A recent news report reveals that the Monetary Authority of Singapore (MAS) has enforced harsh AML penalty fines related to Singapore’s greatest money laundering case, totaling up to SGD 27.45 million (nearly USD 21.4 million) to nine financial institutions. The firms caught in this Anti-Money Laundering (AML) scandal include leading financial firms, such as UOB, Citibank, and more.

The MAS and Its Mission to Combat Money Laundering

Established in 1971, the MAS is Singapore’s central bank and integrated financial regulator. As the primary financial regulatory body for the country, the MAS is in charge of maintaining the integrity of Singapore’s financial system. As a regulator, the MAS is highly involved in several functions, including:

- Responsibility of issuing policies on monetary, currency, and foreign reserves.

- Maintaining supervision over financial institutions such as banks, insurers, and cryptocurrency companies.

- Supporting the stability of the financial system by minimizing the risk associated with money laundering and other financial crimes.

- Enforcing authority and penalties on firms that violate AML laws.

Just last month, the MAS sent a shocking warning to eliminate money laundering in the country, introducing its strict no-exception policy for crypto companies that wish to operate there. Any crypto firms without a valid Digital Token Service Provider (DTSP) license can now face up to SGD $200K in fines and up to three years of jail time.

With this firm stance, the MAS is making waves again with its strong message to the world: money laundering will not be tolerated in Singapore.

Details on The AML Penalties

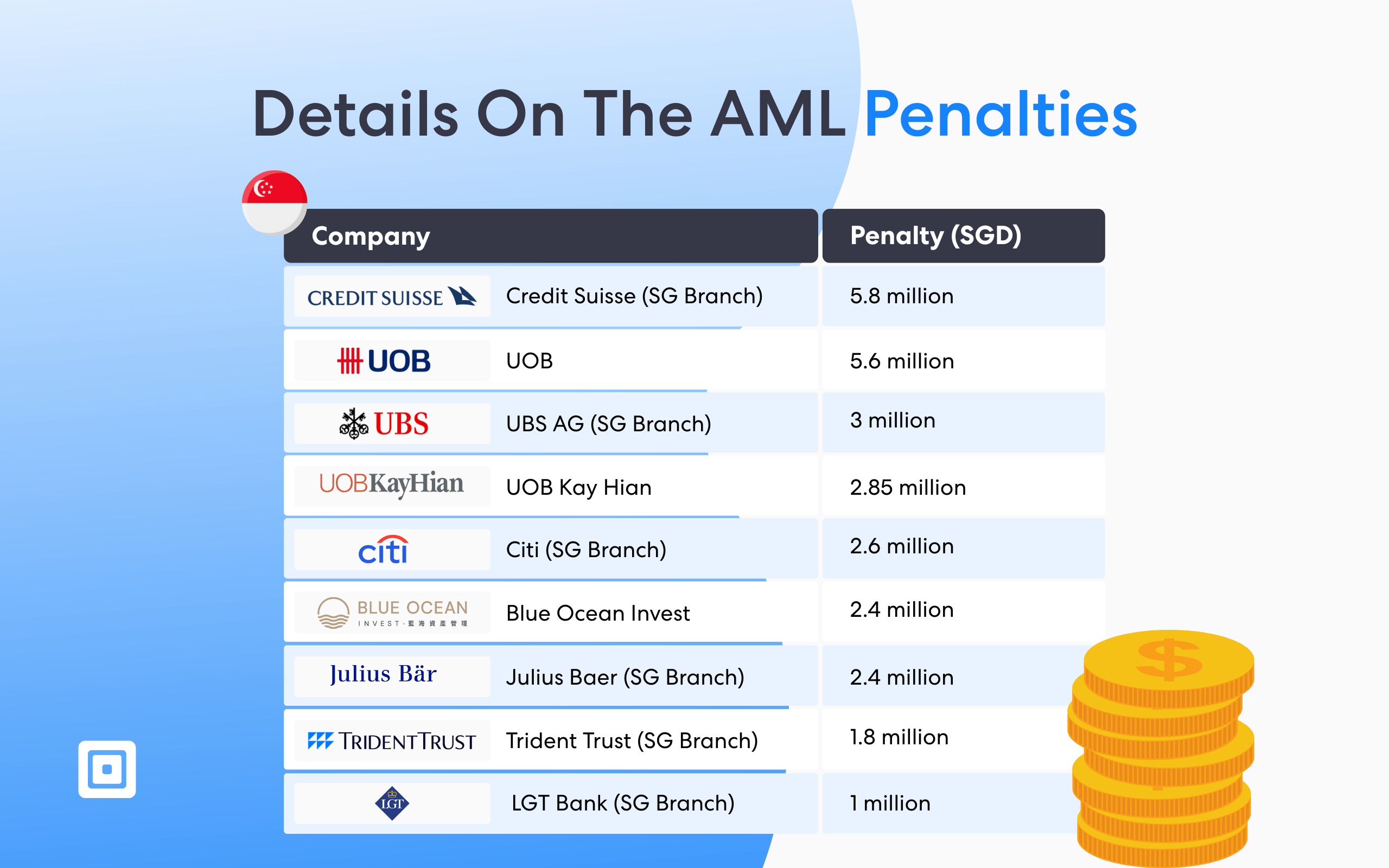

According to The Straits Times, Singapore’s daily newspaper, the fines were announced on July 4, 2025. Credit Suisse received the largest fine among the nine companies involved in this case, amounting to SGD $5.8 million. Other major penalties involved the Singapore branches of leading banks such as UOB, UBS, UOB Kay Hian, and Citibank.

These organizations had significant AML and Counter Terrorist Financing (CFT) failures. Some of the collapses reported include:

- Inadequate risk management which includes not adequately accessing high-risk clients

- Negligence in establishing the source of wealth for high-risk customers

- Ignoring suspicious transactions that were originally flagged by their own internal systems

- Weak customer due diligence process including the lack of oversight from senior managers

Shockingly, the MAS reported that some of these firms had ineffective compliance governance, especially at the executive level. The failures highlighted pose a massive risk to Singapore’s financial ecosystem.

The Increasing Responsibility on Senior Executives

In addition to the penalties imposed on the financial institutions, a few senior executives working in those firms were also charged. 18 individuals were condemned for lacking ownership and oversight over AML controls. Senior leaders from Blue Ocean Invest, including the CEO and COO, and directors from Trident Trust and UOB faced harsh sanctions and were required to exit the financial services industry. This case highlights the growing responsibility of senior management in maintaining robust AML frameworks and policies.

Follow-up to The 2023 Money Laundering Case

These recent enforcement actions follow up on the major money laundering case uncovered two years prior. In August 2023, ten foreign nationals were arrested, jailed, and barred from entering Singapore for money laundering.

The case saw the seizure of over SGD 3 billion in illicit assets, marking one of the largest money laundering bust in Singapore’s history. The 2025 enforcement actions targeted at the nine financial institutions seeks to hold these firms culpable for their contribution to the case.

Safeguarding the Financial Ecosystem

As regulators worldwide tighten their policies around AML and Know Your Customer (KYC) requirements, firms in regulated industries face higher obligations to maintain effective AML practices. This landmark case emphasizes the importance of both individual and collective efforts to combat fraud and money laundering. Contact a member of the team to learn more about how to build a foolproof AML infrastructure.