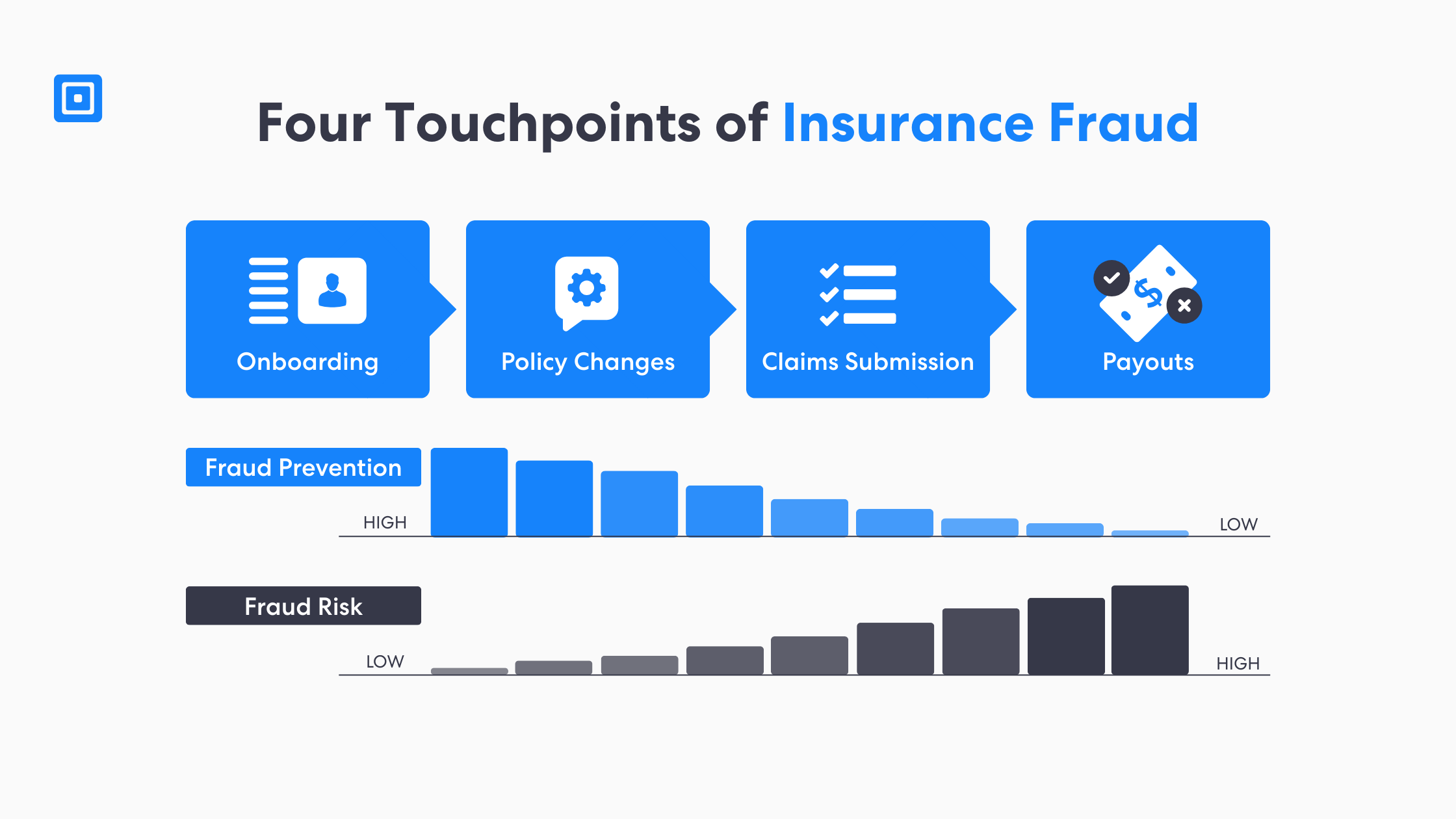

TL;DR: In most cases, insurance fraud prevention stops at onboarding. Fraudsters wait and cash in through fraudulent claims later within the policy lifecycle. Typically, better insurance fraud detection comes from verifying identity properties during policy changes, the claims process, and payouts. A risk-based insurance fraud check helps detect and prevent suspicious activities.

