Choosing the best KYC software is critical to keep your business compliant and free from fraud, but this isn’t always an easy decision to make. This guide will dive into how KYC protects businesses from compliance fines and helps smooth out onboarding processes, while explaining what you should look for in a KYC provider.

KYC software is important for regulatory compliance as it assists companies in maintaining their customers’ information up to date and preventing them from being used in illegal activities like money laundering. Sophisticated KYC systems excel at identity verification, document management, real-time monitoring, and integration with current software. The future of KYC software is centered on greater automaton, artificial intelligence-driven tools for accuracy enhancement in verification processes, and decentralized technologies for greater security and anonymity.

What is KYC Software?

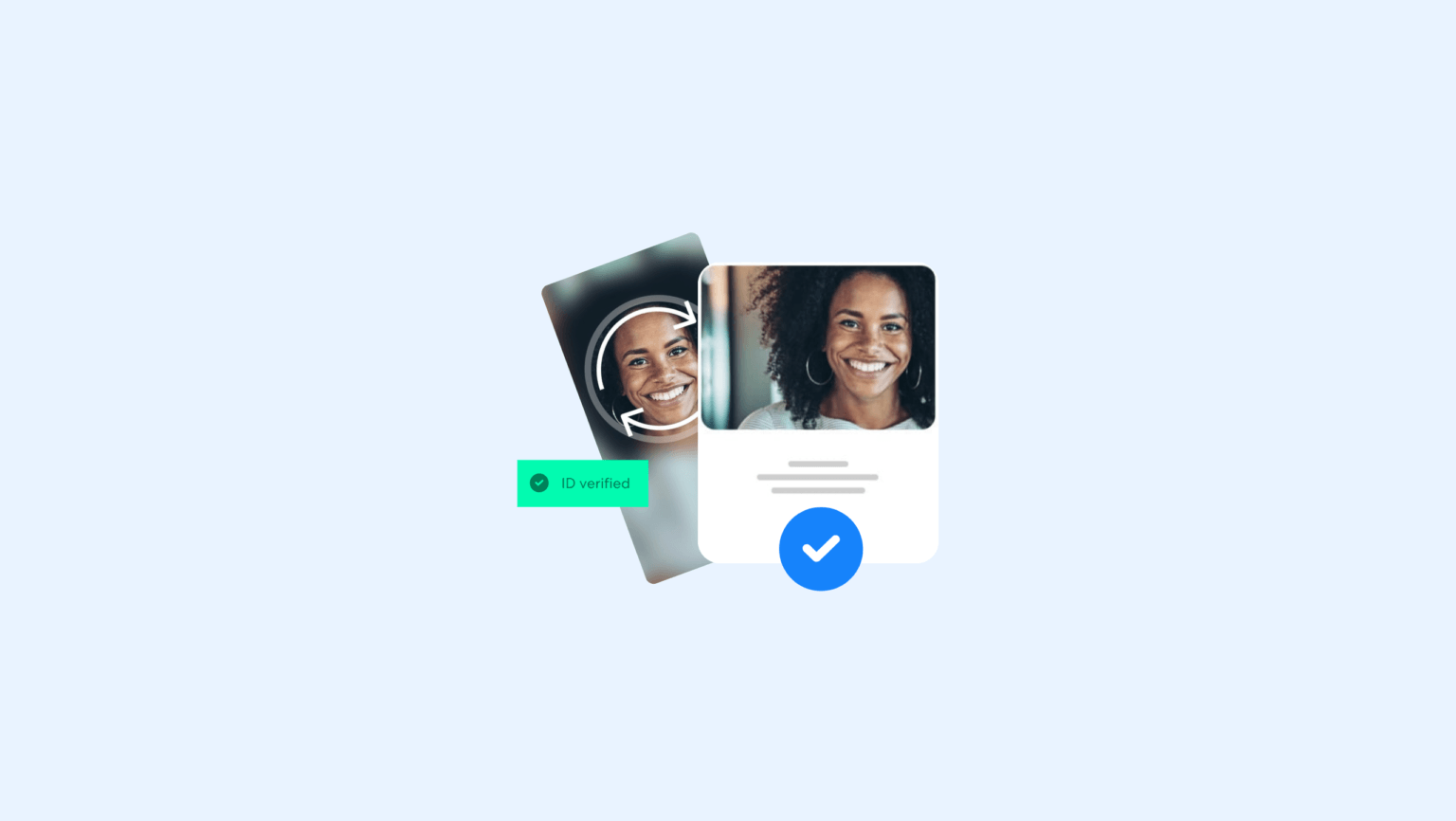

KYC software assists companies, especially financial institutions, in keeping their customer information current and correct as per regulatory requirements. It streamlines the customer onboarding process, such that all the necessary checks are performed effectively. The KYC process includes customer identity verification and risk assessments, through processes such as digital ID verification, face recognition, and biometric authentication.

