TL;DR: As regulators increase the requirements needed to meet KYC and AML compliance, firms must benchmark their compliance spending to stay aligned. With startup AML pricing plans constantly evolving and a variable fintech KYC cost base, a KYC AML pricing benchmark can help develop strategies to optimize spend while reducing compliance friction.

Why is Understanding KYC and AML Pricing Important?

Defining a pricing benchmark for Know Your Customer (KYC) and Anti-Money Laundering (AML) is essential to managing compliance expenses effectively. Understanding the factors that drive the costs of KYC and AML helps organizations to make informed decisions. This results in operational efficiency while ensuring regulatory adherence remains flexible to emerging regulatory changes.

However, pricing remains a major challenge for many firms. Across multiple sectors, fees remain opaque and highly variable. Particularly for early and growth-stage teams, visibility into realistic ranges is limited, making long-term planning difficult. This guide covers key pricing drivers, industry-wide benchmarks, strategic optimizations, and future trends that can help institutions reduce costs and scale smarter.

KYC Compliance and AML Pricing for Regulated Entities

KYC and AML requirements combat financial crimes such as terrorist financing, tax evasion, and money laundering. Regulatory bodies such as the Financial Crimes Enforcement Network (FinCEN) in the United States, the Financial Action Task Force (FATF), and equivalent authorities in the UK, EU, and APAC regions have ramped up expectations for Customer Due Diligence (CDD) and Identity Verification (IDV).

For most businesses, especially for startups, KYC requirements are often a strain on budgets, yet non-negotiable for customer due diligence. For growth-stage firms and banks, the complexity of regulatory expectations increases as the organizations scale. Now, multilingual onboarding, ongoing PEP and sanctions monitoring, and digital audit trails have become crucial.

Delayed investment in a thorough compliance infrastructure often backfires, leading to rising operational costs, loss of relationships with prospective customers, and regulatory fines. A KYC AML pricing benchmark can help mitigate these risks. It provides a strategic approach to reducing the Total Cost of Ownership (TCO) across KYC systems and onboarding functions, reducing onboarding times, and optimizing financial risk management.

