TL;DR: eKYC (electronic Know Your Customer) modernises onboarding by replacing manual checks with secure, automated identity verification. It helps organisations roll out digital KYC faster, reduce fraud risk, and stay compliant while improving the customer experience.

What does eKYC mean?

Secure online transactions are now central to trust in an increasingly digital economy. As a result, making robust online identity verification is absolutely essential. eKYC, meaning electronic Know Your Customer, is a digital KYC process that verifies a customer’s identity remotely using electronic checks and evidence, rather than relying on in-person or paper-based methods.

At its core, eKYC addresses modern identity authentication challenges by streamlining how organisations confirm who a customer is. By using proper verification steps, electronic know your customer helps firms meet digital KYC compliance rules while strengthening defences against financial crime, including money laundering.

Why is eKYC Important?

eKYC plays a critical role in today’s digital landscape. This is where secure and efficient customer onboarding is a business imperative. With fraud on the rise and regulations growing more stringent across regions, businesses can no longer afford to rely on outdated methods. As a result, eKYC enables businesses to:

- Mitigating Security Risks: The digital space, while convenient, is rife with threats such as identity theft and cyber fraud. eKYC acts as the frontline defense against these digital adversaries.

- Optimizing Business Dynamics: In our on-demand era, businesses must act swiftly. A digital KYC process facilitates rapid customer onboarding without sacrificing any security.

The electronic Know Your Customer market is projected to grow to around $2.79 billion by 2030.

eKYC vs. Traditional KYC Processes:

Traditional Know Your Customer methods have long relied on manual verification. This requires physical presence, paper documentation, and in-person checks. These processes proved time-consuming, resource-intensive, and highly prone to human error. This makes it increasingly difficult for businesses to scale and meet growing customer demands.

Digital KYC harnesses the power of technology to streamline customer identity verification using online platforms, digital documentation, and automated checks. The electronic Know Your Customer online process offers faster and more efficient identity verification. It also reduces human error, and ensures a consistent approach through a paperless process. Moreover, it can service customers globally without the limitations of physical boundaries.

