TL;DR: eID verification, also known as electronic identification, is reshaping digital ID verification in the fintech space. In today’s complex fintech landscape, firms must meet strict digital verification and AML programs. This guide explores what is digital identity verification for fintechs and how to implement it for faster onboarding and regulatory trust.

What is Digital Identity Verification in the Context of eID?

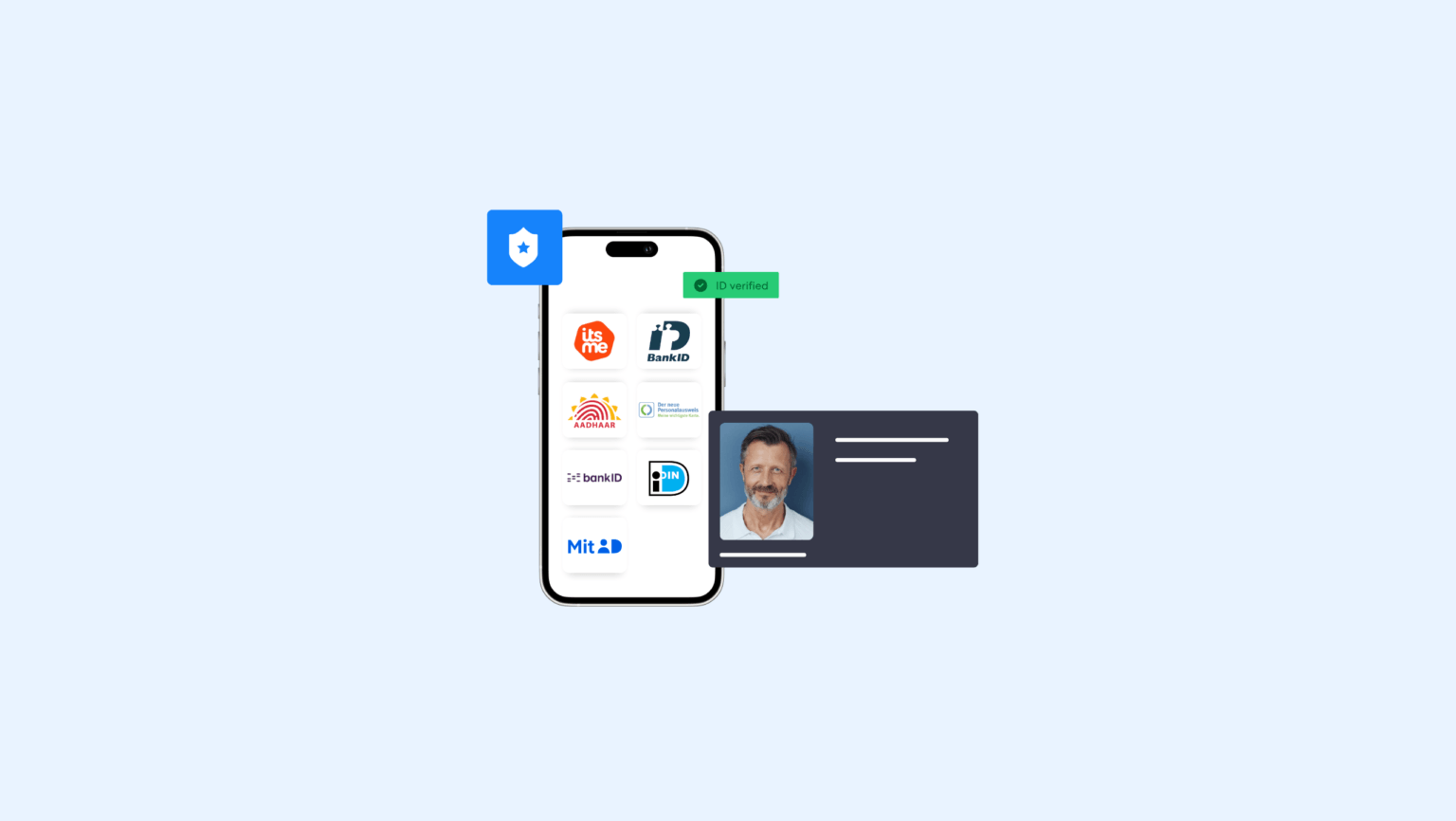

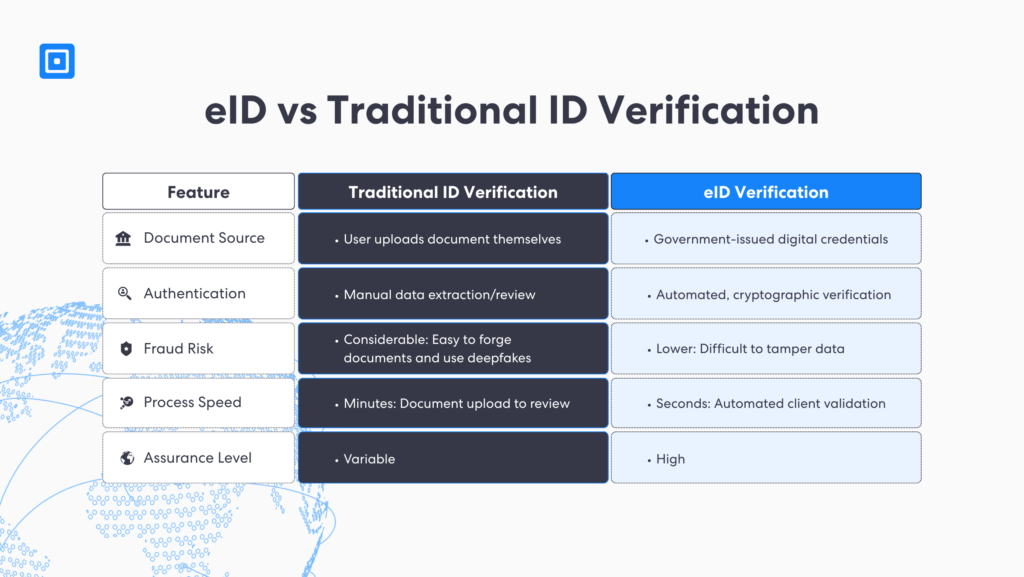

eID in regulatory compliance is a digital credential provided by an authoritative body, such as a government or national registry. It provides a secure and portable method for verifying a person’s identity in digital transactions. Electronic identification moves away from traditional methods such as physical document verification of passports and driver’s licenses. Instead, eID is cryptographically signed, enabling real-time identity verification against government-certified registries.

eID reduces administrative burden, in terms of time, expenses, and effort, a necessity for many in an increasingly globalised world.

eIDs have been growing in adoption, mainly due to its built-in authenticity and security measures. Regulated organizations, such as those providing financial services, utilize eID to comply with regulatory requirements and enhance operational efficiency. Unlike manual verification, it enables rapid account creation and access to online services.

Digital Verification Methods

Online identity verification matters because it offers a reliable foundation for trust in online transactions. According to CIFAS, over 118,000 fraud cases were reported to the National Fraud Database. As such, comprehensive identity verification processes serve as a cornerstone against identity theft and fraud.

Digital identity verification works through a combination of advanced technologies and data sources to verify identities in real-time. It utilizes artificial intelligence and machine learning to enhance the security and accuracy of document verification, biometric verification, and proof of address checks. Digital ID verification is the process that includes key components:

- Document Verification: Scans documents, such as driver’s licenses, passports, and national IDs. The collected data is then scanned for forgery and verified against authoritative databases for authenticity.

- Biometric Verification: Confirms that a user is present during transactions. Biometric data is used to verify that a person submitting their information is genuine. Liveness detection and selfie verification enhance the process in real-time.

- Digital Fingerprinting: Organizations can monitor attempts to use synthetic identities or stolen credentials by scanning browser fingerprint. Suspicious activities on mobile devices can be flagged to prevent identity theft.

