TL;DR: Implementing Anti-Money Laundering (AML) software without a clear strategy can be costly and expose firms to serious compliance risk. This guide outlines practical steps, such as closing audit trail gaps and reducing manual review errors, to ensure successful AML software implementation that delivers lasting value.

What are Common AML Software Implementation Failures?

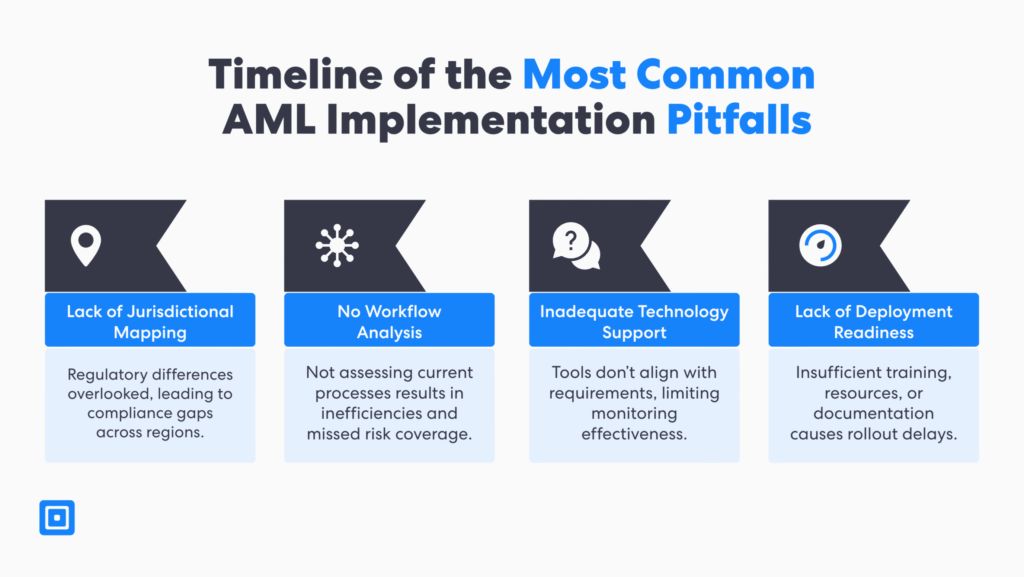

Anti-money laundering compliance failures can result in millions in fines and irreparable reputational damage. Despite adopting AML software, many companies face challenges at the implementation stage, inviting regulatory scrutiny and financial penalties. The most common failures in AML software implementation include inadequate planning, human error, insufficient risk management, and poor training.

Businesses can reduce compliance issues and prevent costly mistakes by learning the most common pitfalls in AML software implementation. This is particularly critical for firms in highly regulated industries, such as insurance, accounting, and financial services, as compliance standards tend to be more stringent.

Mistake 1: Inadequate Planning for AML Software Implementation Requirements

Rushing into implementing compliance software without a thorough understanding of specific regulatory obligations and business requirements can expose an organization to significant risks. Institutions operating across multiple jurisdictions (global, federal, state, local, etc.) are at a much greater security risk simply because they are responsible for complex regulatory obligations that vary between regions.

The biggest AML software implementation mistakes are rarely technical issues; they are often shortcuts taken during implementation – Joshua Vowles-Dent, AML Compliance Lead

Organizations often overlook how an AML compliance program could align with their existing business processes and services. Many underestimate the resources, cross-functional alignment, and planning required to successfully embed evolving AML regulations across the business. Additionally, the collection of technical requirements and improvement of data quality often receive insufficient support and attention during implementation planning.

To successfully execute AML software implementation, companies must thoroughly understand their current customer onboarding workflows and reporting processes. Without this strong foundation, a new system may not integrate properly with existing operations and services. Additionally, resource allocation planning helps determine a more realistic timeline expectation for implementation.