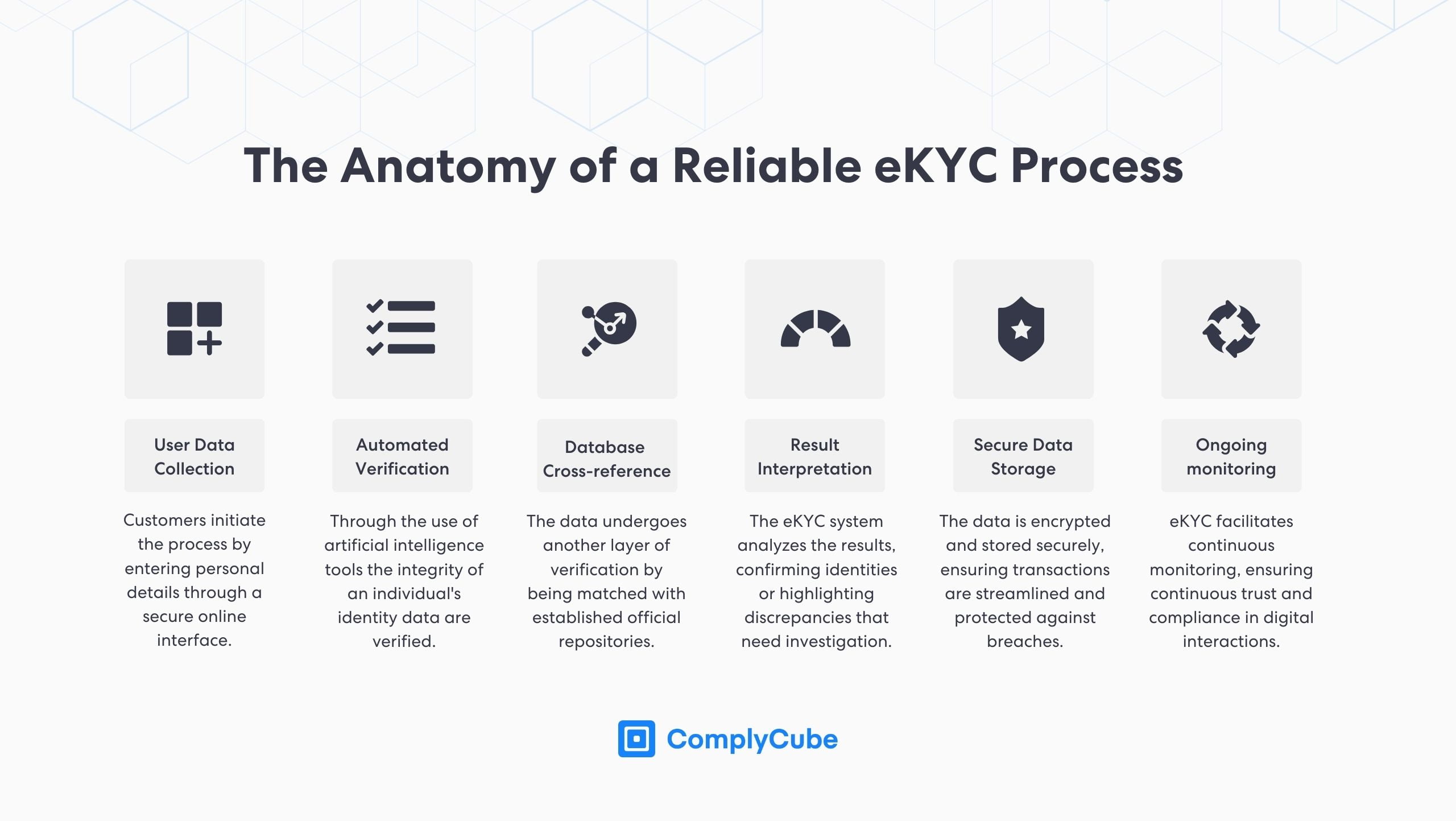

The Anatomy of a Reliable eKYC Process

For financial institutions and varied other industries, understanding the electronic KYC process is vital. They must grasp its effectiveness in digital identity verification and preventing identity fraud. As businesses increasingly move toward digital onboarding, having a clear understanding of how eKYC verification works is needed for maintaining compliance, protecting customers, and building a secure and scalable verification framework.

