LONDON, FEBRUARY 04, 2026 – Identity verification is at a breaking point. Legacy document-based checks are slow, fragmented, and increasingly vulnerable to synthetic identities, deepfakes, and cross-border fraud. Today, ComplyCube addresses that gap with the launch of a real time identity verification solution. With a real time eID check and SSN check, ComplyCube brings two of the world’s most authoritative identity systems directly into a single compliance platform.

Why Real Time Identity Verification Needs to Change

Across regulated industries, identity verification is under more pressure. Onboarding delays are frustrating users. With fragmented compliance tools straining operations, and evolving deception tactics, fraud is getting harder to detect. Compliance teams are being forced to balance speed, accuracy, and risk mitigation without the tools they need to do all three well.

- Synthetic identity fraud had $3.3 billion in U.S. lender exposure in H1 2025.

- Manual document checks cuts conversion rates by 15–20% per extra day.

- 60% of business onboarding requires manual multi-tool compliance reviews.

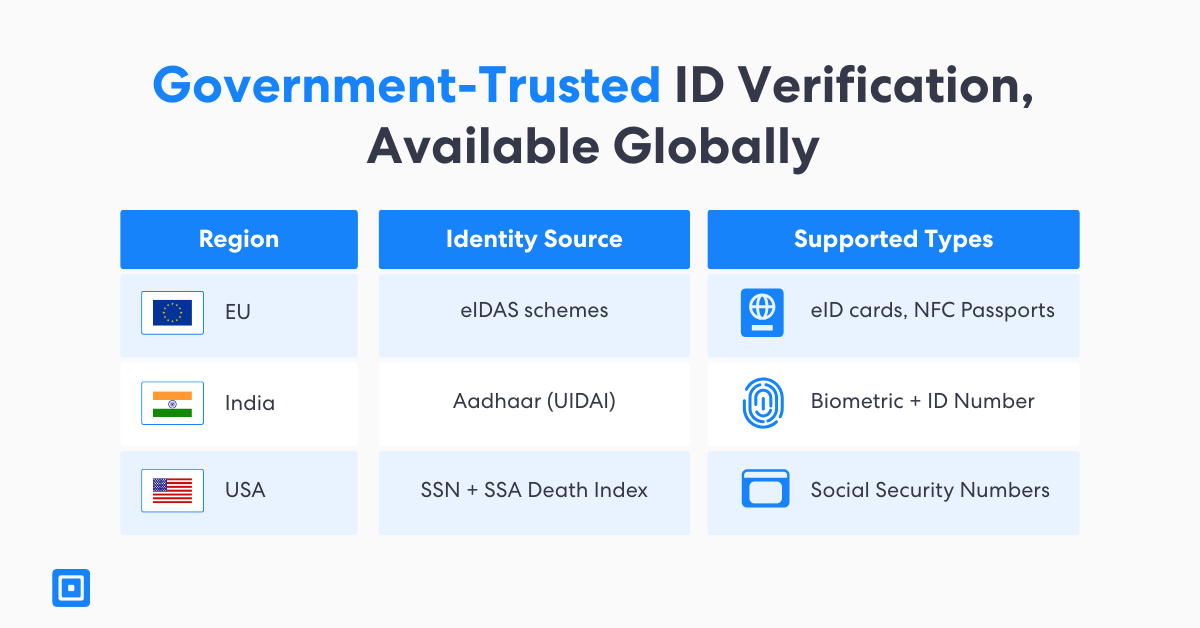

ComplyCube’s new SSN and eID services are purpose-built to address these challenges by enabling verification at the source. Through government-backed identity systems, the platform moves beyond static document uploads and toward real time, regulation-ready identity assurance. This shift reduces fraud exposure. It also improves onboarding speed and user experience across global markets.

SSN Validation: Real Time Identity Verification for the U.S.

ComplyCube’s SSN verification service enables real time validation of U.S. Social Security Numbers as part of onboarding and Customer Due Diligence (CDD) processes. This capability directly supports compliance with the USA PATRIOT Act and FinCEN’s Customer Identification Program (CIP) rules. Rather than relying on delayed reviews, organizations can now instantly confirm whether an SSN is:

- Correctly structured and issued

- Currently active and valid

- Flagged as deceased or potentially synthetic

These instant verifications reduce both operational risk and compliance friction. All outputs are CIP, KYC, and AML compliant, making it easier for firms to satisfy reporting obligations without disrupting onboarding flows. When this SSN validation is embedded into digital onboarding journeys, it allows organizations to implement more secure, scalable workflows. Specifically, businesses are able to:

- Detect and block synthetic or recycled identities early

- Reduce reliance on manual escalation teams

- Accelerate onboarding while maintaining regulatory integrity

In a regulated environment, speed, accuracy, and trust are equally essential to the process. ComplyCube’s SSN Verification gives compliance teams a critical tool to verify identities with confidence. Now, real time checks deliver both security and speed. By embedding these checks into workflows, businesses gain the agility to meet compliance demands without slowing growth.

