Fintech, also known as Financial Technology, is an emerging sector that aims to revolutionize financial services. Fintech companies pride themselves on adopting the most advanced technological tools to disrupt the infrastructure found in traditional banking sectors and financial institutions. With rapid innovation in the industry, fintech compliance has moved from just being a “check box” exercise to proactive fintech risk management practices. This guide covers the importance of compliance for fintech companies and the best practices for complying with evolving regulations.

The Birth of Fintech Companies

Although the financial, technological, and fintech sectors are distinct in their purposes, they remain intricately connected. Conventional financial systems typically rely on physical functions, emphasizing client-customer relationships. On the other hand, technological firms drive the development of digital tools and platforms to move traditional banking into a digital space. Fintech takes the center stage, leveraging state-of-the-art technology such as Artificial Intelligence (AI), blockchain, and real-time analytics to make financial services faster, cheaper, and more tailored than ever before.

Fintech is expected to reach a market size of $1.5 trillion in revenue by 2030, a growth of roughly five times from 2024.

While this emerging sector picked up momentum relatively quickly, the immense growth opportunities for fintech companies were also met with complex challenges. This was particularly in building a flexible and agile compliance program that satisfied evolving regulatory standards while enabling scalability.

Increasing Scrutiny of Fintech Firms

The distinction between fintech and traditional financial industries will wear off as regulatory bodies extend oversight and compliance expectations across a wider financial ecosystem. This means that now, any companies involved in working with other financial institutions or providing financial transactions must align with new regulations and implement security measures to actively combat terrorist financing, money laundering, and unfair or deceptive acts.

Fintech organizations that fail to adapt to these expanded regulations could face significant penalties, reputational damage, and loss of consumer trust in an increasingly competitive marketplace. The factors that drive this heightened scrutiny towards fintech businesses include:

1. Gaps in the regulatory environment

The acceleration of fintech growth has often outpaced regulatory frameworks. This has created compliance difficulties in data protection and consumer protection laws, forming a breeding ground for financial crimes like money laundering and fraud. As a result, regulatory authorities implement stringent compliance requirements for fintech firms to abide by to ensure compliance and financial stability.

2. The rise of threats and failures

As we know, financial service providers commonly have inadequate compliance processes, with the Financial Conduct Authority (FCA) imposing over £176m in fines just last year. The fintech sector is not immune.

In 2023, 86% of fintech respondents said their organization paid over $50,000 in compliance fines last year, with more than 37% paying over $500,000.

Fintech compliance practices and poor risk management have increased over the years, prompting increased regulatory oversight of fintech companies and their partnerships with other financial institutions to safeguard the financial system.

3. Data processing and Artificial Intelligence (AI) concerns

Due to their extensive contact with sensitive financial data, fintech businesses now face stricter data protection laws. Legislation such as the General Data Protection Regulation (GDPR) and the California Consumer Privacy Act (CCPA) mandates higher privacy rights and customer protection. Companies must adopt compliance programs that include regulatory reporting and risk assessments to satisfy regulatory compliance.

4. Prioritising Growth Through Investment

Companies that fail to keep up with the complex regulatory environment can face devastating consequences from federal regulators. Reputation damage, financial losses, and even the shutdown of business activities are not unheard of. Fintech firms prioritizing compliance-first models, syncing with international regulations like the Bank Secrecy Act and Anti-Money Laundering (AML) standards, are more likely to garner the interest of investors and customers.

5. Evolving global regulatory developments

AML and Know Your Customer (KYC) regulations are now being enforced on wider sectors globally. Regulatory bodies such as the Financial Action Task Force (FATF) are now given more decisive power to drive harmonized compliance standards to ensure fintech compliance and financial market stability. Companies that fail to adapt to the new regulatory landscape will fall behind with increased financial penalties and potential exclusion from key markets.