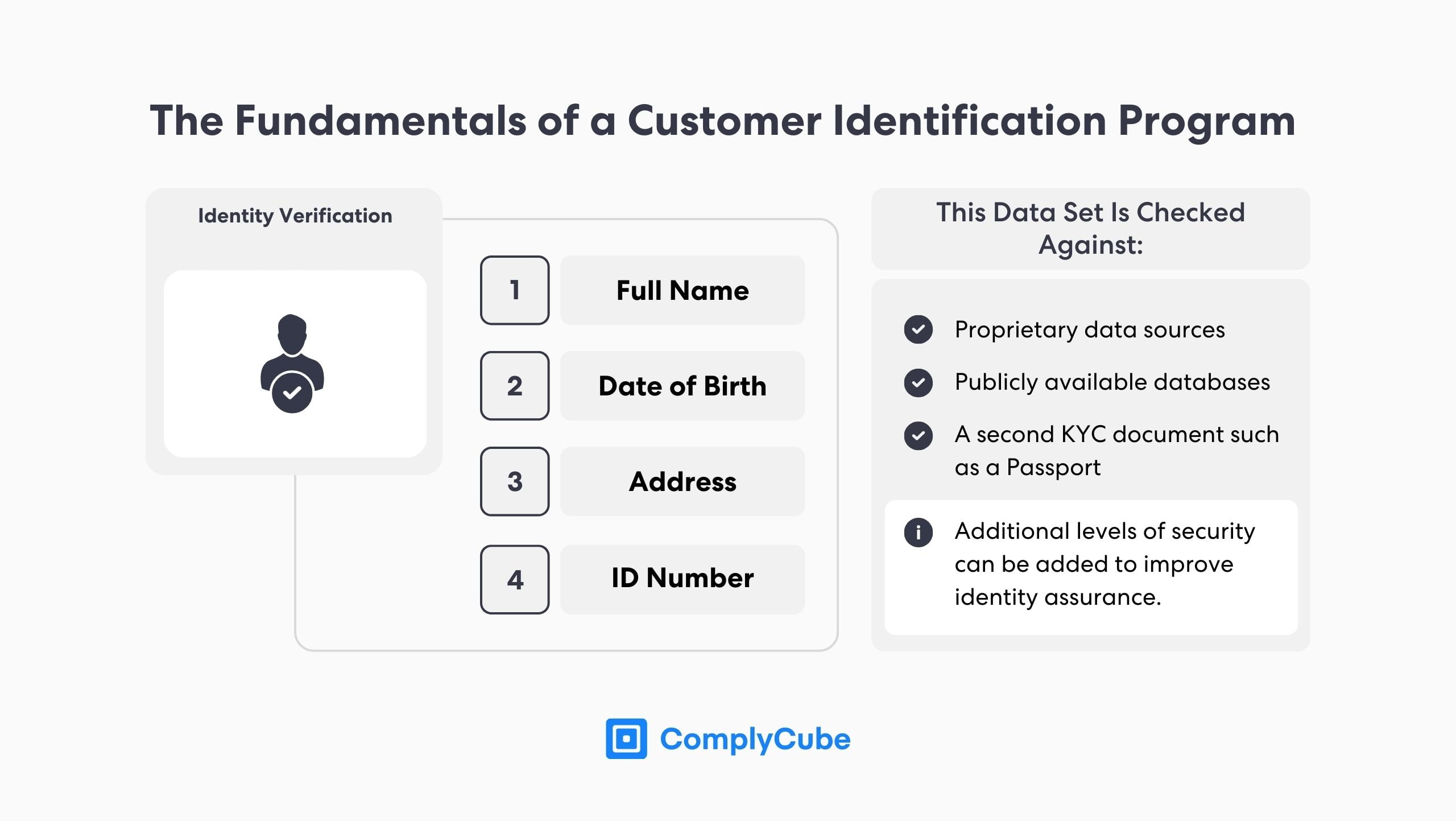

Customer Identification Program (CIP)

A CIP is vital for businesses when obtaining client information. It is completed during the online registration process. When a new account is created, a user enters personal details through a secure online interface. A good example is the beginning of a customer’s journey when opening a new bank account.

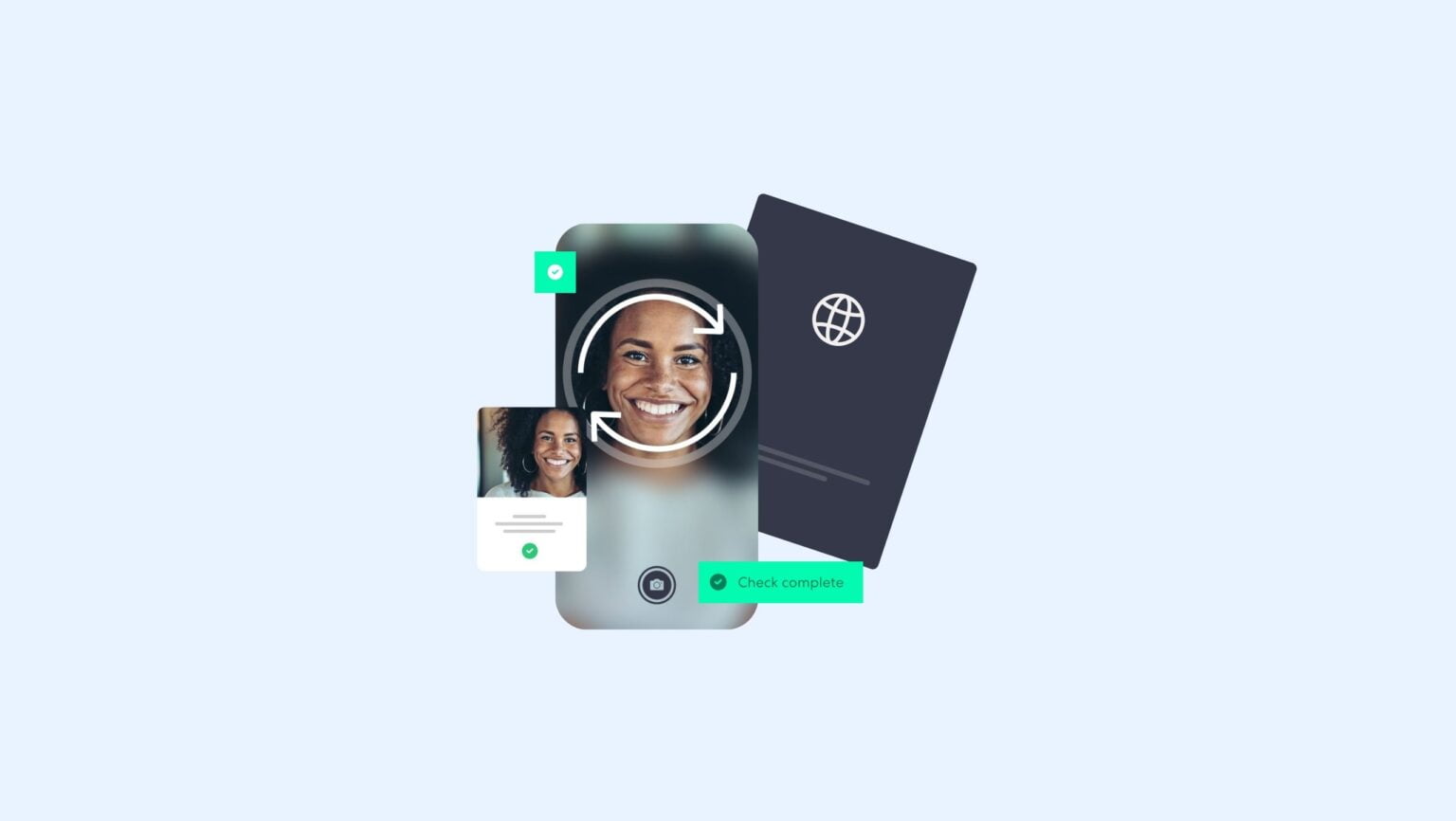

Automated Identity Verification (IDV)

