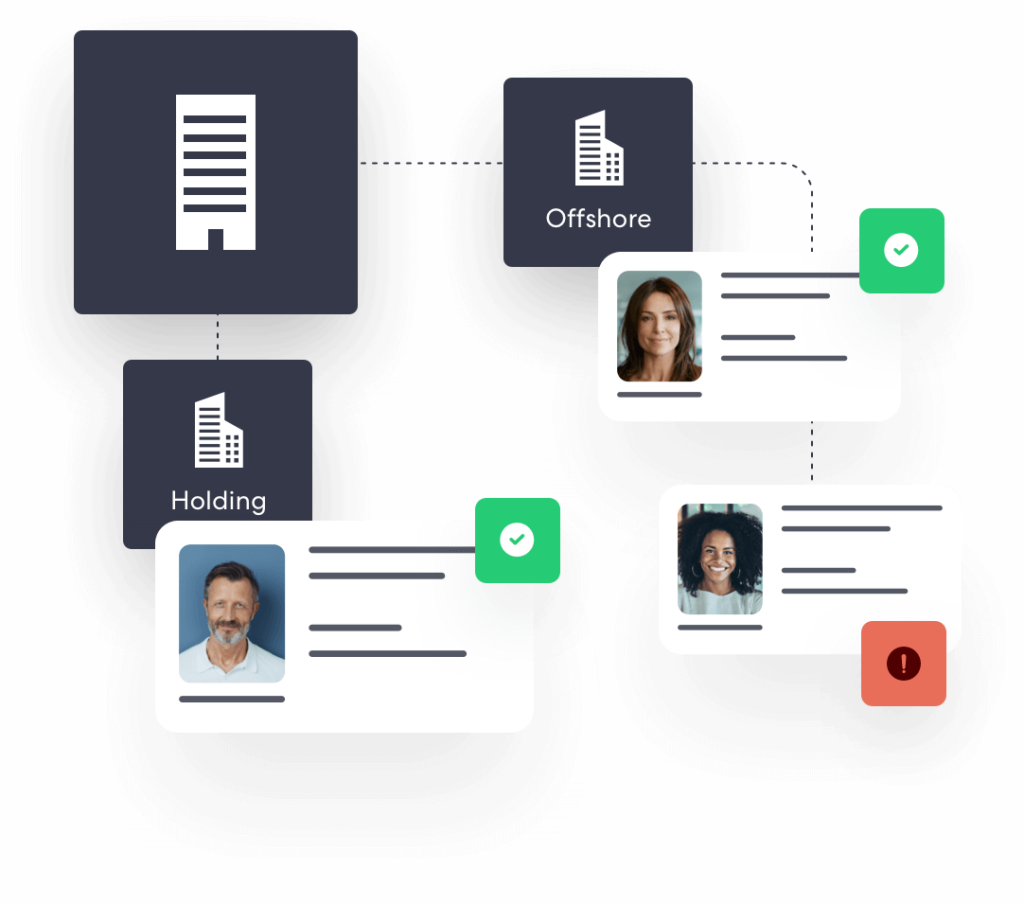

bureau verification of shareholders

Verify shareholders and director information

When onboarding legal entities, you want to be able to corroborate the information provided by owners for KYC with third parties.

Our access to data sources such as Governments and Credit Bureaus worldwide allows you to verify information such as SSN, Name, and Date of Birth with trusted third parties.