TL;DR: Fraud is a threat to the healthcare industry, jeopardizing patient safety and compliance with regulations. To combat this challenge, health insurance fraud detection tools are critical. Explore how advanced AI fraud detection in health claims and healthcare fraud prevention software can eliminate fraud, waste, and abuse (FWA) effectively in this guide.

What is Healthcare Insurance Fraud?

Health insurance fraud is the illegal exploitation of the healthcare system by submitting false or inflated medical claims. For example, it includes falsifying records, over-billing, and dishonest health insurance claims using stolen identities for financial gain. The impact of insurance fraud is startling, with common examples including bribery and identity theft. Common fraud committed by policyholder includes:

- Submitting claims for medication that were not received.

- Falsifying customer information when buying a policy.

- Exaggerating or incorrectly diagnosing health issues.

- Bribing medical providers to provide a fake claim.

- Incorrect reporting of health issues or diagnosis.

- Committing identity theft through stolen ID to access medical services.

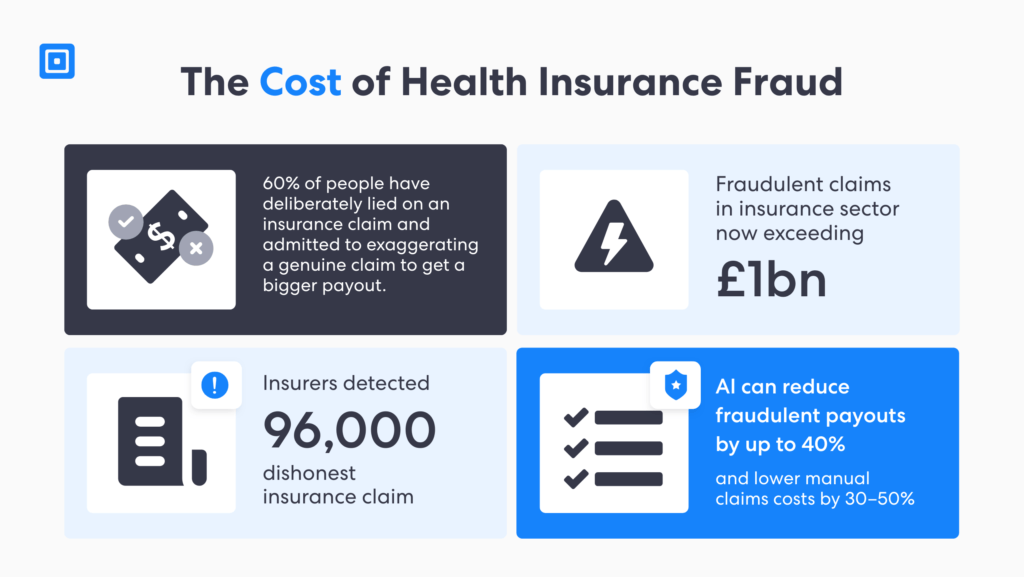

To mitigate the financial toll, insurance providers pass these losses on to policyholders through higher premiums. Consequently, trust is eroded for legitimate claims and patients who require medical care. According to the National Health Care Anti-Fraud Association (NHCAA), key statistics indicate that financial losses from health care fraud exceed billions of dollars each year.

To address this challenge, insurers must use effective tools for health insurance fraud detection. These tools help identify patterns of suspicious claims earlier in the process, safeguarding the financial integrity of patients, healthcare providers, and insurers. Additionally, cutting-edge solutions, such as AI fraud detection in health claims, enable rapid, accuratedetection of fake claims.

Understanding Health Insurance Fraud Detection Solutions

Medical insurance fraud identification systems use Know Your Customer (KYC) and Anti-Money Laundering (AML) frameworks to block the use of stolen credentials and tampered documents before false claims are filed. By integrating artificial intelligence AI) and machine learning methods, these solutions flag high-risk suspicious patterns via real-time processing.

It takes a concerted team effort to fight back against insurance criminals

A robust KYC and AML program supports health insurance fraud detection more effectively while complying with global regulations, such as the EU’s 6th AML Directive (AMLD6). Additionally, modern healthcare fraud prevention software further supports compliance with data privacy laws, including the Health Insurance Portability and Accountability Act of 1996 (HIPAA).