IDV is completed to verify a customer’s identity, proving they are who they say they are. The authenticity and integrity of an individual’s collected identity data are verified through artificial intelligence tools. This includes tools such as identity document verification, biometric data checks, facial recognition, and more. You can learn more about secure identity verification here: The Essentials Guide For Robust Identity Verification.

Customer Due Diligence (CDD)

Once customer identities are confirmed, users are subject to further checks. This is done via Anti-Money Laundering (AML) screening and comprehensive comparisons with third-party databases, known as multi-bureau checks. For example, a user’s residency could be compared against a credit bureau’s partnered database checks.

Feedback and Result Interpretation

The eKYC system analyzes the results verified electronically, confirming true identities or highlighting discrepancies that require further investigation. Based on the findings, a risk score is swiftly produced and assessed against a financial institution’s Risk-Based Approach (RBA). This automatically determines whether a user passes or fails verification. This automated process eliminates the need for manual review, ensuring faster, more accurate, and consistently compliant onboarding decisions.

Secure Data Storage

Verified data is securely stored, ensuring future transactions are more streamlined and protected against breaches. As data security remains a top priority for regulators worldwide, businesses must ensure their chosen solutions provider is fully compliant with both local and international data regulations. This safeguards customer information and maintaining regulatory adherence at every stage of the verification process.

