Balancing privacy rights with fraud mitigation in a digital world is far more complex than ever. Businesses must fully verify who their clients are before providing account access, while also managing costs through Know Your Customer (KYC) processes. Thus, many organizations are now turning to flexible KYC pricing models to balance security with budget considerations, making factors such as ID verification pricing and identity check cost crucial.

Achieving both robust security and cost efficiency can be complicated. The complexity stems, at first, from the ease of fraudulent activities online. Artificial intelligence can create highly authentic-looking passports, driver’s licenses, and other seemingly genuine documents that can pass some of the most rigorous evaluations. This guide will delve into the rising costs of identity verification (IDV), compare different IDV pricing methods, and explore how AI-driven solutions such as ComplyCube can deliver value to businesses.

Additional Costs and Speed Comparison

To determine who the prospective customer is, corporations must apply tools and software that provide accurate, real-time verification. This approach ensures that firms can confidently avoid fraud and meet compliance requirements.

The risks are higher than ever. According to the United Nations, 2 to 5% of global GDP is laundered annually, accounting for between $800 billion and $2 trillion.

However, ID verification pricing can be confusing and expensive. While ID checks are vital, understanding the cost of the IDV process is essential to meeting financial objectives. Finding the balance between reliable IDV and financial affordability requires considering multiple pricing strategies.

Research on the Increasing Costs of IDV Platform Pricing

According to Juniper Research, the average cost of digital identity verification solutions in 2025 is approximately $0.20 per check. However, a shift is happening across the industry, aiming to alleviate some of the cost burdens. The same research indicates that the cost per check will drop to $0.17 by 2029 as companies strive to make technology and verification processes more efficient.

The Different Types of ID Verification Pricing Methods

Another factor to consider when choosing IDV software is the associated costs. Services have various pricing strategies. For instance, some vendors charge a flat-rate licensing fee, while others apply user-based pricing. Another pricing method involves pay-as-you-go, whereby organizations solely pay for each verification completed.

In the pre-verification method, firms may incur fees if they go beyond the transaction volume purchased. For this method to be beneficial, companies must maintain precise and controllable verification volumes that satisfy the subscription requirements. Companies growing rapidly, particularly startups and scaleups, need to consider long-term contracts that do not limit checks.

