Leveraging advanced customer identity verification software is not just best practice, but also a business imperative. As digital interactions become the norm, the potential risks from fraud, identity theft, and non-compliance have skyrocketed. Companies without identity verification processes are vulnerable to these criminal activities, which can result in massive financial losses and loss of reputation.

Adopting strong identity verification processes helps businesses identify and combat fraudulent activity, protecting their assets and customers’ data. This guide will explore identity verification, its main elements, and the considerations for selecting the best customer identity verification software.

What is customer identity verification?

Identity verification is when companies confirm whether an entity or person is actually who they claim to be. Businesses adopt identity verification typically when a person or client opens an account or aims to use a service. The process involves collecting various forms of identification document types to gather essential information such as name, address, and date of birth. The documents may include passports, driving licenses, and residence permits, which are then verified through biometric authentication or against reputable databases. But why does it matter if a user or entity is legitimate?

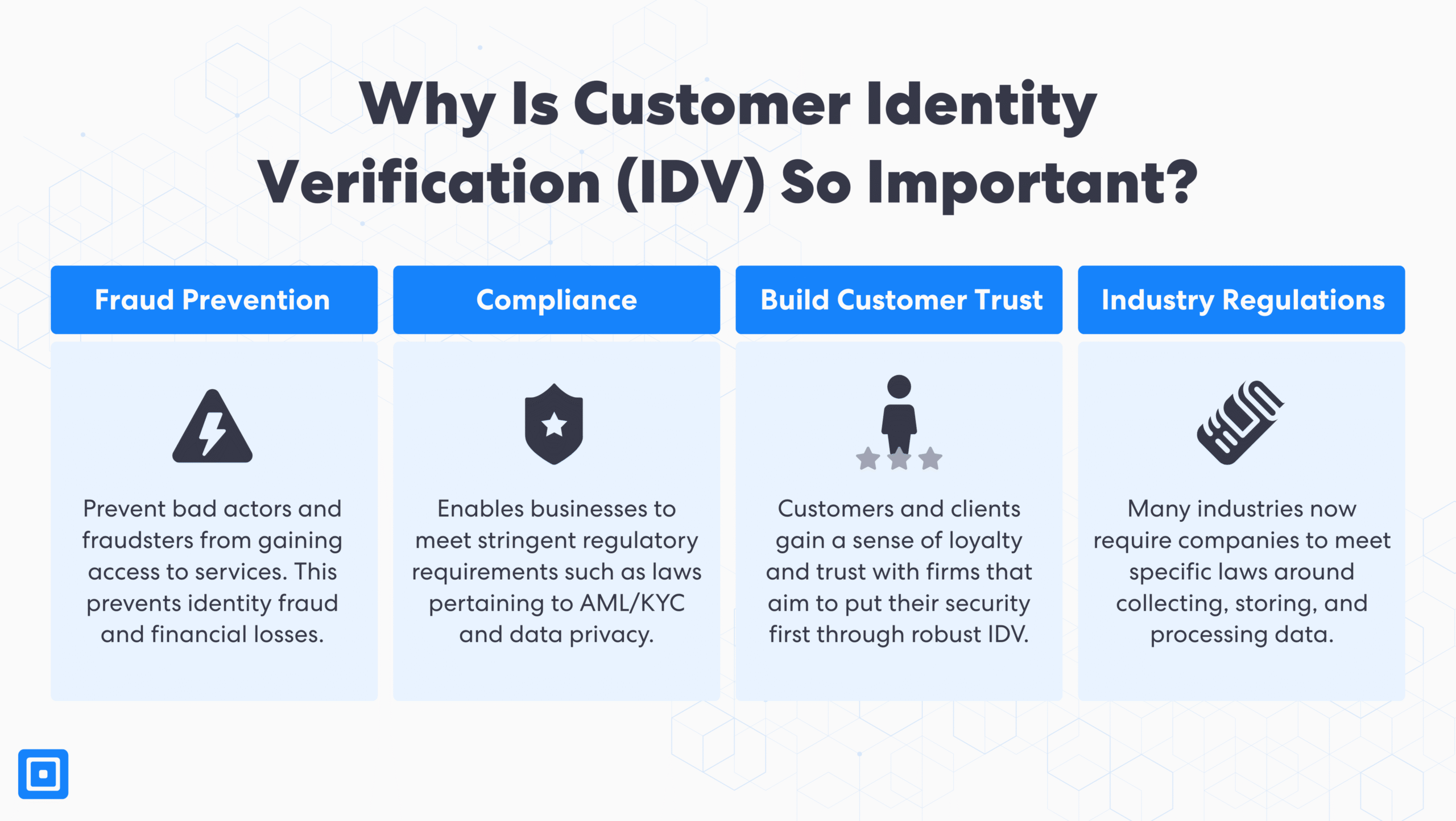

Why Does Customer Identity Verification Even Matter?

The digital world is plagued with sophisticated fraud attempts, from account takeover and synthetic identity fraud to payment fraud and deepfakes. The list goes on. Beyond fighting fraud, verifying legitimate users enables firms to build trust with users, who expect their personal information to be handled securely. It also fulfills a moral duty: businesses are responsible for ensuring their platforms are safe, secure, and free from abuse.

1. Potential Fraud Prevention and Other Illicit Activities

Organizations can deny access to unauthorized users across different countries and territories, preventing identity fraud and financial losses. Advanced identity verification tools support businesses in avoiding sophisticated scams and crimes, building a secure digital ecosystem for users to make transactions and take actions safely.

2. Meet Stringent Regulatory Requirements

Regulations worldwide state specific guidelines for complying with Know Your Customer (KYC), Anti-Money Laundering (AML), and data protection laws. These regulations mandate that organizations, especially in regulated industries, collect, verify, and securely store identity documents and customer information.

The EU’s GDPR, along with similar global regulations, has resulted in penalties exceeding $5 billion, driving companies to boost data protection.

Non-compliance costs greatly exceed the expenses of implementing strong identity verification solutions, with some companies even being forced to close down.