What is Insurance Fraud Prevention?

Insurers want to prevent fraud before ever having to pay out. Insurance fraud prevention typically occurs through thorough identity verification, fraud detection rules, and any deeper investigations. It is essential to prove user legitimacy at key stages during the process. This process protects policyholders, consumers, and the insurance industry from crimes such as theft, staged losses, and scams.

Fraudsters rely on confusion, speed, and assumptions. – Milosh Caunhye, Solutions Consultant

Solutions Consultant, Milosh Caunhye also says, “Insurance companies need to protect policyholders by replacing any assumptions with proof. By combining thorough identity verification, advanced analytics, and accountable escalation, every high-risk decision is defensible before an insurance claims payout.”

To effectively prevent or even detect insurance fraud, insurance companies need to stay aware of any emerging fraud schemes or red flags. Insurance companies need a comprehensive approach to solutions that blend people, processes, and data. Using advanced analytics and machine learning helps them spot risk earlier, while clear escalation paths to Special Investigative Units (SIUs) and law enforcement ensure the right response when required.

Why Insurance Fraud Prevention Fails After Onboarding

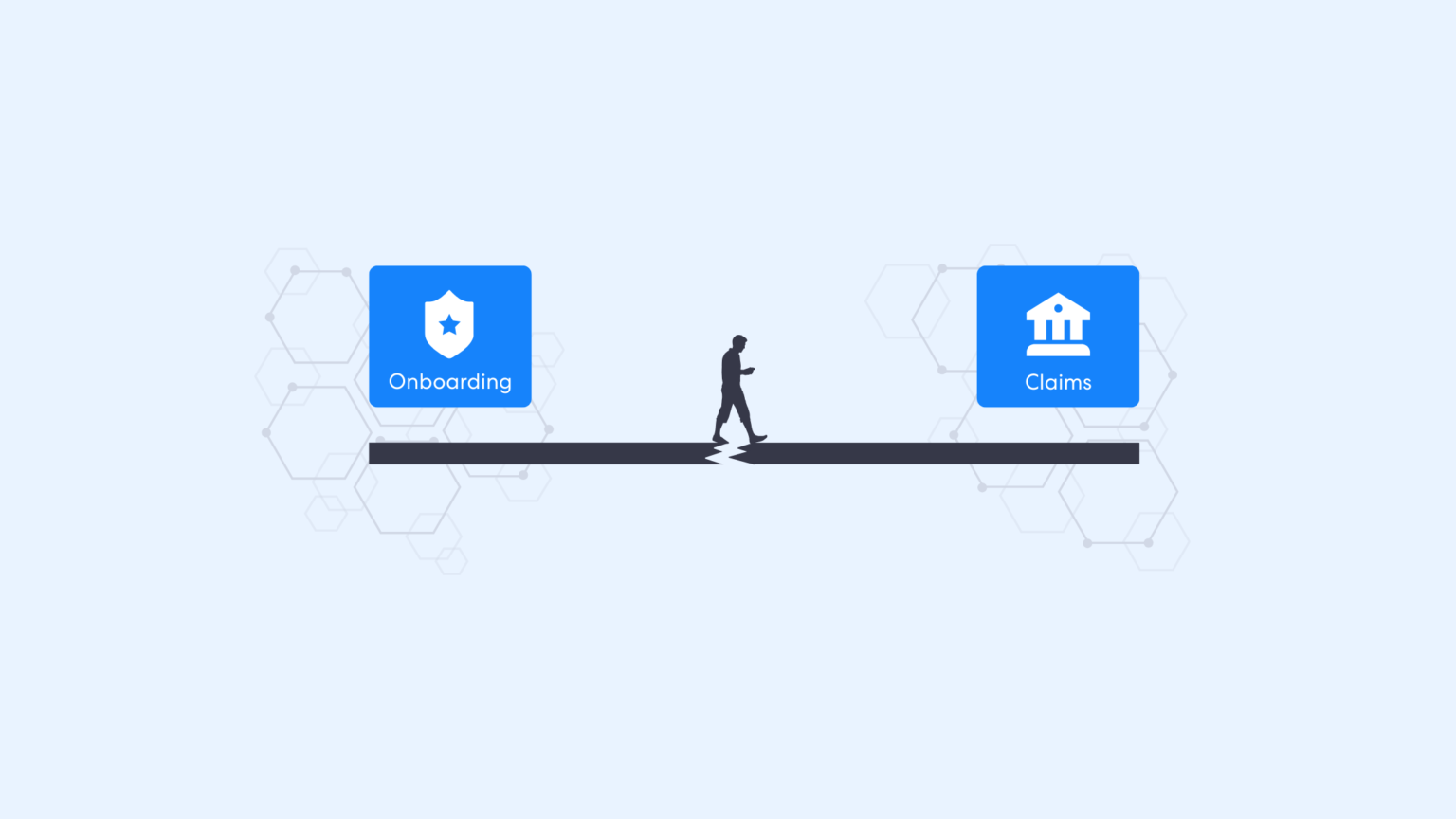

Nowadays, onboarding receives more attention than ever. In today’s world, organizations have easy metrics to measure. Metrics such as conversion, time-to-bind, or a clean “pass/fail” flow. However, fraudsters do not need to beat the onboarding process. At any point, they can compromise a person’s real identity. At any point, they can compromise a person’s identity, take over an account, or manipulate insurance claims processes later down the line, especially when identity checks are a little lighter.

There is a perception that if an identity is proven once in the process, that trust is granted forever to the user. However, this gap becomes apparent during policy serving and any claims. This is truly where speed matters. Attackers exploit any discrepancies and move money quickly before patterns are even noticed. More importantly, insurance fraud detection must not compromise any customer experience. Best practices need to align both objectives to ensure effective fraud detection while maintaining satisfaction and trust.