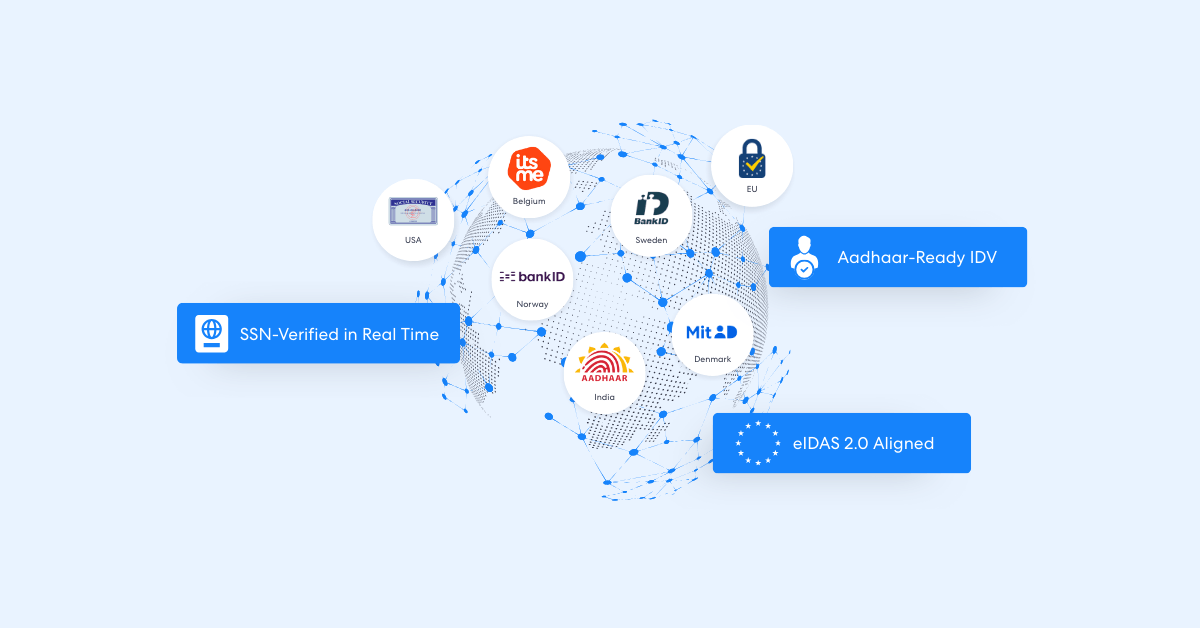

eID Verification: One-Step Trust Across Global Identity Networks

Additionally, ComplyCube’s eID verification service allows businesses to connect directly to government-backed electronic identity schemes in major global markets. The service simplifies identity verification across Europe and APAC without requiring document uploads or biometric scans. It supports key eID schemes including:

- BankID (Sweden)

- itsme (Belgium)

- MitID (Denmark)

- iDIN (Netherlands)

- Aadhar (India)

This solution aligns with the eIDAS regulation, which establishes a common legal framework for secure digital identification across all 27 EU member states and defines clear Levels of Assurance (LoA) for electronic identity schemes. As eIDAS adoption accelerates across Europe, organizations are under increasing pressure to support trusted digital identity methods that work seamlessly across borders while meeting local regulatory requirements. As a result, businesses benefit from:

- Seamless identity verification with higher conversion rates

- Compliance with both domestic and cross-border regulations

- Reduced fraud exposure through verified, government-issued credentials

Instead of layering multiple regional tools or managing separate identity providers for each market, ComplyCube offers a single point of integration for electronic identity verification. This unified approach delivers fast, trusted identity decisions at scale, allowing teams to expand internationally while maintaining consistency, compliance, and operational control.

One Platform, Authoritative Identity at Scale

With the launch of SSN and eID verification, ComplyCube strengthens its position as a unified identity assurance platform built for global compliance. No more stitching together localized providers or forcing users through document-heavy flows. Instead, businesses can now streamline onboarding with scalable, trusted verification at the source.

- Apply consistent identity logic across jurisdictions

- Meet U.S. mandates (e.g., SSN + FinCEN) and E.U. standards (e.g., eIDAS 2.0)

- Streamline onboarding while maintaining security, trust, and audit readiness

“Bringing these national-level identity systems under one roof aligns with our mission to simplify global compliance,” said Dr. Tarek Nechma, CEO of ComplyCube.

Expanding on this, Dr. Tarek Nechma added, “SSN and eID verification are foundational identity systems. By integrating them directly into our platform, we’re helping organizations meet local regulatory obligations while delivering faster, more trustworthy onboarding experiences for their customers.”

About ComplyCube

ComplyCube, the FinCrimeTech50 winner, is a global identity verification and compliance platform enabling businesses to verify users, prevent fraud, and meet regulatory obligations with confidence. Its modular solutions span identity assurance, biometric verification, fraud intelligence, and no-code workflow orchestration, delivered via APIs, SDKs, and hosted flows.