3. Building Trust Through Enhanced Security and Customer Onboarding

Customers and clients are at the forefront of every business. To build long-term customer relationships and brand loyalty, providing users with a platform or service that is secure and transparent is key. Identity verification builds customer confidence and trust knowing that their data and activities are free from bad actors.

4. Industry Specific Compliance

Identity verification is no longer limited only to the finance industry. In finance, it’s about safeguarding accounts and transactions. In e-commerce, it prevents fraudulent orders and chargebacks. In health care, it protects patient data and identity documents and addresses regulatory compliance with privacy law. From financial institutions to healthcare, travel, and gaming, every industry that has a digital service must prioritize identity and business verification.

Must-Have Features to Look For in Customer Identity Verification Software

Robust identity verification solutions have become a necessity in all industries. They provide safer onboarding, regulatory compliance, and defense against elaborate identity fraud and cyber attacks. Modern identity verification software can provide a significant advantage through its use of advanced technology. Here are some of the must-have features to look out for when choosing the right vendor:

AI-Driven Biometric and Document Verification

Look for identity verification tools incorporating Artificial Intelligence (AI) and Machine Learning (ML). AI and ML technologies allow companies to run document verification, adverse media screening, and biometric checks like facial recognition and liveness detection in real-time. With such functionalities, businesses can fight identity fraud by confirming document authenticity and distinguishing genuine users from fraudulent attempts.

Automated Verification Options

Another must-have feature of identity verification software is its automation capabilities, enabling firms to securely and quickly verify users in real-time. Companies can set the right resources for more complex cases such as dealing with Politically Exposed Persons (PEPs) while enhancing accuracy and operational efficiency according to their business goals and risk tolerance.

Global Document Coverage and Cross-Border Compliance

Choosing software providers that support multiple languages and cross-border compliance is imperative. Additionally, choose an identity verification solution that can verify various identity document types from diverse countries and regions. This tailored approach ensures businesses can facilitate the smooth onboarding of more users internationally.

Support for Multiple Verification Methods

The best software offers multi-layered security to support document verification, biometrics, and knowledge-based authentication. This enhances fraud detection and ensures that the verification process satisfies regulatory conditions.