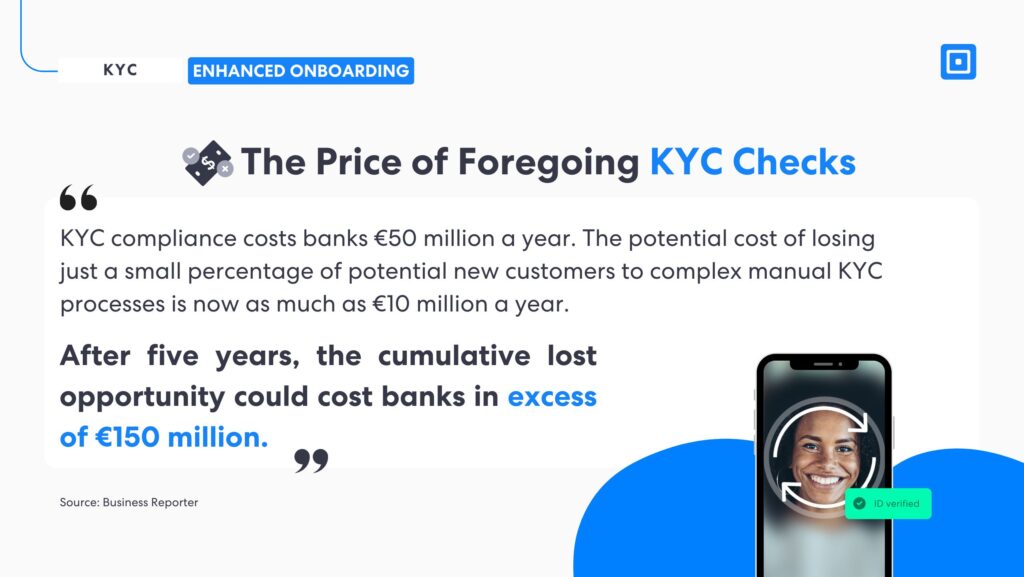

After five years, the cumulative lost opportunity could cost banks in excess of €150 million

Partnering with a KYC platform may seem like an unnecessary expense, however the price of foregoing these checks is often far higher. Business reporter pointed out that, “KYC compliance costs banks €50 million a year. The potential cost of losing just a small percentage of new customers to complex manual KYC processes is now as much as €10 million a year. After five years, the cumulative lost opportunity could cost banks in excess of €150 million.” This doesn’t even take into account the regulatory fines that are often handed out to businesses, with TD Bank facing a fine in the billions in 2024. For more on the TD Bank fine, read “TD Bank Fails Anti Money Laundering Compliance.”

How Best KYC Software Empowers Financial Services

The best KYC software enables financial institutions to streamline compliance processes by automating customer onboarding, enhancing due diligence, and ensuring regulatory compliance with stringent KYC regulations. Through advanced identity verification solutions, such as biometric verification and digital identity verification, these systems help perform KYC checks and verify customer identities effectively, reducing the risk of identity theft and financial crimes like money laundering and terrorism financing.