- Device Intelligence: Utilizes network signals and IP addresses during online activities, such as digital banking, to flag suspicious transaction patterns. A user’s login behavior, either on a new or the same device, can be analyzed.

- Email and Phone Checks: Analyzes number and email indicators, including carrier types and email domains, to flag misuse. Additional security measures, such as two-factor authentication, further validate genuine users.

Identity Verification (IDV) forms a crucial aspect of Customer Identification Programs (CIP), mandated by international regulations. Unlike manual identity verification, digital ID verification supports a quicker onboarding process. While digital IDV is beneficial, eID provides a fast-track, government-backed method for fintechs. You can learn more here: Customer Identification Program: What Is CIP?

Regulatory Alignment and Assurance Levels with eID

Online identity verification via eIDs supports compliance with regulatory requirements. In the EU, the eIDAS 2.0 regulations use national eID schemes, including MitID and BankID, to detect fraud and prevent fraudulent transactions. Additionally, the UK’s Digital Identity and Attributes Trust Framework (DIATF) and Sixth Anti-Money Laundering Directive (AMLD6) establish standards for Know Your Customer (KYC) and Anti-Money Laundering (AML) programs. Secure eID-based identity verification puts these standards into operation.

These frameworks categorize levels of assurance (LoA) as low, substantial, and high, defining the strength of identity verification methods required to prove a user’s identity. For example, for fintechs operating in the EU, high LoA is needed for high-risk transactions, including large payments or account creation. Fintechs that integrate eID into their workflows demonstrate compliance and can scale across jurisdictions more efficiently, boosting global growth.

Speed, Efficiency, and Customer Trust

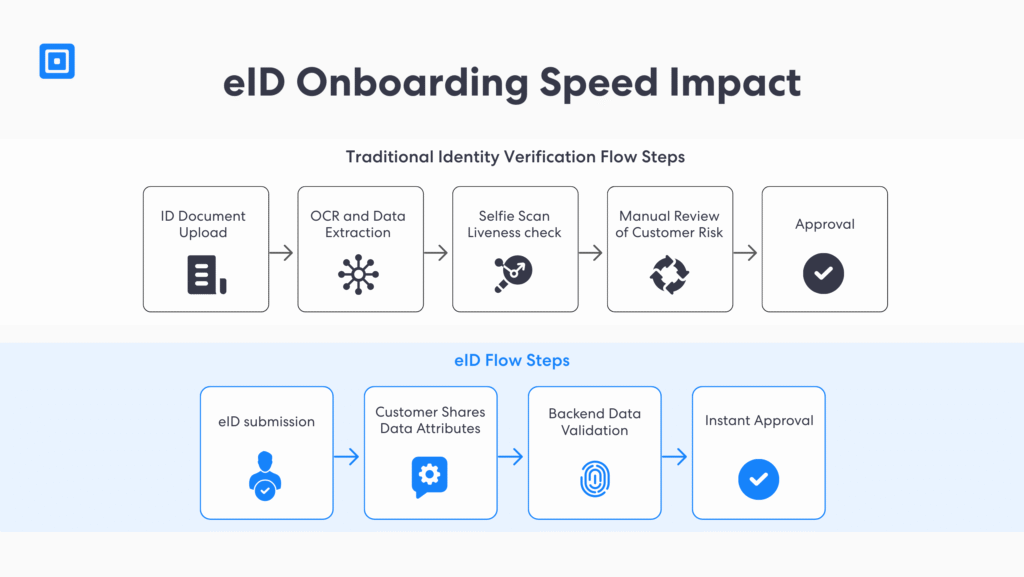

The benefits of digital identity verification cannot be overlooked. However, eID can replace traditional identity verification checks, validating an individual’s identity in a single step within a workflow. A standard workflow for financial institutions performing IDV includes a selfie check, digital document verification, and proof of address. From a customer’s point of view, they would need to search for and upload the right identity documents. This might seem invasive, introduce friction, and impact customer experience.

eID schemes bypass a lengthy and time-consuming process to gather personal details. Customers can provide their identity data consensually, and t trusted sources on the backend in seconds. For fast-paced fintechs, eID proves to be a strong method for rapidly analyzing customer identities, thereby enhancing time-to-revenue. Customer loyalty increases as users can open a bank account or access services with enhanced security measures and speed.

