TL;DR: Generative AI fraud is making synthetic identities, document fraud, and ID fraud easier to scale, while many businesses still rely on outdated identity verification checks. This guide explores how modern generative AI fraud detection, combining live document capture, biometric liveness, NFC, and device intelligence, helps prevent online fraud and keep identity attacks in check.

What is Generative AI?

Gen AI is a technology that can create new text, images, videos, and other content. It’s powered by advanced models trained on huge volumes of real-world data. From a few written or visual prompts, it can generate content that looks highly realistic. Fraudsters exploit this to produce convincing fake IDs and supporting documents at scale.

Generative models learn patterns in the data they’re fed and then generate new variations. This is often called data augmentation through machine learning. In a fraud context, it means endlessly tweaking documents and faces until something passes checks. As a result, AI-enabled fraud is faster, cheaper, and harder to spot with legacy controls.

What is Document Fraud?

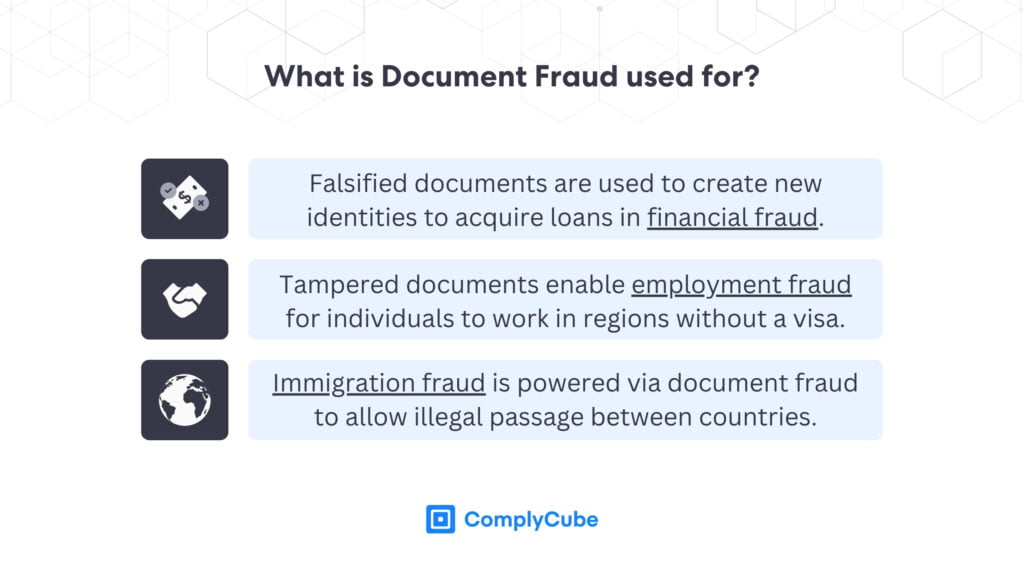

Document fraud is when someone uses falsified or tampered documents to pass themselves off as someone they’re not. The goal is to deceive a business, institution, or individual. These forged documents can support a wide range of illegal activities. They are widely used across the modern economy, from finance to employment and immigration.

- Financial fraud – using falsified documents (including financial information such as a credit report) to acquire a loan or for tax-related identity theft or credit card theft.

- Employment fraud – tampering with documents or VISA records or records to attain a job you are unqualified for or are not legally allowed to do.

- Immigration fraud – using false documents to gain immigration rights, cross borders, or claim certain benefits.

Victims of any type of fraud should file a report with the Federal Trade Commission (FTC). Reporting identity theft, impersonation scams, or document fraud helps authorities understand how widespread these crimes really are. This information allows the FTC to spot emerging patterns, target enforcement, and coordinate with other agencies. In turn, it supports stronger consumer protections, remedial action, and future legislation designed to reduce fraud.

Fraud can be conducted in many ways. We’ve all seen Catch Me If You Can, where a young Leonardo Di Caprio makes a fool out of a Tom Hanks detective. In the 1960s, it was far simpler to create counterfeit personal or financial information in the form of IDs, bank statements, or even bank checks.