How to Avoid it:

- Conduct a detailed assessment of regulatory requirements specific to the organization’s industry, whether that is insurance, accounting, legal, or banking, to ensure full compliance.

- Dedicate sufficient lead time and resources for thorough testing, staff training (onsite or offsite), and phased deployment. Collaboration between IT, operations, finance, and legal departments is crucial to address requirements.

- Assess technology infrastructure, data quality, and integration capabilities to provide a seamless customer experience while maintaining compliance.

Mistake 2: Underestimating Risk Assessment and Management

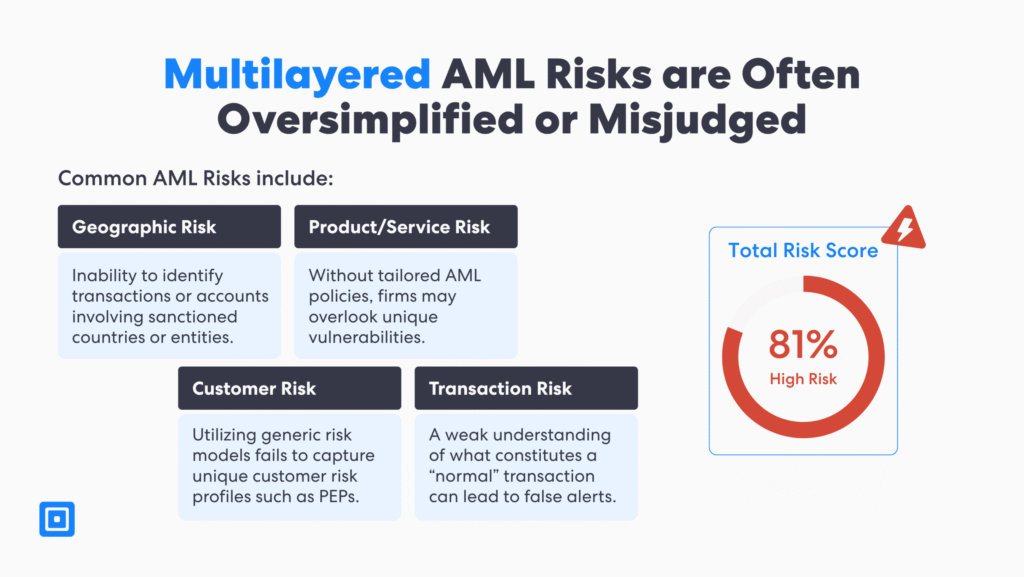

Businesses often underestimate the need for robust compliance risk assessment and risk management. It is common for companies to identify needs based on oversimplified risk categories, which can fail to capture the nuanced risk profiles that effective AML monitoring requires. A risk assessment process should be implemented across the customer base and reviewed at least periodically; however, to achieve continuous compliance, organizations require ongoing monitoring to identify changes to sanctions, PEPs, and adverse media in real time.

Inadequate risk assessment can have severe consequences. It can lead to poorly calibrated monitoring systems, inappropriate regulation measures, and other various regulation violations that could be prevented. Different risks must be identified and considered. For example, complex financial products, cross-border services, and digital payment solutions present unique vulnerabilities and risks for fraud that require adherence to specific regulations.

Geographic risk assessment requires a detailed understanding of jurisdictional differences in AML regulations. Failing to assess geographic risks leads to inadequate controls in high-risk regions and potential regulatory violations. Customer risk profiling, which requires sophisticated analysis of customer types, transaction patterns, and business relationships, is another area where companies and organizations frequently fall short.

How to Avoid it:

- Global corporations must evaluate country-specific risks, sanctions regimes, and regulatory expectations to make informed decisions. To start, follow the international standards set by the Financial Action Task Force (FATF).

- Regular risk assessments must be established to ensure AML programs remain effective against evolving business models, new products, and changing regulatory requirements.

- Vendors, partners, and service providers could introduce AML risks. Therefore, evaluating extended business relationships and implementing ongoing monitoring is critical.

