The FATF’s 5th Round of Mutual Evaluations is expected to begin in 2025 and will put significant pressure on financial institutions to upgrade their existing AML/CFT systems. The FATF mutual evaluation framework is designed to analyze how well the FATF recommendations have been implemented.

This short guide covers what the Mutual Evaluation reports are, how they are changing, and what business and financial enterprises need to consider when choosing the right AML and CFT solutions.

What is the FATF?

The Financial Action Task Force (FATF) is an intergovernmental organization that sets the global standards for Anti-Money Laundering (AML) and Counter-Terrorist Financing (CTF) policies. In doing so, they promote the correct implementation of regulatory and operational measures to combat financial crime.

These standards are outlined in the FATF 40 Recommendations, in which over 200 countries and jurisdictions are committed to implementing these standards. This means that the FATF has a profound effect on the way financial organizations operate locally, nationally, and globally and has brought about major changes in laws from governments.

What are the FATF Recommendations?

As the FATF sets the precedent for its members, it is left up to the member jurisdictions themselves to decide on how to implement the 40 recommendations. This means that the global regulator’s guides are left somewhat open to interpretation, and the efficacy of the FATF recommendations is not always guaranteed.

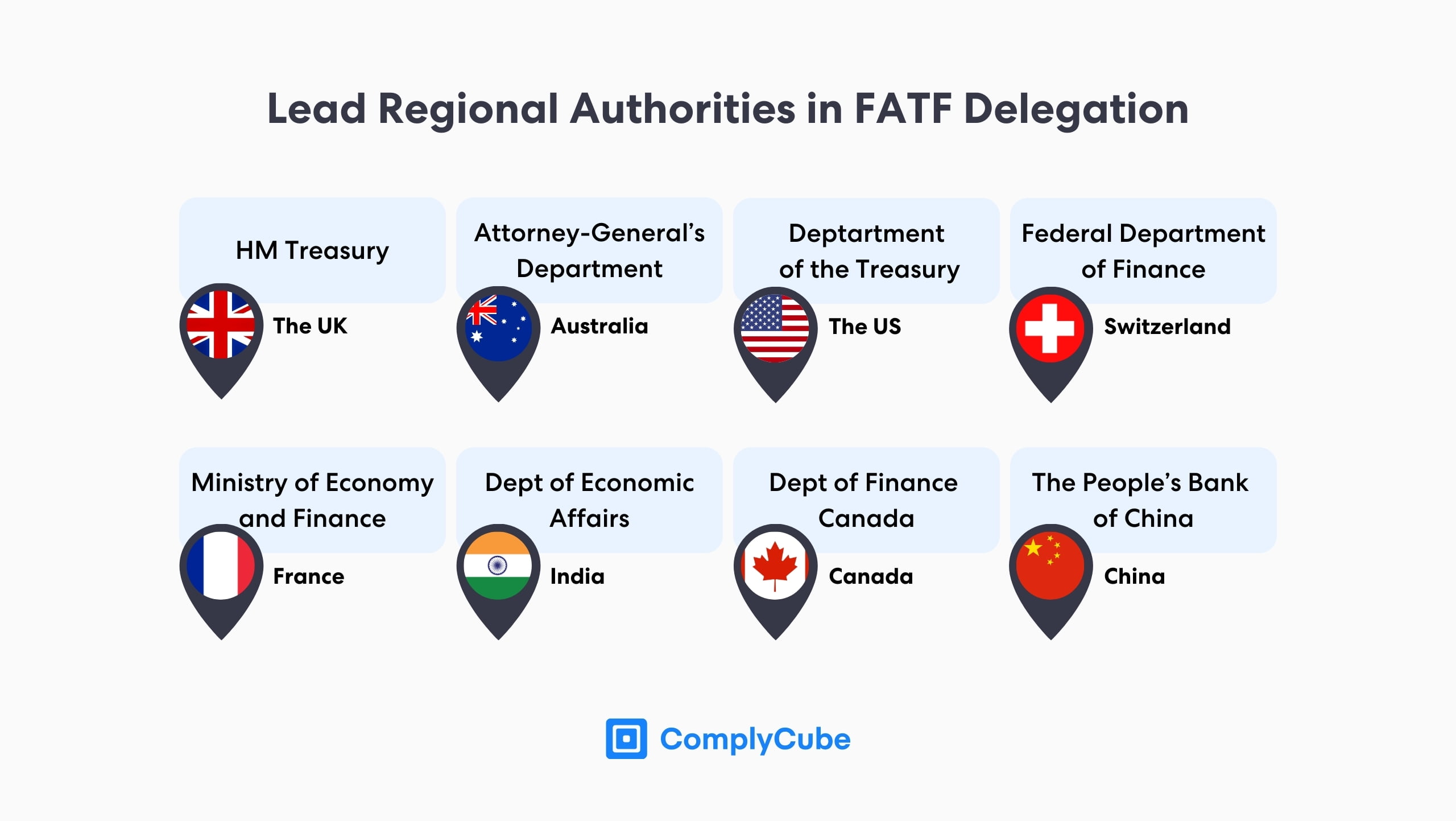

It is, therefore, the responsibility of national FATF-style regional bodies to successfully implement AML policy throughout local jurisdictions. While the FATF has a very strong authority over global AML regulations, they have no direct power when it comes to government agency enforcement or penalization of money laundering or financing of terrorism.

What are the Mutual Evaluations?

A mutual evaluation is the methodology of assessing the compliance of each member’s AML framework as influenced by the FATF standards. These are particularly insightful for both the FATF and its members as they:

Provide a starting point whereby areas of improvement (and non-compliance with their recommendations) are identified, and

Inform the agency itself of areas they can improve in regarding recommendation quality, depth, and expectations.

Each country can then strengthen its framework accordingly, boosting the effectiveness of global AML, CFT, and other financial crime prevention strategies. The evaluations, therefore, can be seen as an ongoing initiative to align national policies combating money laundering with the FATF.