The Swift Uptick of Fintech Compliance

Although faced with increased scrutiny, fintech companies have been quick to integrate compliance technology, outpacing conventional financial institutions due to their digital-native operations. A majority of fintech companies view new regulations not just as a regulatory requirement but as a competitive advantage for boosting financial innovation and growth.

The swift integration of fintech compliance is driven by:

- Technological Intelligence: Fintech companies are familiar with advanced AI, machine learning, and blockchain technology for real-time monitoring, automated risk assessments, and robust compliance programs. This enables them to pick up regulatory technology more easily than the traditional financial services industry.

- Proactive Culture: The competitiveness in the fintech space means that most fintech companies need to be proactive in winning consumers’ trust. This has led to rapid alignment with risk management practices, consumer protection laws, and compliance requirements in their product roadmaps.

- Competitive Advantage: Implementing strong security enhancements and regulatory standards from the start enables fintech companies to address operational risks and differentiate themselves from big players in the financial markets.

- Huge Risk of Non-Compliance: Operating in a saturated market, fintech companies need to be agile and swift to respond to the complex regulatory landscape. Any wrong mistake, such as poor compliance expertise and unfair business practices, can negatively impact their financial innovation, setting them back.

- Customer-First Principle: Lastly, fintech firms view customers as the beating heart of their operations. As a result, ensuring financial stability for their users through anti-money laundering (AML) efforts and alignment with data protection laws is a priority.