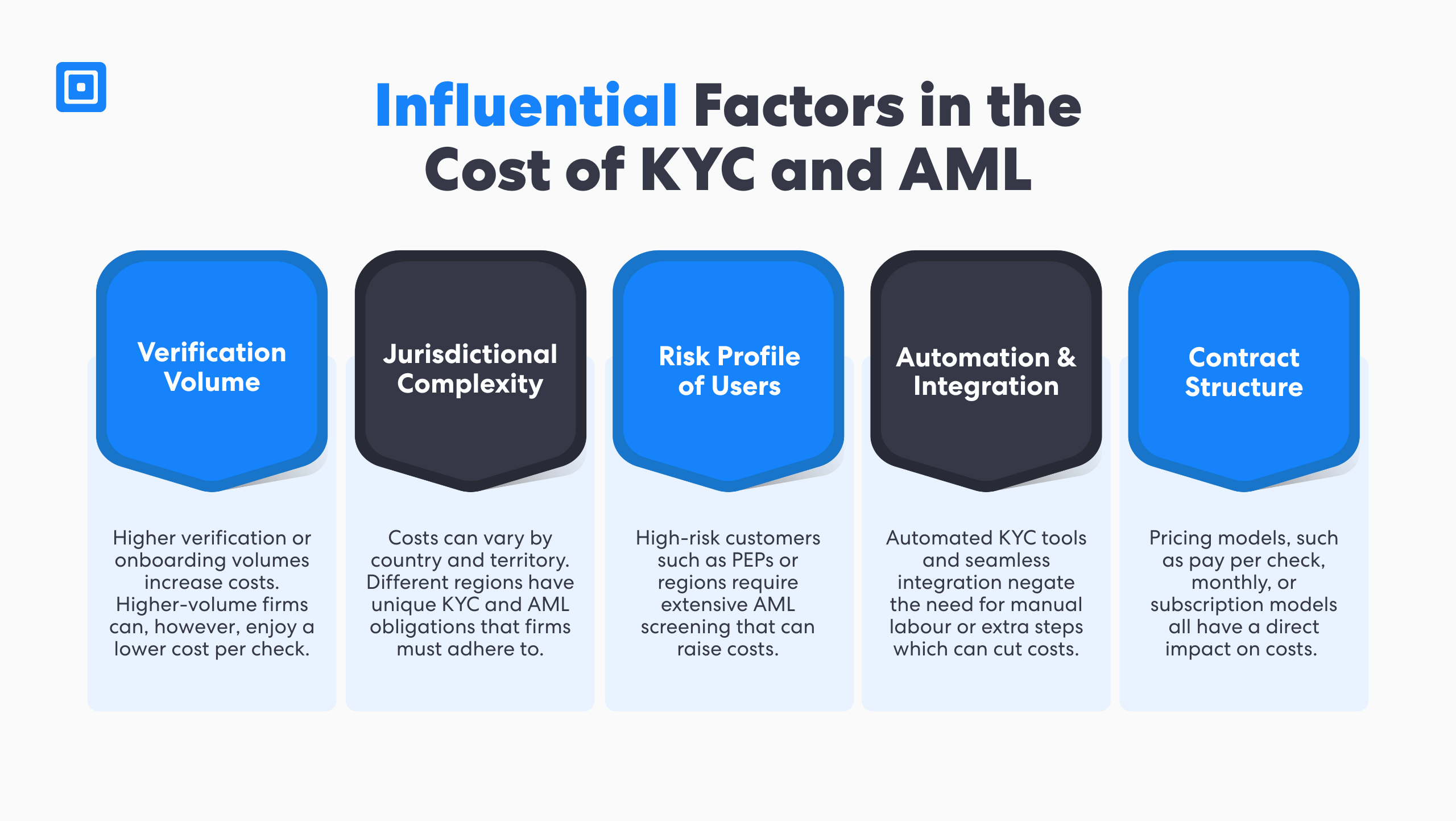

What Influences KYC and AML Pricing Structures?

Compliance expenses vary dramatically across organizations. From nimble crypto startups to multinational retail banks, a KYC AML pricing benchmark should not be the same from one sector to another. Factors such as the level of risk involved and the degree of automation can influence the mixture of checks that need to be conducted and the total cost base, with manual interventions driving up expenses.

Relying on manual processes leads to increased costs and a loss of potential business opportunities.

According to Fintech Global, manually driven processes can drastically undermine profitability. Large enterprises spend up to $500m yearly on CDD. With manual processes, organizations face potential human error, reduced efficiency, and a loss of business customers. Additionally, the scale of operations, regulatory environment, and the need for ongoing support for robust compliance can further influence overall expenditure.

It’s easy to overlook hidden expenses that can add up behind the scenes. Risk management teams could spend hours on manual reviews while potential customers drop out because the onboarding process is too complex. The main factors impacting KYC AML pricing benchmark include:

Verification Volume

The number of verifications performed directly impacts pricing tiers. Large enterprises typically opt for high-volume pricing packages, enabling them to onboard more customers. This leads to improved cost-efficiency in the long run, with many providers, including ComplyCube, offering a discounted average fee per verification for high-volume corporations.

Operating in multiple countries introduces regulatory fragmentation. Differences in regulations across regions can force firms to maintain separate regional processes, creating duplication of effort and inefficiencies. To achieve profitability, corporations need strong organizational alignment and to establish streamlined processes around global policies.

Risk Profile of User Base

Businesses serving high-risk sectors may need to conduct additional checks on their clients as part of Enhanced Due Diligence (EDD). This is especially true for companies in regulated markets with unique vulnerabilities, such as the banking, insurance, and cryptocurrency sectors.

Automation and Integration of Manual Processes

Automation with real-time ID verification and document parsing, reduce customer onboarding time and operational expenses. To make an informed decision, firms need to evaluate the ROI of a KYC solution by understanding the average fee of onboarding a single user through a manual process, then quantifying the investment needed to implement additional automation.

Contract Structure

Typical pricing models include volume-based pricing and tiered subscriptions. Some RegTech platforms offer discounted rates or credits as the number of checks performed or the committed account balance increases. In addition, startups can levy reduced pricing through various pricing subsidies.