In the era of digitalization, data scraping and basic photo editing tools already made it easier to create counterfeit documents. Fraudsters could copy logos, reuse stolen data, and adjust images just enough to fool basic checks. Now, with the rise of Gen AI, the barrier has dropped even further. Anyone can produce highly realistic fake IDs and supporting documents with just a few prompts.

What is Generative AI Fraud?

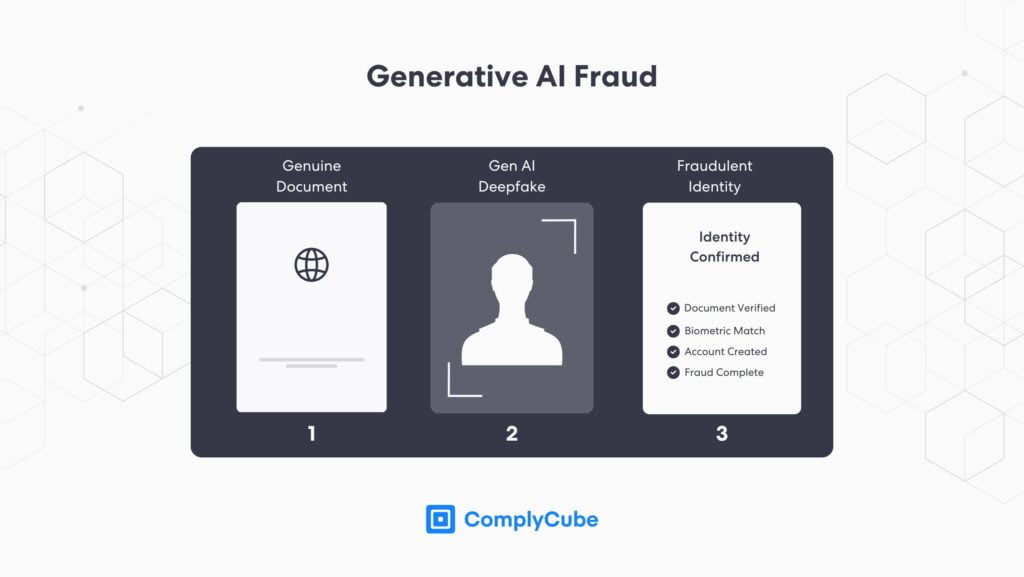

Generative AI fraud is the use if Gen AI tools to create counterfeit documents, images, or identities. The aim is to bypass security systems that rely on visual checks, template matching, or basic biometrics. Fraudsters generate or manipulate IDs, selfies, and supporting documents until something slips through. An example of the Gen AI fraud process can be seen in the illustration below:

As displayed above, Generative AI fraud can be used alongside identity theft for synthetic data generation to create what apear like genuine accounts. Leveraging fraudulently generated images, bad actors can create convincing new accounts with a different individual’s identification documents and bypass security systems used by Financial Institutions (FIs) across the world.

This Deloitte report suggests that the adoption of compliance technologies is giving criminals the advantage over firms when it comes to leveraging Gen AI to circumvent compliance security programs. If this development continues past 2024, the global financial system could be at risk of exceeding today’s volume of money laundering.

The solution to not only preventing this figure from rising but actively reducing it, is adopting compliance solutions that make use of the same advanced technologies that attempt to breach FIs. This is made clear through many national and international regulatory bodies, such as:

- The US Department of the Treasure (DoT)

- The Financial Conduct Authority (FCA).

- The Monetary Authority of Singapore (MAS).

- The Financial Action Task Force (FATF).

Case Study: Hong Kong: Deepfake “Selfies” Open Accounts at 30 Banks

Problem: Deepfakes Bypass KYC Across Hong Kong Banks

In April 2025, the Israeli Money Laundering and Terrorist Financing Prohibition Authority (IMPA) reported a case where a fraud network used deepfake technology to replace criminals’ faces with images taken from stolen IDs. Using these manipulated selfies, fraudsters successfully opened accounts at 30 different banks in Hong Kong, then used those accounts to launder over USD 1.2 million.

Solution: How ComplyCube Could Have Helped

ComplyCube’s stack could have added multiple lines of defence here: advanced liveness and presentation attack detection (PAD) to detect deepfake artefacts in selfie streams, document and selfie cross-checks with NFC chip data where available, and device intelligence to expose patterns such as the same devices, IP ranges, or emulators being reused across “different” customers and banks.