KYC processes, including customer due diligence and ongoing monitoring, help businesses manage customer accounts while adhering to Anti-Money Laundering (AML) solutions and compliance requirements. KYC providers integrate with existing systems, offering a robust verification system to ensure accurate customer data management and risk assessment. In addition to verifying individuals, KYC software can handle business verification, ensuring that business entities meet KYC compliance standards.

The integration process of these systems allows for automated KYC document management and verification, reducing manual intervention and improving the customer experience. Through appropriate due diligence measures, financial services can maintain a customer identification program (CIP) and monitor politically exposed persons (PEPs) for regulatory compliance. With these KYC solutions, financial institutions can onboard legitimate customers, reduce risks, and improve customer relationships while staying compliant with the Financial Crimes Enforcement Network (FinCEN) and other regulatory bodies.

Characteristics of the Best KYC Software

The best KYC software utilizes various tools to facilitate companies to comply and minimize risks. Some of the main characteristics are:

- System Integration: Smooth integration with existing banking or financial systems offers efficiency and better compliance monitoring.

- Identity Verification with Document and Biometric Checks: These facilities enable businesses to authenticate the identities of their clients and store KYC documents in a secure and structured manner.

- Anti-Money Laundering (AML) Tools: The tools are necessary in order to ensure that companies can track suspect activities and comply with the law.

- Ongoing Monitoring: The tool provides additional protection as it detects fraud in real-time.

The Benefits of KYC Automation

KYC process automation leads to an improved onboarding process that increases customer experience. Over 70% of KYC-related onboarding processes will be automated by 2025, driven by technologies like biometric authentication and eID verification. Automated processes, in addition to enabling organizations to stay compliant, reduce the risk of fines, improve security, as well as detect latent fraud.

When choosing a KYC solution, choose vendors who show a good understanding of regulatory requirements. Consider features like identity verification, customer onboarding, document management, and surveillance on a permanent basis. Coverage globally is a must for businesses across the globe, and the application of emerging technologies like AI and machine learning also becomes a requirement. Security must also be a priority. Top KYC vendors must provide secure protection of customer data, yet also seamless, effective onboarding procedures. Looking out for recognized industry awards, such as the RegTech 100, or government certifications, such as the UK DIATF, can help you identify trustworthy providers. Learn more about the UK DIATF framework here.

The Role of AI in KYC

AI also plays an important part in KYC since it achieves speed and precision in verification. AI systems monitor enormous amounts of data in an attempt to look for suspicious transactions and money laundering. AI and machine learning through the year 2025 will reduce false alerts for transactional monitoring by a substantial percentage, thus making it easier to do risk management and compliance. In addition, AI fortifies the biometric verification process, with AI analyzing facial features and powering liveness detection. AI-powered OCR similarly strengthens the document verification process, extracting information with OCR.

Future Trends in KYC Technology

KYC solutions find extensive application in regulatory compliance, anti-fraud security, and frictionless onboarding. These solutions in 2025 offer high-end capability in the form of AI-based verification, biometric identity verification, and frictionless system integration. With these kinds of advanced technologies, businesses can attain security, ease compliance, and provide an improved customer experience. As fraud continues to evolve, so must identity verification and KYC.

As new forms of fraud evolve, new sectors will need to rely on KYC technologies to protect their customers and their platform. Social media platforms will need increased user verification, as new regulations, such as the recent “UK’s Online Safety Act” (OSA), spearheaded by Ofcom, come into play.

Protect Your Business From Fraud with Best KYC Software

As technologies continue to improve, AI and blockchain-based KYC will bring increasing efficiency, transparency, and compliance to enable companies to remain competitive in regards to regulatory shifts and customer demands. For more information on how to fortify your business with advanced KYC infrastructure, get in touch with one of our compliance experts.