TL;DR: Since FCA registration has been mandatory for UK crypto trading platforms, firms must meet stringent KYC for crypto legal requirements. This guide examines the primary regulations, regulatory bodies, and strategies for partnering with a reliable KYC provider UK to achieve full KYC compliance in 2026.

What is Know Your Customer (KYC) in Relation to UK Crypto Trading Platforms?

KYC is the process used to determine the real identity of customers. For cryptocurrency exchanges, KYC is critical in the effort to combat money laundering and terrorist financing. Implementing strong identity verification solutions and KYC builds a security-first market reputation, enabling firms to build trust with customers.

Accepting a completed form and a copy of a utility bill is not enough. Firms offering crypto assets are now required to comply with new regulations that demand greater security and oversight. Notably, for UK crypto organizations, regulations are shaped by the Financial Action Task Force (FATF) standards, shaping Anti-Money Laundering (AML) regulations.

Cryptocurrency KYC and How it Supports Anti-Money Laundering Initiatives

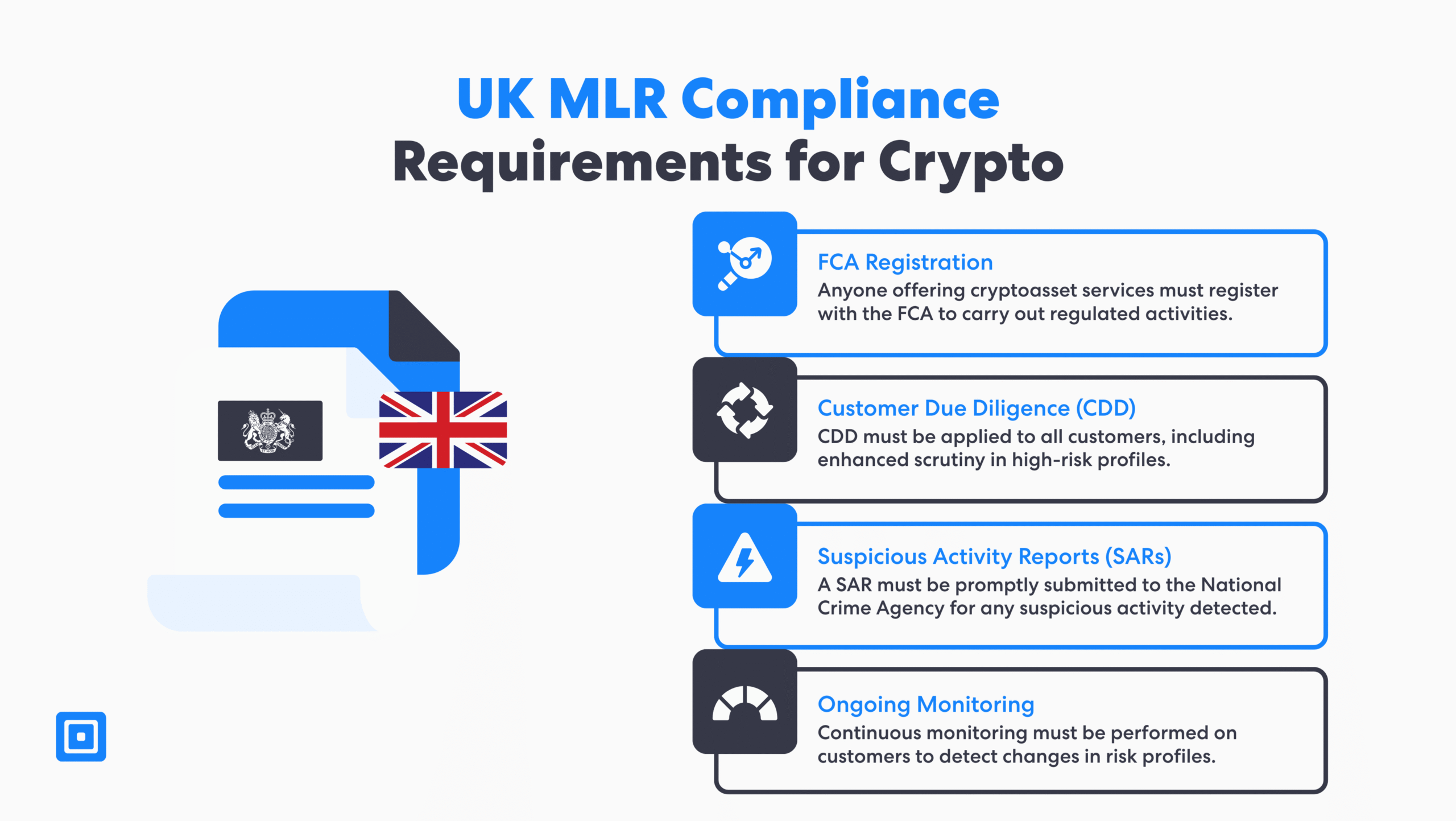

KYC processes serve as a defense against financial crime in the UK and are also part of broader AML compliance. For UK-based cryptoasset firms, registration with the Financial Conduct Authority (FCA) is required under the Money Laundering, Terrorist Financing and Transfer of Funds (Information on the Payer) Regulations (MLRs).

Companies operating in the cryptocurrency market must adhere to the MLR to prevent illicit activities, including fraud and financial crime.

The MLR sets AML and KYC standards required for compliance. Businesses must conduct due diligence, ongoing monitoring, and submit Suspicious Activity Reports (SARs) to the National Crime Agency (NCA) promptly. Any firm classified as a cryptoasset exchange provider, which can include hybrid decentralized exchanges, is subject to AML and KYC measures in the UK.

Walid M’Sallem, Full-stack Engineer and Compliance Policies Specialist at ComplyCube, notes, “Companies operating in the cryptocurrency market must adhere to the MLR to prevent illicit activities, including fraud and terrorist financing. Failure to meet regulations will result in heavy restrictions on their operations, face reputational damage, and, in more severe circumstances, criminal investigations”.