Ease of Integration with Existing Systems

The best verification solutions feature easy integration with existing workflows and systems via web SDKs and APIs. As a result, disruption is minimized and operational efficiency is maintained throughout the entire process.

Prioritizing these features helps businesses save money, prevent fraud, and offer a reliable, user-friendly experience on online platforms. Comprehensive compliance solutions with ongoing monitoring and real-time fraud prevention are also beneficial.

Security and Frictionless Onboarding Process

Designing a smooth document verification and customer onboarding approach is crucial in enhancing customer satisfaction and boosting conversion rates. Businesses should aim to make onboarding easy from the beginning. This includes providing clear guidelines, leveraging a user-friendly interface, and offering privacy statements. To achieve a balance, leading organizations adopt a risk-based approach, tailoring identity verification steps according to the level of risk associated with each customer or transaction.

Essential Factors to Maximize Customer Satisfaction and Reduce Drop-off Rates Include:

- Optimize UI: Design a user friendly interface for easy navigation.

- Offer Choices: Support document verification, facial recognition, and age estimation for inclusivity.

- Speed Matters: Use optical character recognition and machine learning to verify identities quickly.

- Seamless Integration Process: Connect with existing workflows to reduce manual work and friction.

- Ongoing Monitoring: Enable real-time monitoring to support anti-money laundering efforts and protect genuine users.

- Adopt Risk-based Approach: Only request critical information during onboarding and add further checks if a customer or transaction is high-risk.