Strengthening Fraud Prevention with eID

Electronic identification plays a broader role in Anti-Money Laundering (AML) and risk management frameworks. eIDs are significantly harder to forge or tamper with as they contain electronically signed attributes, preventing identity theft, fraud, and money laundering. In addition, businesses can layered with other checks under international standards, such as the Financial Action Task Force recommendations.

The FATF calls upon all countries to implement effective measures to bring their national systems for combating money laundering and terrorist financing.

According to the FATF, digital businesses must adopt adequate Customer Due Diligence (CDD), which includes online identity verification with document and biometric verification. Additionally, continuous monitoring, Politically Exposed Persons (PEPs), and watchlist screening produce a stronger customer risk profile, mitigating ML and terrorist financing (TF) risks more effectively.

Fintechs and digital financial services have unique vulnerabilities in the sector, making eID service critical. Fintechs rely on remote customer relationships and quick transactions, which bad actors can easily leverage to commit illicit activity. According to UK Finance, at the beginning of 2025, losses from online unauthorised transactions reached £372 million.

Unauthorised transactions across payment cards, remote banking, and cheques amounted to £372 million in the first half of 2025.

eID solutions address these challenges by providing enhanced security, accuracy, and a government-backed method for onboarding users. Fintechs can achieve reduced false positives, lower costs, and stronger fraud prevention. Additionally, EU customers are much more likely to validate their Personally Identifiable Information (PII), such as date of birth and full name, with eID due to its ease of use and familiarity. For fintechs, this means faster onboarding while meeting compliance regulations

Key Takeaways

Manual identity verification introduces bottlenecks, including human error, dependence on coding knowledge, and a slower onboarding process.

Digital identity verification, which includes facial recognition features and document checks, can be completed remotely, thereby reducing friction and enhancing the customer experience.

Electronic identification offers a government-backed method. It verifies identities in a single step, enabling fintechs to boost conversions and meet compliance more efficiently.

Leading fintechs utilize eID services from a single provider to eliminate cross-border compliance complexity, reduce costs, and enhance interoperability.

All-in-one RegTech vendors offer tailored and layered verification, including sanctions screening and ongoing monitoring, to meet global AML requirements.

Selecting the Right eID Provider for eIDAS 2.0 Compliance

For compliance with eIDAS 2.0, a partner that provides various LoA and can support the European Digital Wallet (EUDI) is key. A typical eID verification process consists of three steps: a customer chooses an eID scheme, shares the required data attributes, and trusted sources validate this on the backend. You can learn more here: A Digital Europe: Introducing the EUDI Wallet.

Verifying digital identities through a compliance partner that offers multiple eID schemes supports fintechs in scaling and building trust globally. Additionally, with an all-in-one software, companies benefit from robust user behavior analytics to identify fraud more effectively. The factors influencing eID solutions include:

- Security and Data: Select a provider that demonstrates strong alignment with global privacy and data protection laws, including the US NIST, EU GDPR, and ISO 27001 certifications.

- Multi-Scheme Support: Instead of relying on third-party vendors, choose an eID provider that supports scalability across multiple national eID schemes to reduce complexity and cost.

- All-in-One Platform: For fintechs that require robust KYC and AML programs, choosing a unified platform that offers eID, sanctions screening, and ongoing monitoring streamlines compliance.

