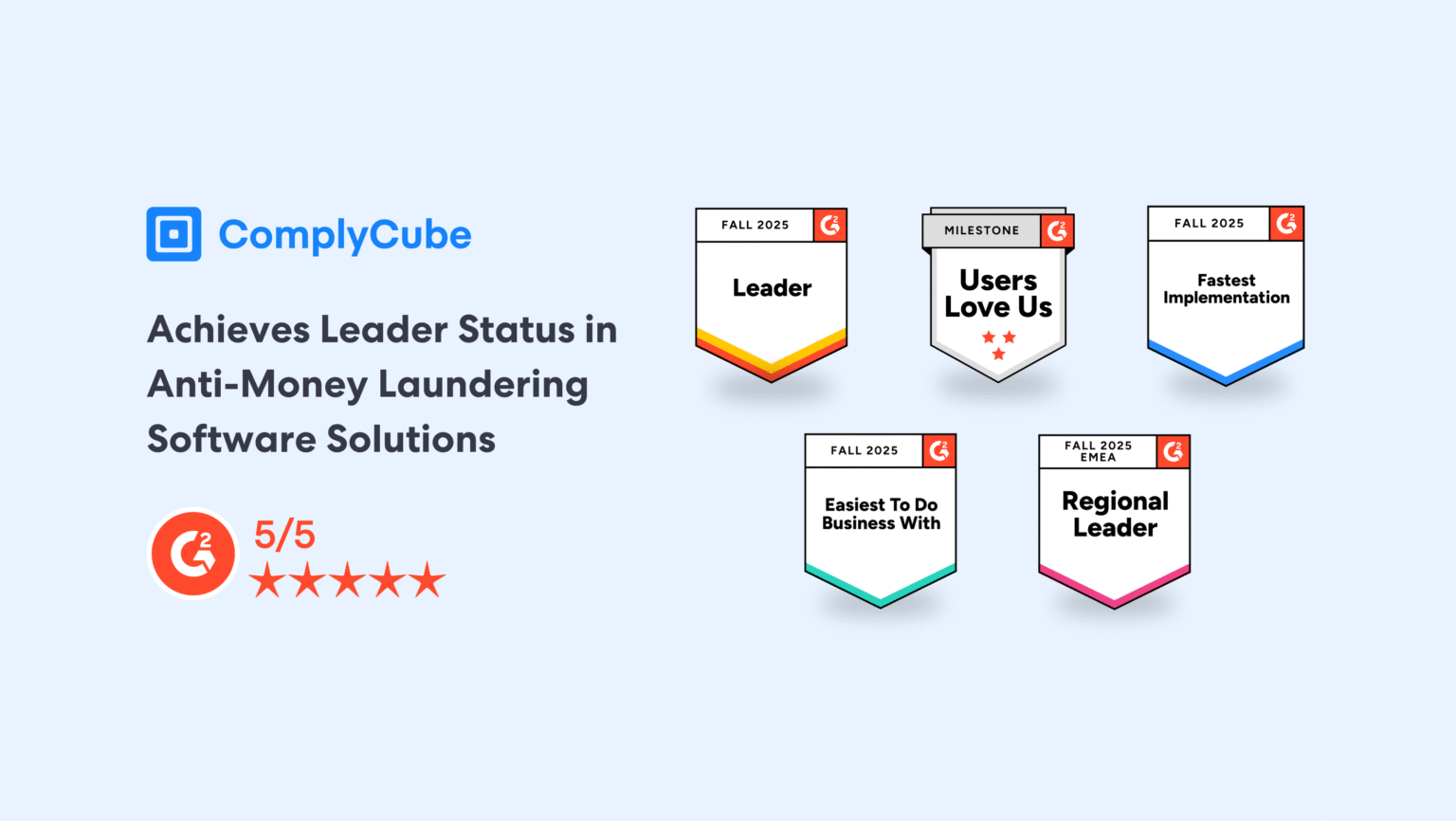

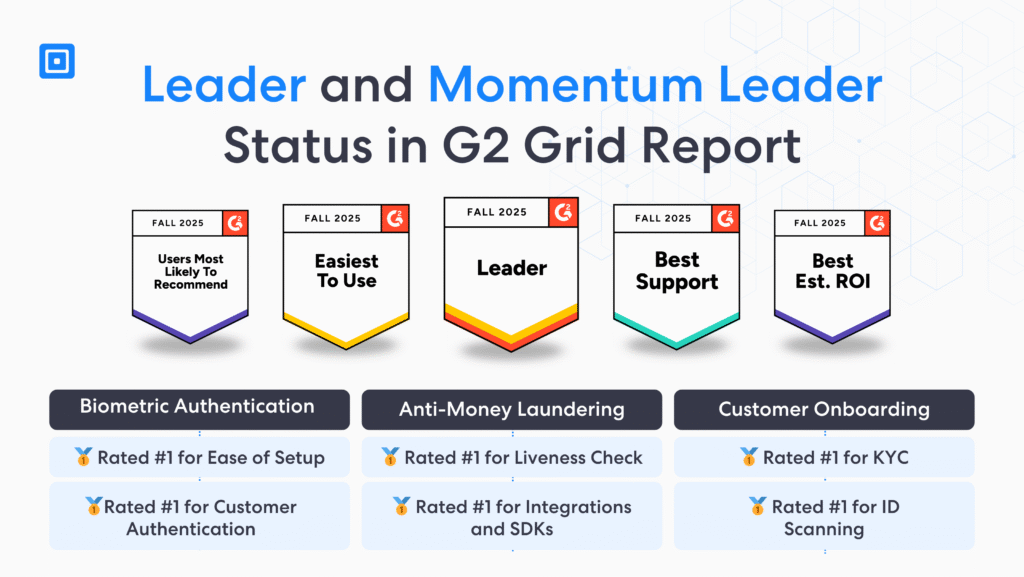

London, September 9, 2025 – ComplyCube, the RegTech provider with the largest number of identity profiles certified under the UK’s Digital Identity and Attributes Trust Framework (DIATF), continues to set industry standards for Anti-Money Laundering (AML) and Know Your Customer (KYC) excellence. The company has once again distinguished itself as a Leader in several key categories, including Biometric Authentication and Digital Customer Onboarding. Retaining its AML industry Leader status and overall 5-star rating in the G2 Fall 2025 Report, ComplyCube stands out as a trusted partner for Fraud Prevention and Customer Onboarding.

Industry Challenges Driving RegTech Adoption

In the latest G2 Fall 2025 Report, ComplyCube was featured in 82 reports and accumulated 107 badges, positioning itself as a Regional Leader in the Small-Business EMEA Grid Report and High Performer in the Enterprise Grid Report for AML. These achievements underscore the company’s strong performance across both small and enterprise-level AML solutions.

As the leading review site for business-to-business software, G2 enables customers to submit unbiased feedback about their experiences with SaaS solutions. G2 categorizes these reviews to support organizations in making more confident and well-informed buying decisions.

Regulators worldwide have issued over $6 billion in AML fines. With heightened regulatory scrutiny and the prevalence of fraud, more businesses are now turning to smarter AML and KYC software for better compliance and security. According to compliance executives, data protection and privacy (51%), corporate governance (40%), and compliance risks such as AML and fraud (38%) are their top priorities. These findings highlight the need for AML solutions that offer speed and accuracy to realize long-term cost savings.

