TL;DR: Budgeting for Identity Verification (IDV) effectively using a KYC cost calculator is crucial for ensuring operational efficiency while delivering a seamless customer experience. This guide breaks down the main cost drivers, strategic compliance cost planning steps, benchmarks, and practical tools to forecast and manage digital identity verification spend with confidence.

What Does Compliance Costs Refer To?

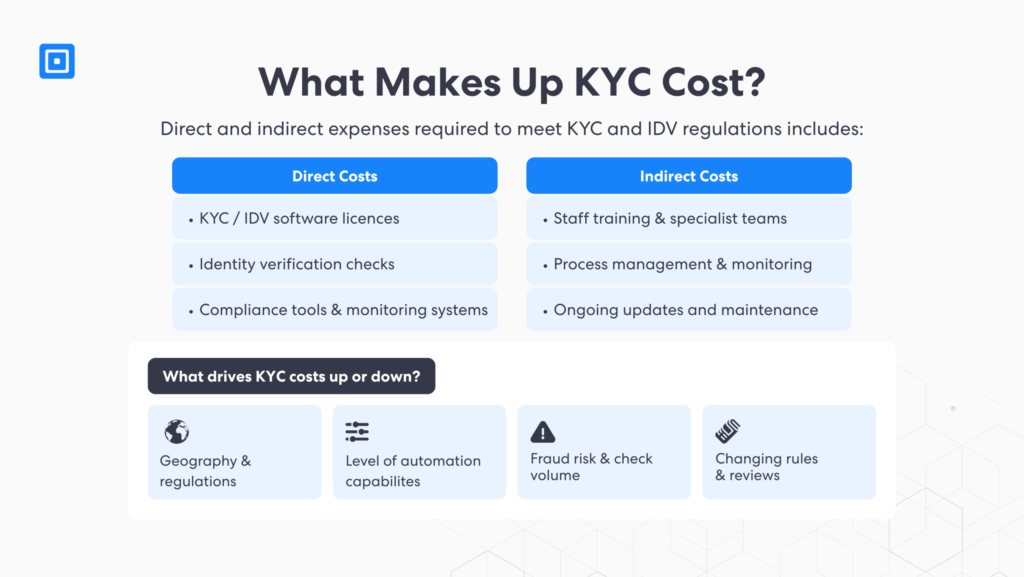

Compliance costs encompass the total amount of money spent by businesses to meet current regulations and standards established by the relevant regulatory authority. In Know Your Customer (KYC) compliance, costs refer to the expenses required to satisfy identity verification and data privacy laws. The cost of KYC includes direct costs, including compliance software expenses and IDV checks, as well as indirect costs, including staff training and monitoring software updates.

Strong IDV processes support secure onboarding, protection against fraud, and compliance with global standards. For financial institutions and international service providers, forecasting these costs is rarely straightforward. For example, the technology used and the verification volume required significantly impact the cost of compliance. Furthermore, fluctuating verification volumes, evolving fraud risks, and regulatory updates introduce an additional layer of complexity.

The Complexity of Compliance Cost Planning for Identity Verification

Identity verification costs are complex due to variable factors. However, the importance of IDV solutions cannot be overstated. In 2024, UK Finance reports £722.0m in unauthorized fraud, with over 109,000 cases involving ID theft. Yet, many organizations underestimate the true cost of implementing robust systems.

The total gross losses from unauthorized fraud, including counterfeit card fraud, remote purchase fraud, and ID theft, totalled over £722.0m.

Additionally, businesses often account for initial IDV solution fees but overlook hidden costs, including compliance with multiple jurisdictions, infrastructure, and staffing. Furthermore, regulatory adherence to enhanced due diligence and ongoing monitoring to meet Anti-Money Laundering (AML) standards can lead to higher compliance costs if not factored effectively. Failing to account for these costs can lead to unplanned, reactive spending during audits. Proactive planning, by contrast, enables scalability and cost-efficient growth from the outset.