Mistake 3: Failure to Manage Audit Trail Gaps Effectively

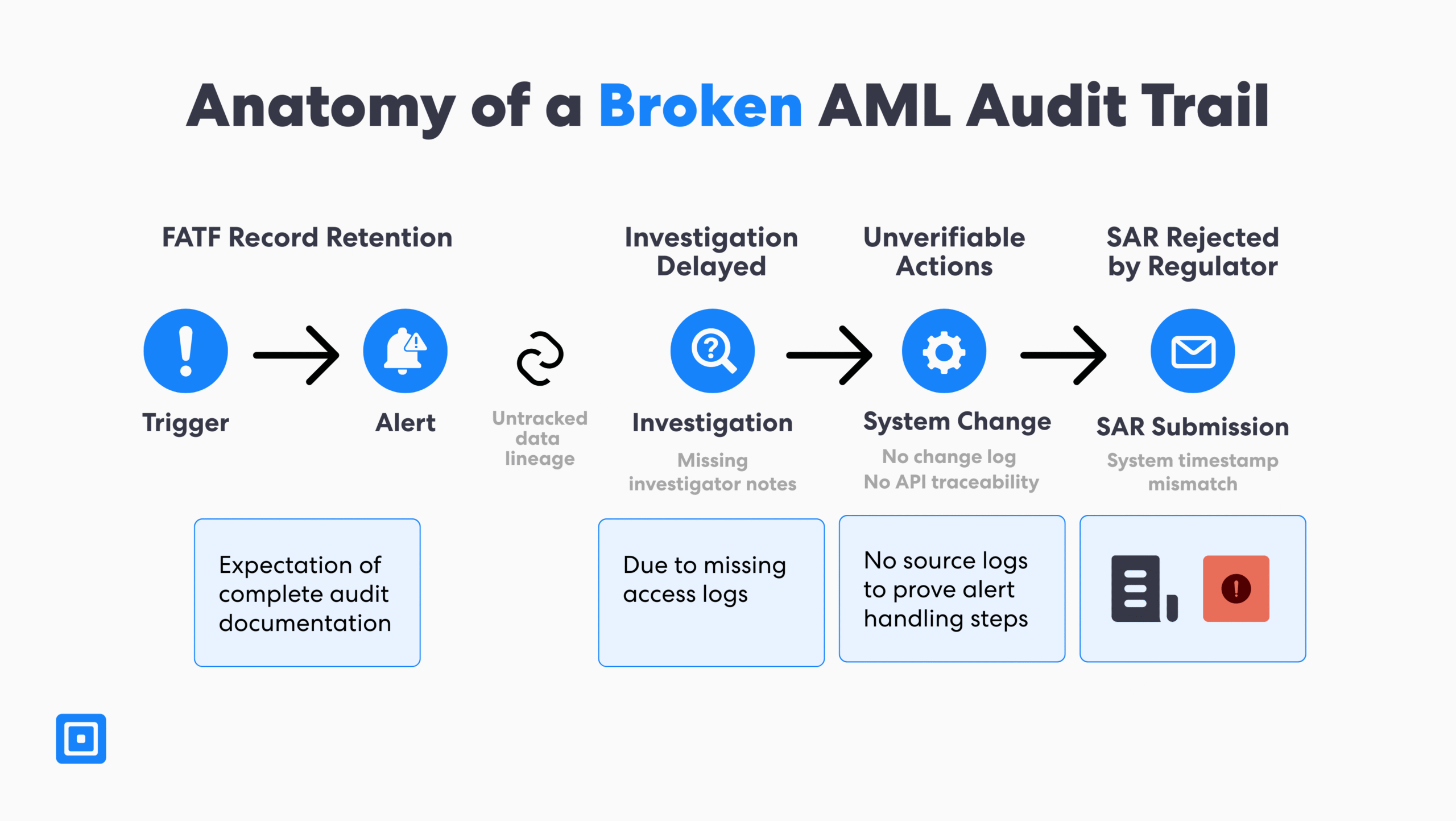

Audit trail gaps are one of the most critical compliance challenges during technology implementation. Regulators expect complete transparency and accurate records of all AML-related activities, decisions, and system changes. As a result, companies must provide comprehensive operating procedure documents, including who made the changes, when modifications occurred, and the business justification for the adjustments.

