What Are Sanctions Screening Tools?

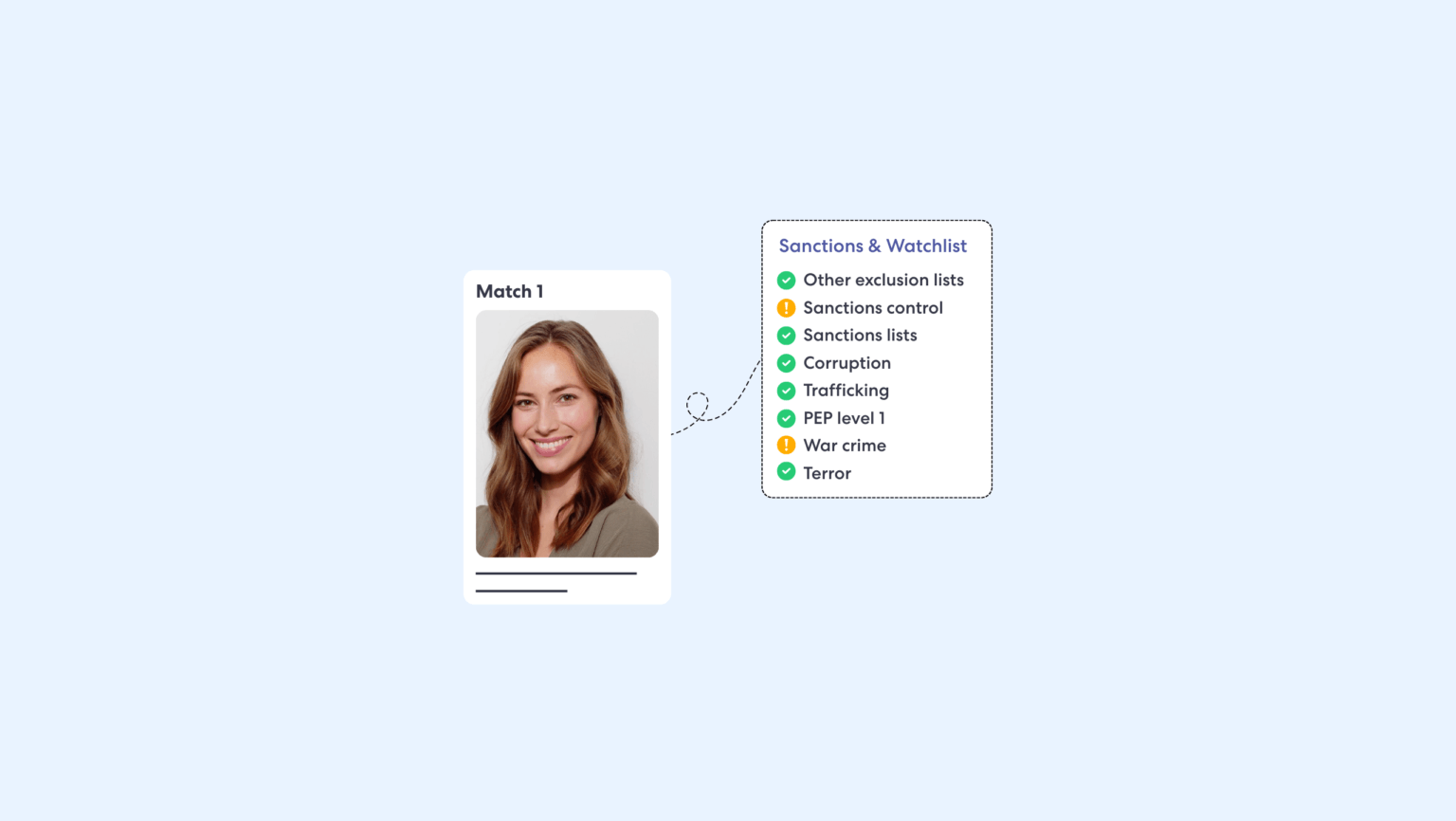

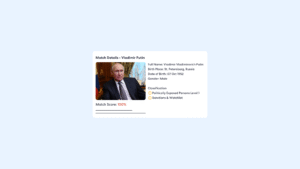

Businesses and individuals use software solutions such as sanctions screening tools to screen clients, customers, or transactions against official global watchlists and sanctions lists. These lists are exhaustive databases that include the names of individuals, entities, and even countries restricted from certain activities due to their involvement in financial crime, illicit behavior, terrorism, and more. Sanction screening is critical to Anti Money Laundering (AML) and Counter-Terrorism Financing (CTF) measures, aligning compliance with regulatory bodies and jurisdiction.