The Real Value Behind Identity Verification Services

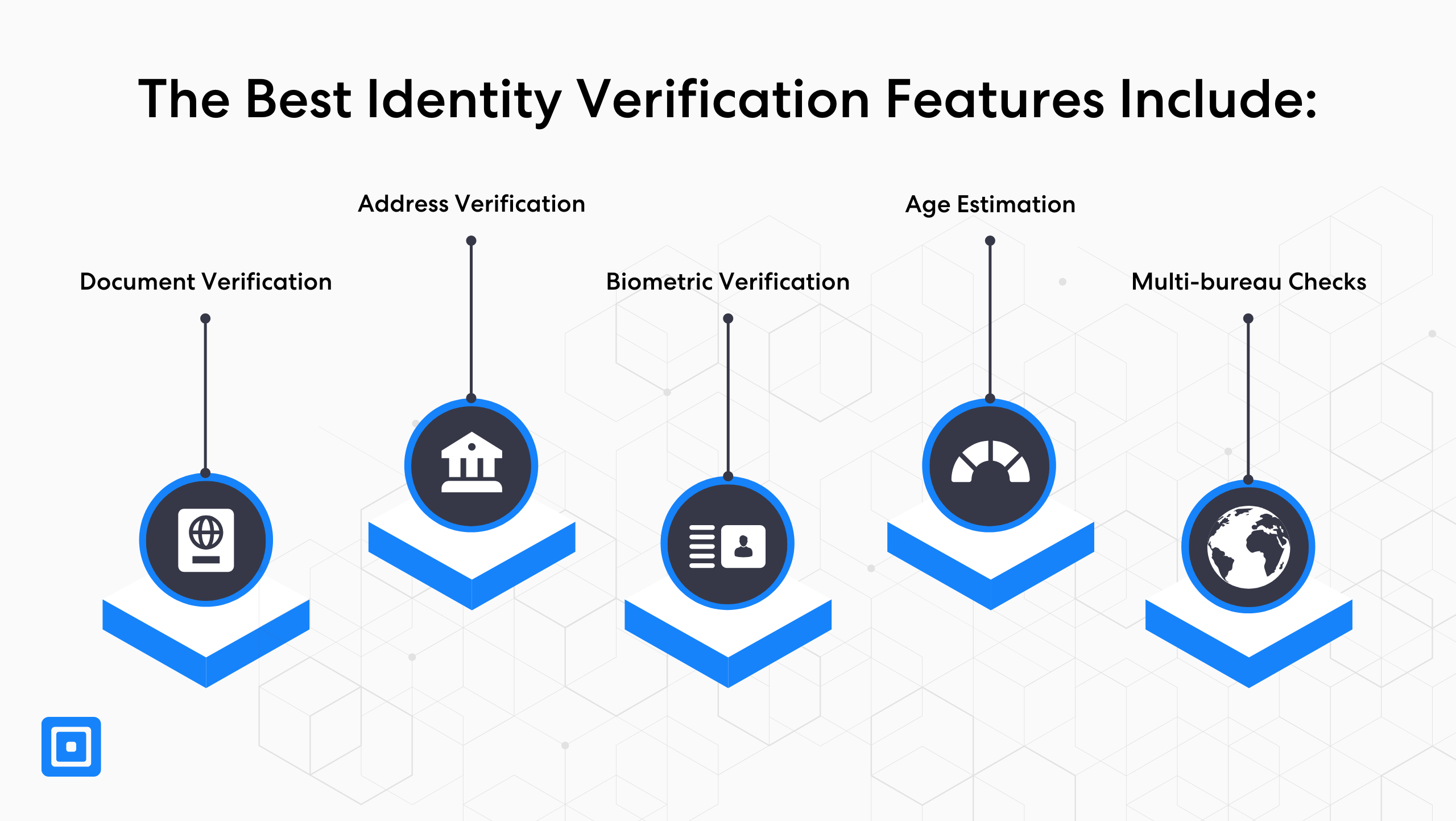

IDV involves scanning a document and confirming it matches an individual’s personal information. Modern IDV software includes advanced features and tools to make customer onboarding more accurate and efficient. The most popular IDV features that businesses seek include document verification, age estimation checks, and biometric authentication.

Selecting an IDV platform solely from factors such as its features and pricing might sound reasonable at first. However, this approach can lead to painful migrations later, especially if it does not align with current and future operational goals. Thus, organizations need to consistently evaluate the IDV software’s broader impact. Some important questions to raise include where budget is being allocated and how these expenditures enhance the verification process.

