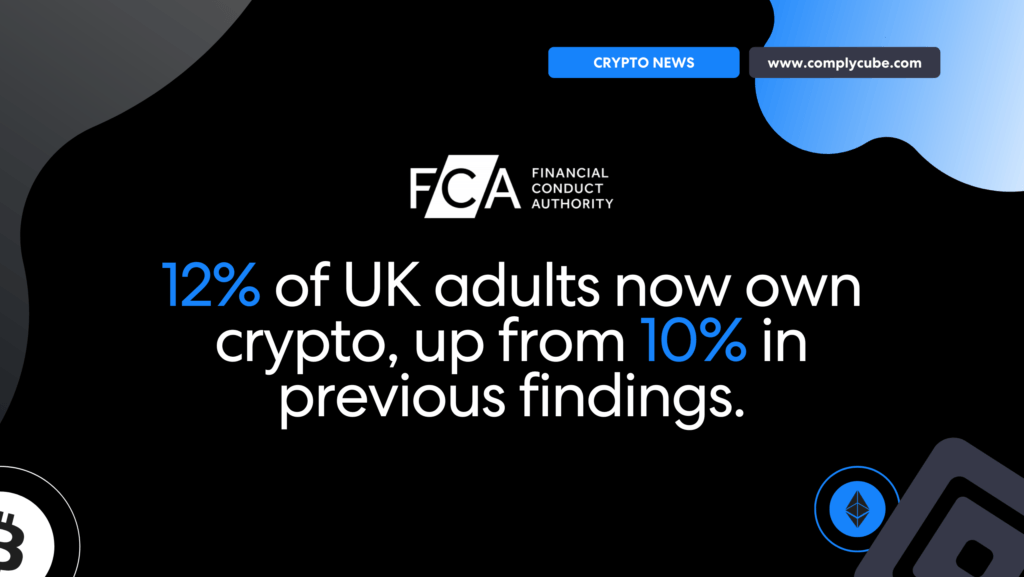

As the US spearheads the global crypto surge, the future of UK crypto regulation remains uncertain. Tulip Siddiq, the U.K. Treasury Minister and a prominent advocate for cryptocurrency regulation has resigned, leaving the nation with questions over the future of crypto in Britain. Meanwhile, the FCA reports that 12% of UK adults now own cryptocurrency, a clear indication that Britain is eager to avoid being sidelined as America embraces its new financial frontier. With the U.S. gearing up for Trump’s crypto era, let’s dive into how Britain might follow and what we can expect from 2025 crypto regulation in the UK.

Uncertainty After Tulip Siddiq’s Resignation

The resignation of Tulip Siddiq, the U.K. Treasury Minister and a prominent advocate for cryptocurrency regulation, has cast a shadow over the future of digital asset oversight in the country. Siddiq stepped down amidst allegations of illegal ties to an anti-corruption investigation in Bangladesh. Her departure raises concerns about the continuity of the U.K.’s regulatory ambitions for digital assets, which had been gaining momentum under her leadership.

Siddiq formed a key part of the Treasury’s crypto regulatory stance, including plans to regulate stablecoins and staking services in early 2025. Her ambitions included pushing London as a global crypto capital, hoping to re-establish its position as a leading hub for digital finance. Yet, her resignation leaves the nation questioning whether the Treasury will carry out these plans.

The Growing Urgency for Crypto Regulation in the U.K.

While Siddiq’s resignation casts uncertainty on the UK’s crypto regulatory future, the growing public interest in digital assets cannot be ignored. The FCA’s findings show that 12% of U.K. adults now own crypto, a 10% increase from previous findings. General awareness of crypto also rose from 91% to 93%, and the average value of cryptocurrencies held by UK citizens increased from £1,595 to £1,842. These statistics provide critical insight into public interest and demand for this growing sector as America continues to push crypto in campaigns with global reach.

12% of UK adults now own crypto, up from 10% in previous findings.

