TL;DR: Digital KYC onboarding presents a practical way to verify a customer’s identity remotely. With onboarding automation tools, businesses can design quicker and streamlined user journeys. This guide covers the mechanics behind automated identity verification methods and how to build customizable customer onboarding processes to enhance trust and conversion rate.

How Does User Onboarding Impact Trust and Conversion?

Onboarding flows have a significant impact on customer experience and brand image. This is especially true in the modern era, where customer expectations are high. Trust breaks down when the onboarding process feels complex. For example, unclear instructions, repeated requests, and sudden friction lead to dissatisfaction. As a result, a customer will have a negative perception of the company, which creates a sense of distrust, leading to drop-offs. Here are some statistics firms must know:

- 38% of new banking users abandon account creation if the process is long

- 89% of customers who have a poor onboarding experience will turn to a competitor

- 63% of customers consider the onboarding experience in purchasing decisions

- It costs five times more to source a new customer than to keep an existing one

Additionally, in regulated sectors, particularly financial institutions, customers are becoming more particular about how their data is collected and used. Thus, without a clear explanation, this can also result in distrust. For companies in competitive sectors or those serious about growth, streamlined onboarding tools act as a strategic advantage.

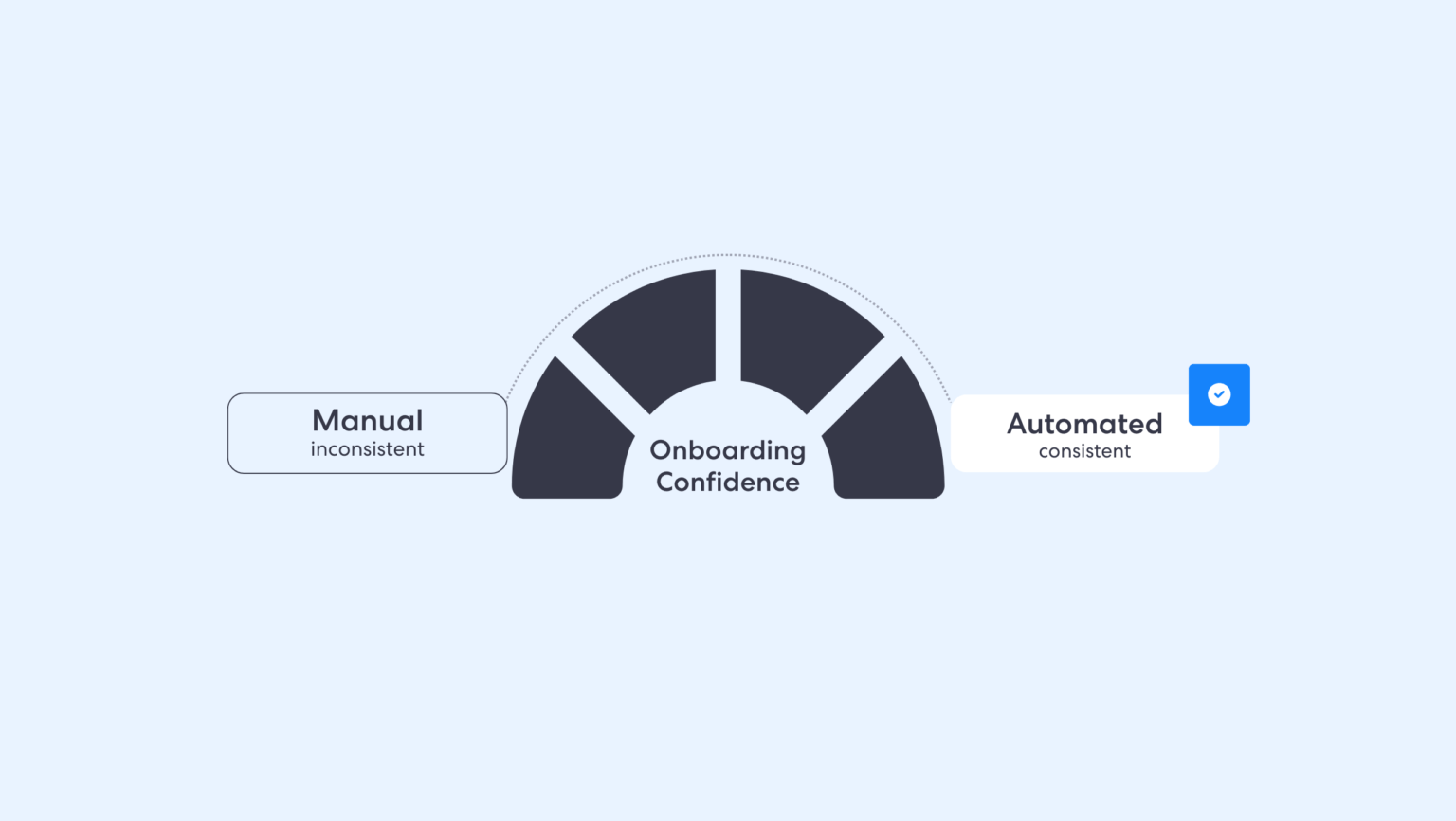

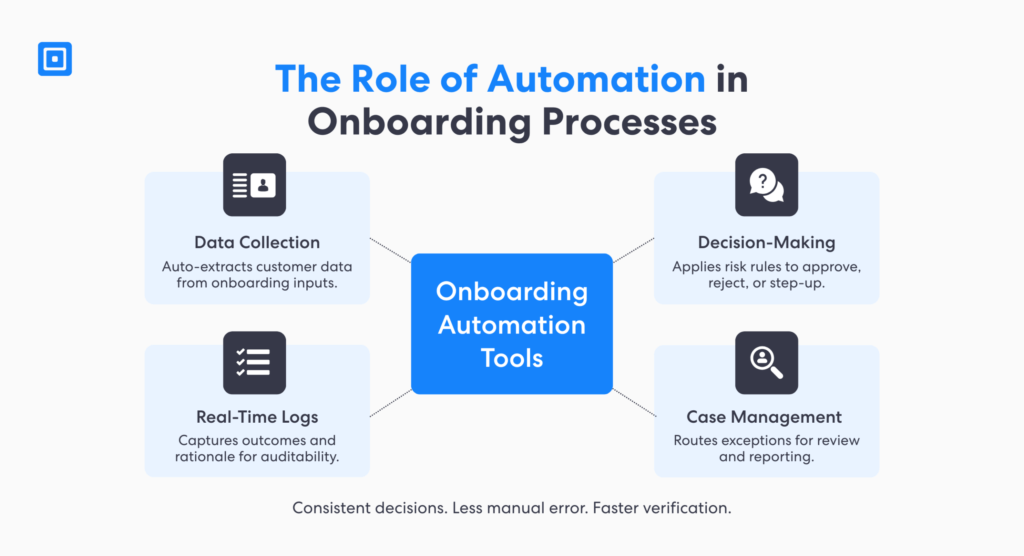

The Role of Onboarding Automation Tools

Automation enables businesses to build tailored onboarding workflows with precision, balancing security and user experience. It utilizes sophisticated artificial intelligence and machine learning algorithms to standardise what “good” looks like and apply it consistently. Additionally, automation removes customer friction that can arise from human error during manual review. It streamlines the verification process by removing human judgment from the equation.

Furthermore, automated onboarding provides higher customization and scalability. For global businesses, these two benefits are crucial to long-term business growth. Thus, automated systems deliver lower customer drop-off, faster time-to-value, and consequently higher return on investment. Onboarding automation tools support 4 distinct steps:

- Data Collection: Automatically extracts relevant customer data once a user completes onboarding, removing the need for manual data submission.

- Decision-Making: Applies rules according to the risk profile of the user to decide whether to reject, approve, or route to a different step.

- Real-Time Logs: Details verification outcomes so compliance teams can demonstrate decision rationale, building a defensible proof for regulators.

- Case Management: Escalates suspicious scenarios that require senior oversight or submission to regulators for compliance requirements.