If hidden expenses are overlooked, they can result in spending much more in the long run and seriously affect operations. Furthermore, firms must consider the opportunity cost of their chosen pricing model, as an inflexible contract can limit scalability and divert resources from research and development.

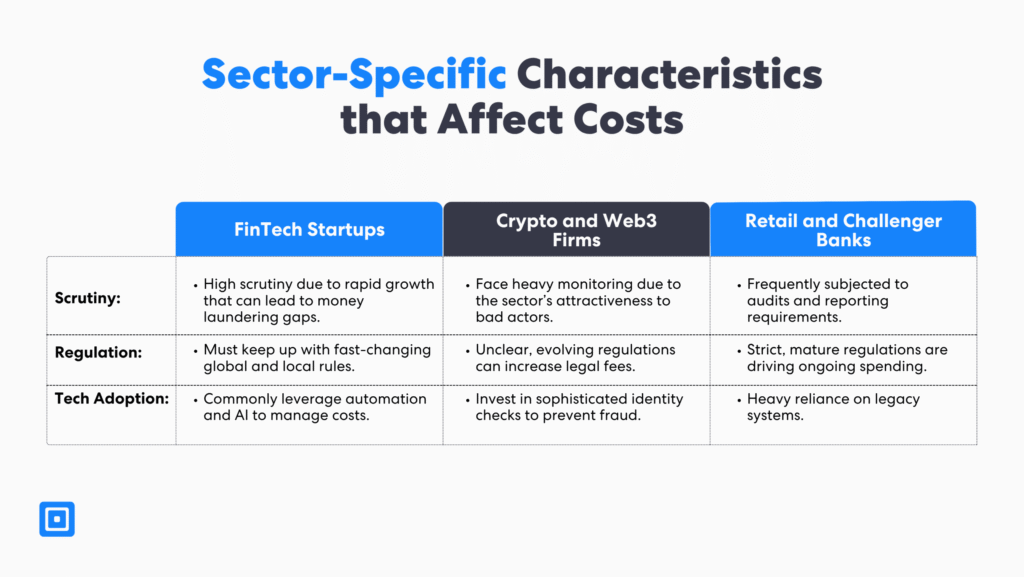

KYC and AML Expenditure by Sector

To make informed budgeting decisions, a KYC AML pricing benchmark could be developed per industry or use case. The product’s complexity, its geographic reach, and credibility impact its effectiveness and pricing. These variables influence the effectiveness of compliance efforts and the overall spend required to meet regulatory requirements.

Recognizing the unique characteristics of a sector is essential to understanding the main cost drivers. Firms in Crypto, FinTech, and Financial Services face intense scrutiny because the nature of their industry and its high transaction volumes can make them attractive targets for money laundering and fraud.

For crypto firms, regulations such as the EU’s MiCA regulation has increased scrutiny on this sector, while for financial institutions, regulations are much more mature. In terms of technology adoption, fintechs prefer AI and automation to boost operational efficiency, crypto firms invest in advanced fraud prevention solutions, while many traditional banks rely on legacy technology with manual oversight since decision-making and change management are slower.

The Compliance Cost for FinTech Startups

FinTech startups often prioritize fast onboarding without sacrificing regulatory demands. These companies favor plug-and-play identity verification solutions. With low-commitment pricing and entry-level plans, companies can avoid large costs in the early stages. Startups typically use basic identity verification, sanctions screening, and age verification services. Given limited in-house resources, many organizations rely on modular, scalable API-driven platforms.

Early-stage fintechs, in particular, benefit from simplified dashboards and automation-ready tools. These can reduce operational overheads, speed up deployment, and reduce false positives. This means a KYC AML pricing benchmark for a start-up may prioritize budget control and speed over product complexity. You can learn more here: How Much Does KYC Cost?

KYC and AML Spending for Crypto and Web3 Firms

Due to their higher risk profiles, cryptocurrency exchanges, wallet providers, NFT marketplaces, and DeFi platforms are subject to intense regulatory oversight. These entities must comply with global AML requirements, including the FATF and the EU’s MiCA framework, which require comprehensive internal controls, beneficial ownership disclosure, and real-time transaction monitoring.