Core KYC Operational Costs of Compliance and Key Drivers

According to research by PwC, financial institutions face annual regulatory compliance costs that exceed £33.9 billion, accounting for over 13% of operational expenses. The rising cost of KYC compliance places a significant strain on a company’s operational budget. Additionally, compliance teams are feeling the pressure from evolving regulations, with 85% reporting that compliance processes and requirements have become more complex over the last three years.

Understanding the key factors that drive the true cost of compliance in KYC, such as verification volume, check types, and pricing models, is crucial for strategic planning. It also enables businesses to achieve cost savings while avoiding non-compliance, which can lead to reputational damage and legal fees.

Verification Volume

The number of identity verification checks performed by a business directly influences compliance costs. However, many vendors offer lower costs per check to high-volume firms, thereby boosting long-term cost savings. Alternatively, some providers provide fixed costs based on a monthly pricing model, allowing a predictable budget and cost effectiveness.

Verification Types

Standard verification of documents, facial recognition, or biometric authentication processes typically have separate pricing tiers. Layers, such as liveness detection, multi-factor authentication, or risk assessment, further increase complexity and spend. Businesses, particularly those in regulated sectors, must determine the level of assurance and risk appetite appropriate for their use case.

Jurisdictional Complexity

Companies operating in multiple regions must comply with local and international regulatory requirements. Different jurisdictions have specific legal requirements, including data privacy laws and accepted verification methods. Organizations incur increased associated costs when utilizing significant resources, such as higher expenses in staffing, training, and software licensing, to maintain compliance.

Manual Review vs. Automation

Manual tasks in KYC drive up costs due to labor-intensive administrative tasks, human error, and longer document retrieval time. With automated workflows, organizations can achieve faster data extraction and validation, as well as make real-time decisions. Automation streamlines compliance processes, enabling firms to reduce operational overhead and costs effectively.

Vendor Pricing Models

Vendors may offer pay-as-you-go, subscriptions, or tiered pricing. Some providers bundle multiple services, such as customer onboarding and biometric technology, while others price them separately. Choosing the right pricing model is crucial for striking a balance between scalability and expenditure. By planning for these drivers, businesses can effectively control costs and maintain operational agility. You can learn more here: Understanding the Essentials of KYC Pricing Models.

Case Study: Crypto Markets in South Korea Transition to Increasingly Regulated Environments

South Korea Intensifies Oversight and Fines on Cryptocurrency Exchanges

Regulators in South Korea have penalized leading crypto platforms as they aim to enforce heightened scrutiny on the sector. Out of the firms involved, Dunamu (also known as Upbit) faced approximately US $25 million in fines. Bithumb, Coinone, Korbit, and GOPAX faced similar penalties, including market suspensions and monetary fines.

When Warnings Are not Sufficient for Robust AML and KYC

The country’s Financial Intelligence Unit (FIU) indicated that it issued multiple warnings to crypto firms regarding increased oversight in their sector. However, warnings were not enough, as some of these firms continued operations without establishing adequate KYC programs aligned with the risk faced in the crypto space. As such, the FIU escalated from warnings to fines.

Outcomes & Learnings

The compliance failures in these firms resulted in significant financial losses, hindering their operations.

The case underscores the importance of comprehensive, proactive KYC solutions to ensure compliance and prevent fraud and money laundering.

Firms are required to be more vigilant about sector-specific risks and evolving regulations as part of their compliance costs planning.

Managing Compliance Costs Across Business Types and Maturity Stages

The scope, complexity, and cost of implementing KYC solutions vary depending on a company’s size, risk exposure, and industry regulations. For global and regulated businesses, such as those in payments and cryptocurrency, solutions such as ongoing monitoring, Enhanced Due Diligence (EDD), and sanctions screening are essential to meet compliance requirements.

Aligning compliance strategies with an organization’s maturity and projected growth stage is crucial for achieving cost-effective compliance and long-term scalability. For example, businesses in the early stages will have a different compliance approach compared to a company in the high-growth stage. You can learn more here: Selecting KYC Software for Your Industry and Growth Stage.