Four Touchpoints Where Insurance Fraud Occurs

When insurance fraud occurs, there are four touchpoints at which you could encounter it. This arc includes onboarding, policy changes, claims submissions, and eventually payout. Yet, if you only secure the first step, you are only capable of defending the “front door.” This leaves the entire vault wide open during the entire claims process.

Companies and industry organizations only further reinforce this view. The National Insurance Crime Bureau works with insurers and law enforcement to fight insurance crimes, and the Coalition Against Insurance Fraud shares research and awareness. A coordinated, data-driven organization that works with law enforcement, government agencies, and industry partners is essential for effective insurance fraud detection. It enables a united and resource-sharing approach to detect, deter, and prevent insurance-related crime.

Touchpoint 1: Onboarding (Strong Controls, Limited Coverage)

The first touchpoint will be the onboarding process. Businesses and organizations with strong onboarding controls can catch any obvious fraudsters. Controls identify at any mismatched identity data, low-quality documents, inconsistent details. These types of checks also create a baseline record for businesses that helps any Special Investigations Unit (SIU) prove what happened later.

However, it still remains that in the onboarding process, teams cannot prevent post-issuance abuse or fraud risk. For example, a legitimate customer can still become a victim through theft of credentials or a scam. Fraudsters can use their accounts later to create fraudulent activity even if the consumer’s onboarding was fully legitimate.

Touchpoint 2: Policy Changes (Quiet Setup for Claims Fraud)

Second, companies and businesses need to keep an eye on policy servicing. This is where fraudsters and attackers set the stage. Any bank changes, beneficiary updates, address edits, and channel swaps determine who gets paid. Yet teams often handle them as routine requests across multiple channels and teams.

For example, if a call-center script is much weaker than an online portal flow, fraudsters will route through to the easiest path. As a result, insurers spend effort on solutions or investigations after the fact. So, a risk-based insurance fraud check on high-impact changes can detect and prevent diversion before claims arrive.