Outcomes: Likely Impact With ComplyCube in Place

With ComplyCube in the flow, many of those 30 applications would have raised a high-risk score due to repeated devices, abnormal onboarding, or inconsistencies between document, chip and selfie. That would have limited the number of accounts opened, reduced the total amount laundered, and generated richer signals for suspicious activity reports (SARs), helping both the banks and local FIUs intervene earlier.

Generative AI Fraud Detection

Detecting Gen AI fraud requires advanced machine learning to leverage similar data sets that are used to create fraudulent documents and images. When verification systems utilize the same – or similar – data sets, they can identify the patterns that Generative AI fraud technologies would create to bypass traditional methods. These tools significantly increase a firm’s fraud detection capabilities.

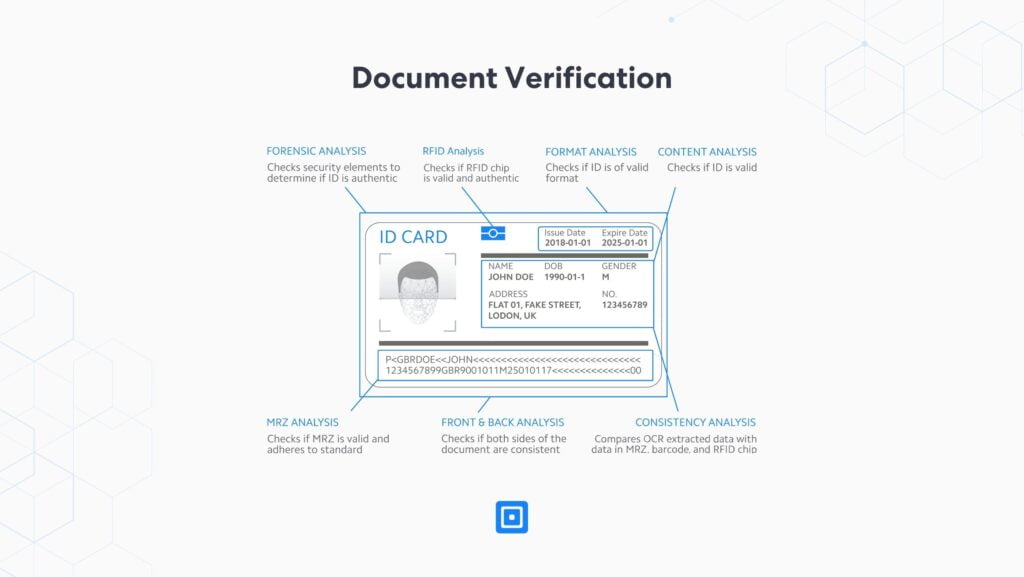

Document Verification

For the most reliable results, document verification processes must be conducted live and during the client acquisition process. Document liveness ensures that the uploaded image will not have been tampered with, as it must have come from a user’s smartphone camera to be completed. The process then examines all available data spots from the ID.

- Visual Inspection Zone (VIZ)

- Machine Readable Zone (MRZ)

- RFID chip

- Barcodes

Near-Field Communication (NFC) verification takes this process even further by reading an embedded chip inside the document that provides an immutable data transfer. NFC verification captures the stock image of a document in far greater quality than an image upload ever could, permitting greater biometric matching and assurance of unadulterated documents. For more information, read What is NFC ID Verification?