Automation in KYC and Identity Fraud Prevention

Automated identity verification methods reduce bottlenecks for genuine customers while making fraud tougher for bad actors. This is where no or low-code workflows come in. In Know Your Customer (KYC) compliance, businesses can layer multiple identity verification checks according to risk. No-code workflows leverage API integrations for rapid deployment without waiting for long development cycles. You can learn more here: Simplify AML With No-Code Compliance Workflow Software

Common methods used in automated identity verification include:

1. Document Verification and Optical Character Recognition (OCR):

Document verification is the process of screening submitted document types to validate genuine customers. Firstly, identification documents such as driver’s licenses, passports, and national ID cards are submitted on the user’s end. Next, the security features in these documents, including holograms and watermarks, are scanned for authenticity. Automated document verification makes use of cutting-edge OCR technology, which extracts and analyses customer information in real-time.

2. Biometric Verification and Liveness Detection:

Biometric authentication enables firms to ensure customers are genuine and present during online transactions. It includes facial recognition, such as selfie checks to determine if a user is the actual owner of an account. Automated verification involves liveness detection technology, which involves anti-spoofing detection to prevent advanced presentation attacks. Thus, companies can achieve maximum security and prevent fraud more effectively.

3. NFC Chip Screening:

Near Field Communication (NFC) screening is the process whereby a customer uses their NFC sensor on their phone to read the biometric data on their e-passport chip. It plays a crucial role in KYC and helps businesses identify cloned or tampered passports. With automation, NFC checks are triggered in real-time, producing instant outcomes. As a result, companies detect any potential for fraudulent or suspicious activities much quicker than manual verification.

4. Database Verification or Multi-Bureau Checks:

Database verification refers to cross-checking a customer’s information against trusted sources, including credit and identity bureaus. It gives firms a more comprehensive picture of risk assessment. Using automation, this process increases in accuracy and scalability. Unified reports can be generated in real-time, shifting from manual checks, so customers can onboard at a much quicker pace. You can learn more here: Why Multi-Bureau Identity Verification is the Ultimate Fraud Defense

Case Study: Accelerate Compliant Onboarding with Automation

StartDock is the leading coworking space provider in the Netherlands. The firm had to comply with the country’s Anti-Money Laundering and Anti-Terrorist Financing Act (Wwft) when onboarding new customers and businesses.

Enhanced KYC, KYB and AML Screening for Virtual Addresses

StartDock required automated tools to enhance onboarding compliance. The firm leveraged ComplyCube’s real-time regulatory technology platform. The firm was able to run KYC checks on members and conduct enhanced due diligence on businesses requiring virtual addresses.

Outcomes

StartDock was able to perform real-time biometric and document verification process, onboarding users instantly.

The firm was able to implement advanced, customizable KYB and KYC checks according to the risk profile of customers and entities.

As a result, the company was able to improve member and business onboarding by 28% through automation.

