesses prioritize features when evaluating KYC solutions?

Segment features into must-have, nice-to-have, and future-state categories to align immediate compliance needs with long-term strategic goals.