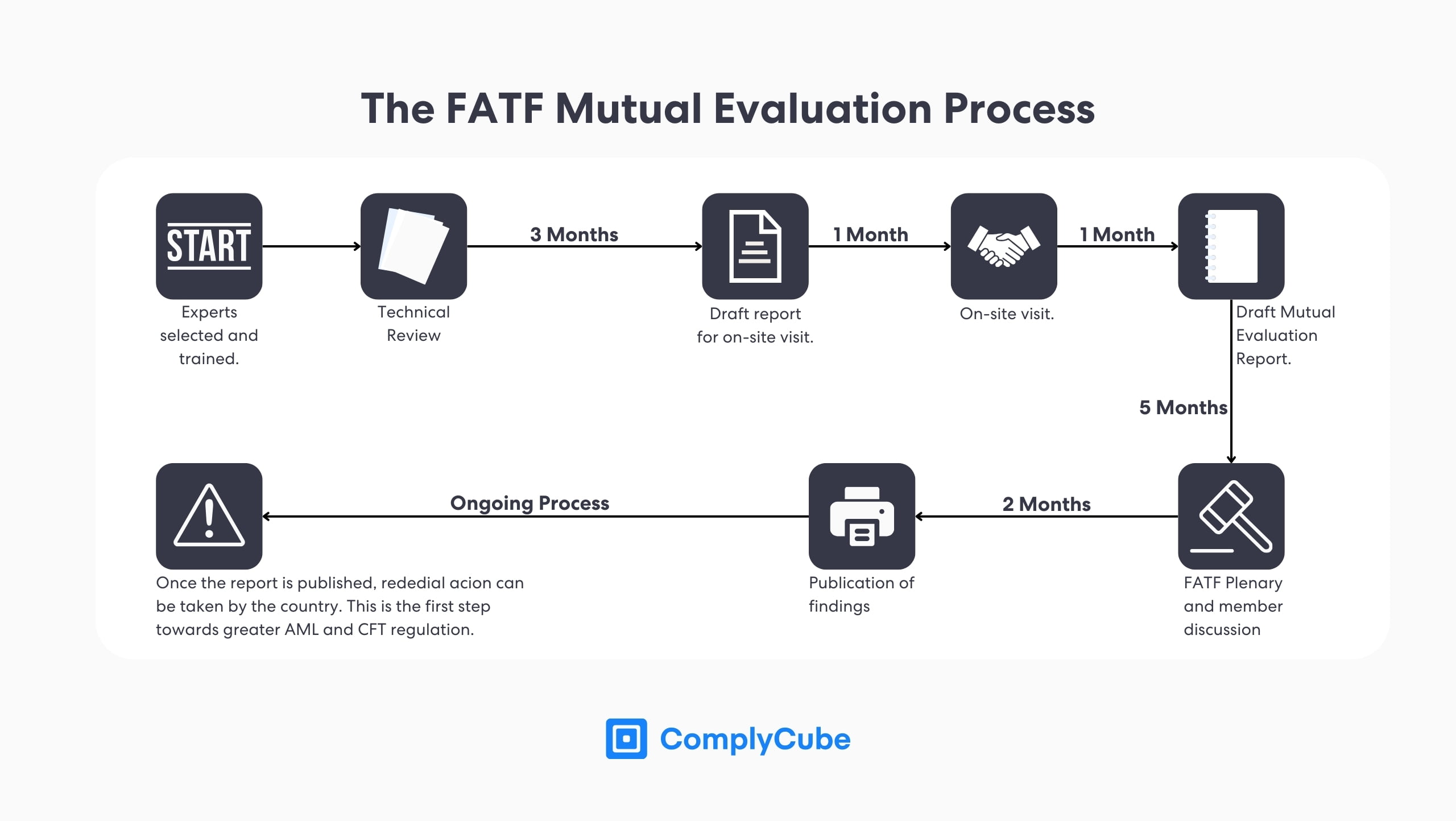

The Mutual Evaluation process historically can take up to 18 months and consists of multiple stages:

Compliance experts are trained in the recommendations and methodology for assessing compliance with the FATF.

Financial professionals (central bank officials) from the assessed country are given training so they are familiar with the processes and expectations of the FATF.

Assessors are selected depending on the specific requirements for the assessment, such as language and legal barriers that can be particular to a jurisdiction.

The analyzed country provides the assessors with details about its financial regulations and laws and how they compare to the FATF’s guidelines. This takes around 4 months.

The assessors undertake a preliminary scoping exercise ahead of an on-site visit. This is done to ensure their focuses are correctly placed during the analysis.

Assessors attend the country’s policymaking financial system venues and the private institutions that are subject to those policies. There are 11 key areas that the assessors will be analyzing for effectiveness and 40 for technical compliance.

Following the on-site visit, the assessors will draft their report, finalizing the mutual evaluation report with findings from both the effectiveness and technical compliance with the FATF.

The assessors present the draft to the FATF Plenary at a tri-annual meeting. A consensus is gathered here from members to ensure the ratings are justified and fair.

A final quality review is undertaken by all countries in the organization to mitigate technical inadequacies before publishing.

All countries are then liable to a follow-up assessment. This can range from regular reports to public warnings issued against a country for repeated and insufficient remedial actions.

Technical Compliance vs Effectiveness

Technical compliance assesses whether a FATF member has the right laws and regulations in place for an AML/CFT framework. This includes 40 ratings that determine to what extent the country’s laws and regulations are inclusive of the FATF requirements.

The Technical Compliance Ratings Include

Compliant – No shortcomings.

Largely compliant – Minor shortcomings.

Partially compliant – Moderate shortcomings.

Non-compliant – Major shortcomings.

Not applicable – There are requirements that do not apply due to lacking national infrastructure.

The Effectiveness Ratings

Effectiveness, on the other hand, measures whether these AML/CFT systems are working and whether the FATF member is achieving the specific outcomes recommended by the FATF themselves. 11 ratings are used to reflect the extent to which a country’s regulatory systems are effective:

High level of effectiveness.

Substantial level of effectiveness.

Moderate level of effectiveness.

Low level of effectiveness.

For more information on this, read the FATF’s report from 2022.

