TL;DR: Money laundering software, commonly referred as Anti-Money Laundering software, helps firms stop financial crime. By verifying identities, Anti-Money Laundering solutions strengthen compliance processes, reduce operational risk, and stop illicit funds from entering businesses.

What is Money Laundering Software?

Money laundering software is technology designed to help businesses with compliance. It enables organizations to automate Know Your Customer (KYC) processes, manage risk assessments, and generate audit-ready reports. Modern Anti-Money Laundering (AML) software includes advanced capabilities, such as automated checks and real-time verification. AML checks and customer screening enhance detection and management of illicit financial activity.

At its core, AML compliance software replaces manual verification processes with intelligence-driven, automated workflows that operate continuously. As a result, customer onboarding and ongoing compliance remain accurate, efficient, and auditable. By automating repetitive verification tasks, firms can save time and internal resources while reducing human error.

Why is Money Laundering a Critical Business Risk?

Financial crime has become more sophisticated than ever. Now, criminals are exploiting digital platforms and cross-border transactions to launder illicit funds. Combating money laundering is essential to stop criminal activity, including drug trafficking and other illicit activities. Firms without thorough AML software or Anti-Money Laundering efforts risk facilitating financial crime inadvertently.

Regulators expect organisations to have proactive software controls. Therefore, they need to mitigate money laundering activities and risks. Failing to comply can lead to regulatory penalties, reputational damage, and operational restrictions. Accord to a study by the United Nations Office on Drugs and Crime (UNODC), financial institutions face risks from money laundering, which can cost up to 5% of global GDP annually.

Nevertheless, investing in identity verification and AML software helps firms address these risks. Setting aside budget for such processes also demonstrates compliance with regulatory obligations. This means that AML teams play a role in analyzing alerts and managing investigations to effectively manage risk and critical errors when it comes to financial crime.