Early-Stage Startups and FinTechs

Startups often operate in Minimum Viable Product (MVP) mode, striking a balance between the need for digital IDV and the realities of constrained funding. Firms at this stage utilize features such as Artificial Intelligence (AI) to streamline operations while keeping compliance costs manageable. Additionally, an integrated approach to compliance is ideal at this stage, ensuring that verification and system upgrades can be embedded without significant time or expense.

Scaling Platforms and Mid-Size Enterprises

At this stage, companies are primarily focused on rapid expansion of business operations. Therefore, investing in features such as machine learning, Optical Character Recognition (OCR), and liveness detection is crucial. Together, these solutions enable a secure, accurate, and scalable compliance infrastructure. Furthermore, automated and customizable workflows streamlines compliance efforts, meeting industry regulations while keeping compliance costs low.

Global and Regulated Businesses Operating in Multiple Jurisdictions

For mature and regulated platforms, scrutiny and heightened oversight from regulators are common. As such, robust KYC and AML solutions must be implemented. Regulations such as the US Bank Secrecy Act (BSA) and the UK’s Proceeds of Crime Act 2002 (POCA) mandate strong frameworks, including ongoing monitoring, Suspicious Activity Reports (SARs), as well as strong data protection.

Failing to disclose suspicions of criminal property or money laundering can result in unlimited fines.

Additionally, businesses must establish transparent audit trails and secure storage for sensitive data to demonstrate resilience against money laundering, data breaches, and fraud. Compliance failures can lead to significant market restrictions and reputational damage. The POCA states, “A conviction for failing to disclose suspicion of criminal property or money laundering can incur a custodial sentence of up to five years and an unlimited fine.”

Key Steps to Mastering Compliance Management and Digital Identity Verification Spend

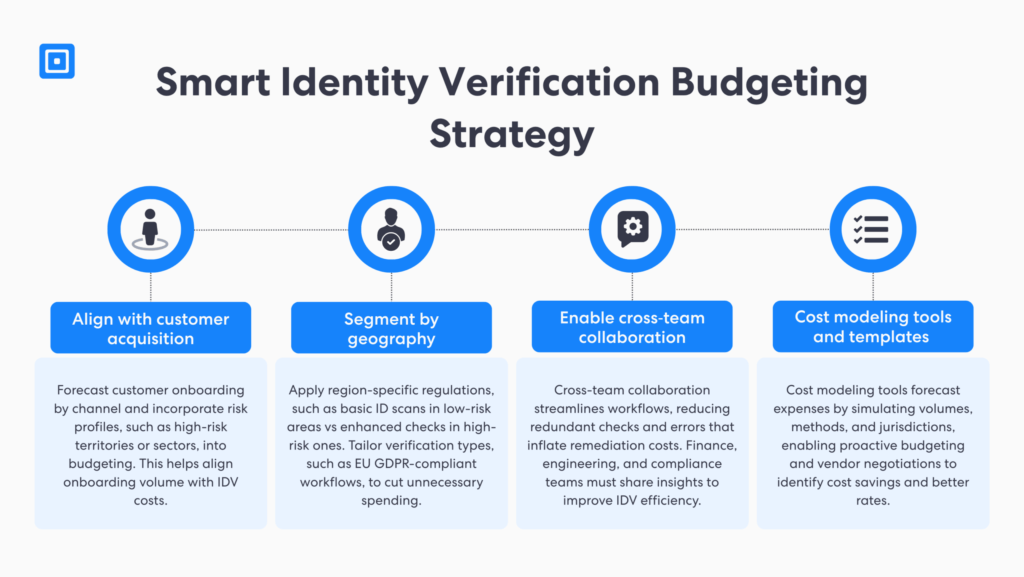

Compliance management in KYC requires strategic planning around both direct and indirect costs. Understanding how compliance expenses correlate with customer acquisition, risk appetite, and future growth is key to ensuring compliance aligns with the budget.

