Electronic Know Your Customer (eKYC) has become a fundamental part of the fight against deep fakes. Deepfake photo and videos has become one of the largest security threats worldwide, bypassing facial recognition software and leading to large-scale data breaches. Customer identity verification processes must leverage advanced eKYC solutions and AI technologies to fight against this threat. This can be achieved through implementing strong biometric authentication methods and verification of identity documents within every verification process.

Insight Partners, a leading Private Equity firm, stated in their 2024 tech predictions piece that “the risks created by AI will only be combated with AI.” This is certainly true regarding digital fraud and the need for defensive eKYC solutions.

Deepfakes are a form of media created by Artificial Intelligence, and they’re being used for deception worldwide. They’ve become a leading tool for digital impersonation, as they’re generated by expert machine-learning algorithms and facial mapping software, which can implement data into digital content without permission. The execution of these deepfakes is usually excellent, making them highly realistic and believable despite being completely fabricated. They tend to consist of either videos, images, or voice recordings.

The Threat Posed By Deepfakes

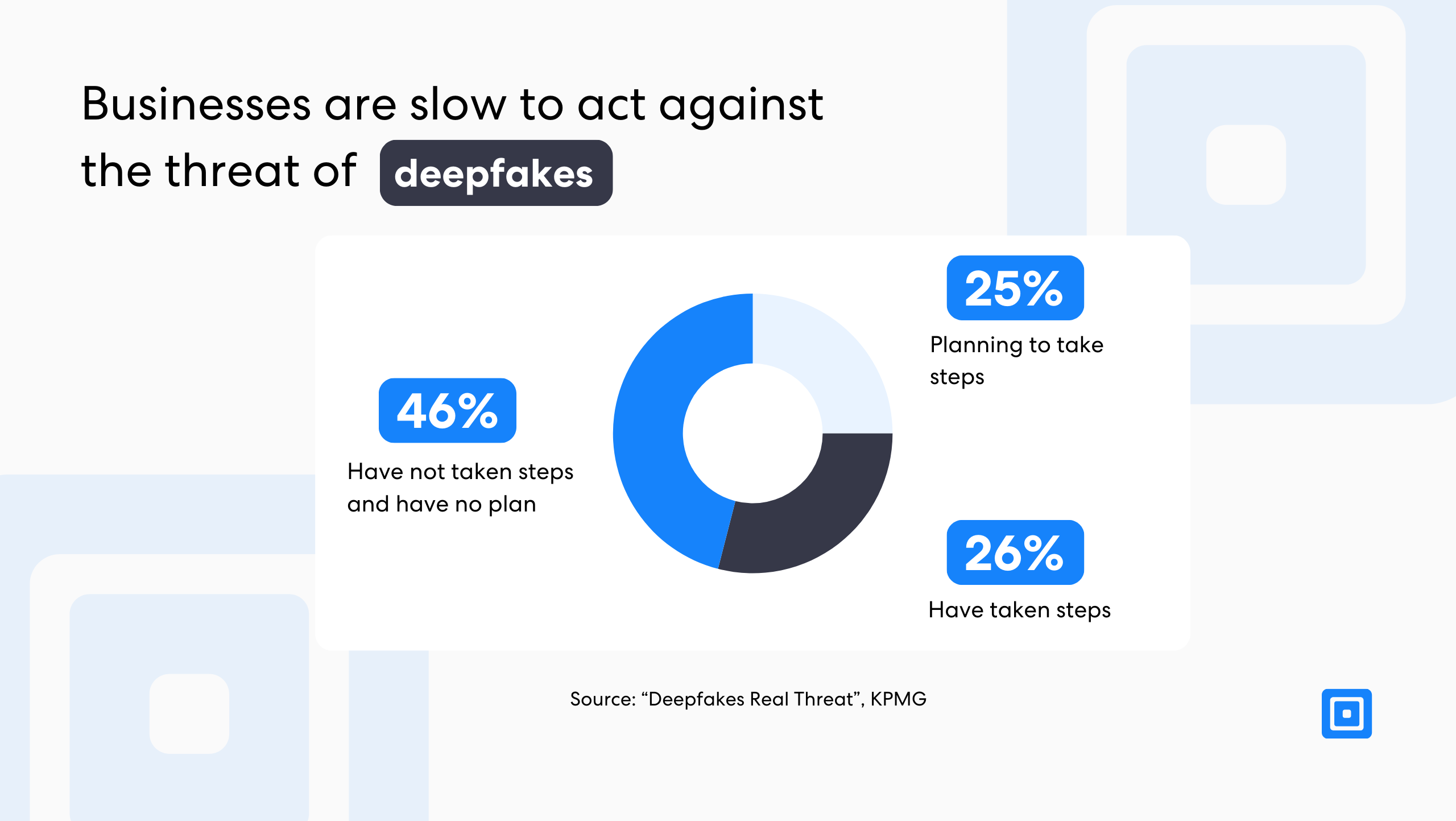

35% of US businesses have experienced a deepfake security incident in the last 12 months, with this form of crime ranking as the country’s second most common cybersecurity incident. Despite the apparent danger, businesses are slow to act against the threat of deepfakes.