According to the National Insurance Crime Bureau (NICB), “It takes a concerted team effort to fight back against insurance criminals”. To that end, combining the resources and expertise of insurers and law enforcement agencies, fraud can be detected, deterred, and stopped.

AI Fraud Prevention with AML and KYC in Health Claims

Insurers invest at least £200 million each year to prevent fraud. It is no news that fraud in the insurance industry is a serious crime. To combat it, modern regulatory technology software employs sophisticated fraud-identification models powered by AI and ML.

This software can analyze large amounts of data to detect anomalies and patterns missed by human oversight. According to reports, the AI market in Regtech is forecast to reach $3.3 billion by 2026, growing at a CAGR of 36.1% from 2021 to 2026. Thus, by applying AI fraud detection in health claims, insurers can:

- Identify Fraudulent Behaviors Faster: AI-powered KYC software utilizes advanced data analytics and anomaly detection to sift through thousands of documents and biometrics in real-time. This enables insurers to block stolen credentials that enable claims fraud before medical records are tainted.

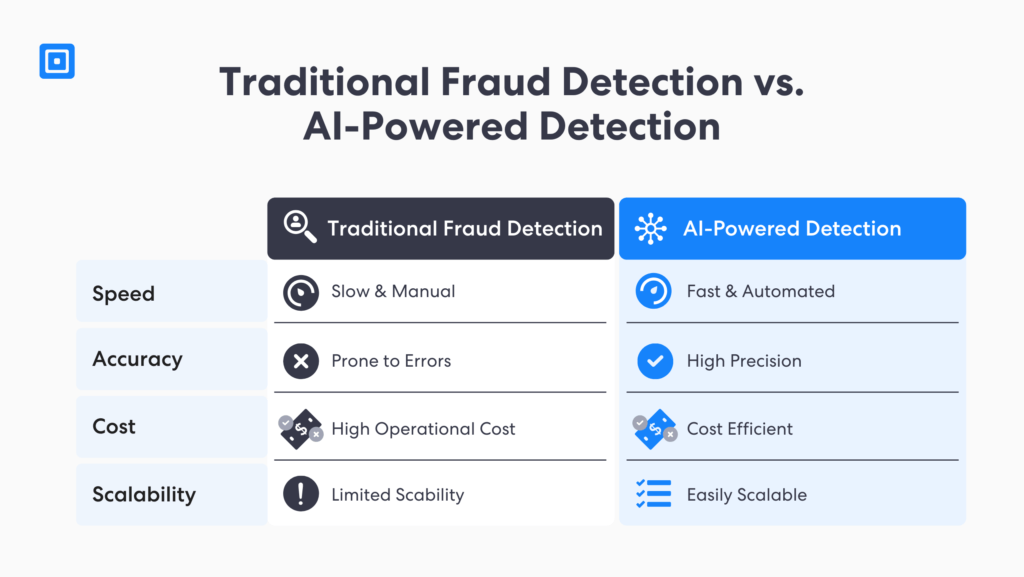

- Improve Fraud Detection Accuracy: Unlike traditional fraud prevention in KYC insurance processes, AI-powered solutions deliver improved accuracy at an unprecedented rate. This enables reduced false positives and reliance on human effort, achieving significant cost savings in the long run.

- Enhance Predictive Analytics: AML screening can improve risk scoring by analyzing new data, such as biometric data, against sanctions lists, watchlists, and adverse media coverage. High-risk entities flagged with risk triggers can undergo further investigations through automated Enhanced Due Diligence (EDD).

- Automate Manual Processes: Insurers can streamline policyholder onboarding with real-time detection, enabling a shift away from manual identity verification. Companies in the insurance sector can maintain HIPAA audit-ready compliance, combating fraud schemes before patient records are compromised.

AI-driven fraud intelligence solutions enhance the efficiency of compliance teams by significantly speeding up verification without error, reducing fraud waste and abuse in insurance companies. It is an innovative solution that makes healthcare identity theft precise. You can learn more here: Generative AI Fraud and Identity Verification.