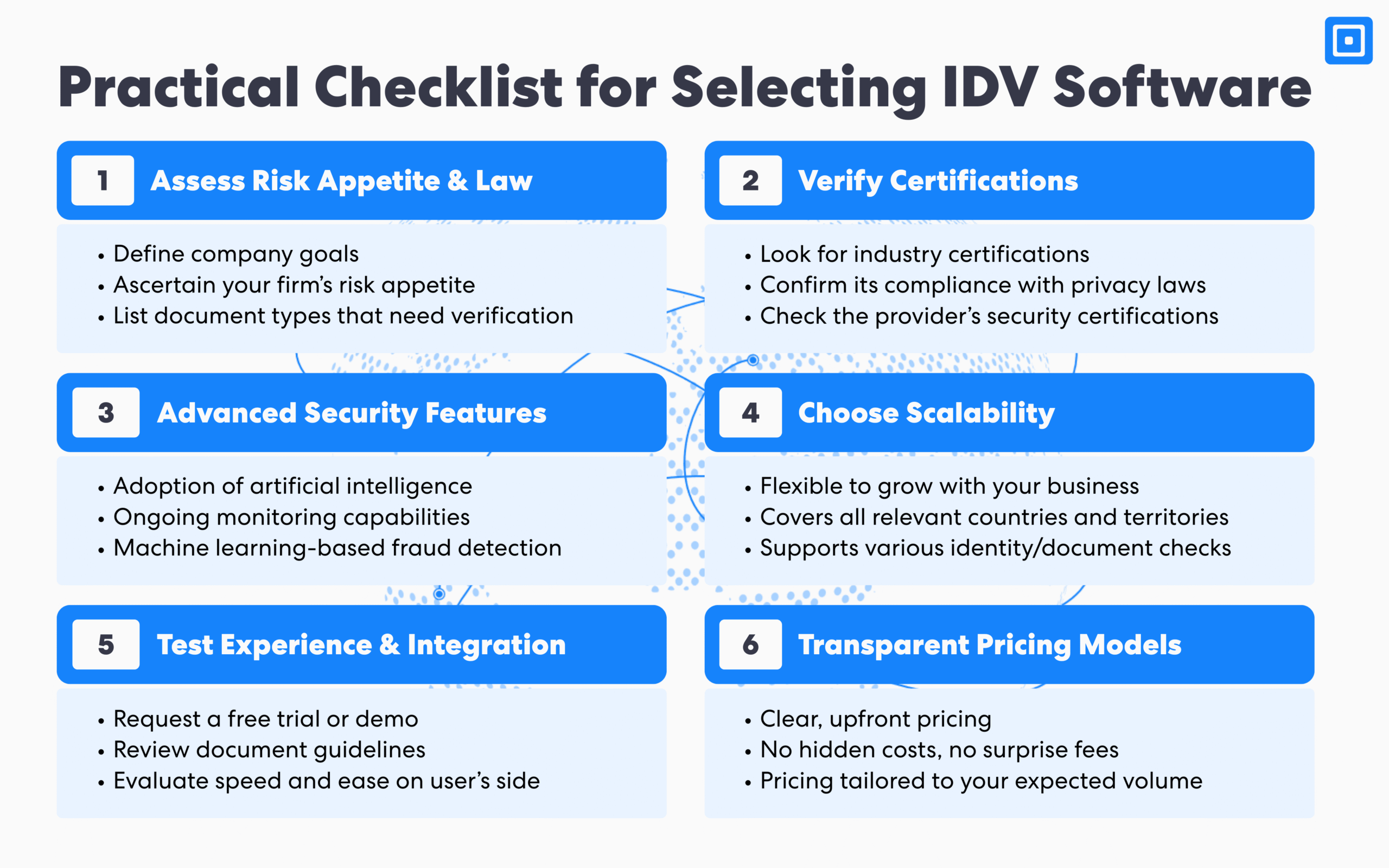

Practical Checklist: Choosing the Right Customer Identity Verification Software

Selecting the appropriate identity verification solution depends on several key factors. Ultimately, the right provider to choose will be one that can meet your unique business needs. Here is a practical step-by-step checklist you can download when navigating the myriad of ID Verification Vendors available today:

1. Assess Your Risk Appetite and Requirements

Firstly, document your businesses’ risk appetite and exactly what it needs. This includes the goals of your company such as onboarding more users, the amount of checks required, or implementing ongoing due diligence. Determine the document types needed to be verified based on the countries and territories you operate in. This can include driving licenses, residence permits, utility bills, and more. Having this understanding enables you to make a more informed decision.

2. Verify Certifications and Compliance

Next, check the provider’s certifications and compliance. You can request or look for security certifications which can be found easily on their website. Confirm if they comply with privacy laws like GDPR or CCPA, especially when it comes to handling customer data. For example, ComplyCube is a UK DIATF-certified Identity Service Provider, meaning it meets strict requirements for data protection, fraud prevention, and secure digital identity verification.

3. Look for advanced security features

Opt for solutions with facial recognition, liveness detection, machine learning-based fraud detection, and ongoing monitoring for adverse media. These security measures help block fraud attempts and protect sensitive information efficiently. Compliance teams can remove bottlenecks and allocate their resources and focus more effectively to complex cases.

4. Prioritize Scalability and Support for Your Target Markets

It is crucial to ensure your chosen identity verification software can support a wide range of identity checks and document checks across the countries and territories where you operate. Having this flexibility from the beginning assures that your business has the ability verify various identity documents as your business grows.

5. Test User Experience and Integration

Don’t hesitate to test the user experience and integration. Try a free trial or demo to make sure the verification process is fast and easy for your users. Additionally looking at a provider’s document guidelines can enable you to check if they offer APIs, SDKs, or plugins for your tech stack.

6. Consider Transparent Pricing Models

Lastly, always keep an eye out for providers that have hidden costs. Look for software vendors that offer clear, upfront pricing models tailored to your expected volume of ID verification requests. Transparent pricing helps businesses plan costs efficiently while meeting regulatory requirements. This ensures you won’t encounter unexpected charges for additional identity checks or document checks.

Get Started with Secure Identity Verification Solutions

Robust identity verification solutions enable you to verify users in an efficient and fast manner using advanced document verification processes. With support for diverse identity documents and different types of documents, businesses can onboard users smoothly, irrespective off where they are located globally. With built-in security features such as liveness detection and sophisticated fraud detection, companies are assured that it’s identity verification process is efficient and secure, safeguarding business and users from malicious attempts.

Learn more about ComplyCube’s advanced Identity Verification solutions.