Victims of online fraud are scattered across the UK, yet it seems that going forward, they may finally be served justice—but at whose expense? The Labour government plans to enforce a new way forward, in which big tech companies will be held accountable and must compensate online fraud victims for their losses through their platform. These firms will need to buckle up for this change, as a lack of adequate fraud checks will now cost them a pretty penny. The solution? AI-powered identity verification with a sophisticated document and biometric check.

Unsurprisingly, banks such as Lloyds Banking Group have been quick to back the government’s initiative. Until now, the cost of reimbursing victims of fraud has fallen almost exclusively with them. Yet, from October 2024, the burden will be lifted off their shoulders and placed on those belonging to the nation’s tech giants.

Billions Lost to Online Fraud

Online fraud currently costs the UK billions annually, yet tech firms seem to escape accountability due to “weak laws.” The importance of adequate regulation cannot be understated despite the increased complexity faced by firms in achieving compliance. With the cost of online fraud only increasing, it’s time for identity verification infrastructure to tackle this challenge head-on before blame is assigned. An oversight body will be set up in order to hold these firms accountable and assess whether or not their contributions to fraud victims are considered sufficient.

According to UK Finance figures, 232,429 authorised push payment scam cases were reported in Britain last year, resulting in losses of £459.7 million. However, this figure will likely be much higher as most scams go unreported.

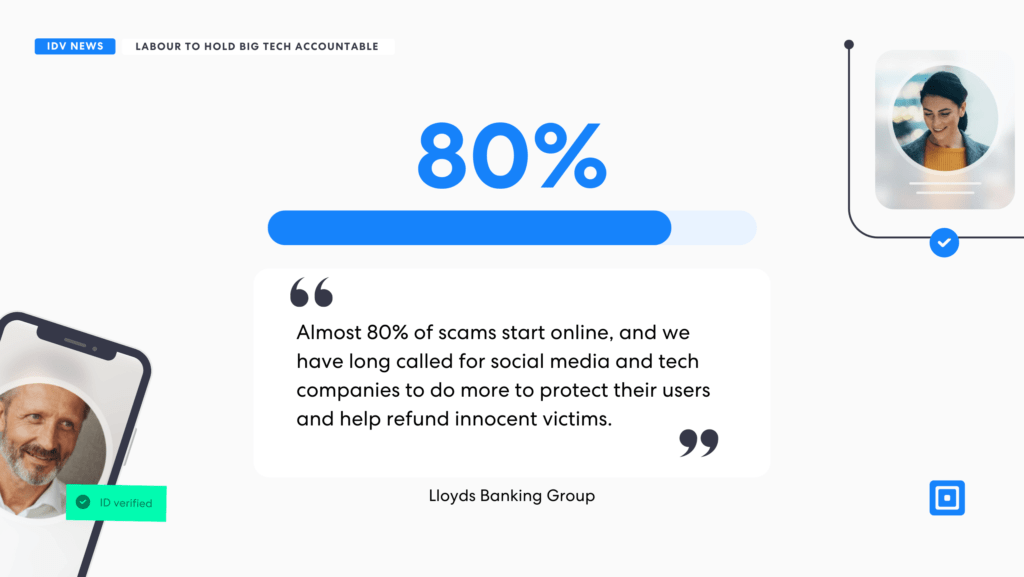

A spokesperson from Lloyds Banking Group spoke to The Sunday Times on the matter, stating that “almost 80% of scams start online, and we have long called for social media and tech companies to do more to protect their users and help refund innocent victims.”

A key point to consider here is whether or not tech firms are really doing all they can to ensure IDV and eKYC measures are up to scratch. Jessica Cath, Head of Financial Crime at Thistle Initiatives, a compliance consultancy for financial services, believes otherwise. She suggests that perhaps increased interoperability between these firms is needed in order to detect online fraudsters through increased information sharing.

Cath explains, “If tech firms were liable for reimbursing victims (at least in part), this would encourage collaboration and data sharing across sectors to bring fraud rates down. Multi-industry responsibility and collaboration would make APP fraud prevention much more effective – for example, if social media and telecom companies were encouraged to share suspicious behavior related to a phone number or social media profile, they could be linked to bank accounts. This would make the identification and elimination of fraud networks far easier.”

If tech firms were liable for reimbursing victims (at least in part), this would encourage collaboration and data sharing across sectors to bring fraud rates down.

However, taking full responsibility away from financial services is certainly not the answer, as the industry has a clear role to play in ensuring its fraud detection and monitoring systems are robust. The burden must be shared across the entire ecosystem—from tech giants to financial institutions—so that no single sector is left to shoulder the costs alone. However, this shift in responsibility comes with its own challenges.

Will tech companies and banks find common ground, or will this lead to new tensions as they juggle costs, accountability, and customer trust? Ultimately, the success of this initiative will depend not just on policy changes but on the willingness of these industries to work together for the greater good of consumer protection.

What does robust IDV and eKYC infrastructure look like for tech firms?

Several forms of fraud checks need to be implemented to safeguard customers, including AI-powered identity and document checks that can effectively spot presentation attacks. Deepfakes are only becoming increasingly deceptive, and presentation attack detection technology must include liveness detection in order to accurately spot and deter these criminals.

Document verification: Ensures that the identity being presented is genuine and valid. This process involves authenticating official documents such as passports to confirm that they are legitimate, unexpired, and have not been altered. Key security features are analyzed using Optical Character Recognition (OCR) technology to ensure both speed and accuracy. Technologies such as Near-Field Communication (NFC) verification have also become integral to document verification, adding another layer of protection.

Biometric Verification: Biometric verification goes a step further by analyzing a person’s unique facial features to confirm their identity. This technology is often paired with document verification to ensure that the individual presenting the ID is its rightful owner. Biometric authentication offers improved security and convenience by storing and indexing these physical traits, such as 3D face maps, for future use. The use of liveness detection within the biometric verification process is key, as it leverages advanced biometrics and machine learning to distinguish between real individuals and fraudulent attempts involving 3D masks or photographs. Active and passive biometric checks further enhance the system’s ability to detect fraud, ensuring that identity verification remains robust.

Identity Proofing Services

Robust Identity Verification (IDV) and Know Your Customer (KYC) infrastructure are more crucial than ever to effectively meet the challenges posed by increasing online fraud. For tech firms now facing the burden of reimbursing fraud victims, implementing advanced document verification, biometric checks, and liveness detection is not just a recommendation but a necessity.

With the introduction of regulatory oversight, the spotlight is on whether tech firms will rise to the challenge of deploying and maintaining these advanced IDV measures. Their success—or failure—will have far-reaching implications for the future of consumer trust and financial security in the UK.

ComplyCube is renowned for its state-of-the-art identity verification (IDV) checks. It offers advanced security measures alongside a seamless user experience. The platform streamlines onboarding processes to under 30 seconds while maintaining precise IDV, AML, and KYC compliance.

Reach out to ComplyCube’s expert compliance team to explore how a robust IDV infrastructure can be implemented to protect your organization against online fraud.