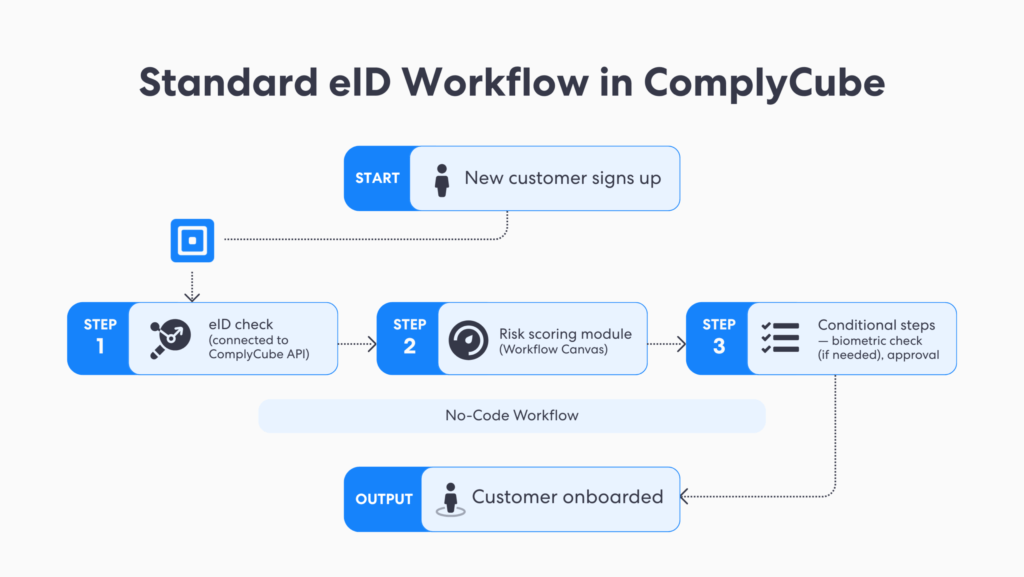

- No-Code Workflows: No/low-code workflows benefit fintechs that require additional checks, such as adverse media screening, without relying on manual processes or IT resources.

- Multilingual Aid: Global firms must choose eID from a provider that offers multilingual support features to cater to a diverse customer base, enhancing the customer experience.

- International Compliance: To meet cross-border compliance, pick a vendor that aligns with global AML requirements, such as the EU AML Directive, and those with configurable LoA.

Implement Multi-Scheme eID Services

Countries such as Norway, India, the Netherlands, and Finland have an adoption rate of eID exceeding 90%. With ComplyCube’s no/low-code tailored workflows, fintechs can scale their business with multiple eID schemes. Get ahead and speak to a member of the team to learn more about ComplyCube’s eID service today.

Frequently Asked Questions

What is electronic identification (eID)?

eID is a secure way for businesses to validate a person’s identity online. It contains digital data attributes that are government-backed. Companies benefit from eID because it reduces customer friction and streamlines cross-border compliance.

Why are fintechs choosing electronic identification over digital ID verification?

Fintechs utilize eID verification because it provides a simpler and secure method for customer onboarding. Unlike digital ID verification, which requires document submission or selfie verification, eID checks occur in a single step. eID schemes are also recognized by global frameworks such as eIDAS, enabling fintechs to meet stringent KYC requirements.

How does eID support Know Your Customer and Anti-Money Laundering requirements?

Electronic identification (eID) supports KYC and AML as it offers a secure and accurate way to validate that a customer is who they claim to be. It provides a remote method to verify that a user is legitimate, thereby reducing the risk of identity fraud and money laundering.

How to choose the right eID solution for your business?

The right eID service allows an organization to scale simply and securely. To select the right eID partner, companies should assess their alignment with global privacy data laws and KYC/AML requirements, including the EU GDPR and FATF recommendations. Additionally, a provider that supports multiple eID scheme integration and multilingual support boosts global growth seamlessly.

How can fintechs leverage ComplyCube’s no-code workflows for eID?

ComplyCube offers no-code workflows for businesses to perform identity checks without coding knowledge. With its drag-and-drop interface, fintechs can build workflows tailored to various use cases and layer additional checks for robust compliance, including sanctions and PEP screening, on a single platform. It supports all eID scheme types, including India’s Aadhaar, Norway and Sweden BankID, and Denmark’s MitID.