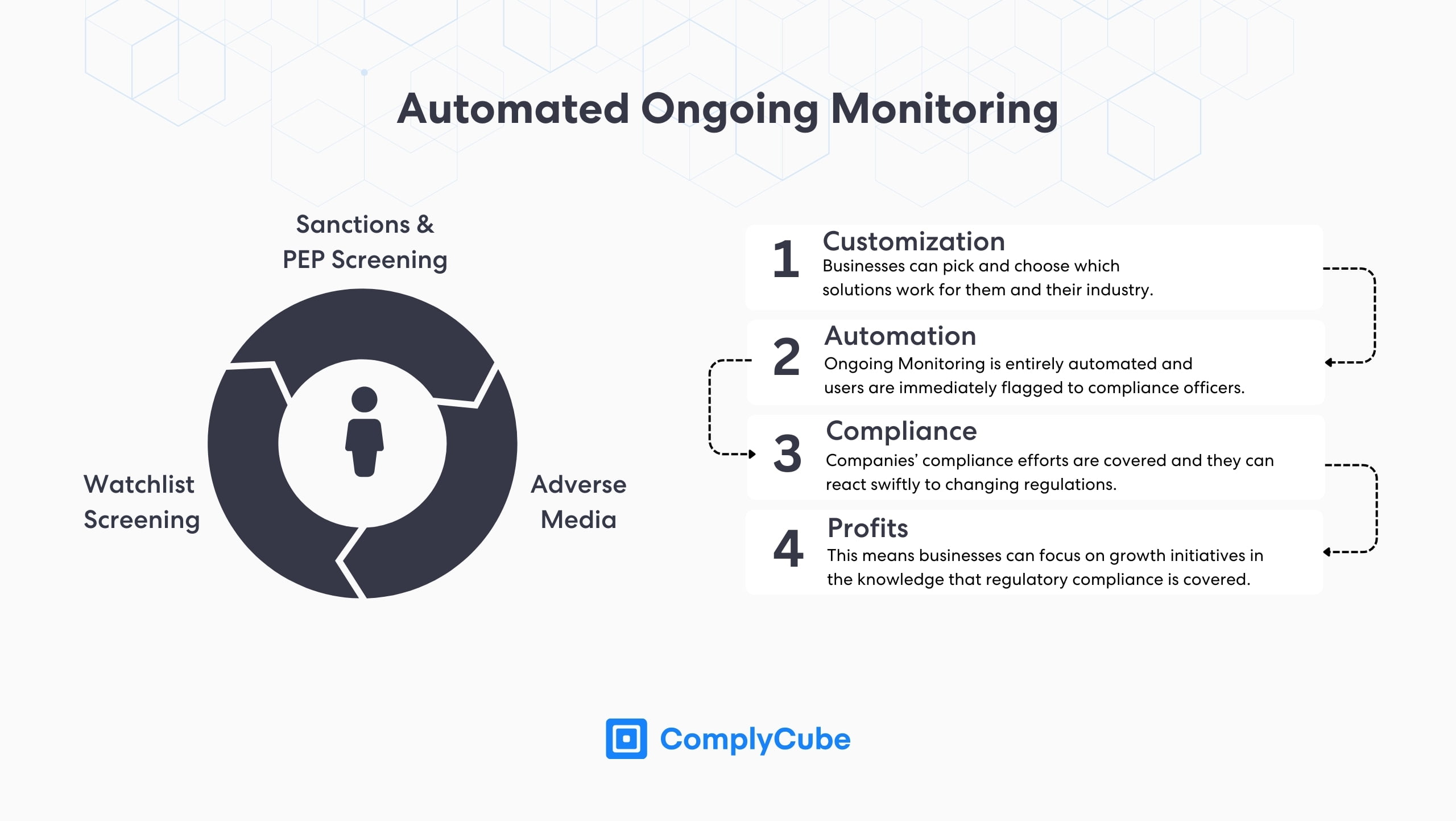

Ongoing monitoring

eKYC verification not only streamlines initial identity assurance but also facilitates continuous monitoring, ensuring ongoing trust and compliance in digital interactions. In an era where fraud tactics are constantly evolving, continuous monitoring has become a important component of any good electronic KYC framework. This ensures that a customer’s compliance status remains accurate and up to date long after their initial onboarding.

Choosing the Right eKYC Provider

To stay on top of your business’s needs, ensure scalable growth, and maintain strong anti-money laundering practices, partnering with the right eKYC solutions provider is crucial. As requirements continue to evolve, selecting a provider that aligns with your electronic KYC standards can make the difference between smooth compliance and costly setbacks. Here’s a guideline to ensure a selection that matches your required electronic identification standards:

- Reputation and Track Record: Research potential providers’ market reputation and past performance. Examining client feedback, reviews, and success stories can offer a clear picture.

- Technological Capabilities: Ensure your chosen provider is at the forefront of technology, using tools such as AI, facial biometrics, automatic video identification, and other cutting-edge verification methods.

- Regulatory Requirements Compliance: The provider should be well-versed with global and local KYC policies and regulations, ensuring adherence to worldwide data privacy norms.

- Seamless Integration Capabilities: Your solution should easily meld with your current digital ecosystem, offering minimal disruptions and maximum efficiency.

- Robust Customer Support: A provider’s value is also in their post-integration support. A dedicated, responsive team is indispensable for addressing concerns or optimizations.

- Value for Money: An effective eKYC provider should offer top-notch services that align with your budgetary constraints without compromising quality.

With these criteria in mind, businesses and economic agents can confidently navigate the eKYC solutions landscape. They can ensure they partner with a provider that truly complements their identity verification objectives. In a world where digital fraud is escalating and regulatory pressures are intensifying, choosing the right electronic KYC partner is not just a compliance decision. Instead, it is a strategic one that directly impacts the security, scalability, and long-term success of your business.

eKYC Processes: Benefits and Challenges

While eKYC verification offers numerous benefits, it is crucial to acknowledge the accompanying challenges that businesses may face during implementation. Understanding both the advantages and limitations of electronic KYC is key to making informed decisions, allowing businesses to implement eKYC solutions more effectively and build a verification framework that is both resilient and future-proof.