Per Verification and Per Transaction Methods

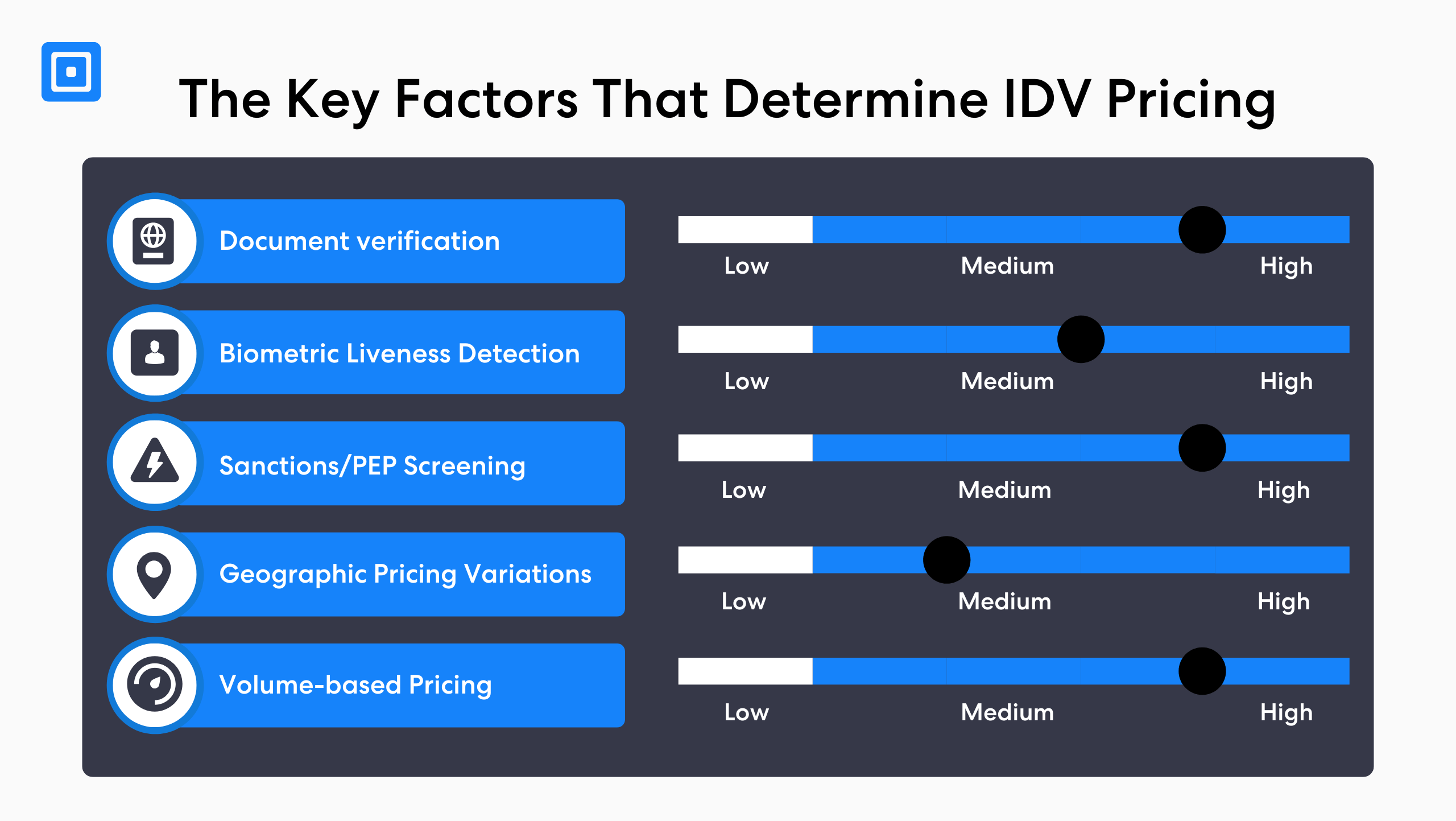

Per-transaction or per-verification services are typically limited and focus mainly on document verification, offering basic identity assurance coverage. To align with compliance objectives, selecting a solution with extensive verification, including biometric authentication and sanctions screening, is key. These advanced features and factors, such as geographic variations and liveness technology, can directly influence ID verification cost and effectiveness.

While solutions that are inexpensive may be appealing, it can be challenging as they may come with severe limitations. Although it may provide benefits for some of your needs, it might not address all of them. Instead, it is worth investing in a more robust IDV software that can effectively mitigate high risks.

How ComplyCube Goes Further in the Identity Verification Process

ComplyCube offers more than just the standard customer screening solution. The company leverages artificial intelligence and machine learning to provide a suite of IDV intelligence solutions. Additionally, by utilizing advanced technologies such as liveness detection and optical character recognition (OCR), ComplyCube empowers companies to achieve a high standard of identity assurance:

- Document Verification: Instantly authenticate over 13,000 documents, including passports and driver’s licenses, to prevent illegitimate accounts from accessing a business service.

- Address Verification: Verify an individual’s location by screening Proof of Address (POA) documents to reduce synthetic fraud.

- Biometric Verification: Leverage facial recognition and liveness detection technology to reduce the risk of identity theft and sophisticated deepfakes.

- Age Estimation: Accurately verify an individual’s age through a selfie to comply with age-related restrictions.

