Regulatory bodies worldwide continuously update Anti-Money Laundering (AML) regulations as organised crime and terrorist financing become more sophisticated. In the UK, various legislation authorities enforce new requirements that align with international standards to reduce the potential for money laundering risks within the country. As a result, UK businesses must adapt and rethink their approach to anti-money laundering regulations. This guide outlines the essentials of AML compliance UK and offers actionable steps for crafting an effective anti money laundering policy template UK.

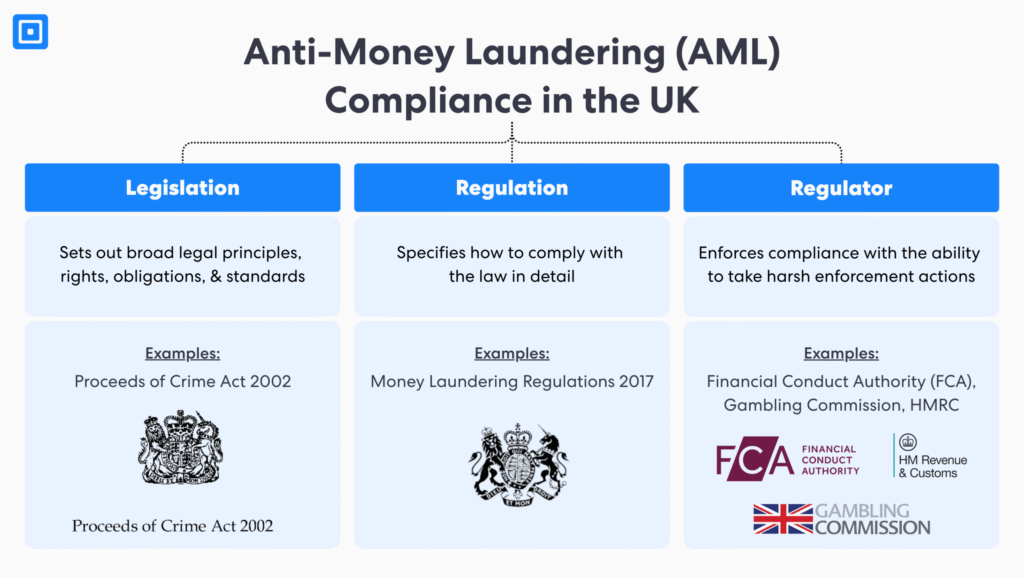

Legislation vs Regulations vs Regulators for AML Compliance UK

While the terms may sound interchangeable, legislation, regulators, and regulations are separate concepts. Knowing the difference is vital so businesses know where to find the right resources and guidance on anti-money laundering compliance.

Legislation

- Definition: Defined as the laws passed by Parliament (in this context, the UK Parliament)

- Purpose: Outlines the legal principles, rights, and obligations of businesses and individuals

- Key Examples in the UK: Proceeds of Crime Act 2002 (POCA), Sanctions and Anti-Money Laundering Act 2018 (SAMLA 2018), Terrorism Act 2000

Regulation

- Definition: Defined as the specific rules made under the authority of legislation.

- Purpose: Explains how the rules stated in legislation must be followed in practice for compliance.

- Key Examples in the UK: Money Laundering Regulations 2017 (MLR 2017)

Regulators

- Definition: Defined as the specific authority figure or entity responsible for enforcing compliance with legislation and regulations based on a specific sector.

- Purpose: Monitors, oversees, and penalises non-compliance

- Key Examples in the UK: Financial Conduct Authority (FCA), HM Revenue & Customs (HMRC), Gambling Commission.

To summarise, legislation sets out the legal framework, regulations provide the detailed requirements for compliance, and regulators ensure that businesses follow these rules.

What is The Anti-Money Laundering Act UK?