Touchpoint 3: More Claims Submission (Where Money Is Requested)

Next up in the insurance lifecycle, claims submission is a very crucial moment. It is the point at which monetization occurs and suspicious activities turn into real claims. This process is typically built for speed and customer experience. So when respondents report injuries, fraudsters have the opportunity to exploit urgency and “plausible” narratives.

That is why modern insurance fraud detection must re-identify the person requesting money. It is their responsibility to identify patterns in the data collection. This covers new devices, any unusual timing, changes in payout, repeated discrepancies or any claim velocity. If done well, a good detection method prevents fraud while reducing any false positives. It only routes higher-risk claims for further review.

Touchpoint 4: Payouts and Beneficiaries (Where Loss Becomes Final)

Finally, even when a claim is legitimate, the payout could be fraudulent. This occurs if the beneficiary or bank details were manipulated by a fraudster earlier. Remember, once the money is sent, recovery can be slow and expensive. Any disputes, case investigations and legal constraints across laws and jurisdictions can take a lot of time.

It is incredibly important that insurers need to treat any claims payout as its own control touch point. Implementing identity verification checks with step up in intensity before any funds move to a claimant will protect both policyholders and insurers. It reduces reliance on SIUs and law enforcement after the fraud loss has occurred.

Why False Positives Are a Hidden Tax

Alternatively, false positives irritate customers. They reduce any chance at efficiency, slow legitimate claims, and waste investigative expertise or time. So, when every single insurance claim looks like potential fraud, SIUs spend too much time clearing clean cases from their queue instead of stopping real organized crimes.

It is important to use proportionality. Organizations must learn to apply advanced analytics and machine learning to rank risk when it comes to insurance fraud. This will allow teams to then step up verification only when it’s meaningful. As a result, it protects the overall customer experience while fighting fraudsters in real-time.

Tax Evasion, Law Enforcement and Proof-by-Paper

There are some fraud schemes that overlap with tax evasion or accounting manipulation. Sometimes, people engineer documents that “prove” a certain type of narrative. As a result, fraud then becomes a paperwork exercise rather than a blatant lie. These case examples exploit gaps between systems, vendors, and teams.

Companies need to look to risk-based guidance. This supports stronger controls at high-risk moments. For example, the Financial Action Task Force (FATF) digital identity guidance reinforces any compliance measures proportionate to risk. This can help better determine which processes fits claims-stage verification and payout protection.

Case Study: Closing the Claims-Stage Identity Gap

In auto insurance, a major onboarding-stage fraud pattern is premium misrepresentation. This is where applicants provide false information at quote/bind (e.g., unreported drivers, garaging location, mileage, vehicle use) to secure cheaper coverage, creating downstream claims risk.

More checks and stepping up verification for insurance fraud prevention

Insurers reduce this risk by strengthening onboarding verification before binding. They must validate identity and household/driver context, apply risk-based checks when quote data shifts across attempts, and use pre-bind controls such as inspections and evidence requirements.

Outcomes

$35.1B in annual losses are attributed to auto premium fraud driven by onboarding.

Unrecognized drivers are the largest contributors to auto premium fraud.

Millions of claims are processed annually and cites that an estimated ~20% are fraudulent.