Why do Businesses Require Sanctions Screening Tools?

A sanction screening tool enables firms to efficiently identify high-risk individuals or entities and easily make informed decisions about onboarding customers. These tools provide businesses with a simple and straightforward way to check if any of the parties that they are engaging with are listed in any sanctions list by automatically extracting data from various global sanctions lists and cross-referencing them within a centralized platform. This automation reduces manual workload, enhances accuracy, and ensures compliance with constantly changing regulatory requirements.

How Do Sanctions Screening Tools Work?

Sanctions screening tools work to automate the process of checking and proactively preventing businesses from unintentionally interacting with sanctioned parties. These tools involve data collection, data standardization, and analyzing risk scores based on the information collated from a comprehensive database of sanction lists worldwide. Customers with a high-risk match will undergo thorough analysis to confirm whether they are true or false positives. Once confirmed, appropriate actions are taken, such as blocking transactions or reporting to authorities. Ongoing monitoring ensures ongoing compliance with evolving sanctions lists and regulatory requirements.

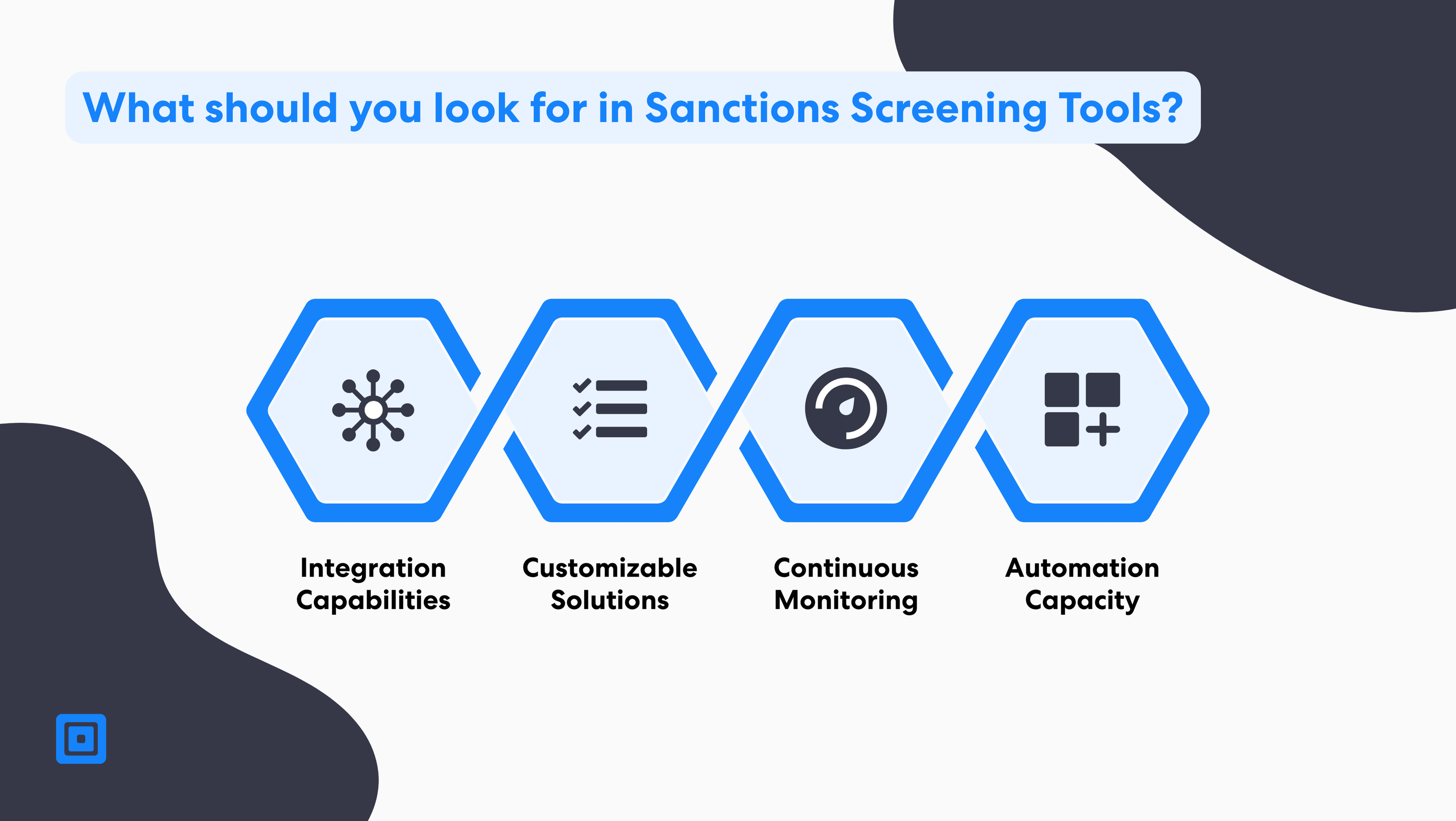

Essential Features to Look for in Sanctions Screening Tools

Seamless Integration Capabilites

One of the most crucial components when searching for the best sanctions screening tool for your business is its integration capabilities. Advanced screening tools enable companies to seamlessly integrate it into their existing technology stack, providing a centralized platform for managing customer data and compliance processes. This ensures that all customer information can be accessed through a single dashboard, simplifying workflows and enhancing efficiency. Screening tools with API and Web SDK integration further enhance this by enabling real-time data exchange and easy embedding into applications, ensuring automated and up-to-date compliance checks.

Key Questions for Buyers to Consider

- How frequently are sanctions lists updated, and does the integration support real-time updates?

- Does the integration process require significant technical expertise, or is it user-friendly for non-technical teams?

- Will integrating this tool disrupt other compliance systems or workflows?

- Does the vendor offer technical support during and after integration to troubleshoot issues?

- Can the tool integrate with CRM systems like Salesforce, HubSpot, or others to streamline customer management processes?

- Are safeguards in place to prevent data quality issues or mismatches during integration?

Customizable Solutions for Unique Business Needs

Another vital factor to consider is the level of flexibility and customization in a sanction screening tool. In some instances, screening tools may offer limited customization options, forcing businesses to adapt their processes to fit the tool, which is time-consuming and inefficient. In contrast, advanced sanctions screening solutions provide robust customization options, allowing companies to tailor workflows, screening parameters, and internal watchlists to align perfectly with their compliance goals. Whether configuring workflows for specific onboarding processes or adjusting risk thresholds to reduce false positives, the right tool should adapt to your firm, not the other way around. Customizable features also enable businesses to scale operations effectively as regulations evolve, ensuring fraud prevention and operational efficiency.

