Digital Identity Verification, or IDV solutions, are being adopted faster than ever to act as online fraud prevention tools for businesses. The advent of Artificial Intelligence (AI) has had extensive effects on the digital world. Digital fraud escalates swiftly; preventative measures like deepfake detection technologies are thoroughly encouraged to help safeguard the digital economy and society.

However, current adoption rates of IDV services remain behind the adoption and development of malicious AI technologies used in fraud. This article guides readers through the dangers of modern fraud online and how firms can use IDV solutions to counter these developments.

The Rising Threat of Online Fraud

Digital fraud has changed. Identity fraud can now be conducted with AI technologies, such as deepfakes, to create lifelike and sometimes indistinguishable synthetic identities. These fraudulent methodologies can bypass many existing fraud prevention systems, delivering a resurgence in demand for new IDV technology.

Fraudulent Identity Documents

Fraudulent identity documents continue to threaten the digital economy. These fake documents, such as passports and driver’s licenses, are created with sophisticated techniques, bypassing existing online fraud prevention and security onboarding systems due to their meticulous detail.

- Counterfeit documents are reproductions of ID cards or other Know Your Customer (KYC) documents. They are made using high-precision printing techniques and official materials, and their resemblance to genuine documents is uncanny.

- Forged documents are authentic documents that have likely been stolen and tampered with. The tampering could be regarding the stock image, date of birth, or other details that the fraudster needs to change to commit malicious acts.

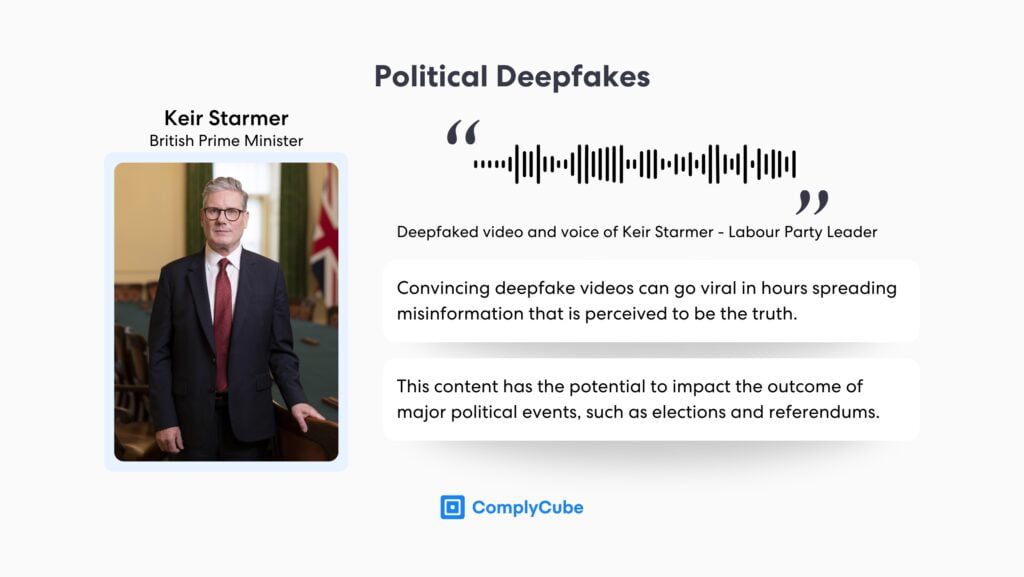

Deepfakes Threaten the Modern World

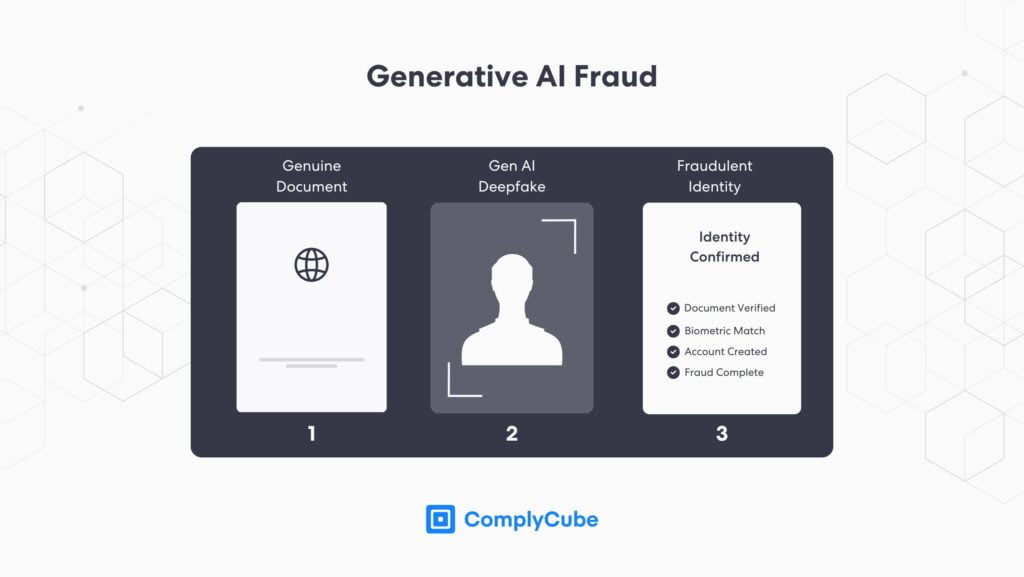

Deepfakes represent one of the most captivating yet alarming advancements in digital fraud. They utilize AI to generate ultra-realistic fake images, videos, sound, and other media, which can be used for multiple malicious activities.