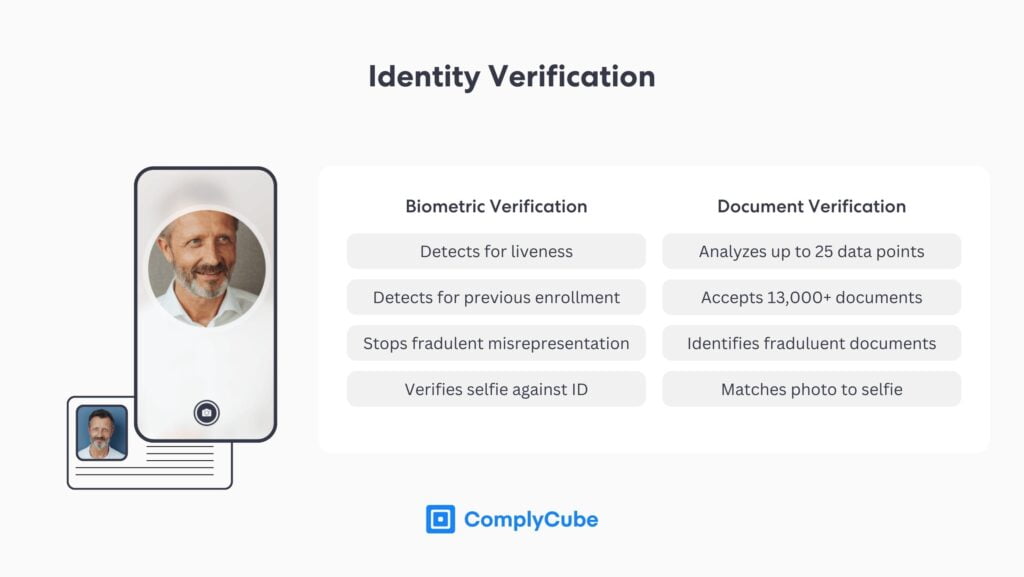

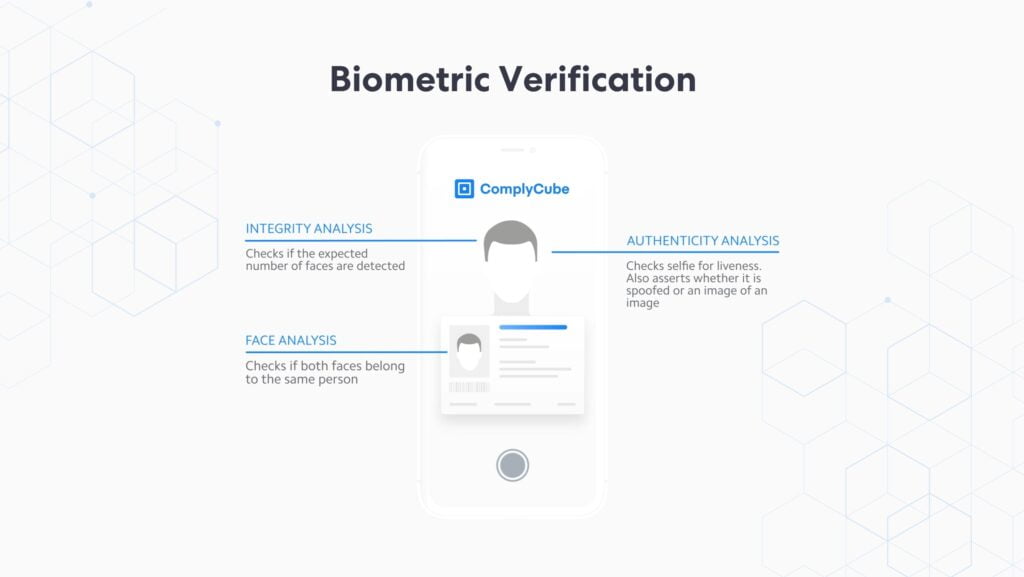

Biometric Verification

Biometric verification, or selfie verification, is used to add a secondary layer of identity assurance for businesses. Following the data capture and verification from the document, biometric verification is used to match for similarities between the stock image in the ID, and the facial biometrics in the selfie.

Again, liveness is crucial, as it ensures that the image has not been edited with or generated by AI. PAD verification builds digital 3D structures around the face to analyze skin tones and micro-expressions, check for masks, and detect pixel alteration. For more information, read Liveness Detection: Best Practices for Anti-Spoofing Security.

ComplyCube’s selfie verification engine can also be used as an age estimation solution. It provides accurate yet frictionless security for age-gated goods while preventing fraudulent individuals from gaining access.