Key Questions for Buyers to Consider

- Does the tool allow you to create custom workflows for your specific business processes?

- Can you adjust screening parameters, such as fuzzy matching thresholds or match types (e.g., exact vs. close matches)?

- Does the tool support internal list management, such as adding or editing custom watchlists?

- Can you configure notifications (e.g., frequency, recipients) to align with your operational needs?

- Does the software allow branded interfaces or reports to maintain consistency with your company’s identity?

- Are there options for customizing user access levels based on organizational roles?

Continuous Monitoring for Evolving Threats

As sanctions lists are updated frequently, ensuring that the screening tools you choose offer real-time monitoring is vital. Sanctions lists are prone to updates very often. Thus, it is important to enable continuous monitoring so your business is always notified of any changes and does not risk missing newly sanctioned entities or outdated compliance checks. Advanced tools leverage AI-driven technologies to track updates from thousands of global sanctions lists, politically exposed persons (PEP) databases, and adverse media sources. This ensures businesses can act on the most current data. This proactive approach to identifying risk is vital in strengthening the overall AML framework in a firm.

Key Questions for Buyers to Consider

- Does the tool provide real-time updates for sanctions lists, PEP databases, and adverse media?

- Can the screening tool monitor transactions continuously without manual intervention?

- Does the solution leverage AI or machine learning to enhance monitoring accuracy and reduce false positives?

- Does the tool support dynamic risk scoring based on real-time data updates?

- Are compliance-related metrics tracked in real-time to meet regulatory requirements?

Automation Capacity for Enhanced Efficiency

Advanced sanction screening tools utilize state-of-the-art AI and ML algorithms to reduce manual processes and streamline the screening process. Automated tools enable companies to analyze vast databases in real-time, reducing the risk of human error and significantly boosting accuracy. Repetitive tasks, including batch screening, risk scoring, and alert generation, can be optimized, further allowing compliance teams to feel empowered to focus on making calculated decisions. Features such as fuzzy logic and natural language processing (NLP) further help reduce false positives, fortifying compliance. By integrating automated solutions into existing workflows, firms can enhance efficiency and accuracy while adhering to evolving regulatory requirements.

Key Questions for Buyers to Consider

- Does the tool support batch screening for bulk data uploads and processing?

- Are repetitive tasks like risk scoring and alert generation fully automated?

- Does the tool provide detailed audit trails for automated processes to ensure transparency during compliance reviews?

- Does the vendor offer training or support to help teams maximize the the benefits and effectiveness of automation features?