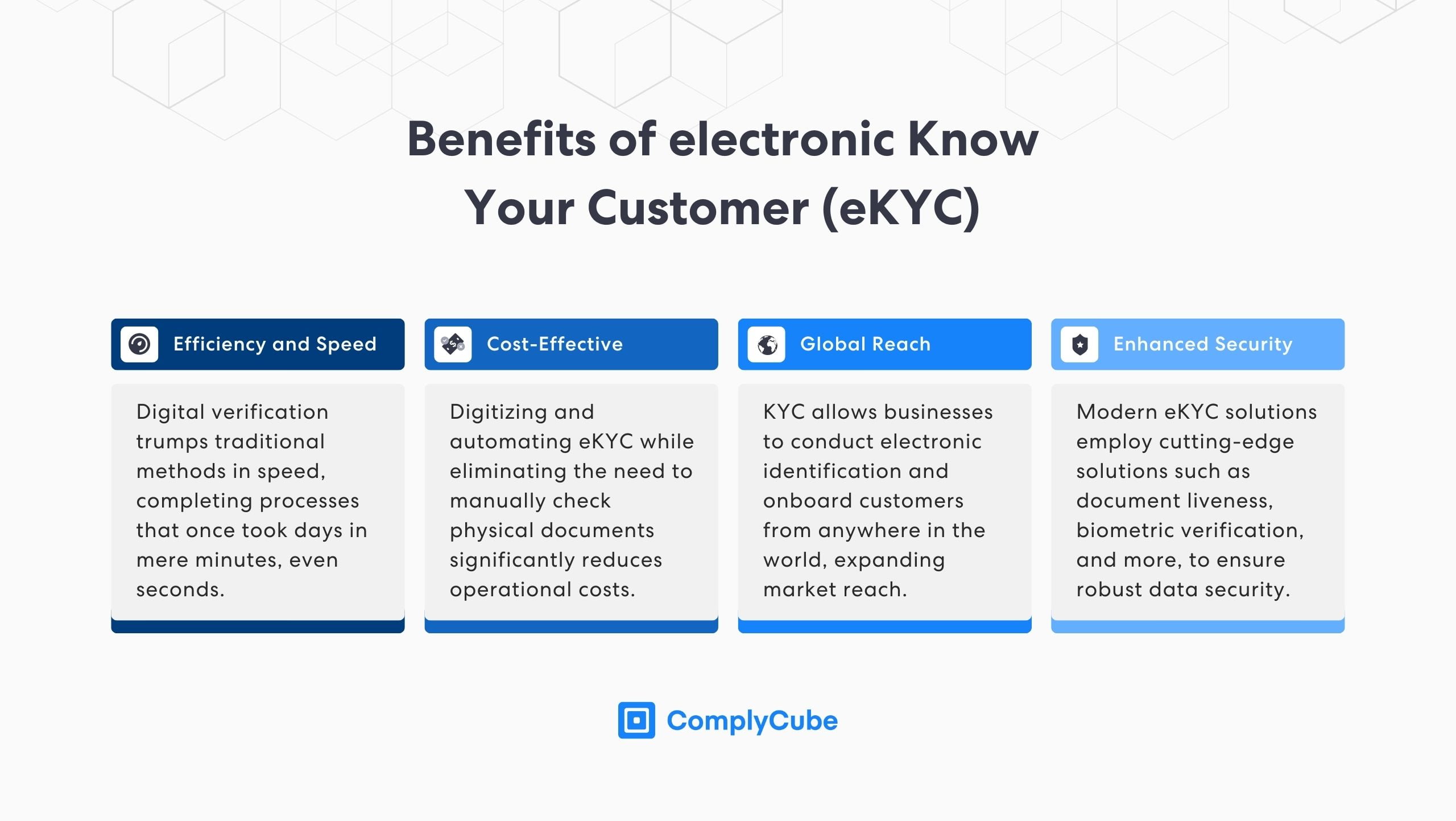

Benefits of eKYC:

- Efficiency and Speed: Digital verification trumps traditional methods in speed, completing processes that once took days in mere minutes, even seconds.

- Cost-Effective: Digitizing and automating the eKYC services while eliminating the need for manually checking physical documents significantly reduces operational costs.

- Global Reach: Digital KYC allows businesses to conduct electronic identification and onboard customers from anywhere in the world, expanding market reach.

- Enhanced Security: eKYC solutions employ cutting-edge technologies such as document liveness, biometric verification, and AI, ensuring compliance with data protection regulations.