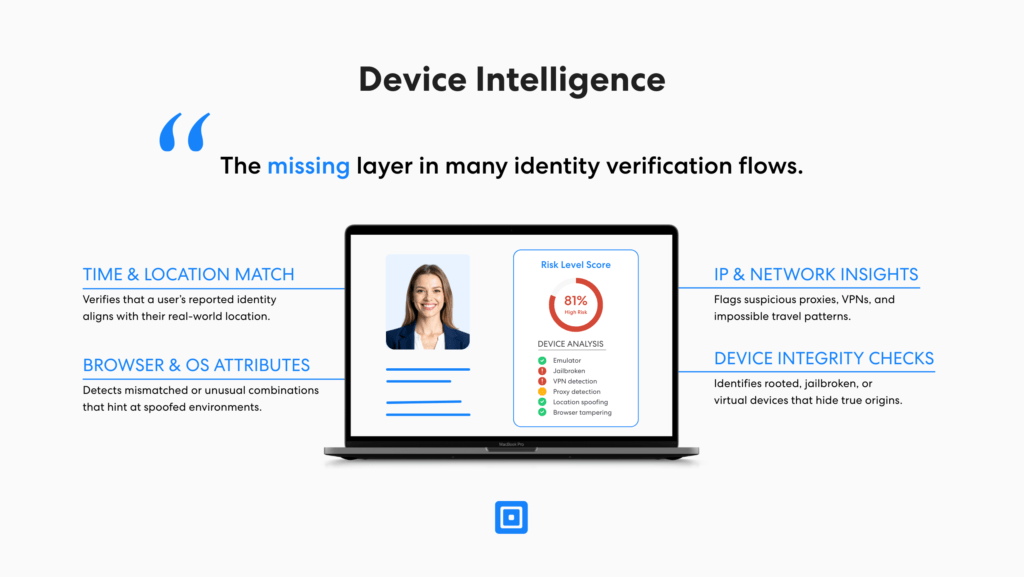

Device Intelligence

Even with strong document and biometric checks, some synthetic identities still slip through, especially when they’re orchestrated by well-coordinated fraud networks. This is where device intelligence becomes the missing layer in many IDV flows, adding context about how a user is accessing your platform, not just who they claim to be.

Device intelligence looks at signals from the user’s device and network: the hardware and operating system, browser attributes, IP address, and whether the time zone and geolocation make sense for the claimed identity. It also detects riskier setups such as emulators, virtual machines, or rooted/jailbroken devices, and spots automated behaviour like scripted form fills or unnaturally fast, repetitive interactions.

When these signals are correlated across sessions and accounts, businesses can start to see fraud rings rather than isolated incidents. High-risk onboarding attempts can be flagged before completion, and step-up checks can be applied only when the device risk is elevated. In combination with Gen AI fraud detection and advanced IDV, device intelligence turns identity verification from a static document check into a dynamic, risk-based assessment of the person, their device, and their behaviour over time.

Key Takeaways

- Gen AI lowers the barrier to document fraud: Anyone can generate realistic IDs and supporting documents, making fraud more scalable.

- Document-only checks are no longer enough: Visual inspection, MRZ, and even basic liveness can be fooled by sophisticated attackers.

- Biometrics need strong liveness (PAD): 3D face maps, micro-expression analysis, and pixel-level checks are vital to stop deepfakes and replay attacks.

- Device intelligence is a crucial “third signal”: Device fingerprinting, reputation, and behavioral patterns help link seemingly separate applications and highlight fraud rings.

- Use device re-authentication when users log back in to confirm it’s the original device (and not a new device in a remote location), reducing the risk of account takeover.

Is Your Platform Protected from Generative AI Fraud?

Generative AI has fundamentally changed document fraud. It’s no longer enough to check a single ID and selfie at onboarding and hope for the best. As this article has shown, modern attacks blend AI-generated documents, deepfakes, synthetic identities, and coordinated device use to slip past legacy controls and then exploit your platform through credit card fraud, mule activity, and complex money flows.

To keep pace, businesses need layered, continuously adaptive defenses. That means combining live document checks, NFC reads, biometric liveness, device intelligence, and machine-learning anomaly detection to monitor behavior across many channels over time. When these signals work together, fraud rings become visible, false positives fall, and genuine customers move through your flows with far less friction.

If you’re rethinking your fraud strategy in light of Gen AI, our team at ComplyCube can help you design and implement a verification stack that matches your risk profile, products, and markets. Get in touch with our team to explore how ComplyCube can help protect your platform from Generative AI-driven document fraud.