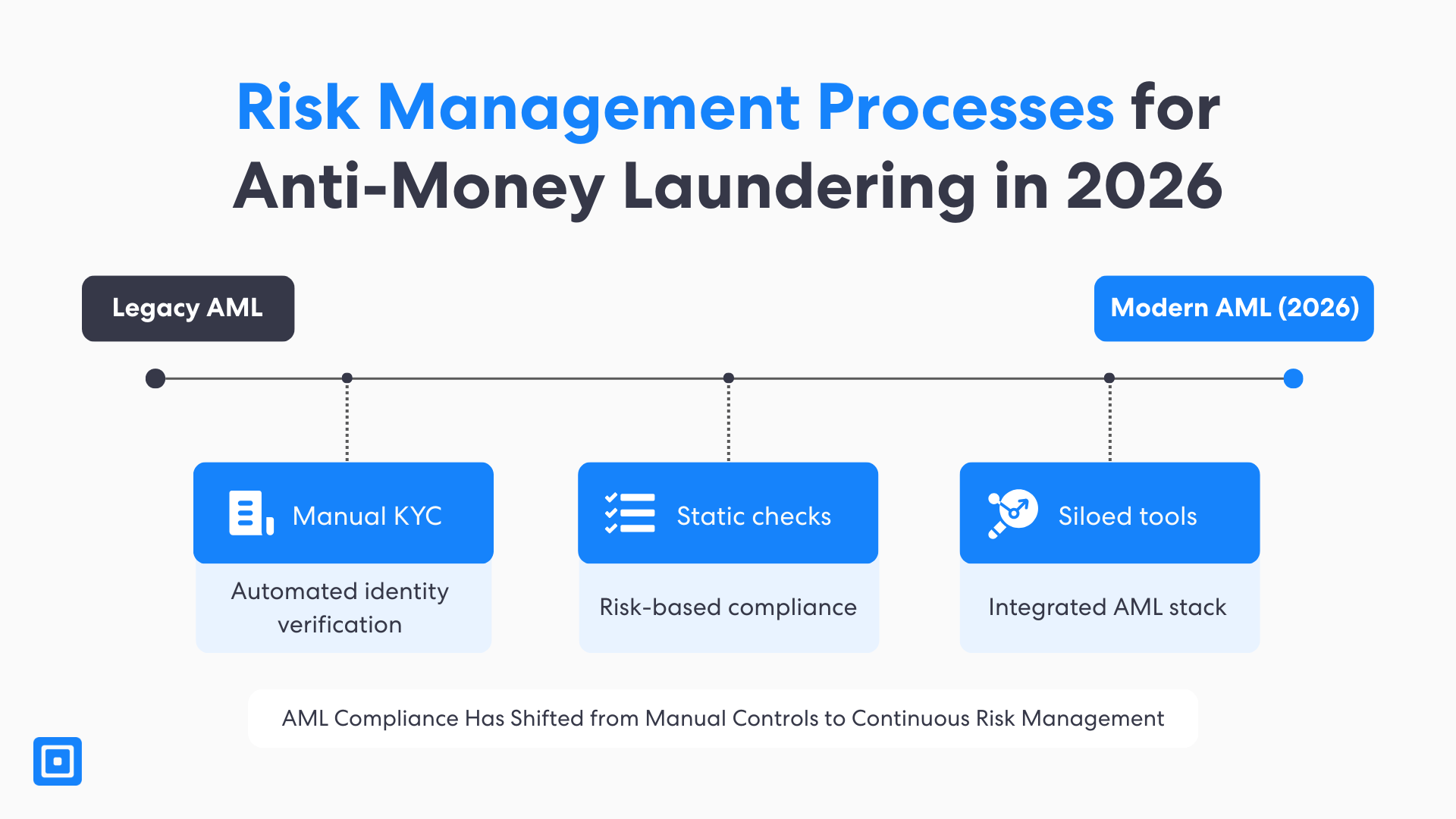

2026 Risk Management Processes for AML Software

From late 2025 and early 2026, global Anti-Money Laundering (AML) enforcement intensified. Regulators such as the Financial Conduct Authority (FCA) and Financial Crimes Enforcement Network (FinCEN), emphasised the importance of KYC, ongoing monitoring and screening processes. Now, authorities scrutinize whether firms have appropriate solutions aligned with risk-based expectations.

As regulatory changes accelerate, firms must adapt quickly and maintain processes. This is necessary for ongoing compliance and maintenance of their organization’s reputation. Therefore, AML regulators now expect an AML compliance solution program to be proportional, explainable and audit-ready as part of the process.

In essence, having the most robust AML software is considered a core compliance control. Firms need to maintain accurate records and verifiable compliance procedures. Regulators such as FinCEN and the FCA require robust, audit-ready monitoring systems for AML compliance.

Case Study: Coinbase Europe, Money Laundering Software & AML Enforcement Action

In November 2025, the Central Bank of Ireland fined Coinbase Europe €21.46 million for AML and counter-terrorist financing breaches. The firm’s let over 30 million transactions go unmonitored, thus creating major compliance gaps and delayed reporting of suspicious activity.

System Overhaul and Retrospective Compliance Review

Eventually, Coinbase Europe corrected the monitoring system errors and completed a retrospective review of unmonitored transactions. The firm also strengthened internal compliance controls and validation processes to prevent future regulatory lapses.

Outcome

€21.46 million fine imposed after cooperation with the regulator.

30 million+ transactions, valued at €176 billion, were identified as unmonitored during the compliance gap.

2,708 late Suspicious Transaction Reports (STRs) were filed following retrospective monitoring.

Who Needs Anti-Money Laundering Programs?

Any organization subject to financial crime risk benefits from AML solutions. This includes banks, fintechs, payment providers, crypto platforms, neobanks, marketplaces, and regulated professional service firms. Other financial institutions, such as credit unions and cryptocurrency exchanges, also require thorough AML solutions.

Even smaller organizations with digital or cross-border operations must implement KYC solutions to meet compliance requirements. AML software must remain flexible and scalable to accommodate diverse business models while maintaining regulatory compliance across jurisdictions. It should seamlessly integrate with existing systems, and strong vendor support is essential for ongoing compliance and system effectiveness.