- Misrepresentation in the media.

- Identity theft to bypass IDV.

- Blackmail and forced coercion.

- Sophisticated phishing scams.

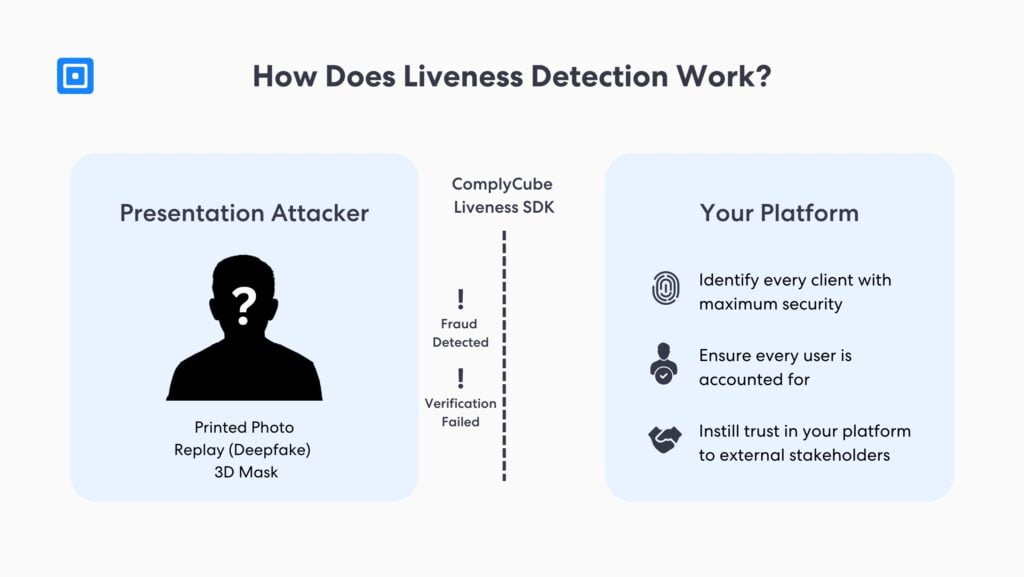

The most common detriment to businesses is the use of deepfakes in the Identity Verification process. Deepfake technology has become so advanced in such a short space of time that even relatively sophisticated IDV solutions can be fooled by them. This begs the need for businesses to search for the most intuitive and reliable KYC onboarding provider. For more information, read Deepfake Detection Software.

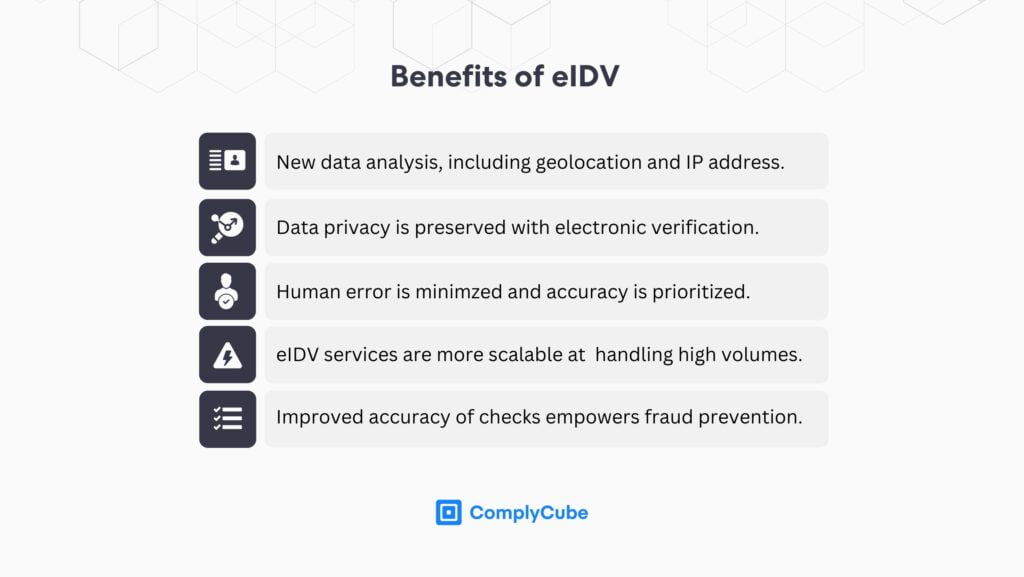

The Need for AI-Powered IDV Solutions

The Federal Trade Commission (FTC) reported significant increases in general fraud, with financial losses to consumers amounting to over $10 billion in fraud in 2023 alone. This represents a 14% increase from the previous year.