Understanding KYC Requirements for UK Crypto Trading Platforms

KYC obligations vary depending on the industry and level of customer risk. UK crypto trading platforms and crypto exchanges must align their processes with the UK’s risk-based regulatory framework through Customer Due Diligence (CDD), Enhanced Due Diligence (EDD), and ongoing monitoring efforts.

Businesses must demonstrate established policies, controls, and procedures to effectively manage the risks of money laundering and terrorist financing.

According to the FCA, crypto firms must take proactive steps to identify and assess the risks of money laundering to which their businesses are subject. This means that while CDD is standard, a company must take additional steps, such as EDD, to ensure high-risk scenarios do not pose a threat.

Customer Due Diligence (CDD)

CDD includes verification methods involving digital identity verification, including Proof of Address (PoA) checks, document scans, and liveness checks. For instance, standard customer information, such as name, date of birth, and government-issued identification, including passports and driver’s licenses, is collected.

A common example in the crypto sector is a custodial wallet, which is a type of wallet where a third party takes custody of private keys on behalf of users. Because the third party has control over the assets, it is also subject to KYC compliance when buying crypto. CDD includes the verification of:

- The customer’s identity

- The purpose and intended nature of the business relationship

- Risk screening and assessment

Enhanced Due Diligence (EDD)

EDD is needed when a customer or entity is associated with a higher risk. As a result, firms must apply EDD to their identity verification process when dealing with any high-risk customers or jurisdictions. MLR mandated measures include senior management approval and multi-bureau checks. Examples of high-risk scenarios can include:

- Politically Exposed Persons (PEPs). You can learn more here: What is a Politically Exposed Person (PEP)?