Adverse media screening, continuous monitoring, sanctions screening, Politically Exposed Persons (PEP) checks, and dynamic risk scoring are typically required. To minimize platform risk and build regulatory trust, these firms must provide regulators with audit-ready data and implement innovative fraud detection screening systems to prevent false positives.

Retail and Challenger Banks KYC and AML Pricing

Retail and challenger banks face unique challenges. With thousands of monthly verifications, these institutions must balance compliance rigor and operational efficiency to manage expenses. Customer trust is vital in this sector and building secure and straightforward onboarding is crucial. For firms in regulated sectors, high-volume IDV, integration with core banking systems, and maintaining audit-ready documentation are critical.

Retail banks often adopt a hybrid model to manage these pressures, utilizing an in-house compliance infrastructure with trusted vendor solutions to enhance efficiency. As operations expand, improving operation models becomes essential for reducing manual workloads, enhancing auditability, and ensuring regulatory alignment. Investment in Optical Character Recognition (OCR), AI-driven analytics, and linear workflows support accuracy and faster onboarding.

Case Study: The impact of speed and automation on onboarding costs

Bots is an innovative cross-asset trading platform that offers AI-based trading. The platform has expanded quickly, garnering over 100,000 users who make daily transactions. Despite its quick growth, Bots faced operational bottlenecks, largely due to its onboarding process, which relies on manual verifications and reviews.

To address these challenges, Bots partnered with ComplyCube. The key driver in selecting ComplyCube was the platform’s ability to automate complex onboarding workflows and reduce operational effort. After analyzing various providers, Bots also discovered its need for extensive AML solutions, multi-bureau (2+2), and case management.

ComplyCube enabled Bots to satisfy its compliance challenges, lowering its total cost. Bots shows how firms can implement a KYC AML pricing benchmark effectively. Its team strategically analyzed the company’s characteristics, sector-specific obligations, and future regulatory needs. They determined the ROI of adopting an automated platform by comparing the cost of a manual check with the expense of automation.