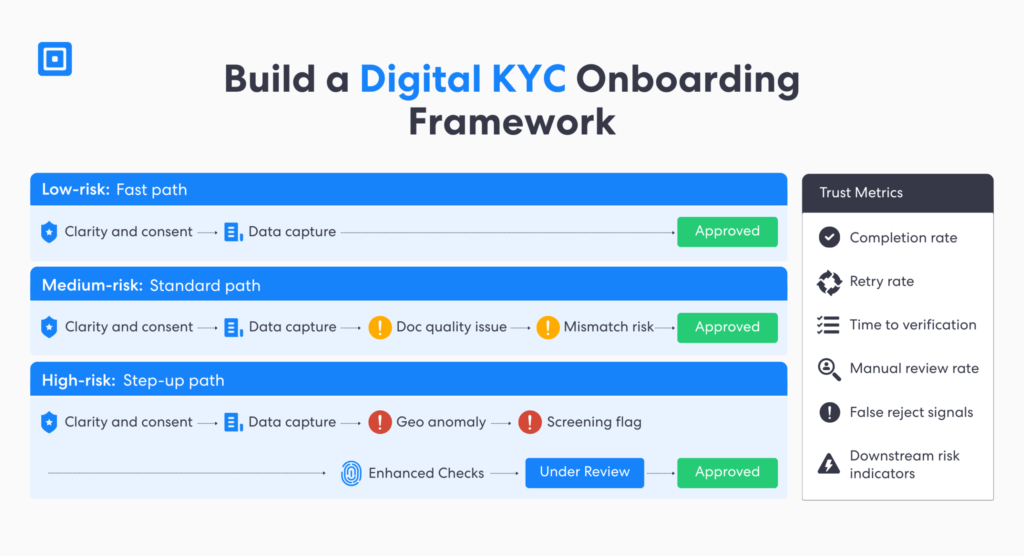

Build a Digital KYC Onboarding Framework

An effective digital onboarding process must use a risk-based approach. This means low-risk users experience faster onboarding flows while high-risk users route to enhanced checks. A risk-based approach is foundational to reducing drop-offs while maintaining compliance, as recommended by the Financial Action Task Force (FATF).

A practical structure for a trust-first, risk-based flow includes:

- Start with clarity: Set expectations for what will happen (data capture, ID upload, selfie, screening) and why. Insert clear privacy terms and ensure data collected aligns with jurisdiction rules, for example, the EU’s GDPR and the US NIST.

- Use progressive disclosure: Only collect relevant customer information to verify identities according to a user’s risk tier at that moment. For instance, do not include additional checks if onboarding documents have not been verified.

- Apply step-up logic: Increase ID verification layers only when signals warrant it (document quality issues, mismatch risk, geolocation anomalies, sanctions screening flags). Ensure all outcomes and decisions are logged for transparency and clarity.

- Treat manual review as a designed path: Provide clear status messaging and timelines to ensure customers are not stuck at a dead end. In particular, including clear links to support teams or additional how-to videos is vital in onboarding checklists.

However, speed alone cannot be treated as a trust metric if onboarding automation tools generate high false positives, fraud rates, or escalation to senior oversight. According to Harry V., Chief Product Officer at ComplyCube, “Risk management teams must track the metrics that signal both user experience and control quality”.

Important trust metrics to consider include:

- Completion rate: The percentage of users who finish onboarding.

- Retry rate: How often users must resubmit identity documents or data.

- Time to verification: median time from start to decision, split by auto-pass vs manual review.

- Manual review rate: The percentage of cases routed to human review, with top drivers.

- False reject signals: False positives, support tickets, and re-onboarding attempts.

- Downstream risk indicators: Early fraud markers, false negatives, or suspicious activity flags.

