Anti-money laundering (AML) efforts are more crucial than ever for businesses of all sectors and sizes. Financial institutions, governments, and businesses must proactively defend themselves from financial crimes such as money laundering, terrorist financing, and sanctions violations. Global watchlist screening is one of the most effective ways of doing so. It plays a critical role in AML framework strengthening and adherence to international regulations. This guide will break down how global watchlist screening can help your businesses strengthen AML efforts.

What Is Global Watchlist Screening?

Global watchlist screening refers to the cross-checking of an organisation’s customers, transactions, or other parties against multiple authoritative global, regional, and local watchlists. These lists typically include individuals or entities suspected of involvement in illegal activities, such as sanctions lists, politically exposed persons (PEP) lists, or high-risk individuals and businesses. This allows organisations to detect and prevent risky business relationships from damaging their reputation or financials in the first place.

Why Is Global Watchlist Screening a Must for AML?

The global nature of financial transactions compels financial institutions to take the initiative in screening customers and business relationships that go beyond geographical boundaries. AML regulations and compliance expectations are becoming more rigorous, and fines and penalties for lack of compliance are becoming more severe. Watchlist screening averts:

- Money Laundering: The washing of “dirty” money from criminal activities, often through complex international transactions.

- Terrorist Financing: Supporting or enabling terrorism through the provision of funds or resources.

- Sanctions Violations: Engaging in business with or trading with individuals or entities listed on international sanctions lists, which can result in severe legal and financial repercussions.

By conducting full global watchlist screening, organizations can not only meet regulatory expectations but also be assured that they are secure from engaging in business with high-risk individuals or entities.

Key Features of Effective Global Watchlist Screening

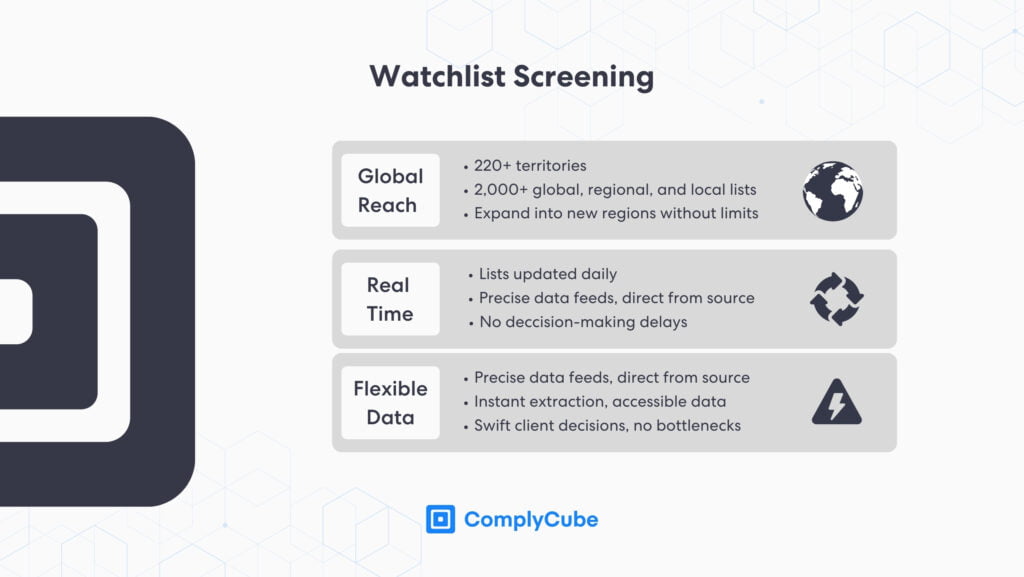

1. Comprehensive List Coverage

One of the main components of successful watchlist screening is access to a broad and diverse range of watchlists. Global watchlist screening solutions typically offer access to thousands of official lists from around the world, including:

- Sanctions lists: Issued by regulatory bodies such as the United Nations, the U.S. Department of the Treasury, and the European Union.