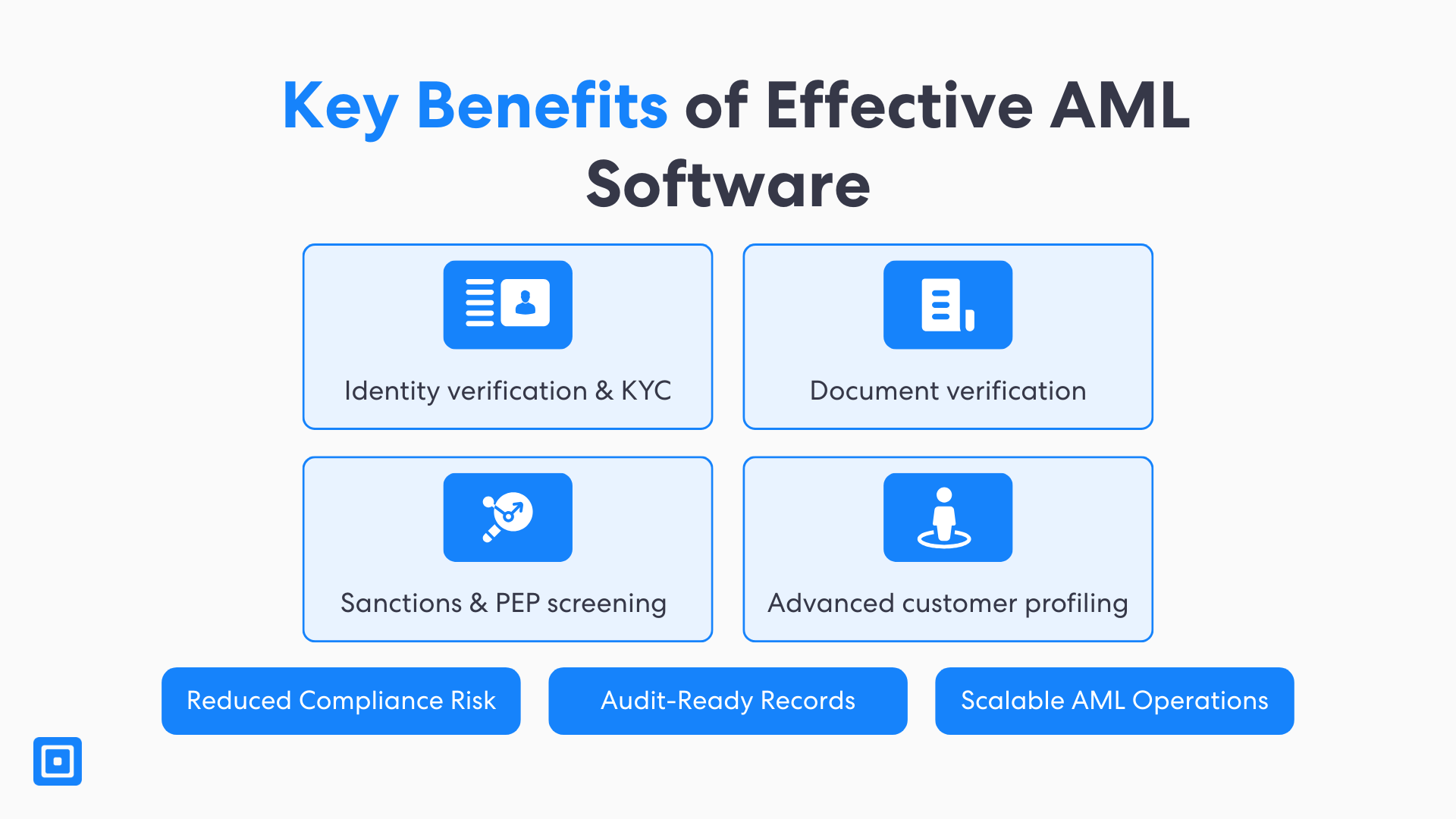

Key Benefits of Money Laundering Software

Effective money laundering software is necessary to prevent financial crime and maintain a strong compliance posture. Beyond meeting regulatory requirements, it enhances transparency, accuracy, and operational efficiency. Implementing this type of software allows compliance teams to automate critical processes such as;

- Customer due diligence

- Sanctions screening

- Risk-based asseessments

This automation reduces human error and helps organizations respond faster to suspicious activity or evolving regulatory demands. AML software helps organisations stay ahead of emerging threats. With powerful AI capabilities and real-time monitoring, businesses can detect suspicious activities early and reduce risks.

The benefits of implementing advanced money laundering solutions extend beyond compliance. These tools not only streamline workflows but also ensure scalability, enabling firms to grow while maintaining regulatory standards. By integrating seamlessly with existing systems, software with AML capabilities offer improved accuracy, reduced human error, and enhanced operational efficiency, making it a vital tool for AML-sensitive organisations worldwide.