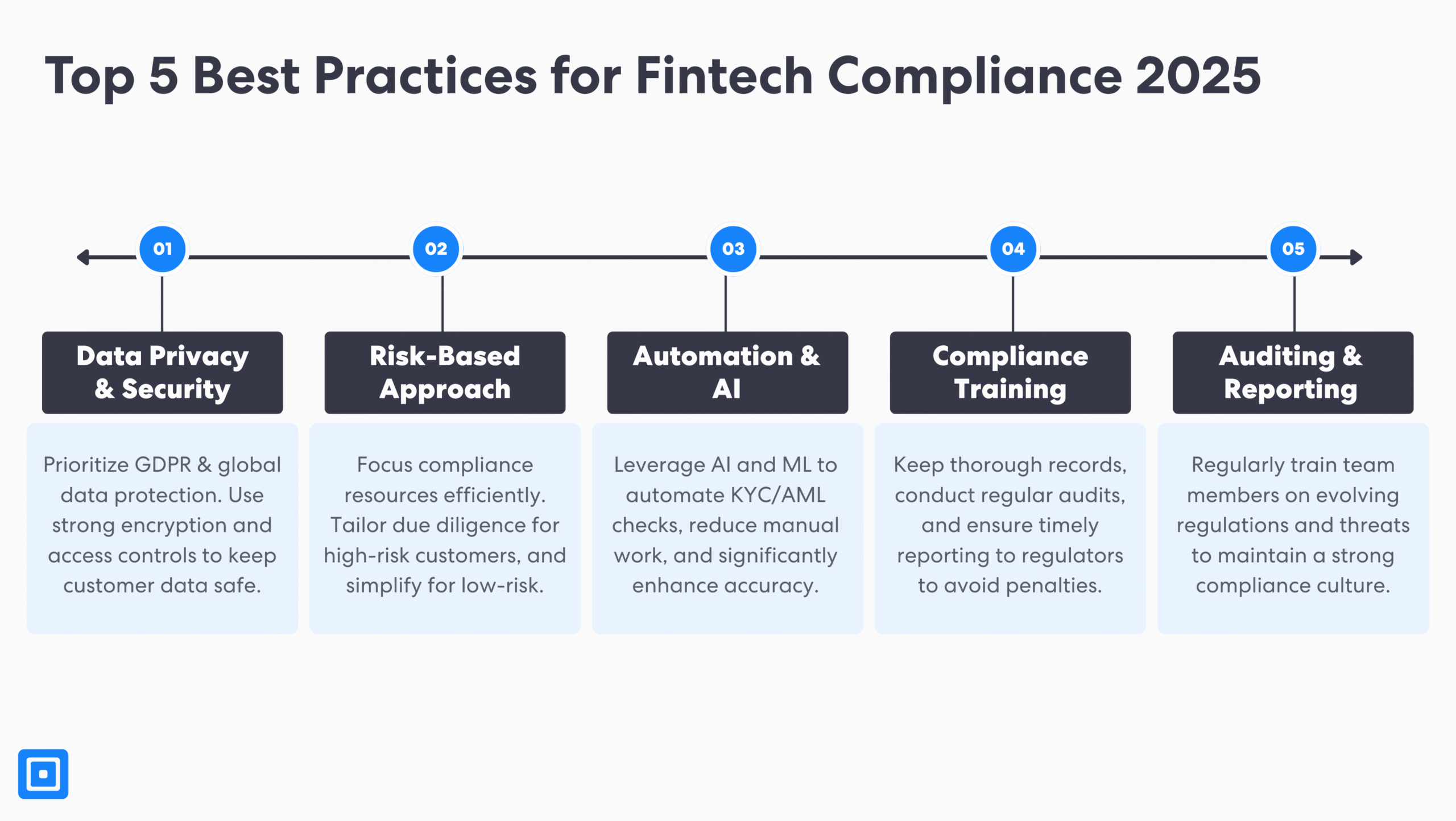

Top 5 Best Practices for Fintech Compliance 2025

As regulations evolve, keeping up with new standards in anti-money laundering and risk management frameworks is key. But how can businesses get ahead of regulatory compliance, especially as regulatory bodies continuously monitor and change legislation? This section will explore the best practices for fintech companies to adopt to ensure agility and flexibility in the face of changing regulatory requirements.

Step 1: Maintaining Priority of Data Privacy and Security Measures

Fintech companies must strictly adhere to fundamental data protection laws like the General Data Protection Regulation (GDPR). Initially, implementing strict security measures, such as access controls, will significantly reduce the likelihood of bad actors and illegitimate users gaining sensitive information.

Step 2: Implementing a Risk-Based Approach (RBA)

In a compliance program, RBA refers to allocating resources to higher-risk situations and clients. With RBA, fintech companies can streamline compliance activities by focusing on enhanced due diligence and ongoing monitoring for high-risk customers to prevent financial crimes and money laundering. In contrast, low customer risk profiles benefit from simplified compliance steps.

Step 3: The Importance of Using Automation Capabilities

Advanced technology, including machine learning algorithms and proprietary AI, helps fintech companies rapidly satisfy compliance requirements. These tools can replace manual compliance tasks, such as filling in customer data and building reports, saving time and costs. Additionally, it can learn from historical patterns to make fraud prevention and AML more accurate.

Step 4: Compliance Training as an Asset

Whether you create an in-house compliance team or choose to integrate a compliance vendor, compliance training cannot be ignored. Staying abreast of new regulatory requirements, financial regulations, and threats in the regulatory environment is key in the financial services industry.

Step 5: Auditing, Documenting, and Reporting Diligently

Lastly, with robust auditing and documentation records, fintech companies can ensure they fulfill regulatory reporting obligations to satisfy compliance regulations and avoid penalties. Moreover, having an internal process to submit regular audits and risk assessments helps rectify gaps in your regulatory frameworks.

Strengthening Fintech Compliance Solutions

From this guide, we learnt that meeting compliance regulations in the fintech industry is critical for safeguarding the financial system and avoiding fines for financial crimes, money laundering, or terrorist financing. Most importantly, meeting compliance standards pays dividends in building trust through consumer protection and resilience within modern payment systems in financial sectors. Fintech companies must take a proactive and agile approach to fulfill compliance requirements and satisfy regulatory authorities.

Get started with advanced AML and KYC solutions today. Learn more from a member of the team.