- Sanctioned individuals or entities

- Financial transactions in high-risk countries

Real-Time Monitoring

Ongoing monitoring efforts enable businesses to identify and stop suspicious activity promptly, allowing the relevant authorities to become involved earlier. The process includes checking against trusted global sanctions lists, watchlists, adverse media, and PEP databases. As risk profiles can be updated rapidly in real-time, continuous monitoring enables companies to stay ahead of high-risk scenarios.

Challenges Facing UK Crypto Trading Platforms

Traditional institutions, such as banks, credit unions, or financial intermediaries, have had years to adapt their Identity Verification (IDV) solutions to the changing AML frameworks. On the other hand, UK crypto trading platforms face several challenges as they often operate under leaner models. With the increasing popularity of crypto, virtual asset trading companies face pressure to implement secure KYC frameworks quickly that can handle high transaction volumes.

Additionally, regulators are increasing scrutiny and oversight over crypto platforms. Since crypto transactions occur at a rapid speed and provide the potential for anonymity, illicit activities are more likely to take place, compromising financial safety. For example, the UK’s His Majesty’s Revenue and Customs (HMRC) will fine organizations up to £300 per customer for KYC reporting failures in 2026.

Defective Document Verification Processes

Many platforms rely on manual identity checks or on using legacy IDV providers. Manual processes in KYC lengthen onboarding time and introduce human error, which further impacts customer experience. Thus, platforms must look for providers fully certified to PAD Level 2, ISO 27001, ISO 9001, and the UK Government’s DIATF to ensure credibility and external validation from approved auditors.

Managing User Drop-Off During Onboarding

User drop-offs can impact customer relationships and trust, leading to revenue losses. To better manage drop-offs, platforms must leverage increased automation, adopt light-touch eIDV methods for instant verification, and analyze onboarding workflows using user behaviour analytics to identify and resolve bottlenecks early. You can learn more about this in our guide, “The Identity Verification Onboarding Bottleneck.“

Shortage of Global Crypto KYC Coverage

Many UK crypto trading platforms serve users in multiple jurisdictions. Some KYC providers offer less effective coverage of identity documents or sanctions lists. Similarly, the lack of multi-language support further hinders effective KYC implementation. As such, firms must partner with global KYC vendors that have multilingual verification capabilities, comprehensive document coverage, and ongoing access to global sanctions lists.

Poor Integration with UK Crypto Trading Platforms

Many exchanges struggle to integrate IDV with customer relationship management (CRM) systems, anti-fraud tools, or compliance systems. The lack of integration coverage creates data silos, undermining overall risk assessment and management systems. Thus, platforms are encouraged to adopt API-first KYC solutions that offer seamless integration with existing tech stacks, enabling real-time data sharing.

Case Study: ComplyCube Powers GRVT’s Crypto Onboarding for Millions

The Rise of Deepfakes and Fraud in the Crypto Space

GRVT is a leading hybrid derivatives exchange in the crypto space, managing over $3.3 billion in monthly volume. As a global firm, GRVT maintains robust KYC and AML frameworks. However, firms in the crypto sector are increasingly facing deepfakes and fraud attacks.

The Power of Scalable and Automated KYC

GRVT needed to increase its KYC verification volume; however, it needed to ensure that its customers and clients are legitimate and protected from bad actors. GRVT’s CEO, Hong Yea, noted that the business required KYC solutions that are customizable, secure, and automated.

Solutions & Outcomes

GRVT turned to ComplyCube’s platform, which was able to elevate its unique pain point of scaling while eliminating fraud risk.

ComplyCube enabled GRVT to onboard customers in real-time with zero downtime and unmatched data accuracy levels.

GRVT was able to achieve full KYC compliance, aligned with the FATF, while reducing the cost and time for customer acquisition.

Selecting Trusted KYC Solutions for UK Crypto Trading Platforms

Establishing a scalable Know Your Customer (KYC) process requires a combination of technology, policy, services, and human expertise. One cannot work efficiently by compromising the other. It is critical to leverage automation capabilities. Automation helps eliminate human error and accelerates the decision-making process. Through automation, data can be extracted from customers using an identity document in real-time and matched against trusted databases, reducing fraud attempts efficiently.