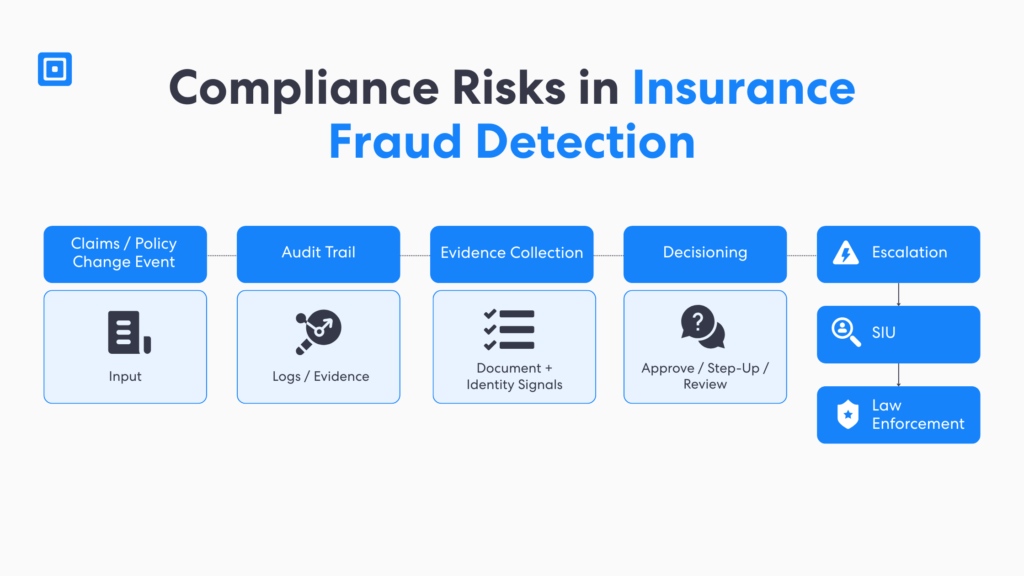

The Insurance Fraud Prevention Playbook for Claims Teams

Claims teams need a playbook to detect and prevent insurance fraud. They need a process they can repeat across claims handlers, fraud operations teams and special investigative units. The goal is to standardize when a claims case becomes “potential fraud.” This clarifies what evidence is required and how the overall claims process changes without derailing legitimate customers who need help.

This is why the most practical approach is tiered handling. Low-risk claims flow fast, medium-risk claims get a small step-up verification and any high-risk claims route to SIU with an evidence pack with important clues and documents. This reduces investigative effort on any noise, focuses on expertise where it matters, and improves consistency across insurance carriers and channels.

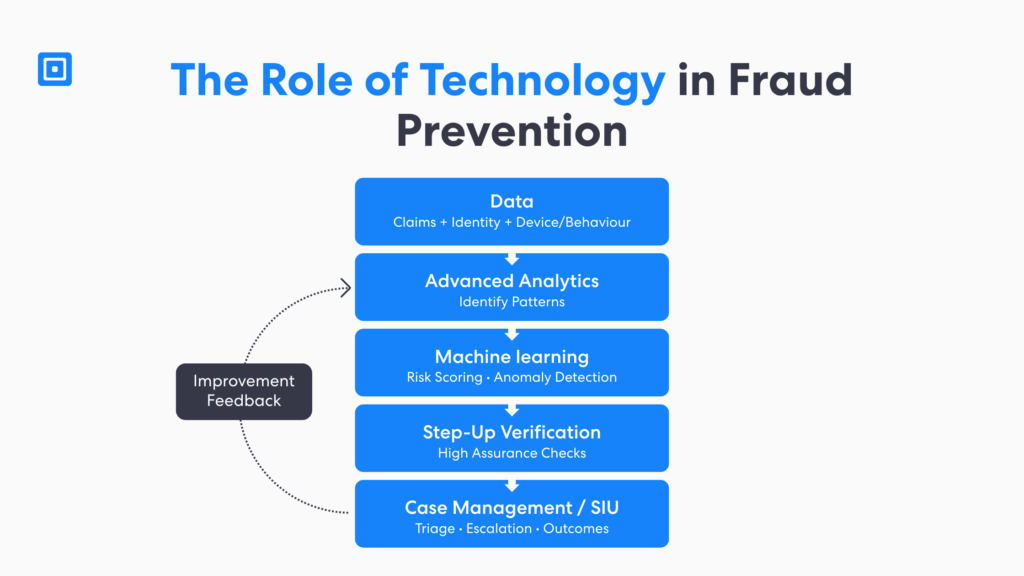

Insurance Fraud Prevention and the Role of Technology

Today, the role of technology is central to insurance fraud detection. This challenge presents especially at the claims stage where potentially billions of dollars are at risk. Insurers and government officials can use advanced analytics, machine learning, and data to spot any suspicious activities. It can speed up how quickly teams can identify patterns across large volumes of claims that humans and simple rules often miss.