According to the Financial Crimes Enforcement Network (FinCEN), failing to file Suspicious Activity Reports (SARs) in a timely manner is a serious offense.

It is not uncommon for an organization to switch to new AML software because of technical limitations or cost. However, a transparent audit trail must still be maintained to show accountability. Typically, regulatory authorities review audit trails during periodic compliance examinations or when a submitted SAR requires further investigation. Recently, FinCEN fined TD Bank $1.3 billion due to failures in AML, including inadequate audit trails that hid suspicious transactions.

Weak user activity logging exposes companies to regulatory violations, increasing security risks, and compliance violations. Poor documentation of data lineage hinders the ability to demonstrate adherence to policy and regulatory requirements. Audit trail gaps hinder investigation processes when suspicious behaviors or transactions that may be related to money laundering activities are identified.

How to Avoid it:

- Ensure audit trails capture all changes in AML settings, rules, and parameters. Comprehensive records are needed to track who accessed what and when.

- System integration documents how AML software connects with other business systems and external data sources. Organizations must maintain records of data exchanges, API calls, and system synchronization activities.

- Different jurisdictions operate under varying requirements for record retention. Organizations must comply with the most stringent applicable regulations.

Mistake 4: Inadequate Anti-Money Laundering Training

Employee training (on-site or off-site) and change management are critical success factors for successful software implementation. Many regulators are increasingly using high employee turnover in risk management teams as an indicator of weak AML oversight. Yet, many companies overlook this important concern.

Compliance officers and investigators require different levels of compliance training tailored to their functions within the company or organization. AML compliance requirements change frequently, and employees must understand and implement these updates to maintain effective compliance programs. Employees often resist changes to familiar workflows, creating critical implementation challenges and compliance concerns.

How to Avoid it:

- Adopt role-based training programs to address specific responsibilities and system interactions for different user groups. Performance monitoring and feedback mechanisms enable organizations to effectively address training gapss

- Change management processes help organizations transition from legacy systems to new AML technology, minimizing confusion and compliance errors.

- Employee staffing issues can hinder compliance. Cross-training and backup procedures must be implemented to ensure continued operations when key personnel are unavailable.

Case Study: Binance Australia’s High Employee Turnover Results in AUSTRAC Scrutiny

AUSTRAC’s Shocking Demand

The Australian Transaction Reports and Analysis Centre (AUSTRAC) requested Binance Australia to appoint an independent reviewer to investigate its AML processes after identifying weak AML/CFT controls. A major issue was the firm’s high staff turnover and lack of senior oversight.

Binance’s Internal Staff Crisis

From AUSTRAC’s view, high staff turnover creates an unstable team that lacks the knowledge of internal compliance processes and regulations. The lack of staff and senior oversight can cause a company to struggle with identifying and reporting suspicious activity promptly.

Outcome

- Binance Australia was given 28 days to nominate external reviewers for AUSTRAC’s consideration and has expressed its commitment to resolving the case.

- This case highlights a broader lesson in compliance. Lack of team member training and high turnover can weaken the effectiveness of a company’s AML framework.

- Mr Thomas, AUSTRAC’s CEO, released a statement calling for increased vigilance towards transactions that indicate suspicious behaviour, noting that these risks are often higher for global exchanges.

Mistake 5: Insufficient Human Errors Prevention

While AI-powered platforms reduce compliance risks, human judgment remains essential for complex investigations and decision-making. However, human errors represent a persistent challenge in AML programs that organizations often fail to address. Addressing human errors requires systematic approaches and robust quality control measures that protect the company and employees.