Despite many repetitive searches about the AML Act in the UK, this specific, standalone law does not exist. Instead, the UK’s anti-money laundering framework is built upon several pieces of legislation that coordinate and work together:

Proceeds of Crime Act 2002 (POCA 2002)

The POCA criminalizes money laundering offences that occurred on or after 24 February 2003. It strictly defines the scope of money laundering crimes and outlines the legal framework for confiscating assets and criminal proceeds. Under the POCA, individuals and businesses, not just financial institutions, must report Suspicious Activity Reports (SARs), with a failure to do so leading to almost 14 years of jail time and fines.

Sanctions and AML Act 2018 (SAMLA 2018)

The SAMLA grants the UK government more power post-Brexit to implement and execute sanctions independently. It keeps pace with the international standards from the Financial Action Task Force (FATF). The SAMLA aims to support the wider UK AML effort by restricting relationships and transactions with high-risk countries and customers, such as Politically Exposed Persons (PEPs), through sanctions.

Terrorism Act 2000 (as amended)

The Terrorism Act 2000 explicitly prevents and criminalizes terrorist financing. The main difference between the Terrorism Act 2000 and the POCA is its focus on the usage, facilitation, and concealment of monetary funds for the purpose of terrorism acts. This legislation plays a critical role in the UK’s financial system and overall AML and Counter Terrorist Financing (CTF) measures.

The Role of the Financial Conduct Authority (FCA) and National Economic Crime Centre (NECC)

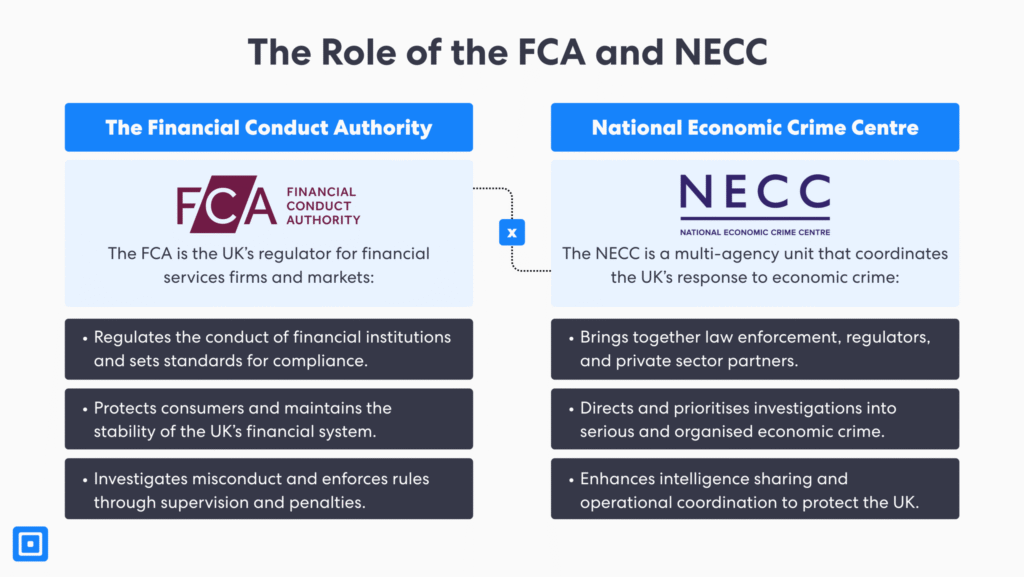

Two prominent bodies, the Financial Conduct Authority (FCA) and the National Economic Crime Centre (NECC), work together to solidify the UK’s defences against economic crime, potential money laundering, and organised crime.

While the FCA and NECC have distinct purposes, the outcome remains to stabilize and protect the UK’s financial system.

- Financial Conduct Authority (FCA): The FCA is the financial services industry regulator in the United Kingdom. Its purpose is to maintain the UK’s financial system by protecting consumers and establishing market integrity. The FCA operates independently of the UK government and has the authority to punish any acts of financial crime, including money laundering.

- National Economic Crime Centre (NECC): The NECC is a multi-agency UK law enforcement unit housed within the National Crime Agency (NCA). It plays a critical role in collaborating and enhancing the efforts of various agencies, government departments, and regulatory bodies in the UK. The NECC provides operational coordination in responding to economic crime, which includes money laundering.