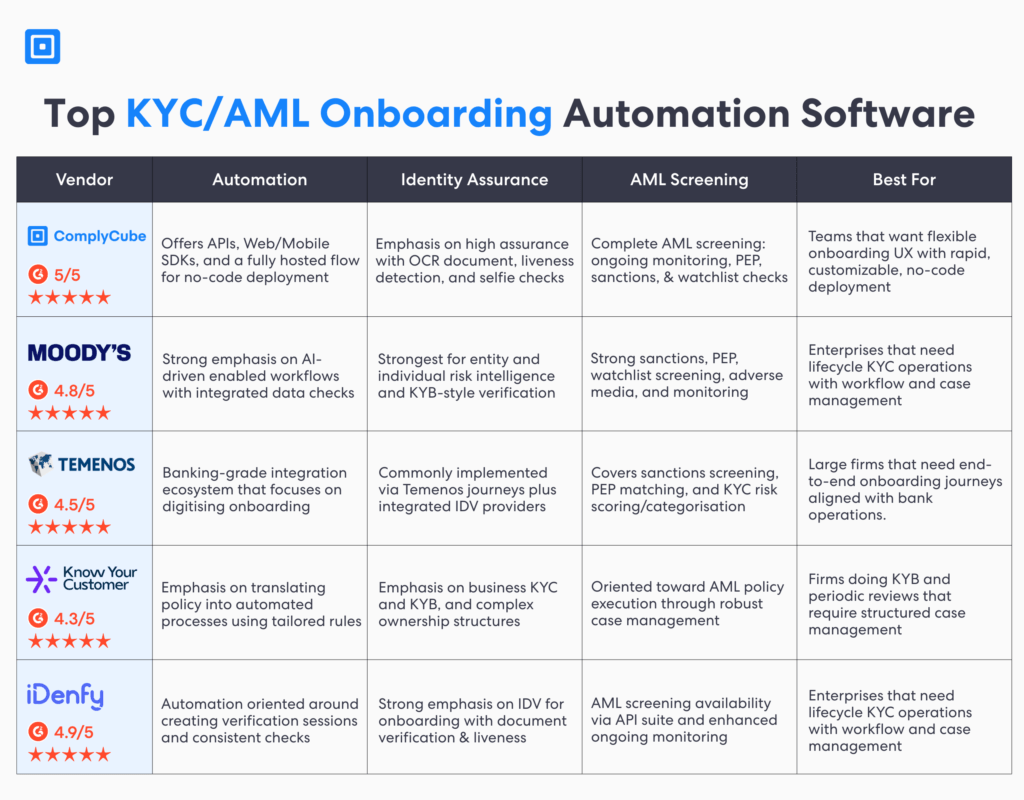

Comparing Top KYC and AML Onboarding Automation Tools

In order for businesses to strengthen their efforts in combating identity theft and money laundering, combining layered checks into workflows is crucial. For example, this includes combining onboarding ID verification with watchlist screening, adverse media checks, and implementing ongoing monitoring to satisfy Anti-Money Laundering (AML) compliance requirements.

Onboarding software supports businesses in meeting regulatory compliance. It provides regulated firms with streamlined digital identity verification, ongoing monitoring, and case management. As a result, organizations can balance security with user-friendly interfaces that adapt to international and local regulations and risk appetite for enterprise teams.

Key Takeaways

Customer onboarding is crucial and has a significant impact on user trust, brand perception, and conversion.

Onboarding automation tools streamlines verification processes, making it more secure, accurate, and quicker than manual reviews.

The effectiveness of onboarding must be analysed with metrics such as false positives, conversion rates, drop-offs, and customer satisfaction scores.

Biometric verification, document checks, NFC screening, and database verification, when done with automation, enable real-time outcomes and decisions.

Top KYC and AML onboarding automation tools support cross-border compliance, enhanced security, and customer trust.

Enhance Customer Experience and Reduce Operational Costs

The right identity verification solution unifies regulatory compliance requirements, satisfying KYC and AML compliance while enhancing customer conversions. While speed is vital, trust metrics, including customer satisfaction, time-to-value, and support tickets, provide an overview of operational efficiency. Automated ID verification software such as ComplyCube empowers companies to make trusted decisions, adhering to cross-border KYC and AML compliance. Start your free trial with ComplyCube today.

Frequently Asked Questions

What are onboarding automation tools?

Onboarding automation tools enable businesses to verify customers more securely and quickly by removing manual reviews and checks. It includes automating identity checks, document verification, and risk scoring during AML and KYC processes. The benefits include enhanced operational efficiency and reduced cost.

How can firms implement automation in KYC?

To implement KYC automation, firms must integrate APIs, SDKs, and leverage AI-driven solutions. Next, businesses must set up rules and risk thresholds for identity verification and real-time AML screening. This enables low-risk customers to onboard more quickly, while applying enhanced due diligence to high-risk scenarios.

What is the digital KYC onboarding process?

Digital KYC processes enable identity verification remotely. It includes collecting customer information, verifying user identity, screening against sanctions and watchlists databases, and ongoing monitoring, all of which occur in the backend via secure web or mobile apps.

What are automated identity verification methods?

Automated identity verification methods include OCR technology for real-time data extraction, liveness detection for instant selfie checks, and AI-based database verification for quick cross-checking against trusted third-party data providers. Automated ID verification processes cut manual reviews and confirm a customer is legitimate within seconds.

Does ComplyCube provide KYC automation solutions?

Yes. ComplyCube offers a large integration capacity, providing regulated firms with end-to-end KYC automation solutions. The firm provides AI-powered identity verification, AML screening, selfie checks, and no-code workflows tailored for AML and KYC compliance globally.