1. Customer Due Diligence (CDD), Enhanced Due Diligence (EDD) & KYC Verification

CDD and EDD is the foundation of any risk management software and compliance tools. This is especially true when it comes to Anti-Money Laundering and economic crime. That is why ComplyCube’s KYC and identity verification tools allow firms to verify new customers quickly and accurately, reducing onboarding friction while ensuring regulatory compliance.

These solutions use a combination of government ID verification, document checks, and biometric validation to confirm that the person or entity is who they claim to be. By automating these processes, firms can maintain audit-ready records, demonstrate compliance to regulators, and significantly reduce human error.

- Faster onboarding while meeting compliance requirements

- Consistent identity verification for all customers

- Reduced risk of onboarding fraudulent or high-risk clients

2. Sanctions, PEP & Adverse Media Screening

Screening customers against global sanctions lists, politically exposed persons (PEPs), and adverse media databases is essential for risk-based AML compliance. ComplyCube’s screening solutions automatically check customers and entities against continuously updated global watchlists, ensuring that high-risk individuals or organizations are flagged immediately.

Automation of solutions allow firms to maintain consistent compliance without manually cross-referencing multiple databases. This continuous verification reduces regulatory risk and ensures that only verified, low-risk customers are approved for services.

- Reduced regulatory and reputational risks

- Continuous and automated monitoring of sanctions, PEPs, and adverse media

- Instant alerts for potential high-risk individuals or entities

3. Document Verification & Advanced Identity Checks

Beyond basic KYC, firms and organisations need to ensure that supporting documents are authentic and valid. ComplyCube’s document verification solutions analyze government-issued IDs, passports, utility bills, and other relevant documents. Organizations can now confirm authenticity and detect potential tampering or forgery.

This feature capability is particularly important for firms onboarding high-risk clients or operating in regions with elevated fraud risk. With ComplyCube’s features, teams can mark certain countries as high/medium/low risk as well. Automated document verification simplifies workflows, shows audit-ready evidence, and improves overall compliance effectiveness.

- High confidence in customer identity and documentation

- Reduced onboarding times with automated verification

- Enhanced fraud prevention and compliance reporting

Risk-Based AML Programs Explained

Risk-based software focus compliance efforts where risk exposure is at its highest. Essential features of such softwares include helping assign risk scores to customers. This can vary based on jurisdiction, identity attributes, and sanctions status. It is essential to align risk assessments from AML software with the organization’s specific risk tolerances.

Low-risk customers require minimal intervention, while high-risk profiles receive enhanced verification. This ensures proportional allocation of compliance resources. A risk-based approach allows firms to scale efficiently while maintaining regulatory effectiveness. The adoption of AML tools and software should be included in a broader AML compliance framework and executed as part of a risk-based approach tailored to the specific requirements of a financial institution.

Entity Resolution and Payment Screening

Entity resolution and payment screening are essential pillars of any thorough anti money laundering (AML) compliance program. For financial institutions, accurately identifying and verifying all parties involved in financial transactions is critical to preventing money laundering and meeting AML regulations. The real-time, high volume nature of payments means processors must use advanced analytics and machine learning to detect risk accurately and reduce false positives.

Such anti money laundering solutions need to match and consolidate customer, vendor, and counterparty records, eliminating duplicates and ensuring that each transaction is linked to the correct entity. This process not only enhances data quality but also strengthens risk management processes by providing a clear, unified view of customer relationships.

Meanwhile, payment screening involves the real-time analysis of transactions to detect suspicious activity. It keeps track of attempts to circumvent sanctions or engage in financing crime. AML compliance software with integrated screening allows organizations can monitor transactions as they occur, flagging potential risks for further investigation.

The use of machine learning helps reduce false positives, allowing compliance teams to focus on genuine threats and improve operational efficiency. Seamlessly combining these two processes within an AML solution empowers financial institutions to more effectively combat money laundering, maintain compliance, and optimize their overall AML process.

Using AI and Machine Learning in Money Laundering Software

AI-enabled AML solutions analyse identity and risk data to identify potential high-risk customers. AI capabilities automate verification processes. It leverages artificial intelligence to optimize efficacy in detecting suspicious activity. This reduces errors and improves compliance efficiency. Modern AML tools use AI and machine learning to identify complex patterns that rule-based systems might miss.