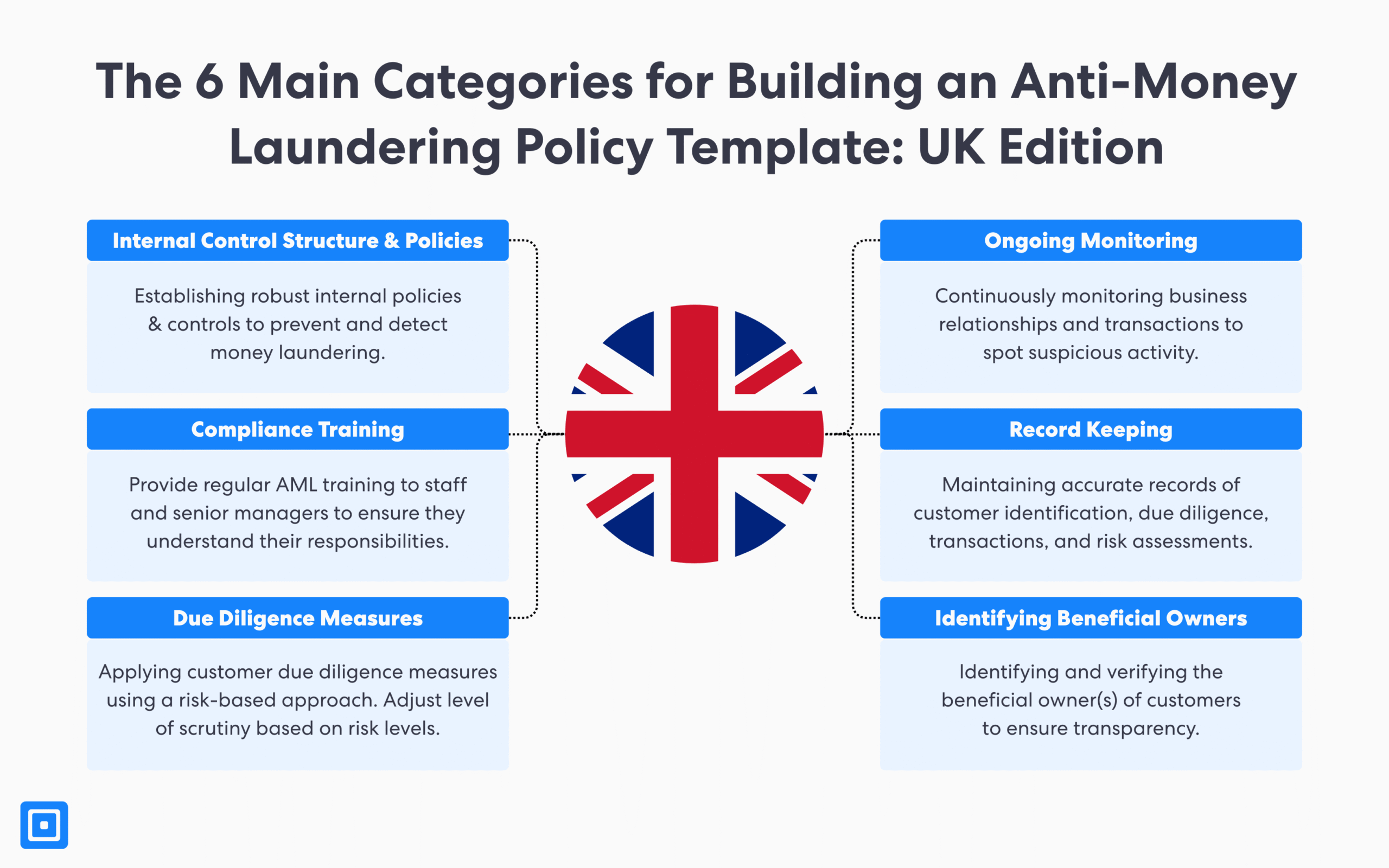

Creating an Effective Anti-Money Laundering Policy Template UK Edition

To build a foolproof AML process, UK businesses should follow the steps listed by the Financial Action Task Force (FATF). The FATF outlines the international standards for compliance with anti-money laundering regulations.