- Multi-bureau Checks: Cross-reference identity details against trusted government databases worldwide to improve risk assessment mechanisms.

While identity verification is critical, companies must consider robust Know Your Customer (KYC), Anti-Money Laundering (AML), Customer Due Diligence (CDD), and risk scoring mechanisms to achieve higher compliance coverage. Consider the following examples:

- Sanctions and Politically Exposed Persons (PEPs) screening: Screens individuals against global sanctions list to identify and prevent high-risk people from committing fraud.

- Adverse Media Checks: Scans organizations and individuals against high-quality news articles to avoid potentially associating with harmful entities.

- Ongoing Monitoring: Enables corporations to track changes in a customer’s risk profile in real-time, creating a proactive approach to fraud prevention.

- Risk Scoring: Quantifies risk according to a multiple number of data points, ensuring companies can quickly identify high-risk individuals and allocate compliance resources more efficiently.

A Look into ComplyCube’s Pricing Models

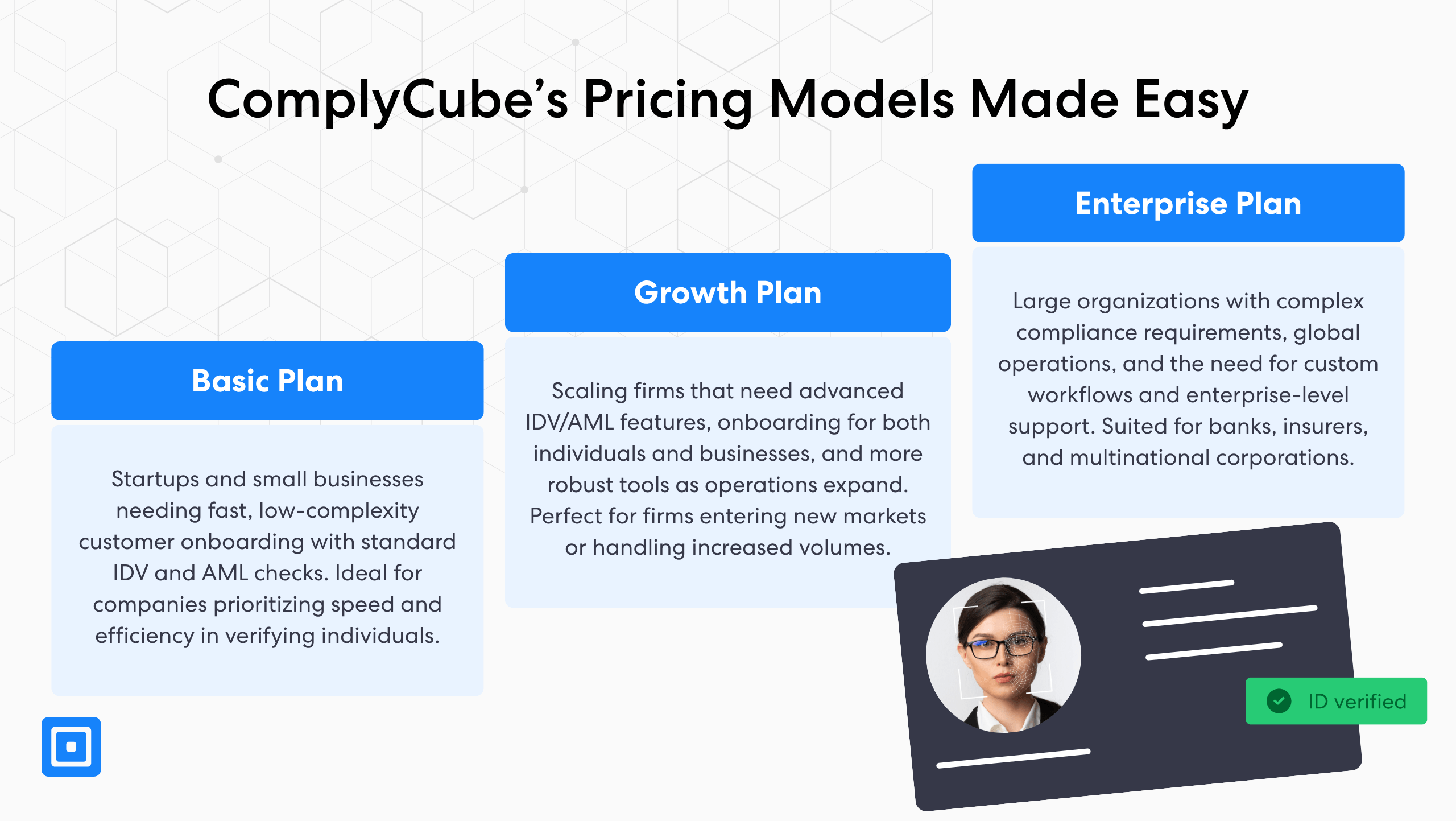

ComplyCube stands out as a leader in the RegTech space due to its developer-friendly and highly customizable solutions. Organizations can choose a pricing model that reflects their operational goals, industry, and risk appetite. Consider the three pricing plans available:

Basic Model

ComplyCube’s basic plan enables companies to reach rapid customer onboarding using standard KYC features. Organizations are given a monthly verification balance to meet their needs. The basic plan helps decrease risk and provides an efficient way to secure operations effectively. Clients can complete onboarding request in under 60 seconds, reducing drop-offs and time-to-verification. The basic plan is the ideal entry-level solution for low complexity onboarding flows in early-stage businesses. In this plan, users get:

- Identity verification for individuals

- Liveness and facial similarity check via photo selfie

- Global AML screening with continuous monitoring of individuals and businesses

Growth

The next pricing model is the growth package. The growth plan is ideal for companies that are scaling and need more advanced KYC and AML components. Managing different features can lead to a rampant increase in cost. The growth package enables businesses to scale without the costly need for multiple integrated tools from different vendors. This plan offers more robust features, such as sophisticated Know Your Business (KYB) workflows. It includes everything from the basic plan, as well as:

- Age estimation checks

- Onboarding of businesses

- RFID and NFC-based document verification

- Dedicated account manager and adoption manager

- Risk scoring and insights to improve decision-making

Enterprise

The enterprise model gives firms access to high-end, advanced technology in a simple-to-use, competitively priced package. With enterprise, users get market-leading compliance tools to manage varying types of verification methods across 230+ countries. Here is where the reality of what most of today’s banks and larger companies must do comes into play. It includes everything from the basic and growth plan, as well as:

- Advanced case management

- Global 2 + 2 multi-bureau checks

- Custom pricing structures to fit needs

- White-label solutions for seamless branding

- Custom multi-organization partitioning, access controls, and enterprise support

ComplyCube is a government-approved Identity Service Provider (IDSP) approved by the UK’s Digital Identity and Attributes Trust Framework (DIATF). The company offers a 14-day free trial, including up to 50 free verifications for businesses who want to activate an account. With a customer-driven approach at its core, ComplyCube is trusted by SMEs and larger enterprises worldwide, including Citibank, AXA, and Accenture. The features listed above are not exhaustive. For a full overview of ComplyCube’s solution, click here.

Modern AI-Based Solutions

Identity verification solutions today deliver speed and accuracy to achieve effective fraud prevention. Most of these solutions leverage generative AI, combined with machine learning technology, to enable data extraction and real-time analysis of identity documents and data. Modern IDV vendors are a smarter investment for businesses expecting efficient and secure transactions with high customization needs.

Unlock Free Trial with ComplyCube’s Advanced IDV

Identity verification solutions now offer flexible pricing, enabling clients to manage costs by selecting pay-per-verification. Additionally, leading IDV providers in the market typically offer free trial options in a sandbox environment, so firms can compare speed, data extraction, and customize workflows before committing.

Investing in a flexible, AI-powered IDV solution empowers corporations to verify customers securely, speed up onboarding, and maintain compliance at the same time. Sign up for a free trial to experience ComplyCube’s advanced identity verification firsthand.