Digital fraud, however, is growing even quicker, and this is emphasized by the proliferation of deepfake attacks. A deepfake AI gang operating in the content of Asia reportedly drained a crypto Centralized Exchange (CEX) account of all of its funds in just 25 minutes.

The exchange in question was OKX, a leading CEX with a global reach that fell victim to fraudsters using deepfakes to bypass identity authentication software to gain total access to the account. This corroborates a recent ComplyCube guide discussing how the crypto industry, in particular, is currently battling a deepfake crisis. Learn more about the technology behind online fraud prevention by reading Why Identity Verification AI is Crucial.

Online Fraud Prevention and IDV Solutions

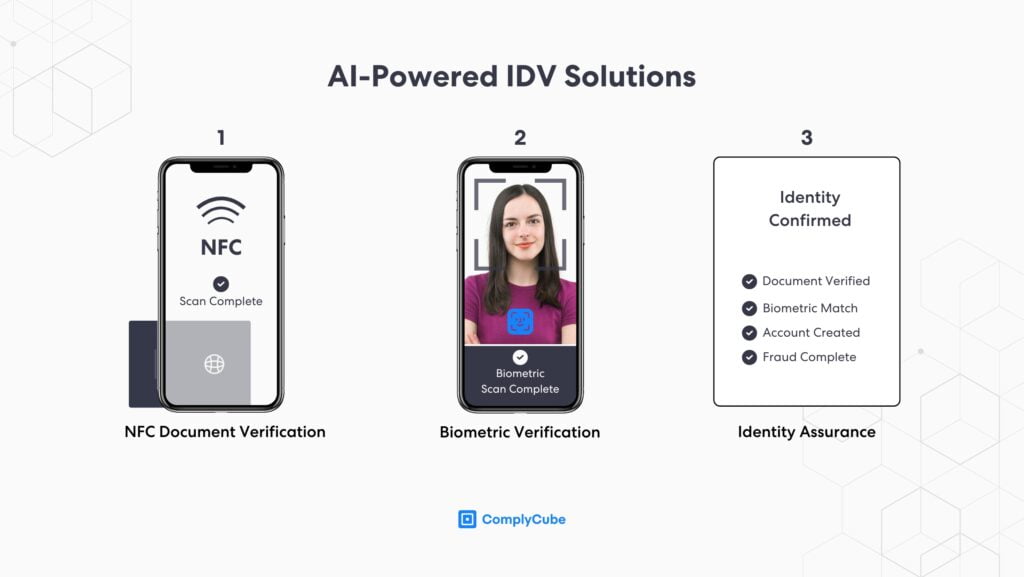

A robust KYC and onboarding process is the most effective method to prevent online fraud. With automated KYC, firms can scan a user’s identity document and match it against a selfie image taken live during the onboarding process.

These processes are known as document verification and biometric verification, respectively. Together, they form the foundation of modern KYC and, when developed properly, act as the best defense against online fraud and deepfakes.

Identity Verification Workflow

Document verification is designed to extract the user’s sensitive data while also verifying the document’s authenticity. Scanning for tampering or other counterfeit factors this process takes 15 seconds to complete, contributing to a frictionless customer experience with inbuilt protection against AI fraud.

This sensitive information immediately populates a user’s new account, including date of birth, and country of origin, amongst many others. The immediacy and availability of this data make ComplyCube’s IDV solution among the very best on the market.

Typically, for maximum identity assurance, this process is followed by a biometric verification which can take as little as 5 seconds to complete. Leveraging bespoke AI, this process analyzes facial biometrics with powerful liveness detection software built in. These selfie images are then compared to the stock image on the KYC document to ensure the person presenting the ID matches the selfie.

Furthermore, face recognition software can be used for biometric authentication, to safeguard users’ accounts from deepfake or other presentation attacks, and to mitigate against repeat sign-ups. Facial recognition software is a fundamental technology in ensuring that the same person cannot open more than one account.

These solutions are used widely across the fintech world to safeguard the account opening process. The benefit of operating under a SaaS model is that they are entirely cloud-based solutions that can be distributed easily across many different digital channels via an SDK or API.

Powerful Identity Verification SDKs and APIs

ComplyCube’s Identity Verification solutions can be integrated in multiple ways and are a leading factor behind the company’s success. However, its Software Developer Kits (SDKs) and Application Programming Interfaces (APIs) are market-leading.

These software tools can be integrated into your platform’s existing tech stack immediately and provide total access to ComplyCube’s dynamic IDV solutions. For more information about integration methods, read the company’s document page.

About ComplyCube’s Online Fraud Prevention Solution

The leading firm for IDV solutions has experienced a rapid accession in the compliance world. Operating with firms worldwide, ComplyCube works in the telecoms, crypto and fintech, digital banking, and finance industries, amongst countless others.

With 4 G2 awards from Winter 2024 alone, including ‘Easiest to use,’ ‘High performer,’ ‘Best support,’ and ‘Users most likely to recommend,’ it is easy to see why firms are choosing to work with the London-based compliance firm.

For more information on their online fraud prevention solutions, including Anti-Money Laundering, Know Your Customer, and Identity Verification solutions, get in touch with one of their specialists today.