For more specific local AML regulations in the UK, businesses can adopt the measures stated in the Money Laundering, Terrorist Financing and Transfer of Funds (Information on the Payer) Regulations 2017 (MLR 2017).

The MLR 2017 regulation incorporates FATF recommendations into UK law. It sets out the specific requirements that businesses in the financial sector or regulated industries must follow to achieve full AML compliance:

Implement Internal Control Structure and Policies

Businesses in the UK, under the MLR 2017, must maintain a documented, internal report covering its policies, which is in proportion with their size, nature, and risk profile. Internal control structures must be clearly defined, defining each individual’s roles and responsibilities in the risk management team. If necessary, firms need to employ an independent audit function in order to manage the effectiveness of its anti-money laundering framework over time.

Regular Staff Training

Next, team members must be continuously trained on money laundering or terrorist financing risk. The training must cover how to identify and report suspicious business relationships and activities, and who to contact if a red flag or high-risk situation is detected. To be prepared, senior management must keep documentation of the training provided, including the dates and content covered.

Integrating a Risk-Based Approach

UK businesses are encouraged to fully adopt a risk-based approach as part of their efforts to combat money laundering or terrorist financing. A risk-based approach enables businesses to conduct the necessary due diligence measures based on the level of risk detected:

- Customer Due Diligence Measures (CDD): CDD is the standard due diligence applied to verify the identity of customers and beneficial owners before starting a business relationship or conducting occasional transactions. Whenever there is a change in ownership and control structure, CDD must be updated.

- Enhanced Due Diligence Measures (EDD): EDD is applied to higher-risk situations, such as dealing with Politically Exposed Persons (PEPs), their family members, customers from high-risk third countries, or complex and large transactions. Firms must obtain additional information and increase monitoring efforts.

- Simplified Due Diligence Measures (SDD): SDD is the basic due diligence applied to new and existing customers where the risk of money laundering or terrorist financing is low. SDD might be applied to certain regulated sectors, financial institutions, or customers from low-risk countries.

Ongoing Monitoring

Ongoing monitoring is a requirement for regulated businesses in the UK’s financial system. It refers to continuously checking customer transactions and their intended nature throughout the business relationship to identify potential suspicious activities that may indicate money laundering. Companies must tighten monitoring efforts under certain circumstances, including a change in ownership and control structure or when higher risk emerges.

Record Keeping

Record keeping involves gathering robust, documented record trails of customer due diligence, enhanced due diligence measures, ongoing monitoring, and risk assessments. Financial institutions are required to keep a clear auditing compliance trail for UK law enforcement. This supports the UK’s response in the relevant supervisory authorities completing investigations and confiscating criminal assets in illicit finance or money laundering cases.

Beneficial Ownership

A beneficial owner has ownership or control over an entity, such as a company, a trust, or a partner organization. Businesses in regulated sectors must accurately identify and update the company ownership with which they are in a business relationship. Identifying beneficial owners is a critical step in customer due diligence measures and supports the National Crime Agency’s efforts in detecting money laundering, illicit finance, and disrupting organised crime networks.

Compliance with Anti-Money Laundering Regulations in the UK

Under the MLR 2017, all financial institutions and businesses in the regulated sector are legally obligated to implement due diligence measures, conduct thorough risk assessments to identify high-risk customers and activities, and submit robust suspicious activity reports. Additionally, effective ongoing monitoring helps financial institutions, tax advisers, and legal professionals identify and report illicit finance, eliminating the hostile environment required for fraud to flourish.

As the UK decided to strengthen its anti-money laundering regulations framework, continuous monitoring and proactive reporting are now crucial to protecting the UK’s financial system integrity. Speak to a member of the team today.