Inadequate escalation procedures within a company can lead to decision-making errors due to confusion, lack of ownership, and fractured communication. Furthermore, excessive workloads and unrealistic expectations can create a culture of high stress or pressure, which can inevitably lead to shortcuts and unintentional errors.

How to Avoid it:

- Utilize AI-powered platform review tools that effectively empower teams to assess data, risks, and analyze complex transactions.

- Provide new or junior team members with clear and concise criteria, tools, and procedures so they can avoid making decisions well beyond their expertise.

- Ensure reasonable workload distribution by monitoring investigation volumes, completion times, and metrics. This will prevent fatigue and rushed decision-making, which contribute to manual review errors.

Key Takeaways for a Successful AML Software Implementation

AML Software implementation requires businesses to adopt a more strategic, unified approach. Cutting corners and rushing processes increases compliance and reputational risk.

Risk assessment and management must include a detailed evaluation of sector-specific risks and extended business relationships.

Adopting advanced tools with systematic, auditable trails and access control will support firms in meeting AML reporting requirements set by regulatory bodies.

Ongoing employee training on regulations, such as the UK’s GDPR, EU AMLD, and the US’s BSA, is crucial to building a proactive culture in the face of evolving risk.

AI-driven AML software, such as ComplyCube, offers no-code workflows and meets global reporting requirements, thereby enhancing the accuracy and transparency of AML processes.

Final Thoughts on AML Software Implementation

The cost of mitigating compliance risk is often a price worth paying in the long run compared to the critical consequences of failed implementation and non-conformity to compliance regulations. Comprehensive planning, thorough fraud risk assessment, and clear audit trail management are essential for a successful AML software implementation. Additionally, considering factors such as providing regular team member training and reducing the likelihood of manual errors occurring helps build a more resilient AML framework.

To address changing risks, an AML provider with comprehensive Know Your Customer (KYC) and AML solutions can help. Modern AML systems provide automated data extraction, risk control, and ongoing monitoring capabilities. Organizations are better positioned to detect suspicious activities earlier, which can significantly reduce their compliance burden. Speak to a member of the team to learn more about ComplyCube’s solutions today.

Frequently Asked Questions

What is the biggest threat to anti-money laundering compliance?

The biggest threat to AML compliance includes weak planning and governance. Inadequate risk assessments, poor audit trails, and the lack of employee training create significant AML gaps. Effective AML programs require a holistic approach, including leveraging advanced risk management, AI, and ongoing training as top priorities.

How to choose the best anti-money laundering platform to avoid compliance and reputational risk?

To choose the best AML platform, firms must assess their specific business needs. Factors such as the geography, company size, customer profile, and overall risk appetite are key considerations when choosing an AML platform. The right AML platform aligns well with a firm’s compliance obligations and long-term growth strategy.

What are high-risk customers, countries, and industries in anti-money laundering?

High-risk customers, countries, and industries in AML pose a higher risk for financial crime. High-risk countries such as North Korea and Venezuela, and sectors such as cryptocurrency and fintech, are commonly flagged by regulatory bodies. High-risk customers include politically exposed persons, sanctioned users, and those with high adverse media coverage.

What does risk assessment mean in anti-money laundering?

In AML, risk assessment helps evaluate a business’s exposure to money laundering and fraud by analyzing risk factors such as political exposure, sanctions lists, adverse media status, and industry. The process involves systematically categorizing these risks, enabling an organization to better align its AML controls with regulatory requirements.

How to prevent human error in anti-money laundering?

To prevent human error, firms should adopt automated and tailored AML software. For example, ComplyCube’s platform leverages AI and machine learning, enabling businesses to achieve full automation while maintaining transparency, auditability, and accuracy. Combined with strong governance and security frameworks, automation enhances compliance while minimizing errors.