KPMG’s recent report, “Deepfakes: Real Threat”, highlights that 71% of businesses have not taken steps to safeguard their organization from this form of fraud. 46% of businesses have not even thought of steps or a plan of action to protect themselves from deepfakes.

Deloitte’s Center for Financial Services predicts that gen AI could enable fraud losses to reach a massive height of over US$40 billion just in the United States alone by 2027:

Generative AI could enable fraud losses to reach US$40 billion in the United States by 2027, with a significant compound annual growth rate of 32% from 2023.

The rising threat of AI-powered fraud requires an AI-powered defense, starting with robust eKYC processes. These technologies are able to detect bad actors and presentation attacks quickly, with liveness detection analysing subtle facial expressions, skin texture and more, identifying even the most sophisticated deepfakes.

AI-Powered eKYC

Traditional KYC processes have been used historically by businesses to achieve AML and KYC compliance, yet this often left the organizations vulnerable to hefty penalties due to these manual processes being prone to error. Traditional KYC processes have been used historically by businesses to achieve AML and KYC compliance, yet this often left the organizations vulnerable to hefty penalties due to these manual processes being prone to error. The Financial Conduct Authority (FCA) has imposed £11.3 million in fines recently:

The UK FCA imposed fines amassing £11.3 million as of March 2025, with the largest single fine of £9.2 million issued to The London Metal Exchange for KYC and AML compliance breaches.

Artificial intelligence in the digital age can now power electronic Know Your Customer (eKYC) solutions that can ensure accuracy and efficiency with advanced technologies. Biometric identity verification with liveness and voice recognition capabilities should be carried out when onboarding a new customer, as these expert technologies are able to look for signs of life and therefore differentiate a deepfake from a video of a living being.

Features of eKYC Enhanced by AI

AI powers many leading features of eKYC solutions, with some examples including:

- Biometric Verification with Liveness Detection: utilizes advanced AI to verify users’ genuine presence. This refers to our custom-built liveness detection feature powered by our Presentation Attack Detection (PAD) technology. This function builds 3D facial maps and analyzes the minutia of skin texture, pixelation, and micro-expressions, ensuring that a user was physically present when the photo was taken.

- Document Verification with Optical Character Recognition (OCR): AI-powered OCR quickly and accurately extracts relevant information.

- Real-time Monitoring and Alerts: AI-driven systems excel at real-time data analysis. This enables organizations to monitor customer transactions in real-time, and any suspicious behavior is caught quickly.

- Enhanced Risk Assessment: AI can analyze large datasets to identify potential risks and can continuously learn from data to improve accuracy.

- Adverse Media Screening: AI allows for comprehensive screening for negative news associated with individuals or companies, identifying clients with reputational risks.

Benefits of AI-Powered eKYC

eKYC solutions that leverage AI are needed to end the threat posed by deepfakes. There have been many cases of deepfakes bypassing face authentication processes, proving the need for eKYC to evolve and implement advanced AI technologies.

At the beginning of 2025, a finance professional was in a video meeting with someone who looked and sounded just like their CFO. The team member then made a transaction of over 200 million Hong Kong dollars (approximately USD 25 million), as instructed. He later discovered that the person he spoke to was not his actual CFO but a sophisticated deepfake impersonation.

Identifying deepfakes is not as easy as everyone thinks. In fact, a majority of people often overestimate their ability to spot them. As a result, many companies became aware of the need to invest in advanced AI technologies to detect and prevent deepfakes from being used within authentication processes.

- Bespoke Solutions: Automatic workflows that can be highly tailored to fit different compliance requirements. Utilizing machine learning technologies, eKYC solutions can streamline data extraction while providing a smooth user onboarding experience.

- Streamlined Onboarding: Implementing a robust eKYC process allows you to verify customers quickly and efficiently, enabling organizations to scale safely.

- Enhanced Security: eKYC is far more effective at protecting organizations from identity fraud and financial crime. The use of advanced biometric verification, as well as AI-driven fraud detection, allows organizations to minimize fraud risk.

- Improved Customer Experience: The streamlined onboarding process also results in a more positive user experience, reducing friction and increasing customer satisfaction.

- Global Reach: eKYC solutions enable businesses to operate globally, quickly verifying many customers and supporting multiple languages and various international regulations.

eKYC Solutions with ComplyCube

ComplyCube is a RegTech100 all-in-one platform for automating Identity Verification (IDV), Anti-Money Laundering (AML), and Know-Your-Customer (KYC) compliance. It has global customers in legal, telecoms, financial services, healthcare, e-commerce, cryptocurrency, travel, and more.

Our full suite of AI-powered KYC/AML solutions enhanced with automatic workflows are highly tailored to fit our customers’ compliance requirements. Utilizing machine learning technologies developed and owned by our team, our solutions streamline data extraction while providing a smooth onboarding experience for the user.

For more information on our eKYC solutions, contact our expert compliance team.