5th Round of Mutual Evaluations

The 5th round of mutual evaluations will usher in a wave of new changes since the 4th round of mutual evaluations in 2013. Unlike the previous rounds, which usually lasted 10 years on average and had a follow-up assessment after 5 years, the next round of evaluations will be significantly shorter over a 6-year cycle.

After a FATF member’s mutual evaluation, countries will only have three years to take action on the gaps identified by the Financial Action Task Force. The consequences of not addressing these deficiencies can lead to the FATF publicly escalating them, which can have significantly negative economic implications for countries.

Public escalation can lead to a reduction of foreign business and a damaging economic and regulatory reputation that is hard to shake without a significant investment of time and resources. For this reason, it is vital to effectively implement the FATF recommendations.

The purpose of this shorter review cycle is to put greater scrutiny on FATF members and is a strategic decision to ensure governments stay on top of implementing AML laws, regulations, and policies in line with the 40 recommendations. This remains on trend with regulatory movements across the globe, where there seems to have been a concerted agreement to improve AML compliance.

The 5th round of mutual evaluations will start once all members have been assessed against the current methodology, meaning they will likely come into force in 2025. This new round will also be placing a greater emphasis on effectiveness to make sure that countries are implementing regulation to the best of their ability.

Financial services, therefore, must be prepared for the increased pressure they are going to face from regulators to ensure that the AML/CFT systems they are using are in line with FATF’s new results-orientated FATF mutual evaluations.

This begs the question, what should financial services look for in an AML/CFT verification system?

What to look for in an AML/CFT verification system?

As the FATF is pushing for the next round of evaluations to be results-orientated, financial services will not be able to get away with just purchasing a new AML system. What the international organization really cares about, and thus what is important to its member regulators, is how these systems are being used to implement the FATF recommendations.

Effective AML/CFT systems are responsive. Providers of AML, KYC, and CFT solutions should have real-time data feeds of global watchlists, sanctions, and PEP requirements. It is true that financial services in FATF member countries will already be aware of and have access to these lists.

However, how they are gathering this data, and leveraging and integrating it into their AML systems to screen customers will be crucial. These data sources are continuously updated due to unforeseeable geopolitical events which lead to swift spikes of sanctioned entities and individuals.

Furthermore, the digitalization of the global economy and innovations in fraudulent activities have made manual retrieval of these data fields an inefficient process. Organizations must adopt a system that takes care of this intensive task for them, where they can access lists that are continuously updated and monitored. They can take advantage of services such as continuous monitoring helping to increase operational efficiency.

Data accessibility is equally important. Compliance teams must be able to carry out their investigations quickly, from the initial alert to a final remedial act. It is very easy for compliance teams to get overwhelmed with an overload of data. This necessitates a system that enables KYC and AML analysts to intuitively act on certain alerts.

Investigative portals are being more commonly used to facilitate these actions. These platforms hold all the necessary data for all stages of an analyst’s investigations into a customer so they can make informed and timely decisions.

Lastly, although false positives will always be an inherent part of AML screening, there has been a growing trend of utilizing artificial intelligence and machine learning in automation settings to reduce false positives. This helps investigators cut through the noise and only focus their time and resources on the individuals who pose the biggest threat to their organizations. This would help to actualize the results that the FATF desires.

About ComplyCube

ComplyCube is a leading provider of AML, KYC, and IDV solutions. The company’s motivation is to build trust at scale and was founded upon key compliance gaps in the international financial system. Boasting identity verification workflows that can be completed in under 30 seconds, they operate in 220+ regions, accept 13,000+ documents, and have partnered with a range of proprietary and institutional AML data lists.

This has made the KYC provider a reliable solution to combat money laundering, striking a balance between operational efficiency and regulatory adherence. ComplyCube has been the choice of partner for a range of companies, including financial institutions, virtual asset service providers, telecoms, and many more.

The ability to continuously adjust, iterate, and shape compliance strategies is fundamental to modern-day compliance teams. This will be particularly pertinent when 5th round of mutual evaluations comes into full effect.

If your business is challenged by anything discussed throughout this article, it might be time to partner with a KYC service. Start a conversation today.