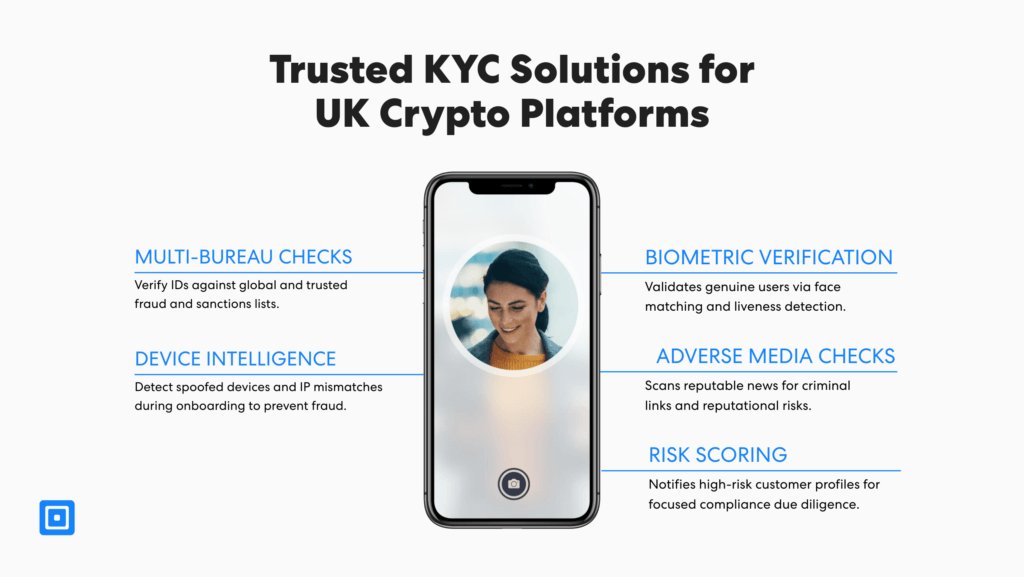

Furthermore, selecting the right KYC provider for scalable compliance is crucial. With all-in-one KYC and AML vendors, businesses enhance fraud detection, streamline sign-ups, and meet FCA requirements on a unified platform. To ensure AML and KYC regulatory compliance, the most important compliance features to look for include:

- Multi-Bureau checks: Use of global databases for the verification of identity documents and match user details against known fraud or authoritative sources.

- Device intelligence: Ability to detect device spoofing, emulators, or mismatched IP and device environments.

- Adverse media checks: Scan trustworthy news sources for signs of criminal association or reputation damage and risk.

- Biometric verification: Face matching and liveness detection confirm that users are genuine customers and verify their identity.

- Risk scoring: Customizable automated scoring can flag risky profiles based on changing thresholds.

Emerging KYC Trends for UK Crypto Trading Platforms

Several developments are reshaping KYC processes for crypto. These evolving standards in KYC are driven by the sector’s vulnerabilities to bad actors and fraudsters. To stay ahead of fraud risks, crypto exchanges are adopting advanced compliance solutions.

This includes AI, machine learning, and behavioral analytics in KYC workflows to facilitate faster risk identification, enhanced accuracy, and adaptability to emerging threats. From changes in the Travel Rule to implementing ongoing monitoring and adopting a risk-based approach, crypto firms are finding strategic methods to effectively mitigate fraudulent activity.

Expansion of Travel Rule Obligations

Financial institutions are responsible for implementing the Financial Action Task Force (FATF) Travel Rule. This travel rule is a global AML standard that requires platforms or Virtual Asset Service Providers (VASPs) to share information about senders and receivers for crypto transactions exceeding a certain threshold.