Case Study: Solidifying Leader Status in the Insurance Space

Hayah is a UAE-based leading firm in insurance services, including health and life insurance solutions globally. The firm required software that could streamline its compliance obligations in the UAE and align with fraud prevention and AML laws while scaling the business.

AI-Powered Automation Solution

The company partnered with ComplyCube to scale its operations globally while maintaining secure policyholder onboarding. ComplyCube provides complete due diligence tools, screening clients against worldwide data in over 250 territories, providing strong regulatory adherence.

Outcomes

Hayah was able to achieve quicker and precise onboarding of its policyholders, significantly lowering false positives and enhancing conversion.

The firm was able to build a frictionless KYC policyholder process and meet both local and global KYC/AML regulations at the same time.

ComplyCube’s AI-driven regulatory technology equipped Hayah’s compliance team with the confidence to verify customers securely, building trust at scale.

Insurance Fraud Prevention Features to Prioritize

To complement AI-powered fraud prevention tools, a unified KYC and AML software is critical. Insurers can adopt a proactive approach in monitoring and reporting fraud across their operations. In addition, a complete KYC and AML platform helps insurance firms reduce compliance complexity and protect the bottom line more effectively. Here are key features of these platforms:

- Real-Time Monitoring and Alerts: Perform document and biometric verification and receive instant alerts on high-risk entities tied to fraudulent activities. Insurers can expect to stop threats before they escalate to payouts.

- Risk Profiling: Develop dynamic risk scoring utilizing data from behavioral biometrics, device intelligence, and sanctions matches to assess fraud likelihood from suspicious patterns, including prior device abuse and hidden IP addresses.

- Multi-Bureau Checks: Seamlessly cross-reference customers to global fraud registries, trusted government agency databases, and watchlists to uncover schemes exploiting medical claims for improper payment payouts.

- Robust Document Checks: Leverage document verification that employs Natural Language Processing (NLP) to validate IDs and records for synthetic identities, tampering, and flagging deepfakes.

With these advanced capabilities, firms in the insurance industry can develop a unified, intelligence-driven defence. Insurers can expect greater policyholder trust, stronger compliance, and increased operational resilience. Co, businesses can scale and sustain long-term growth while reducing fraud, waste, and abuse. You can learn more here: AML Guidelines for Insurance Companies.

The Importance of Detecting Fraud in Healthcare

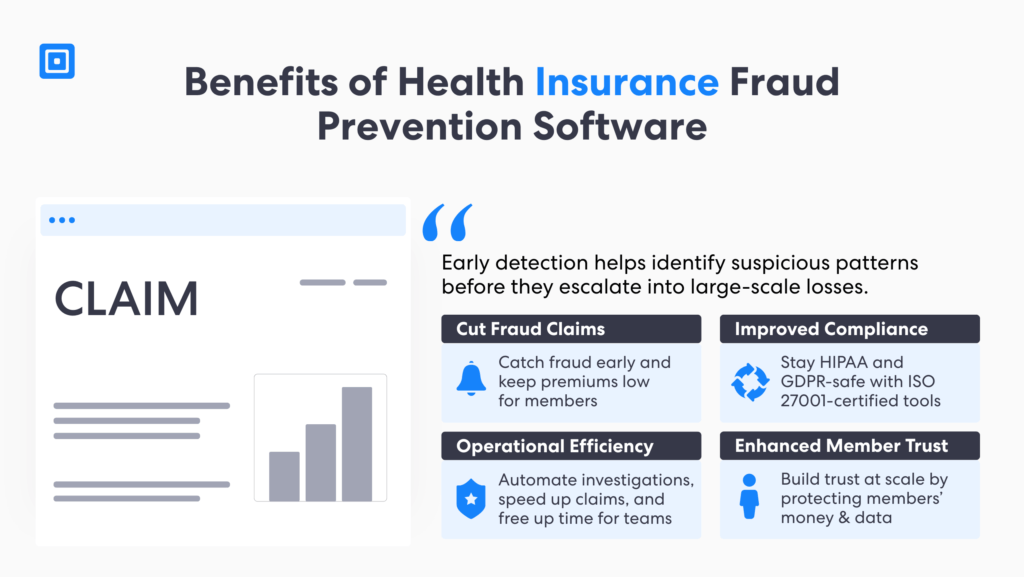

Mastering fraud deterrence related to health care insurance provides multiple benefits. With trusted AML and KYC solutions, insurers can demonstrate high trust in patient care. Early detection helps identify suspicious patterns before they escalate into large-scale losses.