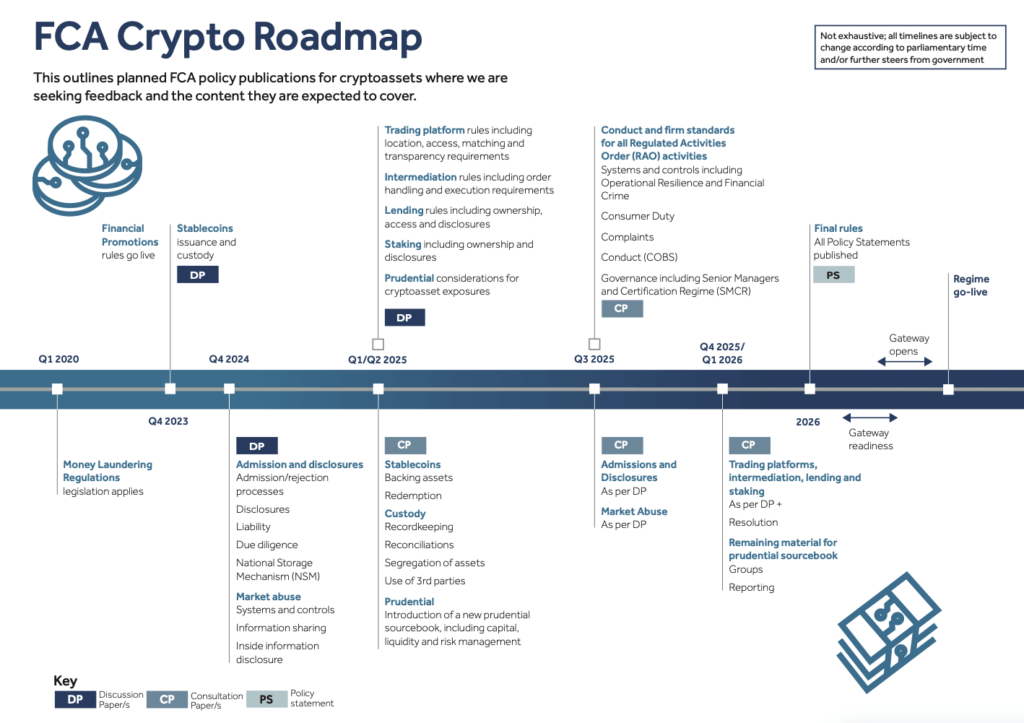

The clear increase in UK crypto demands the right regulatory framework to avoid fraudulent practices and structured growth. Despite Siddiq’s resignation, the FCA remains committed to its roadmap for crypto regulation, with plans to finalize a comprehensive framework by 2026.

The FCA’s crypto roadmap was first released in 2023, marking the regulator’s approach to stabilizing the sector’s growth. The roadmap outlines some clear focuses for the FCA, including consumer protection, market integrity, and Anti-money Laundering (AML) measures.

However, critics argue that the U.K. risks falling behind global competitors if it does not accelerate the implementation of these regulations. As one recent opinion piece in The Fintech Times pointed out, the pace of regulatory development is critical as nations like the U.S. and the European Union push ahead with their own crypto frameworks.

Emma Reynolds Takes Over as the New Economic Secretary to the Treasury

Following Siddiq’s resignation, Emma Reynolds has been appointed as the new Economic Secretary to the Treasury, taking on the responsibility of overseeing the U.K.’s approach to cryptocurrency regulation. Reynolds, a Member of Parliament for Wolverhampton North East, assumes this role at a crucial moment for the digital asset sector. She brings a wealth of experience, having previously served as shadow international trade secretary, which will be instrumental in navigating the complexities of digital currencies, blockchain technology, and the broader financial ecosystem.

Reynolds will lead the U.K.’s regulatory approach through this phase of growth, implementing the needed frameworks to balance innovation efforts with consumer protection. The Treasury’s focus is on providing the sector with a clear rulebook that will outline the treatment of stablecoins and the possibility of a central bank digital currency (CBDC).

What Might We Expect from UK Crypto Regulation in 2025?

1. Increased Focus on Consumer Protection

As the crypto market matures, consumer protection will become a primary concern for UK regulators. The government is expected to introduce more stringent rules around the disclosure of risks for retail investors, especially as cryptocurrencies remain highly volatile. This could include clearer warnings about the speculative nature of crypto assets, mandatory risk assessments for investors, and stronger transparency requirements from crypto exchanges and service providers. Expect further tightening of advertising guidelines to avoid misleading or overly-promising campaigns that could attract uninformed investors.

2. Enhanced AML/CTF Compliance

The UK is likely to implement even more robust Anti-Money Laundering (AML) and Counter-Terrorist Financing (CTF) measures specific to the crypto sector. In line with the EU’s recent developments and global trends, crypto businesses will likely be required to comply with the same AML obligations as traditional financial institutions, such as implementing enhanced due diligence for high-risk customers, regular audits, and real-time transaction monitoring. Expect increased scrutiny on firms’ Know Your Customer (KYC) practices.

