LONDON, AUG 7, 2023 — ComplyCube, the global KYC and IDV platform, has fortified its Document Authentication services to tackle “screen replay attacks” where liveness is used. This is an example of identity theft in which fraudsters present ID documents displayed on monitors, smartphones, or tablets screens to gain access to products and services illegally.

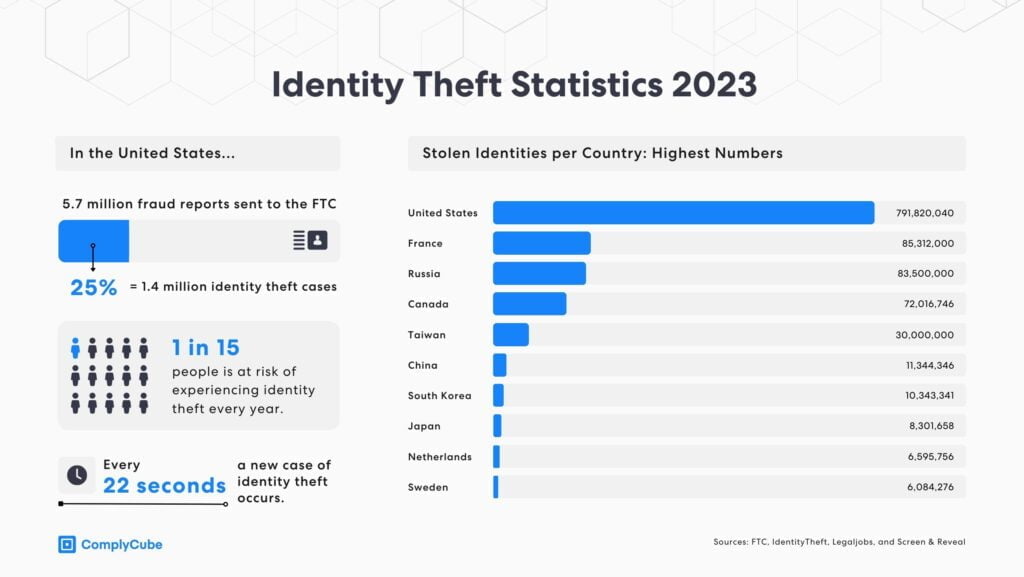

This announcement about document authentication services comes amidst an increase in identity fraud incidents. In the US, there is a new identity theft incident every 22 seconds. Similarly, approximately 70% of UK cases submitted to the National Fraud Database (NFD). In fact, most of these cases are due to identity fraud. These shocking numbers show the immediate need to bolster ID verification systems. It is the next step in combating the extraordinary escalation in identity fraud cases.

In the US, there is a new identity theft incident every 22 seconds.

Leveraging cutting-edge Presentation Attack Detection (PAD)

ComplyCube presents passive (still photo) and active (action-based) biometric checks. For this reason, it allows more flexible verification. As a result, businesses can recognize real customers and deter bad actors. In addition, it uses Presentation Attack Detection (PAD) technology. In other words, this software uses 3D face maps and other proprietary techniques. For example, it looks at screen-photo fraud, printed photo attacks, video-replay attacks, and 3D mask attacks.

“For years, we’ve been studying, building, and launching AI models to detect customers correctly. This established us as a leading liveness detection service provider. Today, the largest organizations in the world heavily rely on us.“, says Harry Varatharasan, Chief Data Scientist of ComplyCube. “Now, we extend our proven technology to detect liveness on ID documents. We boast an identity assurance level our award-winning platform already provides.”

New Standards in Liveness Detection in Document Authentication Services

Presently, the AI company says that Document Liveness Detection now powers the Document Checking Service. As such, it is open to all users across different channels, including SDKs, no-code solutions, and its outreach platform. Now, users can ensure the document is present and held by their rightful owner.

Based on trial runs with select businesses, it has proven to thwart over 80% of fraudulent attempts.

“Spoofed documents are often spotted later on in the customer lifecycle. It can hurt a business’s reputation, lead to fines, and complicate their internal processes”, added Mohamed Alsalehi, Chief Technology Officer at ComplyCube. “Some solutions offer liveness detection, but they fall short when it comes to ID documents. We’re confident that our latest solution will set the bar.”

ComplyCube blends thousands of data points, a Machine Learning (ML) stack, and expert human reviewers to create a new AML and KYC compliance standard. So, its globally compliant products include Biometric Verification, Document Authentication, Address Verification, AML Screening, and Multi-Bureau Checks.

About ComplyCube

ComplyCube is a market-leading SaaS platform for Identity Verification (IDV), Anti-Money Laundering (AML) & Know Your Customer (KYC) compliance with customers across financial services, transport, healthcare, e-commerce, cryptocurrency, FinTech, telecoms, and more.

ComplyCube’s ISO-certified and award-winning platform boasts the fastest omnichannel integration turnaround in the market with Low/No-Code solutions, API, Mobile SDKs, Client Libraries, and CRM Integrations.