Moreover, effective health insurance fraud detection promotes transparency across health care networks. By combining AI-driven analytics with robust KYC and AML frameworks, insurers and healthcare providers can identify emerging schemes, streamline investigations, and safeguard the integrity of patient data. Ultimately, proactive fraud detection strengthens the sustainability of the healthcare system by ensuring fairness, accountability, and operational efficiency.

1. Reduced Fraud Claims

By identifying and preventing fraudulent claims at an earlier point of entry, insurers can save significant amounts of money and human resources. This not only improves the bottom line but also helps keep premiums affordable for members, safeguarding both the insurance and health care sectors.

2. Improved Compliance

Health care insurers are mandated to meet stringent regulations, including HIPAA and privacy laws. Fraud deterrence software supports these requirements through independent certifications. For example, ISO 27001 and EU GDPR certification enable compliance while protecting patients’ identities and personally identifiable information (PII).

3. Operational Efficiency

AI health insurance fraud detection software automates many of the processes involved in identifying and investigating fraudulent claims. This not only accelerates claims processing but also frees up resources for other important tasks while still adhering to regulations.

4. Enhanced Member Trust

Members rely on insurance firms to protect them from fraud. By investing in advanced fraud prevention measures, insurers demonstrate their commitment to safeguarding both their financial integrity and their members’ well-being. This helps build customer satisfaction and loyalty over the long-run.

Key Takeaways

Insurance fraud related to health care can include exaggerated claims, using fake IDs, and bribery to achieve financial gain.

Unified AML and KYC software are essential in proactively identifying and mitigating fraud, reducing compliance complexity across operations.

Tools such as real-time monitoring and dynamic risk profiling support insurers in early identification of high-risk individuals before fake claims escalate.

AI-driven health insurance fraud detection solutions solidify identity assurance and prevent sophisticated fraud such as deepfakes and tampered ID.

Developing a proactive fraud prevention framework is critical to build customer trust, safeguard the health care sector, and enhance regulatory confidence.

Implement Health Insurance Fraud Detection Solutions Seamlessly

By integrating AI, KYC, and AML platform solutions, firms can supercharge health insurance fraud detection systems, supporting the prevention of claims fraud at an earlier stage. Insurers can reduce fraud, waste, and abuse, streamline operations, and enhance member trust, ultimately leading to a more secure and efficient healthcare system. Protect claims data and medical records before they are tainted by stolen IDs and credentials today. To learn more, speak to a member of the team today.

Frequently Asked Questions

How can insurance companies identify fraud?

Firms in the insurance sector can identify and escalate fraudulent cases through features such as real-time monitoring, risk profiling, and document verification. Additionally, multi-bureau checks, sanctions, and watchlist screening against global registries enable flagging of suspicious activities early on.

What is the most common type of health/medical insurance fraud?

The most common type of health or medical insurance fraud includes claiming for services that are not rendered, inflating medical diagnoses, and upcoding for improper payouts. These activities drive up premiums to legitimate policyholders, delaying genuine care and eroding trust in the health care sector.

How does AI-driven AML and KYC software fight insurance fraud in health care?

Artificial intelligence enables insurers to detect identity theft, deepfakes, and tampered documents quickly and reliably. This enables any suspicious activities to be detected and investigated early on before actual payouts, reducing unnecessary procedures such as human oversight. Additionally, AI streamlines regulatory compliance, shifting from reactive to proactive threat prevention.

What are the benefits of utilizing health insurance fraud detection software?

Fraud prevention software enables insurers to reduce financial losses, streamline compliance requirements, and boost authentic claims processing. It supports frictionless onboarding of genuine policyholders, enhancing customer conversion and operational resilience.

Does ComplyCube offer AML/KYC solutions to the insurance industry?

Yes. ComplyCube provides award-winning KYC and AML tools customized to the insurance industry. Its ongoing monitoring, case management, and complete document verification solution supports companies in insurance to speed up policyholder onboarding while reducing false positives significantly.