Mastering the Know Your Customer Process

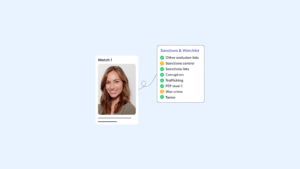

A strong Know Your Customer Process is vital, especially in the digital age where money laundering and financial crimes are rife. But what exactly is KYC, and how can firms remain ahead of regulations while meeting customer needs?...