“Effective AML software transforms compliance from a reactive obligation into a proactive risk management function.

“Effective AML software transforms compliance from a reactive to a proactive risk management function. When AML systems are built around real customer profiles, firms gain both regulatory confidence and operational efficiency.” says Harry Varatharasan, Chief Product Officer of ComplyCube. AI driven solutions identify patterns that rule-based systems might miss. Automation streamlines repetitive verification tasks, and ensures consistent application of compliance policies.

Suspicious Activity Reporting and Reducing False Positives

Suspicious Activity Reporting (SAR) is a cornerstone of effective AML compliance. It requires financial institutions to promptly identify and report transactions that may indicate financial crime from criminals or politically exposed persons. Modern AML software streamlines the SAR process by automatically flagging unusual transaction patterns or suspicious behavior.

SAR enables compliance teams to investigate and document findings efficiently. By leveraging AI, these solutions can analyze vast amounts of data. The best AML software does a good job of recognizing emerging threats, and reducing the risk of human error in the compliance reporting process. Compliance with regulations such as the Bank Secrecy Act hinges on timely and accurate reporting.

AML software facilitates the generation and submission of SARs. It also ensures that institutions maintain comprehensive audit trails and meet evolving regulatory standards. Effective SAR processes help financial institutions protect their reputation. SARs uphold the integrity of the financial services industry. By integrating advanced tools into their AML compliance operations, organizations can maintain compliance and strengthen their efforts.

Money Laundering Software Implementation Pitfalls

Often, firms underestimate the importance of building AML solutions properly. Poor integration can lead to gaps. Choosing the right anti money laundering solution has significant consequences. False positives or negatives can cause problems for both the financial institution and the individuals involved.

Lack of staff training and unclear process ownership can reduce system effectiveness and compliance reliability over time. Addressing these pitfalls proactively is critical for sustainable and effective AML programmes. Additionally, the solution should be regularly updated and maintained to ensure it operates at peak performance. You can learn more here: 5 Critical Errors to Dodge in AML Software Implementation.

Key Takeaways

Money laundering software is essential for verifying identities and screening.

Risk-based AML programs focus compliance resources on high-risk profiles.

Automation and AI improve verification accuracy and efficiency.

Continuous proactive AML compliance is expected by regulators.

Scalable AML solutions support growth while maintaining regulatory standards.

ComplyCube’s Money Laundering Software

In summary, preventing economic crime requires more than policies. It requires intelligent, scalable technology that verifies identities, screens and supports ongoing compliance. Organisations that implement modern AML software are better equipped to reduce regulatory risk. If your organisation or AML team wants to enhance its framework with a seamless integration, ComplyCube’s team can help. Reach out and get in touch to discuss how anti money laundering solutions can support your organisations overall compliance strategy and growth.

Frequently Asked Questions

What is money laundering software and how does it work?

Money laundering software (also known as Anti-Money Laundering or AML software) automates compliance processes. It verifies customer identities, screening for sanctions and politically exposed persons (PEPs), and monitoring transactions for suspicious activity. This software helps businesses comply with AML regulations and reduces the risk of financial crime by detecting illicit transactions in real time.

How does money laundering software help businesses meet regulatory requirements?

Money laundering software ensures compliance with global AML regulations by automating identity verification, transaction monitoring, and suspicious activity reporting (SAR). It supports regulatory bodies such as FinCEN (US), FCA (UK), and the European Union’s AML directives, helping businesses maintain accurate, auditable compliance records.

What are the key benefits of using money laundering software for financial institutions?

Key benefits of AML programs or money laundering software include automated compliance with KYC, AML, and sanctions screening, improved risk management through real-time alerts for suspicious transactions and audit-ready reports that simplify regulatory reporting and reduce penalties.

How can money laundering software help fintechs and cryptocurrency platforms?

Money laundering software enables fintechs and crypto platforms to onboard customers quickly while ensuring they meet KYC and AML requirements. It automates verification, transaction monitoring, and risk assessments, ensuring compliance without disrupting the customer experience.

How does ComplyCube’s money laundering software help firms prevent financial fraud?

ComplyCube’s money laundering software helps firms prevent financial fraud by automating identity verification, KYC checks, and sanctions screening within a single compliance workflow. Organizations can detect high-risk customers earlier, reduce false positives, and maintain consistent AML compliance across jurisdictions.