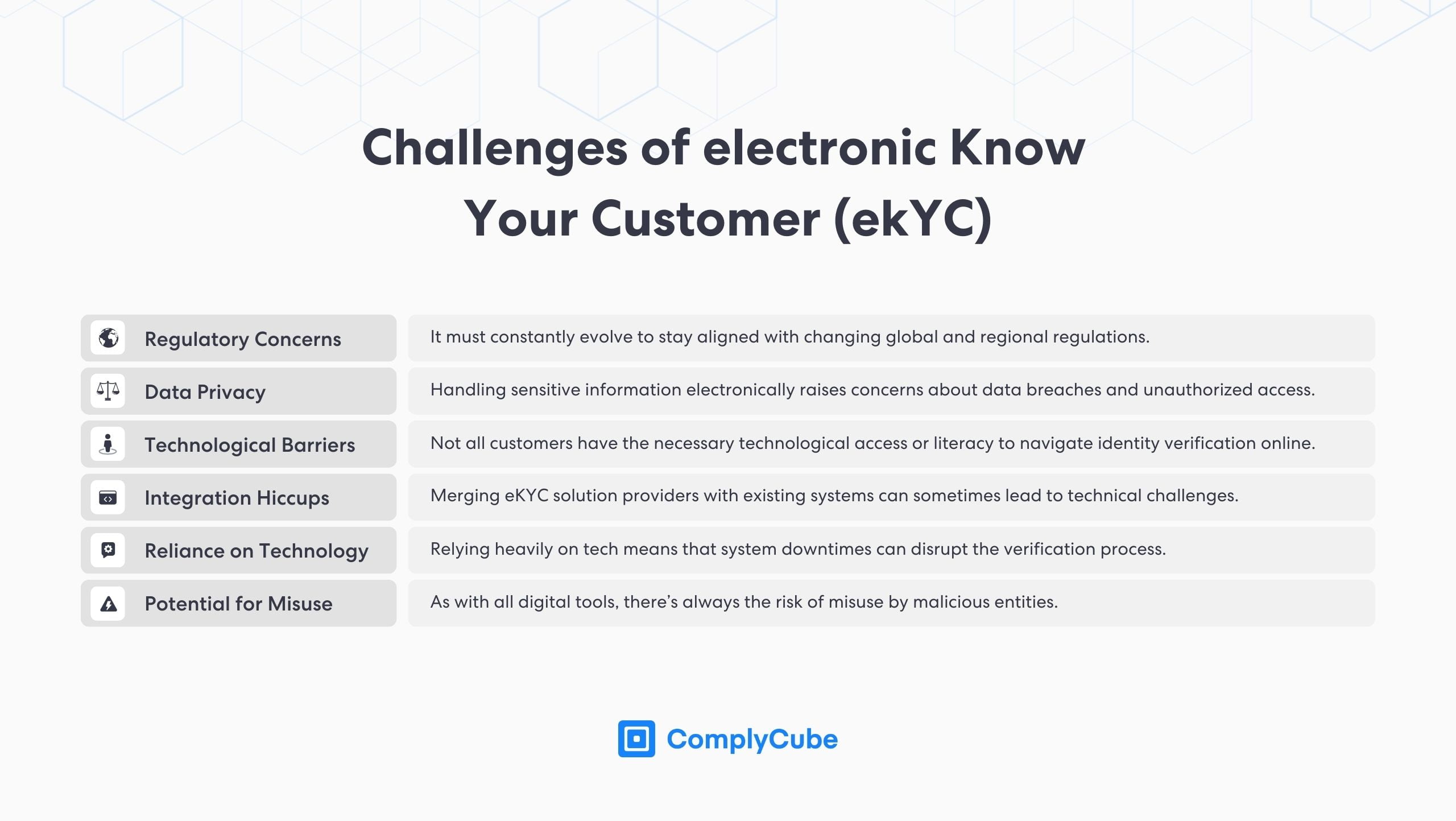

Challenges of eKYC:

- Regulatory Concerns: It must constantly evolve to stay aligned with changing global and regional regulations.

- Data Privacy: Handling sensitive information electronically raises concerns about data breaches and unauthorized access.

- Technological Barriers: Not all customers may have the necessary technological access or literacy to navigate online identity verification processes smoothly.

- Integration Hiccups: Merging electronic Know Your Customer solution providers with existing systems can sometimes lead to technical challenges.

- Dependency on Technology: Relying heavily on tech means that system downtimes can disrupt the verification process.

- Potential for Misuse: As with all digital tools, there’s always the risk of misuse by malicious entities.

Recognizing both the advantages and challenges of electronic KYC allows businesses to make informed decisions. This can be done by optimizing their customer identity verification processes while proactively navigating potential pitfalls. Taking a balanced approach allows businesses to leverage the full potential of eKYC solutions. Teams can streamlining onboarding, reducing fraud, and maintaining compliance, while building a robust verification framework that adapts to an ever-evolving regulatory and threat landscape.

Sectors Thriving on eKYC

As the digital era evolves, electronic Know Your Customer has become a cornerstone for various sectors, ensuring secure and streamlined identity verification. The application of digital KYC is resonating across diverse industries, each leveraging its capabilities to enhance operations. Here’s an insight into some sectors that are truly capitalizing on solutions:

Banking & Financial Institutions

The bedrock of many modern banking operations, digital KYC provides a swift and secure customer onboarding process for bank account opening. It is also crucial to meet ongoing due diligence obligations during the life of the customer relationship, preventing financial crimes and money laundering and enhancing user trust in the financial sector.

Telecommunications

As subscribers and services grow, telecommunication providers use electronic Know Your Customer practices to validate user identities, making legal procedures for registering new users and SIM activations smoother. With regulatory requirements around SIM registration tightening across regions, eKYC verification enables telecoms to meet compliance obligations efficiently, reduce fraudulent activations, and deliver a faster, more seamless onboarding experience for their customers.