Perpetual KYC for Risk-Based Management

Firms are moving away from static KYC procedures in favour of dynamic, real-time assessments for quicker identification of anomalies and threats. This refers to perpetual KYC (pKYC), which enables businesses to utilize automation to manage risk and maintain accurate customer information efficiently. Any changes in identity or risk changes are automatically flagged, building a proactive KYC program.

The Use of Digital Identity and Cryptocurrency Wallets

To reduce onboarding friction while adhering to regulations, crypto platforms are exploring partnerships with digital identity networks that enable users to undergo verification once and reuse their credentials across multiple services. Decentralized IDV utilizes digital wallets to provide customers with greater control over their information through data portability.

Monitoring of Crypto Wallet Transactions and Financial Crime Risk Indicators

Staying KYC and AML compliant means taking proactive steps to ensure that all transactions are legitimate and comply with relevant regulations. Transaction monitoring solutions enable companies to track customer behavior. These risk indicators must be incorporated into broader fraud prevention and AML monitoring systems for integrated risk management. Dormant accounts and crypto wallets that suddenly become active or experience an increase in transaction volume require thorough oversight.

Key Takeaways

- Crypto scrutiny is rising as regulators deem the sector high-risk due to its security vulnerabilities, including large transaction volumes.

- UK Crypto firms must adopt crypto-specific FCA frameworks to meet and comply with AML and KYC regulations effectively.

- A risk-based focus, following FATF guidelines, enables firms to target high-risk areas efficiently while reducing friction for low-risk users.

- Robust integration, automation, and multilingual verification capabilities enhance user experience, boosting conversions.

- Perpetual KYC enables continuous, reusable verifications across platforms, reducing redundant checks and accelerating onboarding.

Final Thoughts on UK Crypto Trading Platforms

For crypto firms, staying compliant is about building trust, reducing fraud, and enabling long-term scalability while providing a seamless customer experience. Strong crypto KYC solutions enable businesses to unify regulatory requirements, including Travel Rule obligations and ongoing monitoring, while enhancing customer conversion rates.

A robust KYC process supports long-term scalability while ensuring a seamless and frictionless customer experience, which is crucial for maintaining a competitive edge in a rapidly growing and fast-paced market. Partnering with a trusted, FCA-aligned KYC service provider ensures that crypto firms are equipped to navigate the evolving regulatory landscape confidently and sustainably. Speak to a member of the team today.

Frequently Asked Questions

Who is the regulatory body for KYC in the UK?

The regulatory body for KYC in the UK is the Financial Conduct Authority (FCA). The FCA is the central regulatory authority responsible for overseeing KYC and AML programs for crypto firms in the UK. It establishes supervision for crypto asset exchanges aligned with the Money Laundering Regulations 2017 (MLRs).

Is KYC mandatory for all crypto businesses with customers in the UK?

KYC is mandatory for FCA-registered crypto firms operating and transacting within the UK to prevent money laundering and financial crime from anonymous transactions. In the EU, regulations such as the MiCA require firms to implement robust identity verification, ongoing monitoring, and strong consumer protection rules.

What are the risks of not doing KYC in the UK for crypto firms?

Crypto firms in the UK can be fined by the Financial Conduct Authority (FCA), facing hefty financial penalties, restrictions, and criminal prosecution for breaches of regulations such as Anti-Money Laundering (AML) rules. Not implementing KYC also exposes a company to security threats, fraud, and scams on its platform.

How can UK crypto trading platforms reduce user drop-off during KYC onboarding?

Platforms can reduce abandonment by utilizing automated, low-friction IDV solutions that expedite onboarding. Utilizing biometric checks, such as liveness detection, ensures both security and ease of use. Multi-language support also enhances accessibility, enabling users to complete verification without confusion.

How does ComplyCube support KYC verification for crypto services?

Aligned with the FCA and FATF’s standards, ComplyCube supports complete KYC verification for crypto services. It offers ISO-certified biometric and liveness detection, enhanced document security, and regulator-aligned workflows. Additionally, its real-time sanctions and PEP monitoring give crypto firms confidence to scale without high costs and complexity.