3. Crypto Derivatives and Lending Regulation

The booming crypto derivatives market, including futures and options based on cryptocurrencies, will likely face tighter regulation. More specific rules could be designed to protect investors from the risks involved in crypto derivatives trading. The Financial Conduct Authority (FCA) may introduce clearer guidelines for crypto margin trading, ensuring that customers understand the risks involved in leveraging cryptocurrency positions.

“For now, cryptoassets are largely unregulated in the UK. Only a few crypto asset activities have needed authorization under the Financial Services and Markets Act 2000 (FSMA).'”

Similarly, the rising popularity of crypto lending platforms, which offer high-interest returns on crypto deposits, will likely face increased scrutiny. Regulators may require lending platforms to hold sufficient capital reserves to protect customer funds and impose transparency requirements about the interest rates being offered and the risks involved.

4. Institutional Adoption and Regulation

As institutional investors increasingly enter the crypto space, with firms like hedge funds, investment banks, and pension funds looking to add digital assets to their portfolios, the UK is likely to introduce more regulation to accommodate and guide institutional adoption.

“Access to investing in digital access and regulation is improving. These are encouraging signs that digital assets could, like commodities, be coming into its own as an asset class.”

Fidelity Digital Assets has pointed out that “access to investing in digital assets and regulation is improving,” signaling that digital assets could soon mature into a standalone asset class, much like commodities. Fidelity further draws parallels between the digital asset market today and the evolution of other alternative asset classes. Just as commodities eventually became their own distinct asset class, digital assets may follow suit, bringing increased institutional interest.

This interest could bring forth clearer frameworks for institutional custody solutions, ensuring that large-scale investors can store crypto assets securely and comply with industry standards. Provisions for asset-backed securities (ABS) and other forms of crypto-backed financial instruments may also be included, which will likely undergo closer scrutiny.

5. Taxation Clarity and Reporting Obligations

As the UK government looks to balance fostering innovation with securing tax revenue, crypto taxation is expected to become more streamlined and transparent. Businesses and individuals will likely face clearer reporting requirements to ensure they pay the correct amount of tax on crypto transactions, including capital gains tax and income tax on crypto assets. This could involve real-time reporting systems integrated directly with crypto exchanges, reducing the likelihood of tax evasion and ensuring more compliance with HMRC guidelines.

The Role of Crypto Firms in Ensuring Industry Stability

While regulation remains essential for the safe growth of the crypto sector, experts emphasize that crypto firms also have the responsibility to protect consumers and maintain market integrity. Ensuring the right processes are in place in order to protect consumers is critical, including the right AML and KYC infrastructure to detect fraud quickly and accurately.

Crypto firms are not just gatekeepers of financial transactions—they are custodians of trust. As the UK seeks to finalize its regulatory framework, these firms have the opportunity to lead by example, demonstrating that a secure, transparent, and compliant ecosystem.

Joshua Vowles-Dent, Business, Strategy, and Partnerships Manager at ComplyCube, highlights the need for the sector to take responsibility for ensuring consumer protection. “The integrity of the crypto sector hinges on the ability of individual firms to continually assess their shortcomings, act swiftly, and integrate the necessary advanced technologies to prevent fraud before it happens. Crypto firms are not just gatekeepers of financial transactions—they are custodians of trust. As the UK seeks to finalize its regulatory framework, these firms have the opportunity to lead by example, demonstrating that a secure, transparent, and compliant ecosystem is not just a regulatory necessity but the bedrock for sustainable growth and long-term investor confidence in the digital asset space.”

Fortifying Crypto Compliance

As the Treasury continues to work towards providing the necessary regulatory frameworks, crypto firms must also take on the responsibility of ensuring a secure sector. Rising crypto adoption means that KYC and AML practices must be at the forefront of the crypto agenda, and the coming years will be critical for crypto giants to position themselves as reputable and compliance-focused digital asset leaders.

Reynolds’ leadership will be crucial in ensuring that the country develops a regulatory framework that is both forward-thinking and adaptable to emerging technologies. For more information on how to safeguard your crypto firm with the necessary AML and KYC processes, contact ComplyCube’s expert compliance team.