Real Estate & Property Management

eKYC verification assists in verifying both buyers’ and sellers’ identity documents, streamlining customer onboarding, property transactions, and rental agreements across the real estate sector. As property transactions remain a key target for money laundering and identity fraud, electronic KYC solutions play a critical role in helping real estate businesses meet their compliance obligations, protect against financial crime, and build a more secure and transparent transaction process for all parties involved.

Travel & Hospitality

For online bookings and check-ins, eKYC verification provides an additional layer of identity assurance, enhancing customer trust and ensuring that reservations are made by genuine, verified individuals. As the travel and hospitality industry continues to shift toward fully digital experiences, electronic KYC solutions are becoming an increasingly essential tool for preventing fraudulent bookings and safeguarding both businesses and their customers.

Case Study: NHS App and Identity Proofing

As NHS App usage scaled, services like test results and prescription ordering required stronger assurance that the person logging in was the right patient. The NHS needed a secure, self-serve way to confirm identity without forcing everyone through in-person checks.

“Full access” identity checks in UK healthcare

NHS login enables users to “prove who you are” for full access using photo ID plus a facial video/self-capture, or via GP online-registration details where photo ID isn’t available. This supports a digital KYC-style identity step for accessing sensitive healthcare features inside the NHS App.

Outcomes

Reduced reliance on manual/in-person identity confirmation for access to personal health features.

Enabled secure access to high-sensitivity functions like prescriptions, appointments, and records.

Demonstrated sustained digital service usage at large scale (millions of sessions and unique logins).

The Future of Electronic Know Your Customer

As the identity verification landscape continues to evolve at a rapid pace, businesses must stay ahead of emerging trends and technologies shaping the future of eKYC verification. From AI-powered fraud detection to increasingly stringent global regulations, the road ahead presents both exciting opportunities and new challenges for organizations looking to strengthen their electronic KYC processes and build a more secure digital future. Here are some examples:

- Technological Fusion: The merging of groundbreaking technologies such as Blockchain and AI is set to amplify the efficiency and reliability of eKYC processes and online procedures.

- Enhanced Security Protocols: With the digital landscape continually shifting, there will be a heightened focus on continually adapting digital customer onboarding and reinforcing electronic KYC processes to counter emerging digital challenges.

Key Takeaways

eKYC (electronic know your customer) verifies identity remotely using digital evidence and checks.

It modernises onboarding by reducing manual steps while strengthening fraud and AML controls.

Digital KYC outperforms traditional KYC on speed, scale, and consistency across markets.

A reliable eKYC flow spans CIP, automated IDV, CDD/AML screening, and risk scoring.

Long-term value comes from secure storage, ongoing monitoring, and smooth integration.

About ComplyCube’s eKYC Solution

eKYC isn’t just another digital trend; it’s a foundational element in the blueprint of future digital interactions. As businesses navigate the digital age, eKYC stands out as an invaluable ally, offering the speed, security, and adaptability required to prevent terrorist financing. Learn more about how you can rapidly integrate eKYC solutions today. Speak to a member of the team.

Frequently Asked Questions

What does eKYC mean in the UK and Europe?

eKYC means electronic know your customer. It is a digital KYC process that verifies identity remotely using electronic checks instead of paper or in-person verification. In the UK and Europe, it’s commonly used to support compliant onboarding under local KYC/AML expectations.

Is eKYC compliant with UK Customer Due Diligence (CDD) requirements?

Yes, eKYC can support CDD by collecting customer details (CIP), verifying identity through automated IDV, and applying risk-based checks like screening and database comparisons. The key is using appropriate assurance levels, audit trails, and data protection controls.

What’s the difference between eKYC and traditional KYC for businesses in London or the EU?

Traditional KYC is typically manual and slower, relying on physical documents and in-person checks. eKYC (digital KYC) uses automated verification to speed up onboarding, reduce human error, and deliver consistent outcomes across regions.

What are the core steps in a reliable eKYC process for fintechs and banks?

Most strong electronic know your customer flows include CIP data capture, automated IDV (document + biometric checks), CDD/AML screening, risk scoring, and secure data storage. Many organisations also add ongoing monitoring to detect changes in risk over time.

How does ComplyCube support eKYC and digital KYC requirements?

ComplyCube helps organisations implement eKYC (electronic know your customer) through automated identity verification, configurable onboarding checks, and ongoing monitoring to support CDD workflows. It’s designed to integrate into digital customer journeys while maintaining strong security and compliance alignment.