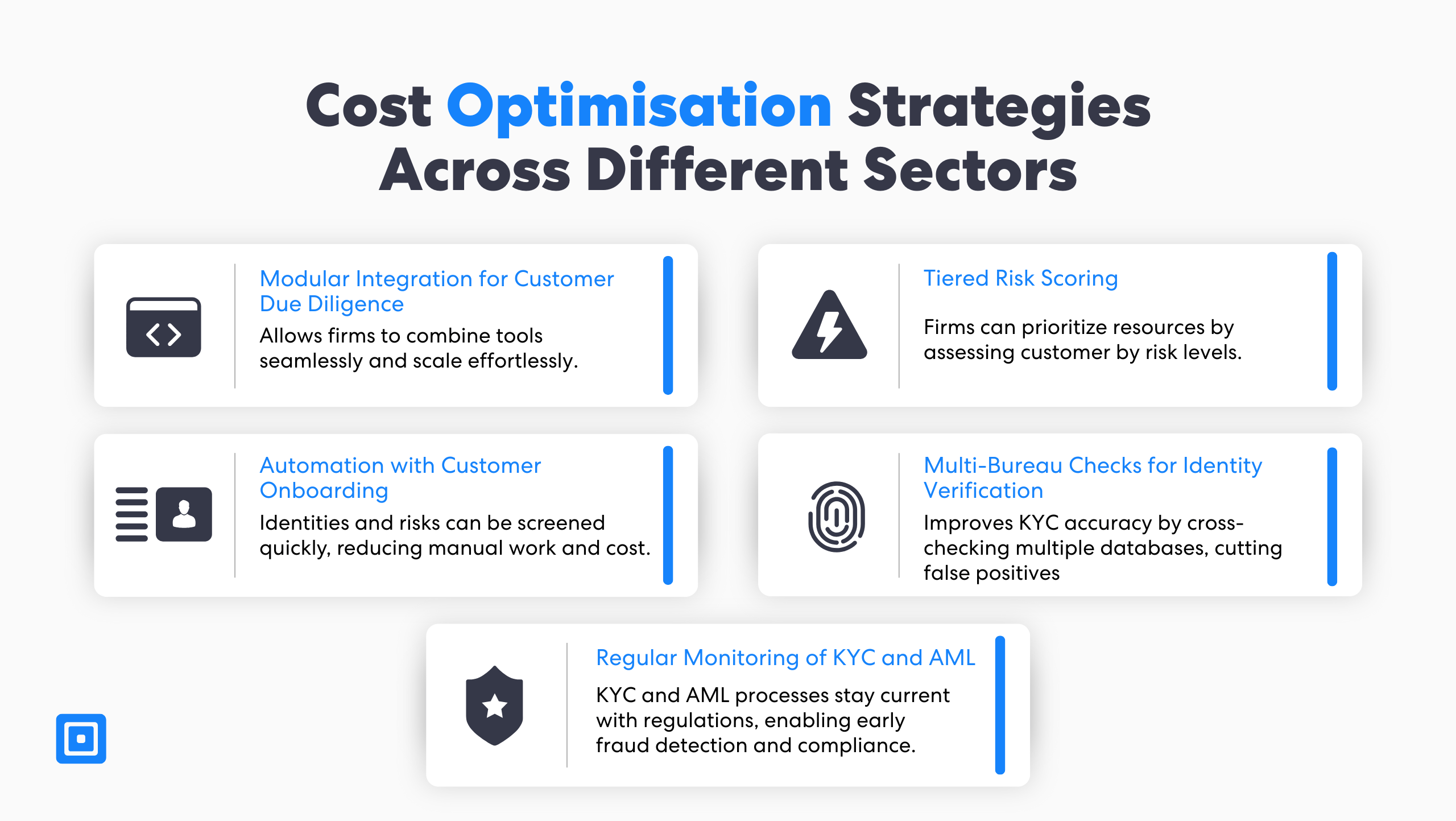

Cost Optimization Strategies in KYC and AML Processes

To make AML and KYC processes more profitable, there are several strategies that any corporation can adopt and implement. As organizations scale, achieving sustainable efficiency is crucial, requiring a mix of approaches, including developing a risk-based model and regular monitoring systems. The aim is to create an environment that can adapt and thrive as the company grows.

The evolution of technology supports this goal, helping risk management teams adapt faster to changing customer data, risk levels, and regulatory updates. Organizations can build long-term trust with regulatory bodies, clients, and investors alike by demonstrating its ability to ongoing alignment with governance standards and laws.

Modular Integration for Targeted Compliance

Instead of going all in on full-suite pricing packages, choose only the required services through modular solutions. Companies can plug in specific features that are mandatory for compliance and avoid paying for items that do not provide ROI in the long-run. This strategy offers firms an informed way to align their compliance budgets with key metrics and risk exposure, allocating resources where it drives the highest operational impact.

Investing in Automation during Document and Biometric Checks

Customers are highly sensitive to the customer onboarding process, with 74% mentioning they will switch to another solution if it’s complicated. Thus, investing in automation for customer onboarding can increase client retention and build brand loyalty as it forms a more straightforward process. Features such as OCR technology and liveness detection enhance the accuracy and quality of document and biometric verification without requiring manual intervention.

Implementing a Tiered Risk Scoring or Risk-Based Approach

When creating onboarding workflows, it is important to build them according to a customer’s risk level. This ensures low-risk customers can onboard quickly without requiring complex steps. Organizations can create a more tailored workflow, requiring comprehensive checks for high-risk users. A risk-based approach strikes a balance between overall profitability and regulatory adherence. You can learn more here: Navigating Enhanced Due Diligence.

Multi-Bureau Checks for Identity Verification

Multi-bureau checks enable businesses to cross-reference customer information against multiple global databases or credit bureaus in a single workflow. This eliminates duplication, enhances the reliability of identity assurance, and supports a thorough AML process. To further enhance security, businesses can implement a 2+2 multi-bureau check, whereby customer identity attributes are validated using two independent data sources.