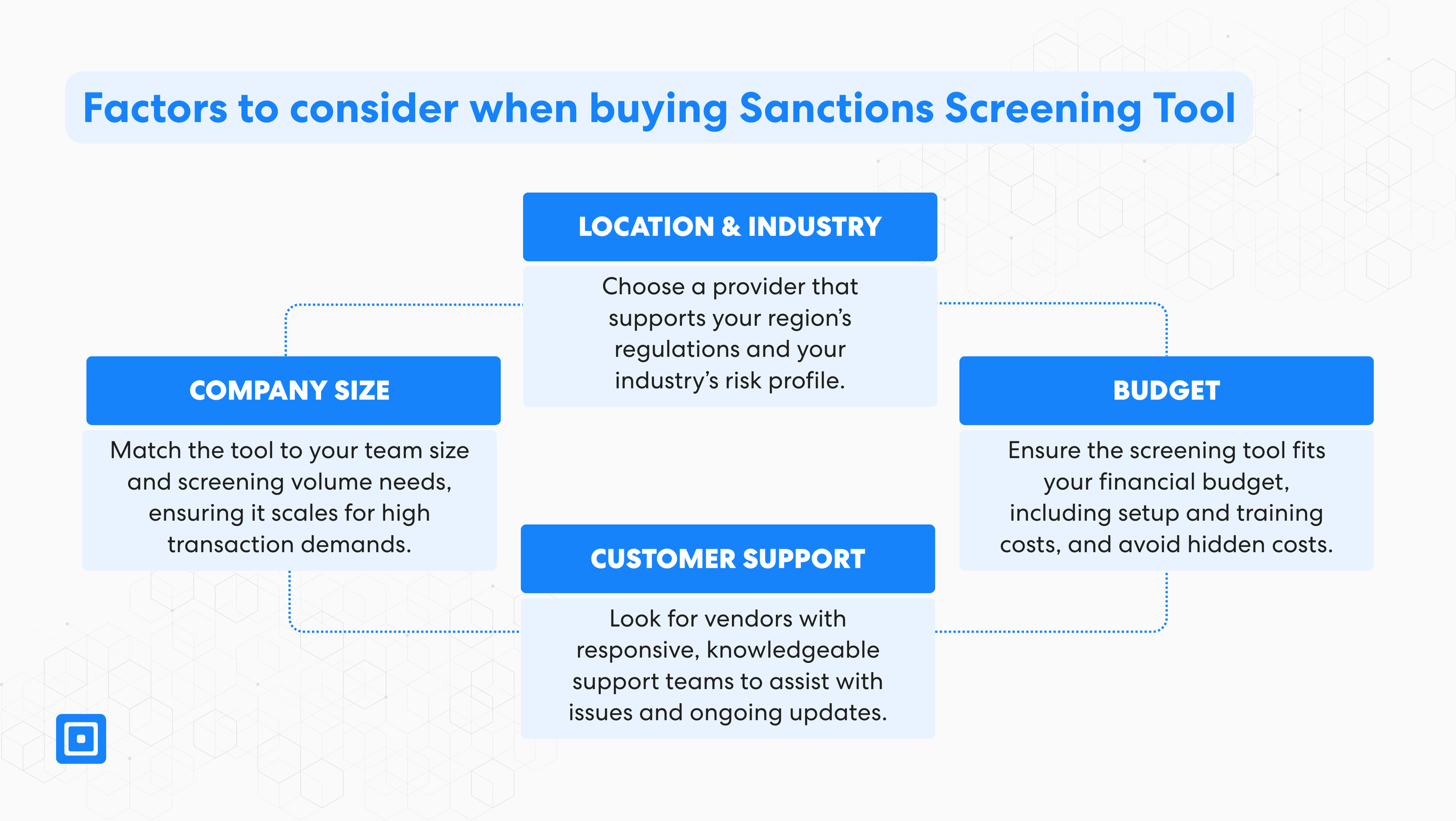

Purchasing the Right Sanctions Screening Tool for your Firm

Selecting the right sanctions screening solution requires evaluating several factors to ensure it aligns with your business needs. In this section, we will discuss the most important aspects you must consider based on conversations with industry leaders and clients in the RegTech field.

Company Size

The size of the organization, such as the number of team members utilizing the tool, is a significant consideration when choosing the appropriate provider. Low-cost tools with minimal integrations may suffice for small organizations with limited resources. However, businesses with high-volume transactions require scalable solutions to manage bulk data rapidly and support multiple users. Additionally, it’s also important to consider how many customers or merchants your business needs to screen and onboard daily.