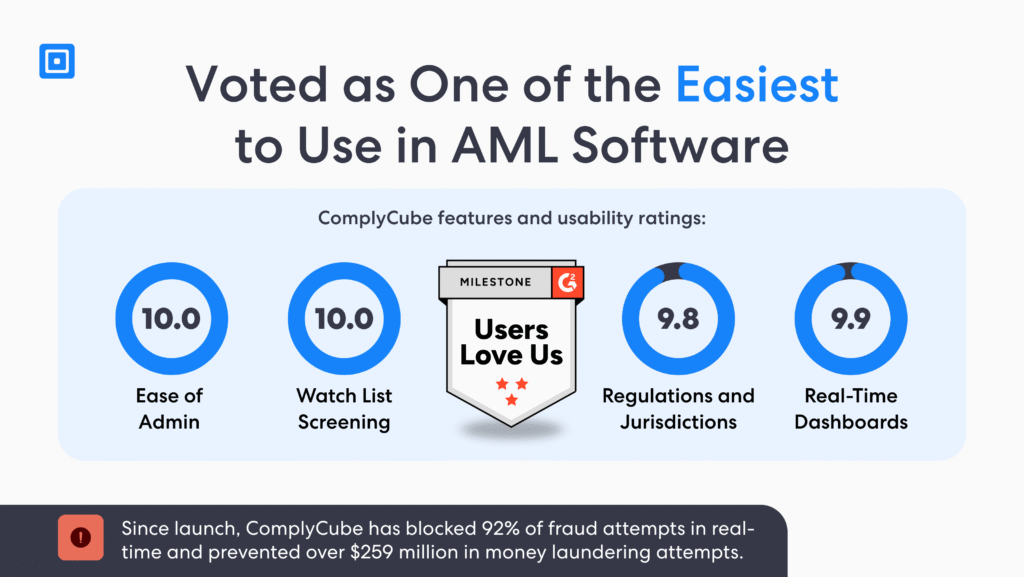

ComplyCube Secures Best Usability for Anti-Money Laundering Compliance

ComplyCube enables organizations to efficiently navigate the growing complexity of compliance, making AML, IDV, and KYC compliance straightforward. Voted Regtech Partner of the Year and listed in the prominent FinCrimeTech50 list, the AI-driven platform offers scalable, automated, and customizable AML screening workflows in real time for businesses worldwide. ComplyCube streamlines compliance burden by offering an all-in-one solution for organizations to stay aligned with evolving cross-border regulations.

Operating in over 230 territories and adhering to international laws such as the FCA’s risk-based approach, FinCEN’s customer due diligence rules, and EU AMLD obligations, the platform equips firms with pioneering AML features such as real-time no-code automation rules to minimize false positives, ongoing monitoring against 3,000+ watchlist and sanctions databases, Politically Exposed Persons (PEPs) screening, and adverse media checks against 5,000+ media outlets. The platform supports a 98% onboarding rate in under 30 seconds while maintaining 100% service uptime.

Recognition for Best ROI and Customer Support in the G2 Fall 2025 Report

According to Grant Thornton’s 2024 RegTech and Regulatory Change Report, 54% of businesses cite cost, ease of use, and operational effectiveness as their top three considerations when selecting regtech vendors. It’s clear that organizations are moving towards AML and KYC solutions that can streamline operational efficiency while delivering high ROI.

In the G2 Fall 2025 Report, ComplyCube ranked highly for user ease indexes, securing badges for best support, best estimated ROI, and easiest to implement across fraud prevention, identity verification, and address verification. Whether a startup or enterprise, businesses of all sizes benefit from the company’s low point of entry. Leading organizations across the fintech, crypto, and accounting industries can leverage the platform with no coding expertise required.

To make implementation manageable, ComplyCube offers free setup, a 14-day free trial, and robust documentation guides for seamless integration to a company’s current systems. The company holds several internationally recognized certifications for information security, quality, effectiveness, and privacy, including ISO 27001, ISO 9001, the UK’s DIATF, and ISO 30107. Businesses can have peace of mind knowing that their customer data is encrypted to the highest international standards.

Building Customer Relationships that Last

According to the PWC Global Compliance Survey 2025, 85% of respondents remarked that compliance requirements have become more complex in the last three years, with compliance and risk management teams across industries experiencing the impact of expanding regulatory requirements.

Vendors and organizations alike must cultivate a culture of curiosity and continuous innovation.

“Compliance executives are feeling the pressure of keeping up with regulators worldwide” remarked Dr Tarek Nechma, CEO of ComplyCube. “Vendors and organizations alike must cultivate a culture of curiousity and continuous innovation. At ComplyCube, we are always stress-testing and developing technology that can make compliance less complex, while also getting ahead of sophisticated deepfakes and fraud.”

ComplyCube aims to navigate these challenges by making AML compliance and technology implementation easier for businesses. In the G2 Fall 2025 Report, ComplyCube has achieved above-average adoption and implementation scores across categories such as reference checks, fraud prevention, and biometric authentication.

We continue to expand ComplyCube’s functionality with cutting-edge regulatory solutions.

“The ComplyCube team is very proud of this recognition from G2. We maintain a feedback loop to ensure our clients know that we are there to support them should they have any issues. Our operating principles, such as trust and stewardship, extend to our relationships with our clients and partners. We continue to expand ComplyCube’s functionality with cutting-edge regulatory solutions as compliance challenges evolve,” adds Mohamed Alsalehi, Chief Technology Officer of ComplyCube.

About ComplyCube

ComplyCube is a UK DIATF-certified, award-winning solution and AML industry leader. Trusted by leading financial institutions, the platform utilizes state-of-the-art features, including liveness detection and device intelligence, to support businesses in accurately identifying customers and combating money laundering. Backed by over 3000+ trusted databases and partners globally, ComplyCube delivers one of the industry’s widest coverage levels for AML screening and multi-bureau checks.

About G2 Software

G2 is known for being the largest and most trusted software marketplace in the world, enabling businesses to discover and purchase software solutions based on unbiased customer feedback. The G2 2025 Fall Reports are part of G2’s commitment to providing customers with market analysis and research into software capabilities. Organizations are empowered to make confident and streamlined technology decisions based on transparent reviews covering pricing and unique selling points.