Regular Monitoring of KYC Processes

Re-screening clients post-onboarding improves risk coverage and reduces frequent full KYC system reviews, lowering the total cost of compliance. ComplyCube supports these initiatives through scalable solutions for existing systems, including multi-bureau checks, continuous monitoring, and device intelligence. Financial institutions can reduce friction, improve audit readiness, and enhance the overall customer journey while remaining lean and responsive.

Future RegTech Trends that can Impact Pricing

Recent developments show a worldwide push to harmonize regulations and boost automation in regulatory management tasks. Organizations such as the FATF, along with the upcoming EU AML Authority (AMLA), are playing pivotal roles in establishing standards around data privacy and raising the baseline requirements for document verification across regions.

Imagine new accounts for digital ID systems that work smoothly and seamlessly, much like the EUDI wallet, making everyday processes quicker. At the same time, institutions are utilizing machine learning to detect fraud and non-compliance. This shift helps reduce tedious manual processes and cuts down labor costs, making the customer onboarding process feel more connected and user-friendly.

The role transparency plays is also increasing. Regulators and users demand more transparent and understandable processes, such as step-by-step policy adherence and transparent audit trails. All these trends point to a future where flexible, tech-savvy RegTech systems are essential for managing pricing and risk efficiently.

Key Takeaways about KYC AML Pricing Benchmark

A KYC AML pricing benchmark helps firms assess potential risks while optimizing compliance expenditure.

Tailoring benchmarks to niche business cases is crucial in crafting a balanced compliance budget strategy.

Automation and dynamic risk scoring can increase efficiency and cut expenses through greater accuracy and lower false positives.

Explainable AI and transparent audit trails reflect the current trend towards accountable and evidence-driven compliance.

ComplyCube is an all-in-one platform for KYC and AML compliance, providing better budget control while meeting global regulations.

Tailoring a KYC AML Pricing Benchmark Cost to a Company’s Growth Stage

The cost of KYC and AML requirements is universal. However, companies’ approaches depend on their size, sector, and risk appetite. Whether operating as a FinTech or expanding into new markets, understanding how KYC/AML regulatory compliance relates to the growth stage is essential. Leveraging features such as dynamic risk scoring, transparent audit trails, and document parsing can significantly cut spending while enhancing processes.

With the right tools and strategies, businesses can reduce verification fees, stay aligned with evolving regulations, and avoid reputational harm. Explore ComplyCube’s global KYC and AML compliance tools to reduce verification expenditure and improve operational efficiency.

Frequently Asked Questions

How much do AML checks cost?

AML screening cost varies. There are two types of screening: Standard and Extensive, which screen against different data sources and offer two different pricing options. An all-in-one platform offers companies access to more checks at a lower total cost, such as customer due diligence, ongoing monitoring, and multi-bureau checks.

What are the hidden fees in KYC and AML?

Hidden fees in KYC and AML come from setup fees, integration costs, and ongoing customer support. To prevent hidden fees, companies need to request full vendor transparency earlier. Request upfront costs and confirm the contract at the beginning stages to avoid unexpected financial strain.

What impacts the cost of KYC and AML?

The factors influencing KYC and AML cost include geography coverage, transaction volumes, and check mix required. Industry-specific risks and regulatory environments influence spending. Firms must assess the gaps in their current compliance stack to identify which checks and security layers are necessary. To align with future compliance expenses, businesses must consider business growth, such as country expansion.

What is the long-term ROI of automated AML and KYC solutions?

Automated AML and KYC solutions reduce manual efforts, prevent costly non-compliance penalties, and improve customer onboarding efficiency. Businesses that invest in scalable automated AML and KYC solutions can achieve compounding savings over time through better fraud detection, reduced false positives, and global regulatory adherence.

How does ComplyCube enable businesses to reduce the price of KYC and AML checks?

ComplyCube offers flexible, modular pricing plans. Its tiered and volume-based pricing models offer companies discounted per-check cost as verification volumes increase. Firms achieve more cost savings as they grow and onboard more customers. ComplyCube does not charge setup fees, delivering full pricing transparency. Its no/low code, automated platform lowers reliance on manual effort, providing cost reductions of 63%.