Industry Requirements and Location

The regulations in an industry and a company’s geographic location will make an influence on the vendor chosen. For example, businesses sitting in the finance or banking sector are regulated by the Financial Conduct Authority (FCA). These firms might require more enhanced features, such as dynamic risk scoring and audit trails, given stricter compliance requirements. Additionally, businesses operating globally must ensure the screening solution they use covers a range of jurisdictions worldwide to support geographic coverage.

Budget

One of the main concerns for businesses of any size is budgetary constraints. Generic screening software can be more cost-efficient; however, it might not include features such as automation, API integration, or AI-powered risk scoring, features that can deliver ROI in the long-term. Companies must do a thorough cost-benefit analysis to determine whether it’s worth investing in a more sophisticated solution that will yield grater returns over time.

Customer Success and Support

Implementing sanction screening can be made easy with a dedicated customer support team. Dedicated account managers provide tailored support, while training programs compliance officers to navigate regulations with confidence. In addition, responsive technical support reduces downtime, enabling businesses to maximize the value of sanction screening and manage risks more effectively. Ongoing support also includes regular product updates, best practice recommendations, and proactive check-ins, all of which help businesses stay ahead of evolving regulatory expectations.

Benefits of ComplyCube’s AML Screening Solutions

ComplyCube’s sanctions screening solution is designed to address the complex compliance requirements of government agencies and businesses worldwide. By leveraging advanced proprietary AI, ComplyCube’s platform provides a comprehensive approach to managing sanctions risk and mitigating risks across the customer lifecycle.

Real-Time Screening and Ongoing Monitoring

ComplyCube’s screening capabilities include real-time screening and ongoing monitoring of sanctions lists, adverse media lists, politically exposed persons, and their close associates. This ensures that compliance teams take a proactive approach in identifying and reporting high-risk customers during screening. With ongoing screening integrated into compliance workflows, firms can effectively oversee transactions while meeting regulatory compliance standards.

Accuracy with Artificial Intelligence and Machine Learning

ComplyCube’s screening solution uses advanced AI features like natural language processing and ML to enhance the effectiveness of the screening process. These technologies significantly reduces false positives by catching any spelling errors, variations in names, and relations to any politically exposed persons or sanctioned parties. Organizations can rest assure knowing they will make informed decisions during customer screening and adverse media screening while improving alert management for compliance teams.

Seamless Integration for Business Requirements

ComplyCube’s screening tools are built to integrate easily with a firm’s existing technology system, allowing risk monitoring and IT teams to align the solution with specific business requirements. Whether for transaction screening or AML screening, this one solution supports a wide range of use cases to focus on risk management and regulatory compliance. Its flexibility ensures that businesses can adapt to evolving regulations without disrupting their operations.

Customizable Screening Needs

The platform offers customizable solutions tailored to meet unique screening needs, including sanctions screening tools for global sanctions checks, adverse media lists analysis, and due diligence processes. Businesses can configure the ComplyCube software to match their diverse monitoring capabilities and workflows while addressing specific risks tied to money laundering or financial crimes.

Transparent Auditable Logs for Compliance

Transparency is a key factor in ensuring compliance with regulatory requirements. ComplyCube provides auditable logs for every transaction and customer lifecycle activity, enabling compliance teams to track suspicious activity, screen payments effectively, maintain accountability, and reduce false positives in their risk management processes. Additionally, it helps teams streamline and oversee any bottlenecks that might occur in their compliance operations.

Scalability for Global Operations

Designed for scalability, ComplyCube’s solutions empower organizations operating across multiple jurisdictions and over 220 territories by offering robust tools for sanctions risk assessment and ongoing monitoring. By leveraging diverse third party official data sources and other global sanctions lists, the platform supports financial institutions in meeting international policies while addressing client risk and preventing anti money laundering effectively.

Strengthen Compliance with Enhanced Sanctions Screening Tools

Sanctions screening tools are essential for clients and merchants to effectively identify and mitigate the risks that arises from financial crimes and anti-money laundering. Advanced software with enhanced screening capabilities enables real-time transaction screening and due diligence, seamlessly integrating with compliance workflows and existing systems to boost regulatory adherence and operational efficiency. As compliance laws evolve and fraud increases, minimizing false positives is crucial, as excessive alerts can overwhelm compliance teams and divert focus from genuine threats. ComplyCube equips customers with the data sources and solutions to get significantly better at detecting high-risk individuals. The platform boost up to 98% in customer onboarding rates in mere seconds while preventing over $259 million in money laundering attempts and 92% of fraud blocked in real-time. Get started by talking to a member of the team.