As the framework illustrates, the real value isn’t “more alerts,” but rather a structured path from signals to action. That prioritisation is what reduces false positives, protects customer experience, and gives SIUs time to focus investigations on high-risk cases separating genuine discrepancies from truly fraudulent claims before payouts occur.

Finally, technology strengthens collaboration by making decisions more consistent, auditable, and shareable across teams. Organizations can now support faster escalation when fraud spans multiple companies. Done well, this turns fraud prevention into an improvement loop: investigation outcomes feed back into the system, improving accuracy over time as fraudsters evolve. Learn more about this here: Enhance Health Insurance Fraud Detection for KYC and AML Compliance

Turning Fraud Detection Into Decisions for Insurance Carriers

Insurance fraud detection is only important when it creates value and drives a decision in the insurance claims process. Fraud detection should do three things at the very least. It should be able to identify, score risk, and recommend the next best action. That could be approve, step-up verify, holding for review or escalating for further investigation by SIUs.

Similarly, feedback is just as important. When SIUs conducts investigations that confirm any fraudulent activity or clear legitimacy, these outcomes must come back to the model and rules. It reduces false positives over time. Moving from “more alerts” to measurable impact means fewer fraud claims are paid, less delays for genuine customers who need help, and a better ability to fight organized crimes.

Key Takeaways

Insurance fraud prevention fails when identity assurance stops after onboarding.

Claims fraud concentrates at policy changes, claims submission, and payout moments.

A risk-based insurance fraud check reduces false positives and protects customer experience.

Advanced analytics and machine learning identify patterns, but only matter when tied to decisions.

The NICB, Coalition, and law enforcement strengthens prevention across the industry.

Insurance Fraud Prevention through Onboarding at ComplyCube

The most damaging fraud is rarely a fake customer; fraudsters exploit an account later in the insurance process. Prevent fraud by focusing controls where money moves: policy changes, claims, and payouts. ComplyCube helps insurers build continuous, risk-based identity verification beyond onboarding. Explore ComplyCube as a lifecycle identity layer for insurance fraud prevention.

Frequently Asked Questions

Why does insurance fraud prevention fail after onboarding?

Insurance fraud prevention fails after onboarding because many insurers treat onboarding as the only high-risk step and then trust the account by default. Fraudsters shift to post-onboarding touchpoints where controls are typically lighter and money moves much faster.

How can insurers reduce claims fraud without slowing genuine customers?

Insurers can reduce claims fraud by using risk-based triggers in the claims process instead of applying friction to every customer. Step-up checks should activate only for suspicious or higher-risk signals such as payout detail changes, new devices, unusual timing, or repeated discrepancies.

What should an insurance fraud check include during the claims process?

An insurance fraud check should confirm the identity of the person, validate claim context, and evaluate risk signals across identity. It should also look at device/behaviour, and payout data. Advanced analytics and machine learning knowledge should be used to identify patterns and anomalies in claims data, then route potential fraud into review.

Which organizations help insurers detect and prevent insurance crimes?

Key organizations that help insurers fight insurance crimes include the National Insurance Crime Bureau (NICB) and the Coalition Against Insurance Fraud. The NICB supports insurance carriers by sharing intelligence and coordinating with law enforcement on organized claims fraud and theft-related schemes. The Coalition Against Insurance Fraud provides research, awareness, and coordination.

How does ComplyCube support insurance fraud detection after onboarding?

ComplyCube supports insurance fraud detection after onboarding by enabling continuous, risk-based identity verification across the insurance process, especially during policy changes, claims submission, and payouts. ComplyCube’s step-up verification helps insurers detect and prevent fraudulent claims when risk signals appear, while reducing false positives and maintaining customer experience.