- PEP lists: A large database of politically exposed persons who may represent higher risk due to their position or influence.

- Adverse media and high-risk individuals: Lists of individuals or entities that have been implicated by negative news reports, investigations, or legal actions.

With multiple sources being used, companies make sure that they are leaving no stone unturned and protecting themselves from every direction.

2. Advanced Matching Algorithms

Traditional watchlist screening methods are weak in matching names precisely, especially in multilingual and multicultural settings. Advanced watchlist screening solutions use AI-driven algorithms to match names phonetically, account for variant spellings, and apply fuzzy logic to identify potential matches. This works to significantly reduce the occurrence of false positives so that companies don’t waste time screening irrelevant or low-risk subjects.

3. Real-Time Screening and Monitoring

Time is money in AML compliance. Banks must screen customers in speed without losing out on accuracy. Advanced global screening platforms offer real-time or near real-time screening, which ensures customers are screened the instant they enter the system. Continuous monitoring is also required to stay updated on any changes to the watchlists. A client who is not flagged initially may be added to a sanctions list at any time, so continuous monitoring helps mitigate the risk of exposure after onboarding.

4. Customizable Screening Parameters

No two businesses have the same risk profile. Effective global watchlist screening allows for the setting of parameters to suit an organization’s individual needs. This may be in terms of adjusting the sensitivity of name-matching algorithms or giving precedence to specific high-risk jurisdictions or sectors. By tailoring the screening, businesses can more directly align their compliance activity with their risk management policy.

5. Simple Integration with Existing Systems

AML compliance software must be simple to integrate with an organization’s existing systems and processes. Global watchlist screening can be integrated with customer onboarding systems, transaction monitoring systems, and customer relationship management (CRM) software. Using APIs or no-code/low-code solutions, this type of integration allows businesses to maintain a streamlined workflow while being compliant without adding complexity. For more on integrating AML and KYC solutions with your existing tech stack, read “What is an Identity Verification API?”

6. Scalability

As businesses grow and venture into new markets, their compliance efforts increase in volume and complexity. Global watchlist screening solutions must be scalable to handle an increasing number of customers, transactions, and regulations. Scalable systems ensure that businesses can meet compliance irrespective of their size or the complexity of their operations.

Real-World Impact: Strengthening AML Compliance

Global watchlist screening can significantly strengthen an organization’s AML program by:

- Mitigating Risk: It aids in the identification of high-risk individuals at an early phase, allowing companies to avoid relationships with criminal entities.

- Compliance with Regulatory Requirements: Companies can meet regulatory demands, escaping fines, sanctions, and legal battles.

- Safeguarding Reputation: By preventing business relationships with high-risk individuals or entities, organizations shield their reputation and maintain the trust of clients and stakeholders.

- Enhancing Efficiency: Real-time screening and automation reduce the need for human intervention, improving operational efficiency and precision.

Global watchlist screening is a cornerstone of AML compliance.

Harry Varatharasan, Chief Product Officer at ComplyCube, states, “Global watchlist screening is a cornerstone of AML compliance, helping businesses safeguard against financial crime by proactively identifying high-risk individuals and entities, ensuring integrity, and protecting both reputation and regulatory standing.”

Fortified AML Across Every Frontier with ComplyCube

Global watchlist screening is a key component of a strengthened AML compliance program. It equips financial institutions and businesses with the means to detect and prevent high-risk relationships, meet regulatory expectations, and safeguard their reputation. By harnessing the power of sophisticated matching algorithms, real-time monitoring, and flexible screening capabilities, businesses can strengthen their AML initiatives and traverse the landscape of global financial regulation with assurance.

In an increasingly interconnected world, leveraging advanced watchlist screening that is complete, automated, and scalable is not just a best practice, it is an imperative part of doing business in a compliant, secure, and responsible manner.

For more information on how to fortify your business with global watchlist screening, get in touch with one of our compliance experts.