The complexity of regulatory standards is unpredictable and can arise naturally as businesses expand or operate in high-risk areas. Thus, keeping KYC compliance programs flexible, scalable, and automation-ready is crucial to make cost and infrastructure changes manageable.

Align With Customer Acquisition Forecasts

IDV costs are inherently tied to the volume of onboarding. Thus, it is vital to work closely with marketing and sales teams to project potential users across key channels. IDV budgeting must also factor in risk profiles, such as high-risk territories or sectors.

Segment by Geography and Verification Type

Compliance requirements and costs vary by region. For example, EU-based companies are required to have GDPR-compliant workflows, while in Belgium, data privacy laws mandate the redaction of PII during IDV. Segment budgets to match verification tiers (basic vs. enhanced) to cut spending on low-risk areas.

Enable Cross-Team Collaboration

Finance, compliance, and engineering teams must work in a unified manner to meet compliance standards while driving ROI. For example, prompt communication ensures finance and engineering teams stay ahead of rapid regulatory updates while minimizing implementation cost. Additionally, within IDV software, team members can manage and transfer caseloads to maintain operational efficiency across teams.

Use Cost Modeling Tools and Templates

Forecasting platforms and internal planning spreadsheets can be enhanced with a KYC cost calculator approach, estimating per-verification costs, failure rates, and review loads across different tiers. Incorporating tools that simulate the cost impact of varying onboarding scenarios helps organizations remain financially agile.

Key Takeaways

Compliance cost refers to the Total Cost of Ownership (TCO) of meeting regulations, including efforts in preventing fraud and money laundering.

KYC cost drivers include direct and indirect expenses, including verification volume, types, pricing models, and the level of automation.

Compliance cost planning involves understanding sector-specific risks, current and future business stage, as well as company size.

AI-based platforms, ongoing monitoring, and automated workflows streamline KYC, lowering compliance costs.

Compliance monitoring with real-time tools detects risks early, avoiding costly reverifications and legal penalties.

Leverage a KYC Cost Calculator for Smarter Compliance Cost Planning

Budgeting for identity verification is a crucial part of building resilient and compliant operations. As businesses expand into new markets and face more complex regulatory changes, understanding and forecasting compliance costs is essential. Investing in key features such as automation, customizable workflows, and an AI-powered platform reduces human error and unlocks savings.

With the right cost and compliance strategy in place, businesses can achieve faster onboarding, reduce fraud efficiently, and enjoy stronger customer trust. Discover ComplyCube’s AML and KYC software to learn how you can ensure compliance with industry regulations while achieving significant cost savings.

Frequently Asked Questions

How do you calculate compliance cost?

Compliance costs are calculated by combining direct expenses (such as KYC and AML features, staffing salaries) and indirect expenses (including hidden costs, re-verification, and false positives) required to meet regulations.

What is compliance planning?

Compliance planning refers to the process of proactively identifying, monitoring, and adhering to applicable regulations, both locally and internationally. It is crucial in the effort to prevent fraud, financial penalties, and reputational damage. Compliance planning also includes defining roles, budget, and governance for compliance management.

How to turn compliance cost into a competitive advantage?

Compliance costs can become a competitive advantage when businesses utilize them to invest in automation and technology, enabling quicker and more accurate onboarding. As processes become more secure, it will also build trust with regulators, investors, and customers, creating brand loyalty and satisfaction.

Why do regulated industries face increased compliance costs?

Regulated industries such as financial institutions, cryptocurrency, and fintech face high compliance costs. Due to the large amount of cash flow and rapid transactions in these sectors, authorities demand advanced AML and KYC tools to deter fraudsters. Typically, firms in these sectors face stringent regulations, increased oversight, and higher penalties.

How does ComplyCube support compliance while offering cost savings?

ComplyCube is a UK DIATF-certified provider offering volume-based pricing and tailored pricing models for each unique business case. Companies in all types of industries can onboard 98% of customers in under 30 seconds, while also enabling cost reductions of 63%.